Ethane prices won’t crack 30 cents per gallon (gal) anytime soon and NGL content in natural gas produced in the Permian Basin will double that of the pre-2010 era, Bernstein forecasts in a new report.

Bernstein expects the wave of new ethylene crackers on the Texas Gulf Coast to add 715,000 barrels per day (Mbbl/d) of ethane demand as they come online between December 2016 and December 2020. PADD III, which includes the Permian and the Eagle Ford Shale, will grow output by 520 Mbbl/d by 2020.

Assuming competition with rejected ethane from outside of Texas, the price will remain at under 30 cents/gal, Bernstein predicts. And if the price rises above that, expect the crackers to switch to propane as a feedstock.

“Notably, the Northeast ethane market is disconnecting from the Gulf Coast ethane market,” the analysts wrote. Enterprise Product Partners LP’s (NYSE: EPD) 1,192-mile ATEX is the only pipeline that connects the Marcellus-Utica shales to Mont Belvieu, Texas, and by next year will reach its 145 Mbbl/d capacity.

“Notably, the Northeast ethane market is disconnecting from the Gulf Coast ethane market,” the analysts wrote. Enterprise Product Partners LP’s (NYSE: EPD) 1,192-mile ATEX is the only pipeline that connects the Marcellus-Utica shales to Mont Belvieu, Texas, and by next year will reach its 145 Mbbl/d capacity.

Bernstein questioned whether all investors are cognizant of the significantly higher NGL content in Permian Basin gas from unconventional shale wells compared to conventional wells drilled before 2010. Measured in gallons per thousand cubic feet (gal/Mcf), the “old Permian” averaged 3 gal/Mcf whereas the “new Permian” averages 6 gal/Mcf.

What this higher content translates to is an additional 400 Mbbl/d of Permian ethane production between now and 2020, resulting in a 2020 average of 700 Mbbl/d and rising to 850 Mbbl/d in 2022. The Eagle Ford’s NGL content is slightly higher than the Permian’s, and its production is expected to rise from its 2017 trough. Nevertheless, its growth from 290 Mbbl/d in 2016 will peak at 430 Mbbl/d in December 2020.

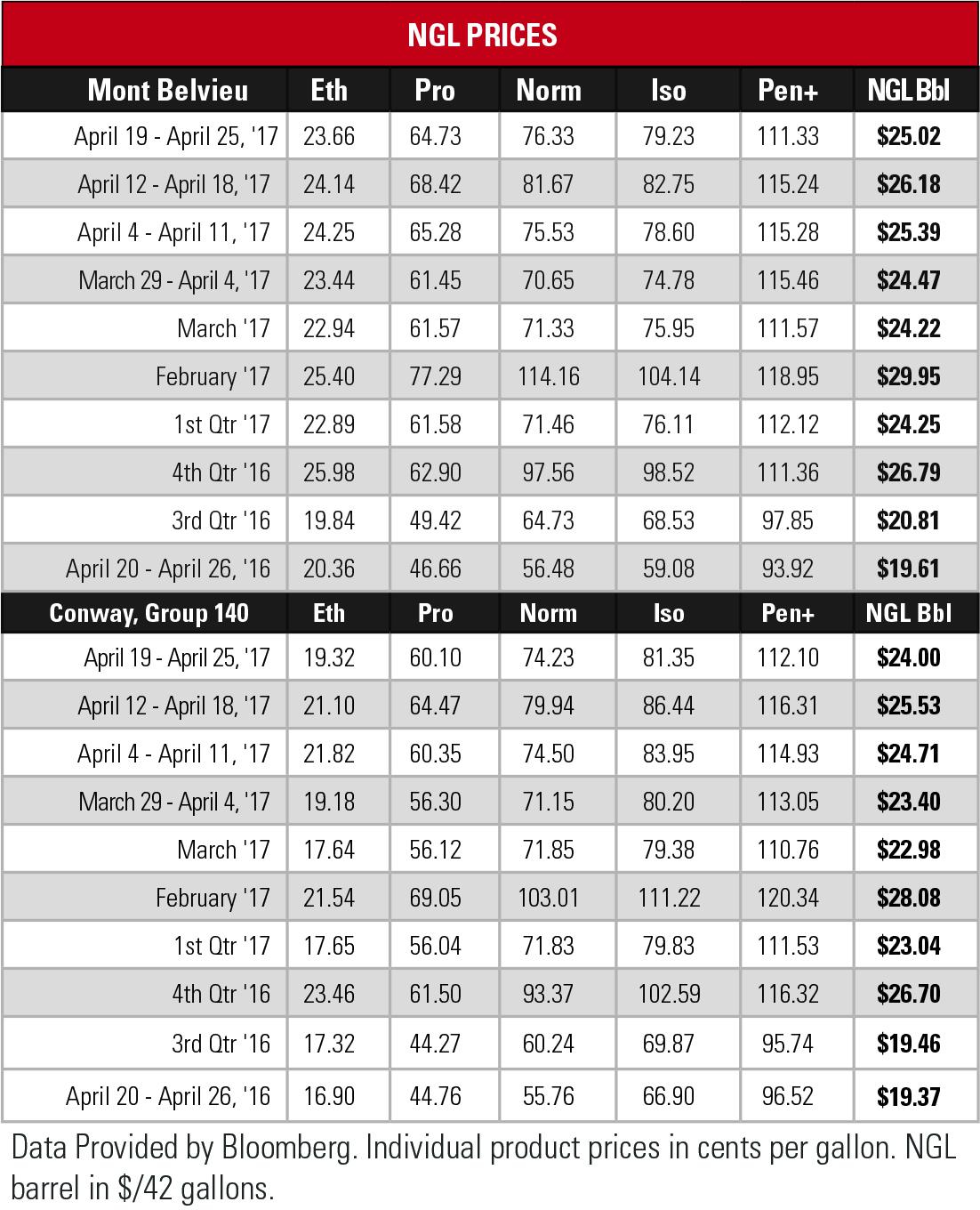

Ethane prices dropped 2% at Mont Belvieu and 8% to below 20 cents/gal at Conway, Kan., in the previous week. Mont Belvieu’s price is 16.2% above the price at the same time last year and Conway’s is 14.3% above. Going back further, ethane at Mont Belvieu is 34.3% higher than it was at this time in 2015 and at Conway, the price is 16.4% higher.

Ethane prices dropped 2% at Mont Belvieu and 8% to below 20 cents/gal at Conway, Kan., in the previous week. Mont Belvieu’s price is 16.2% above the price at the same time last year and Conway’s is 14.3% above. Going back further, ethane at Mont Belvieu is 34.3% higher than it was at this time in 2015 and at Conway, the price is 16.4% higher.

The hypothetical NGL barrel dropped 4.4% in the last week at Mont Belvieu and 6% at Conway. At Mont Belvieu, the barrel is 27.6% above the price at this time last year. And at Conway, the price is 23.9% higher.

Storage of natural gas in the Lower 48 increased by 74 Bcf in the week ended April 21, the U.S. Energy Information Administration reported. The increase, above the Bloomberg consensus of 72 Bcf, resulted in a total of 2.189 Tcf. The figure is 14.1% less than the 2.547 Tcf figure at the same time in 2016 and 15.8% above the five-year average of 1.89 Tcf.

Joseph Markman can be reached at jmarkman@hartenergy.com and @JHMarkman.

Joseph Markman can be reached at jmarkman@hartenergy.com and @JHMarkman.

Recommended Reading

Blackstone Buys NatGas Plant in ‘Data Center Valley’ for $1B

2025-01-24 - Ares Management’s Potomac Energy Center, sited in Virginia near more than 130 data centers, is expected to see “significant further growth,” Blackstone Energy Transition Partners said.

Chevron Delivers First Oil from Kazakhstan Project

2025-01-24 - Chevron Corp.’s newest plant at Kazakhstan’s Tengiz Field is expected to ramp up output to 1 MMboe/d.

US Oil, Gas Rig Count Falls to Lowest Since Dec 2021

2025-01-24 - The oil and gas rig count fell by four to 576 in the week to Jan. 24. Baker Hughes said this week's decline puts the total rig count down 45, or 7% below this time last year.

Tamboran, Falcon JV Plan Beetaloo Development Area of Up to 4.5MM Acres

2025-01-24 - A joint venture in the Beetalo Basin between Tamboran Resources Corp. and Falcon Oil & Gas could expand a strategic development spanning 4.52 million acres, Falcon said.

New Fortress Signs 20-Year Supply Deal for Puerto Rican Power Plant

2025-01-23 - The power plant, expected to come online in 2028, will be the first built in Puerto Rico since 1995, New Fortress said.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.