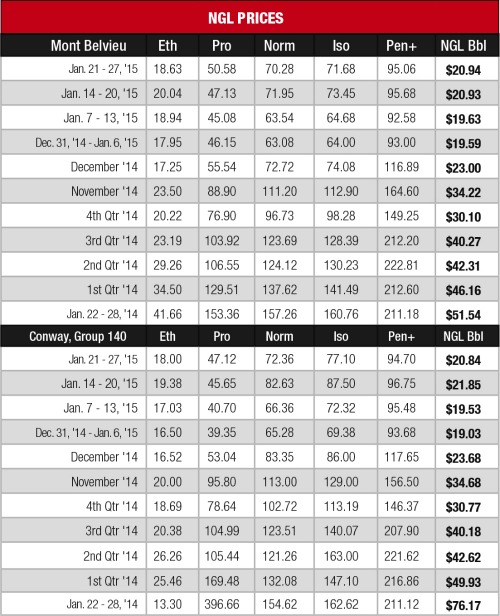

In spite of cold temperatures and the anticipation leading up to the winter storm dubbed “Blizzard 2015” in the Northeast, NGL prices fell almost across the board last week, with propane prices standing out as the only bright spot. As propane makes up a large share of the theoretical NGL barrel (bbl), its gains helped to anchor the NGL barrel’s price.

Propane rose 3% at Conway to 47 cents per gallon (gal), its highest price since the week of Dec. 17, 2014. At Mont Belvieu, the price rose 7% to 51 cents/gal, the highest it’s been since it was 52 cents/gal the week of Dec. 24, 2014. Propane storage levels decreased by 1.9 million barrels (MMbbl) to 69.3 MMbbl for the week ending Jan. 23, according to the U.S. Energy Information Administration (EIA). However, propane prices are likely to face setbacks during the coming months unless the price of crude oil rebounds because despite the slight withdrawal, propane inventories are at more than double year-ago levels of 31.674 MMbbl.

According to En*Vantage, strong propane exports and petrochemical demand will be necessary to keep margins up. “As we have been stating, the Marcellus/Utica, where there is limited bulk storage, will be very vulnerable to extreme excesses of propane this spring and summer. The challenge will be to evacuate as much propane from the region either through exports from the East Coast or by rail, truck and barge to the Gulf Coast, Southeast and Midwest where it can be stored, consumed or exported,” the firm said in its Weekly Energy Report for Jan. 29.

After last week’s gains, ethane experienced another setback, falling 7% at both hubs to 18 cents/gal at Conway and 19 cents/gal at Mont Belvieu. This is likely due in part to the complete shutdown of Boardwalk Pipeline Partners LP’s Evangeline Ethylene Pipeline, because of another leak near Lake Charles, La. Ethane is under additional strain as cracking capacity is hampered by plant turnarounds, including Chevron Phillips Chemical Co.’s Port Arthur, Texas, plant, which is expected to remain down until early to mid-February.

Butane and isobutane both declined 12% at Conway and 2% at Mont Belvieu. C5+ prices remained fairly stable, posting a 3% loss at Conway and a 4% gain at Mont Belvieu.

Natural gas prices continued to fall, with losses of 5% at Conway and 4% at Mont Belvieu. Investment bank Simmons & Co. International said in its Jan. 30 Morning Energy Note that it expects gas prices to remain low in the near term. “Despite January likely reaching a monthly power plant consumption record (22.9 Bcf/d [billion cubic feet per day] through 1/28), production continues to overwhelm demand and the weekly withdrawal figure was below consensus expectations for the second week in a row. Oil rigs are dropping from the market at an alarming pace, but a slowdown in associated gas production will take months to manifest,” the note said.

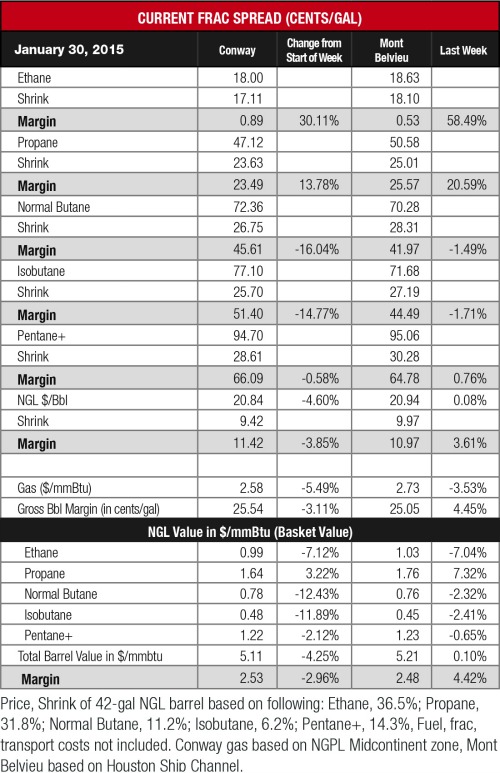

The theoretical NGL bbl price decreased by 4% at Conway to $20.84/bbl with a 4% loss in margin to $11.42/bbl while the Mont Belvieu price increased 0.1% to $20.94/bbl with a 4% gain in margin to $10.97/bbl.

The most profitable NGL to make at both hubs remained C5+ at 66 cents/gal at Conway and 65 cents/gal at Mont Belvieu. This was followed, in order, by isobutane at 51 cents/gal at Conway and 44 cents/gal at Mont Belvieu; butane at 46 cents/gal at Conway and 42 cents/gal at Mont Belvieu; propane at 23 cents/gal at Conway and 26 cents/gal at Mont Belvieu; and ethane at 1 cent/gal at both hubs.

The EIA reported that natural gas storage levels decreased by 94 Bcf to 2.543 trillion cubic feet (Tcf) the week of Jan. 23, down from 2.637 Tcf the previous week. This was 15% higher than the 2.219 Tcf posted last year at the same time and 3% below the five-year average of 2.622 Tcf.

Recommended Reading

Fugro’s Remote Capabilities Usher In New Age of Efficiency, Safety

2024-11-19 - Fugro’s remote operations center allows operators to accomplish the same tasks they’ve done on vessels while being on land.

TGS Awarded 2D Survey in the Sumatra Basin

2024-09-09 - TGS’ Sumatra Basin seismic acquisition is expected to be completed by the end of 2024.

Companies Hop on Digital Twins, AI Trends to Transform Day-to-day Processes

2024-10-23 - A big trend for oil and gas companies is applying AI and digital twin technology into everyday processes, said Kongsberg Digital's Yorinde Lokin-Knegtering at Gastech 2024.

BP to Use Palantir Software to Improve AI in Operations

2024-09-09 - BP and Palantir have agreed to a five-year strategic relationship in which Palantir’s AIP software will use large language models to improve BP operations.

ZEMA Global to Acquire Morningstar’s Commodity Data Business

2024-09-23 - ZEMA Global Data Corp. is acquiring Morningstar Commodity Data to meet demand for data and analytics prompted by the global energy transition.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.