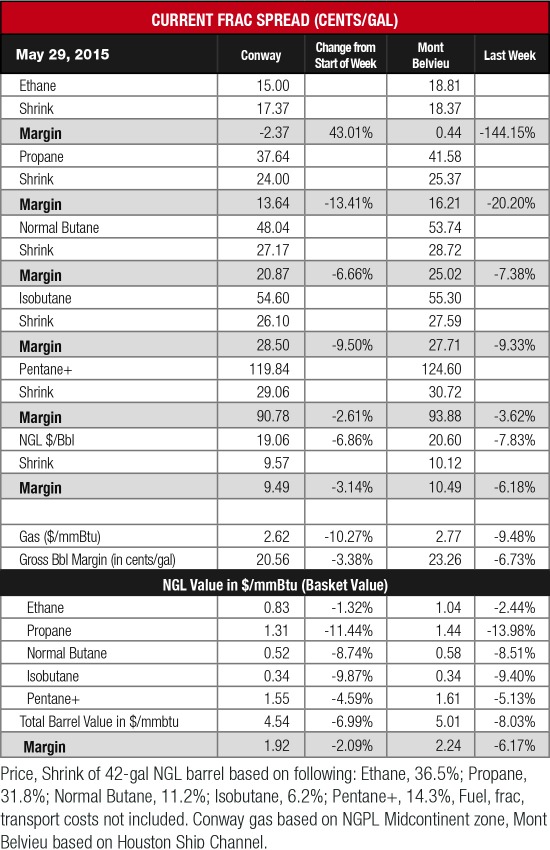

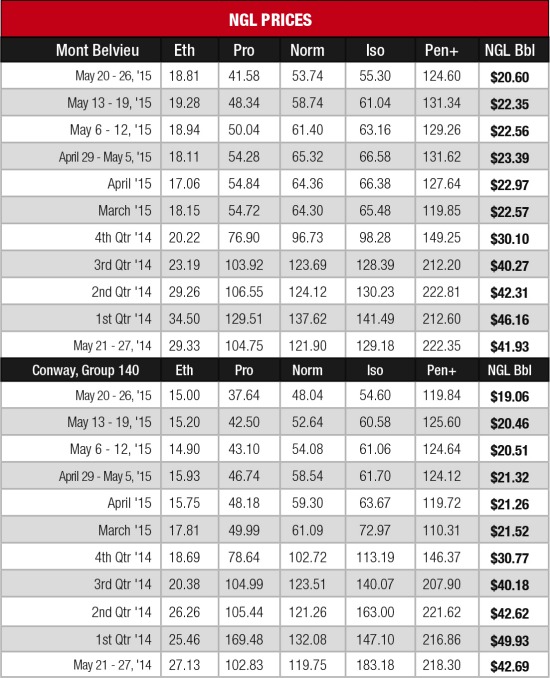

NGL prices may be approaching a new bottom as several products hit their lowest level in years as supply continues to overwhelm demand. This is most notable in the case of propane, which fell by double-digit percentages at both Conway and Mont Belvieu to its lowest level in more than a decade.

Since Hart Energy has been tabulating NGL prices and frac spread margins, the only other period in which propane prices were as low as the 42 cents per gallon (/gal) at Mont Belvieu and 38 cents/gal at Conway was back in summer 2002.

Despite high LPG export levels, propane and butane prices continue to plunge due to record inventory levels. Though frac spread margins remain solid at both Conway and Mont Belvieu, other hubs are beginning to show troublesome signs. Last week, prices at the Edmonton, Canada, hub turned negative for a day before barely returning to profitability. Transportation constraints are also resulting in negative margins in the Marcellus-Utica. Most worrisome is that Mont Belvieu is quickly being overloaded by incoming supplies. If the nation’s top midstream center can’t handle these supplies, there is a real question about where supplies can and will be directed.

As previously noted, butane and isobutane prices fell at a similar rate to propane. However, supplies are not remarkably larger than in other years where demand dwindles in the spring and summer. LPG shipments currently consist of less than 20% butane, which is helping to increase supplies and push prices down. Pentanes-plus (C5+) fell 5% at both hubs due to the drop in West Texas Intermediate (WTI) below $58.00 per barrel (/bbl).

Despite a recent improvement in WTI crude to more than $60/bbl, it appears that more challenges still face the industry before crude can fully recover from its downturn this year. In a recent research note, Moody’s Investors Services noted that oil demand is weakening as conservation and substitution are changing consumption behavior. In addition, the report stated that Saudi Arabia’s decision to not cut back production is oversupplying the market. “Market conditions and Saudi Arabian behavior resemble circumstances in the mid-1980s, which led to a regime of persistently low prices. Absent a source of robust oil demand growth, history suggests that the current regime of sharply reduced oil prices could continue for a number of years,” the report said.

It wasn’t all bad news for NGL prices as ethane was largely flat at both hubs as the combination of widespread rejection the past two years and increased cracking capacity is helping to reduce the storage overhang. Though prices are still low and margins are negative at Conway, and only theoretically positive at Mont Belvieu, there is light at the end of the tunnel. Though prices aren’t expected to fully recover by 2018, there is a good possibility that they will improve throughout the summer.

Although natural gas prices fell this week, they are expected to increase in the coming weeks due to warmer-than-normal temperatures on the East Coast and increased exports to Mexico. These changes will lead to prices rising above $3.00 per million BTU, according to Global Hunter Securities.

Improved gas prices will help further support ethane gains, but could further hinder weakened frac spread margins. This week the most profitable NGL to make at both hubs was C5+ at 91 cents/gal at Conway and 94 cents/gal at Mont Belvieu. This was followed, in order, by isobutane at 29 cents/gal at Conway and 28 cents/gal at Mont Belvieu; butane at 21 cents/gal at Conway and 25 cents/gal at Mont Belvieu; propane at 14 cents/gal at Conway and 16 cents/gal at Mont Belvieu; and ethane at negative 2 cents/gal at Conway and nil at Mont Belvieu.

Natural gas storage levels rose 112 billion cubic feet the week of May 22 to 2.101 trillion cubic feet (Tcf) from 1.989 Tcf the previous week, according to the U.S. Energy Information Administration. This was 54% higher than the 1.364 Tcf posted last year at the same time and 1% below the five-year average of 2.119 Tcf. Cooling demand should begin to increase next week as the National Weather Service’s forecast anticipates warmer-than-normal temperatures throughout the country.

Recommended Reading

EQT Flexes Midstream Muscles in 3Q After Equitrans Acquisition

2024-10-30 - Natural gas producer EQT Corp. says it has far more flexibility to respond to market prices following its acquisition of Equitrans Midstream.

EQT, Blackstone Credit Enter $3.5 Billion Midstream Joint Venture

2024-11-25 - Blackstone Credit & Insurance entered a joint venture with EQT Corp. to take a non-controlling interest in the Mountain Valley Pipeline and other infrastructure from the Equitrans transactions for $3.5 billion.

Analysts: NatGas Price Will Drive Next Appalachian Pipeline

2024-11-13 - Infrastructure development in the Appalachia region could also benefit from greater legislative certainty.

FERC Sides with Williams Over Energy Transfer in Pipeline Dispute

2024-09-30 - The Federal Energy Regulatory Commission has declared that Williams’ disputed Louisiana Energy Gateway project is a gathering network, not a transport line.

Midstreamers Say Need for More Permian NatGas Pipelines Inevitable

2024-11-26 - The Permian Basin’s associated gas output could outstrip the region’s planned capacity well before the end of the decade, pipeline company executives said.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.