The failure of OPEC and several key non-OPEC producers to come to an agreement to freeze crude oil output saw crude prices tumble below $40 per barrel (/bbl) before they climbed back above that price threshold due to supply disruptions in Nigeria, Iraq and Kuwait.

Natural gas prices also experienced significant gains as the forward curve is improving with the expectation that supply and demand will tighten as drilling decreases and export demand increases. According to an April 19 research note from Barclays Capital, the U.S. will be the third-largest LNG exporter by 2020 with as much as 8.2 billion cubic feet per day (Bcf/d) being shipped around the globe. This is likely to create a cap on how prices can get in the next few years as the price spread between the U.S. and Europe will close. It is unlikely prices will approach their 2007 highs anytime soon, but they could double in value, on average, in the next 12-18 months.

The improvements in oil and gas prices is helping support modest gains for NGL prices as they rose across the board at both the Mont Belvieu, Texas, and Conway, KS, hubs. The largest gain at both was for ethane, which experienced an 11% gain at Mont Belvieu and a 12% at Conway. The Texas price rose to 20 cents per gallon (/gal), its highest price since mid-October 2015, and the Kansas price improved to 16 cents/gal, its highest price since late October 2015.

These price increases occurred even as a number of ethane crackers are undergoing turnarounds and is a reflection of the improved balance in the ethane market. In fact, it is likely that ethane is moving closer to the other two ethylene feedstocks - propane and butane. In turn this is moving ethane further from gas prices and closer to crude prices. Though crude prices are struggling, this is a very good sign for ethane on a long-term basis.

On the flip side of the light NGL bbl, propane’s momentum has slowed the last two months as exports have fallen short of expectations and created larger inventory builds than were anticipated. Should this continue, the propane market won’t be as strong heading into the fall and winter as originally expected. Propane prices did improve this week as exports were in line with forecasts and if expectations can continue to be met then the market should be solid come the fall.

Growth was more muted for heavy NGL prices as refiners have switched to making summer-grade gasoline, which uses less butane and C5+ in the mix than winter-grade fuel. Overall, the theoretical NGL bbl improved 4% at both hubs with the Conway price hitting $18.58/bbl with a 2% gain in margin to $11.82/bbl. The Mont Belvieu price rose to $19.10/bbl with the margin remaining flat at $11.80/bbl.

The most profitable NGL to make at both hubs was C5+ at 72 cents/gal at Conway and 70 cents/gal at Mont Belvieu. This was followed, in order, by isobutane at 46 cents/gal at Conway and 37 cents/gal at Mont Belvieu; butane at 34 cents/gal at both hubs; propane at 26 cents/gal at Conway and 27 cents/gal at Mont Belvieu; and ethane at 4 cents/gal at Conway and 7 cents/gal at Mont Belvieu.

The U.S. Energy Information Administration reported that natural gas storage levels rose very slightly the week of April 15 with a 7 Bcf increase to 2.484 trillion cubic feet (Tcf) from the previous week. This was 55% greater than the 1.603 Tcf posted last year at the same time and 49% greater than the five-year average of 1.673 Tcf.

Frank Nieto can be reached at fnieto@hartenergy.com.

Recommended Reading

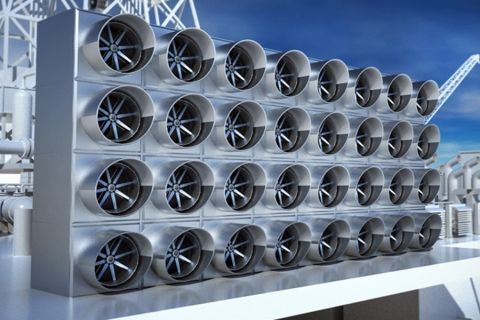

Optimizing Direct Air Capture Similar to Recovering Spilled Wine

2024-09-20 - Direct air capture technologies are technically and financially challenging, but efforts are underway to change that.

Oxy’s Hollub Drills Down on CrownRock Deal, More M&A, Net-zero Oil

2024-11-01 - Vicki Hollub is leading Occidental Petroleum through the M&A wave while pioneering oil and gas in EOR and DAC towards the goal of net-zero oil.

Carbon Removal Company Equatic Appoints New CEO

2024-11-18 - Equatic appointed a new CEO in preparation to launch the world’s largest ocean-based carbon removal plant.

No Shortage of Capital, Shortage of Investable Low-carbon Projects

2024-09-30 - Investors are looking to the bankability equation—sustainability plus guaranteed returns—and finding that the energy transition’s problem is not a shortage of capital, but a shortage of investable projects.

ConocoPhillips Adds Connors to Board

2024-09-05 - Nelda J. Connors will serve on the audit and finance committee and public policy and sustainability committee of ConocoPhillips’ board.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.