Offshore oil loading takes place in the Houston Ship Channel using a single buoy mooring into the oil tanker. (Source: eWilding / Shutterstock.com)

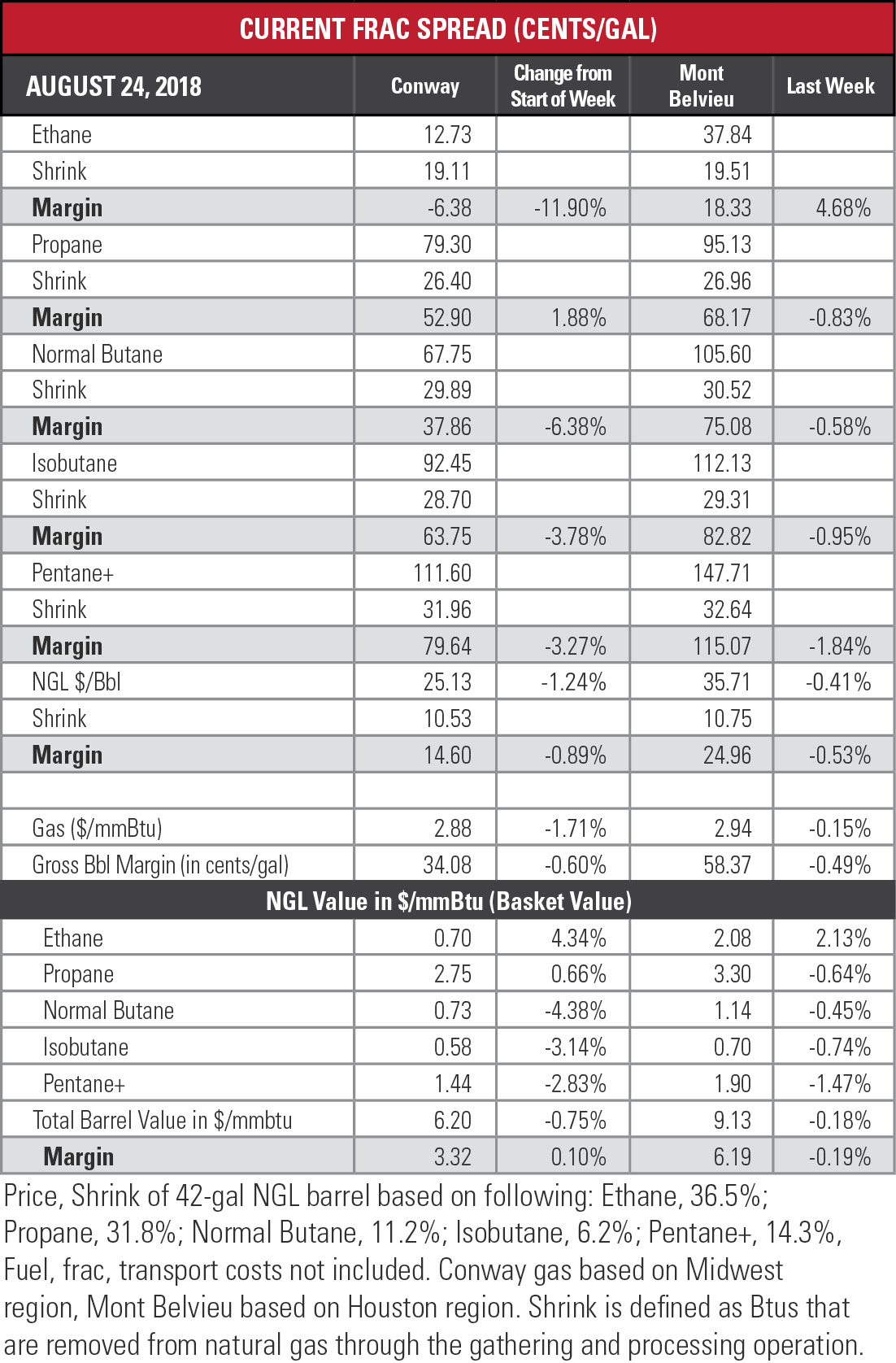

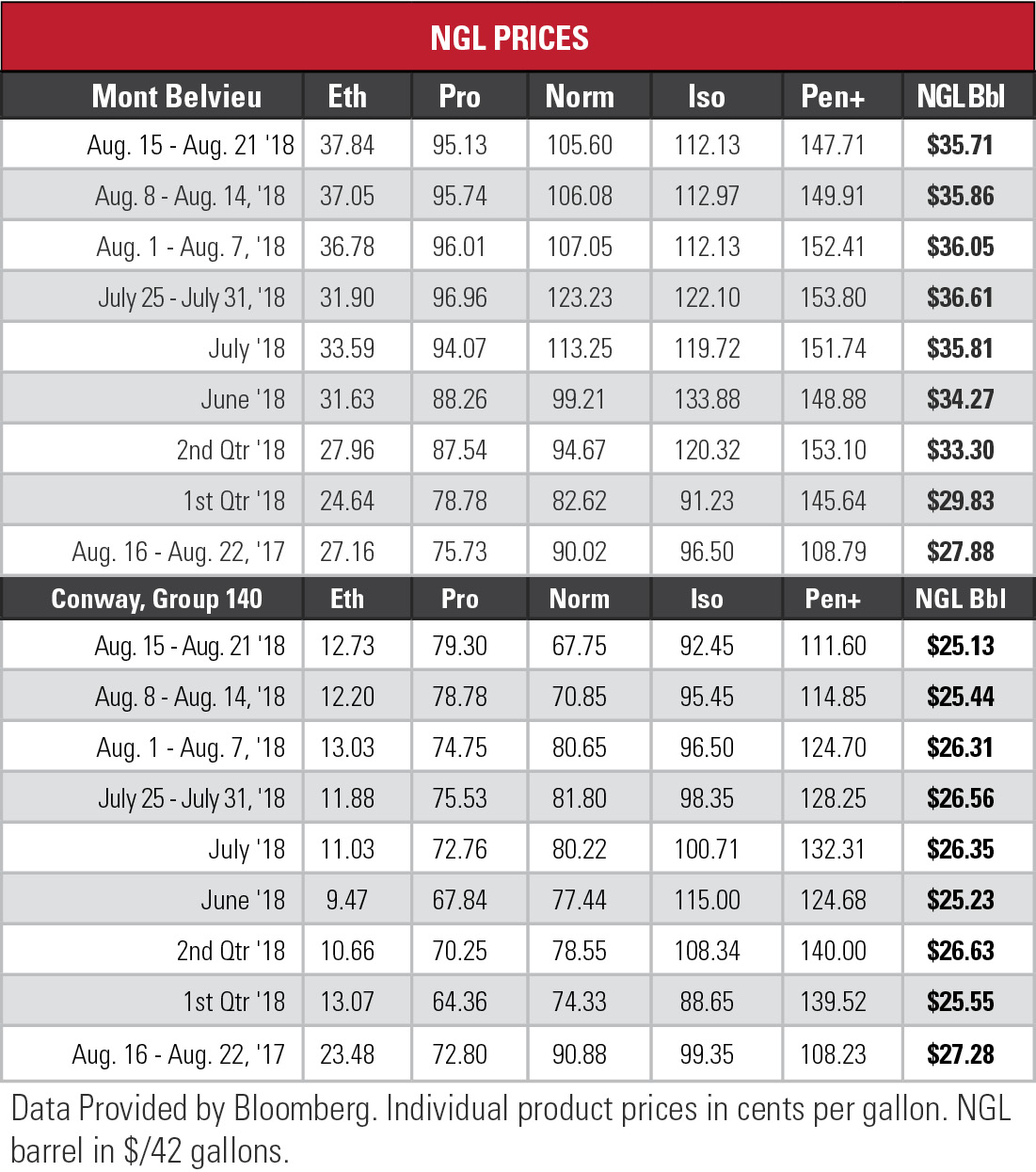

Ethane’s average five-day price at Mont Belvieu, Texas, inched its way toward 38 cents per gallon (gal) last week, reaching another 42-month high. The daily price on Aug. 20 did, in fact, hit 40 cents/gal.

Two new fractionators at Mont Belvieu are adding 90,000 barrels per day (Mbbl/d) of ethane, but the added supply won’t rain on either the price nor margin parades, Envantage Inc. believes. Mont Belvieu’s ethane margin surged to 18.33 cents/gal last week, a 4.7% increase over the previous week. The price is 39.3% above where it was at the same time in 2017.

Envantage sees higher Gulf Coast ethane demand driven by new cracker capacity and strong exports as supporting the higher prices. In fact, demand is so high that more supplies need to flow in from other regions, including the Permian Basin, Midcontinent, Niobrara and Bakken. The industry’s bugaboo—infrastructure constraints—will be an issue until projects are completed near the end of 2020.

Envantage is also concerned about the ability of Gulf Coast storage facilities to handle the increased volumes.

Envantage is also concerned about the ability of Gulf Coast storage facilities to handle the increased volumes.

“At least for the remainder of this year, it is very likely that Mont Belvieu ethane prices will show a similar pattern that we have seen over the past two months with occasional price spikes,” the analysts wrote. “But, even after more pipeline and fractionation capacity is completed over the next year or so, ethane’s storage and distribution system may present bottlenecks that can cause sudden spikes in ethane prices.”

Mont Belvieu propane dipped for the third week in a row, but last week still registered the fifth-highest price for the year. The margin tightened by less than 1% to 68.17 cents/gal.

Mont Belvieu propane dipped for the third week in a row, but last week still registered the fifth-highest price for the year. The margin tightened by less than 1% to 68.17 cents/gal.

Envantage does not expect propane’s price to descend too much more. Balances are tight with inventories even with a year ago and 10% below the five-year average.

The analysts are also bullish about the export outlook. Lower prices tend to lift exports and Envantage expects shipments of propane to average 1 MMbbl/d or more during the fall. The startup of the Mariner East 2 pipeline should ease the overhang in the Midcontinent.

In Envantage’s outlook, as traders realize that Gulf Coast propane balances are tightening as winter approaches, the price should make it over $1/gal by the end of the third quarter.

Butane’s slide continued to its lowest level since averaging just under 98 cents/gal in late June. The margin held up, sinking only 0.6%.

Mont Belvieu isobutane returned to its level of two weeks ago, which was the lowest since early May and 28.7% below its high of $1.5725/gal for that period at the end of May. The margin was squeezed less than 1% to just under 83 cents/gal.

Natural gasoline at Mont Belvieu was also down for the third week in a row to the third-lowest level since mid-April, when the run of $1.50/gal began. The margin shrunk by almost 2% to about $1.15/gal.

In the week ended Aug. 10, storage of natural gas in the Lower 48 experienced an increase of 48 billion cubic feet (Bcf), the U.S. Energy Information Administration reported. The figure, compared the Bloomberg survey’s consensus of 49 Bcf, resulted in a total of 2.435 trillion cubic feet (Tcf). That is 21.9% below the 3.119 Tcf figure at the same time in 2017 and 19.7% below the five-year average of 3.034 Tcf.

In the week ended Aug. 10, storage of natural gas in the Lower 48 experienced an increase of 48 billion cubic feet (Bcf), the U.S. Energy Information Administration reported. The figure, compared the Bloomberg survey’s consensus of 49 Bcf, resulted in a total of 2.435 trillion cubic feet (Tcf). That is 21.9% below the 3.119 Tcf figure at the same time in 2017 and 19.7% below the five-year average of 3.034 Tcf.

Joseph Markman can be reached at jmarkman@hartenergy.com or @JHMarkman.

Recommended Reading

US Drillers Cut Oil, Gas Rigs for First Time in Six Weeks

2025-01-10 - The oil and gas rig count fell by five to 584 in the week to Jan. 10, the lowest since November.

On The Market This Week (Jan. 6, 2025)

2025-01-10 - Here is a roundup of listings marketed by select E&Ps during the week of Jan. 6.

Perma-Pipe Gets $43MM Contract for Services in Middle East

2025-01-10 - Texas company Perma-Pipe International Holdings specializes in anti-corrosion services for infrastructure.

Shale Outlook: E&Ps Making More U-Turn Laterals, Problem-Free

2025-01-09 - Of the more than 70 horseshoe wells drilled to date, half came in the first nine months of 2024 as operators found 2-mile, single-section laterals more economic than a pair of 1-mile straight holes.

Murphy’s Vietnam Find May Change Investor Views, KeyBanc Analysts Say

2025-01-09 - The discovery by a subsidiary of Murphy Oil Corp. is a reminder of the company’s exploration prowess, KeyBanc Capital Markets analysts said.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.