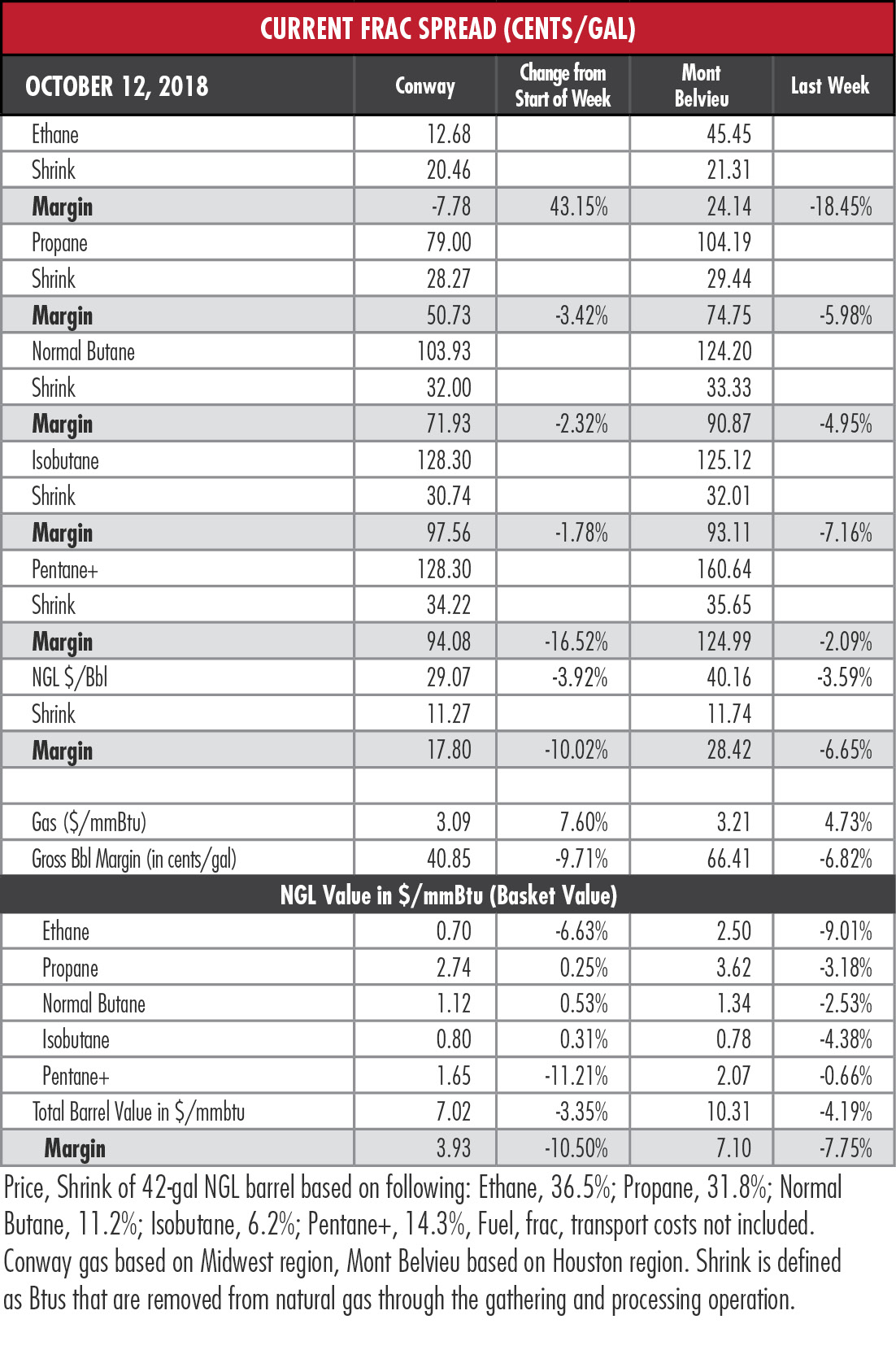

Stronger natural gas prices and slipping NGL prices cut into NGL margins at both the Mont Belvieu, Texas and Conway, Kan., hubs last week, even as the Mont Belvieu hypothetical barrel remained above $40 for the first time in over four years.

This is not your father’s commodities environment. This is not even your own commodities environment from last year.

Crude oil traders are bullish, despite higher inventories and an easing of prices that typically takes place this time of year following the summer driving season, said EnVantage Inc. in a report. But the global markets are roiling because the globe is roiling.

Crude oil traders are bullish, despite higher inventories and an easing of prices that typically takes place this time of year following the summer driving season, said EnVantage Inc. in a report. But the global markets are roiling because the globe is roiling.

Iranian crude exports are in a free fall ahead of the planned impositions of U.S. sanctions on Nov. 4. They averaged 1.1 million barrels per day (bbl/d) for the week of October, which is 31% below the daily average in September and 58% below the high for the year in April.

The CEO of Trafigura Group, a Geneva-based trading house, said recently that he would not be surprised to see crude oil pass $100 a barrel next year. On Oct. 10, Brent was around $83/bbl and West Texas Intermediate (WTI) was about $73/bbl.

Goldman Sachs is not so bullish. A senior executive told CNBC that it would take a complete elimination of Iranian exports and another meltdown of an oil producer a la Venezuela to push crude over $100.

EnVantage concurs, though it notes the possibility of China also cutting off Iranian oil as well as doubts emerging that the OPEC-Russia coalition even has the spare capacity to add 600,000 bbl/d to the world market. Still, the analysts are cautious in their outlook.

“That is not to say we are becoming very bearish on the market,” they wrote. “But, oil prices have a tendency to overshoot the fundamentals and a move too fast, too high, can cause a correction.”

“That is not to say we are becoming very bearish on the market,” they wrote. “But, oil prices have a tendency to overshoot the fundamentals and a move too fast, too high, can cause a correction.”

The oil market relies on emerging economies to power growth but higher prices hamper the ability of those countries to buy the products. India, Iran’s No. 2 customer, has asked the U.S. for a waiver on the sanctions and has already announced that it would buy 9 million barrels of Iranian crude in November.

If oil prices continue to rise, EnVantage said, then the markets could see a 10% to 20% price correction before the end of 2018.

Ethane’s price volatility, said EnVantage, should extend through the end of 2020 with a range of 40 cents per gallon (gal) to 80 cents/gal. The analysts said ethane has a major advantage as a preferred feedstock—to a point.

“What would happen if ethane prices were to spike above 66 cents/gal, causing propane and butane to be more economical to crack than ethane?” the analysts asked. They estimate another 200,000 bbl/d of propane cracking capacity. If the economics justified using that capacity, then EnVantage expects that ethane cracking demand would drop by about 10%, squeezing prices.

But the multiple moving parts of demand won’t let that happen, EnVantage said. A 200,000 bbl/d increase in propane cracking would require a 10 cents/gal to 15 cents/gal increase in price reduce exports by that amount. When that happens, the price spike will force a rebound in ethane cracking. The push-and-pull of the market creates an instability that evokes an eerie similarity to the Houston Texans offensive line.

But the multiple moving parts of demand won’t let that happen, EnVantage said. A 200,000 bbl/d increase in propane cracking would require a 10 cents/gal to 15 cents/gal increase in price reduce exports by that amount. When that happens, the price spike will force a rebound in ethane cracking. The push-and-pull of the market creates an instability that evokes an eerie similarity to the Houston Texans offensive line.

In the week ended Oct. 5, storage of natural gas in the Lower 48 experienced an increase of 90 billion cubic feet (Bcf), the U.S. Energy Information Administration reported. The figure resulted in a total of 2.956 Tcf. That is 17.5% below the 3.583 Tcf figure at the same time in 2017 and 17% below the five-year average of 3.563 Tcf.

Joseph Markman can be reached at jmarkman@hartenergy.com or @JHMarkman.

Recommended Reading

LS Power Completes Acquisition of Algonquin Power’s Renewables Unit

2025-01-09 - With the transaction’s closure on Jan. 8, LS Power formed Clearlight Energy to manage the acquired renewable energy assets.

Coterra to Acquire Permian Assets from Franklin, Avant for $3.95B

2024-11-13 - Coterra made its long-awaited move to grow dramatically in the Permian, moving on large portions in New Mexico’s Delaware Basin.

Enterprise Closes $950MM Acquisition of Delaware’s Piñon Midstream

2024-10-28 - Enterprise Products Partners acquisition of Piñon Midstream expands Enterprise’s New Mexico Delaware Basin footprint with sour-gas processing.

Brigham Exploration Grows Permian Footprint in Non-Op Assets Deal

2024-12-17 - Brigham Exploration is significantly adding to its Permian Basin non-operated portfolio with an acquisition of 7,000 acres from Great Western Drilling.

Vitesse Energy to Buy Bakken Pureplay Lucero in $220MM Deal

2024-12-16 - Vitesse Energy will acquire Lucero Energy’s Bakken/Three Forks assets, including 25 net remaining locations, 1.9 net DUCs and 20 wells that are candidates for recompletions.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.