The president spoke and oil prices dropped.

“OPEC and OPEC nations, are, as usual, ripping off the rest of the world, and I don’t like it,” President Donald Trump told the United Nations General Assembly on Sept. 25. “Nobody should like it. We defend many of these nations for nothing, and then they take advantage of us by giving us high oil prices. Not good.

“We want them to stop raising prices,” the president continued, “we want them to start lowering prices, and they must contribute substantially to military protection from now on. We are not going to put up with it—these horrible prices—much longer.”

“We want them to stop raising prices,” the president continued, “we want them to start lowering prices, and they must contribute substantially to military protection from now on. We are not going to put up with it—these horrible prices—much longer.”

The impact of the president’s words on crude oil’s price might be called questionable, though. Soon after his speech, West Texas Intermediate (WTI) closed for the day up 20 cents to $72.28 a barrel. The next day, WTI did, in fact, slip by 1% but that decrease coincided with release of the U.S. Energy Information Administration’s (EIA) report showing crude inventories increasing by 1.9 million barrels for the week ending Sept. 21.

“It is our opinion that fundamentals will override the comments by President Trump,” wrote En*Vantage Inc. analysts, referring to the president’s first demand that OPEC lower prices on Sept. 20. “The consortium of OPEC and Russia has limited options to increase production to offset global demand growth, the production declines in Iran and Venezuela, and the possible disruptions that could occur in Libya.”

Despite the weekly uptick, the EIA’s data show U.S. oil inventories at about 75 million barrels below the level in 2017 at this time. The Brent-to-WTI spread remains wide ($10 premium for Brent), which should propel exports and tighten balances even more, En*Vantage said.

Despite the weekly uptick, the EIA’s data show U.S. oil inventories at about 75 million barrels below the level in 2017 at this time. The Brent-to-WTI spread remains wide ($10 premium for Brent), which should propel exports and tighten balances even more, En*Vantage said.

Exports of crude oil increased by 273,000 barrels per day (bbl/d) to 2.64 million bbl/d, the EIA reported. Since the week ended Sept. 7, U.S. crude exports are up 44.4%.

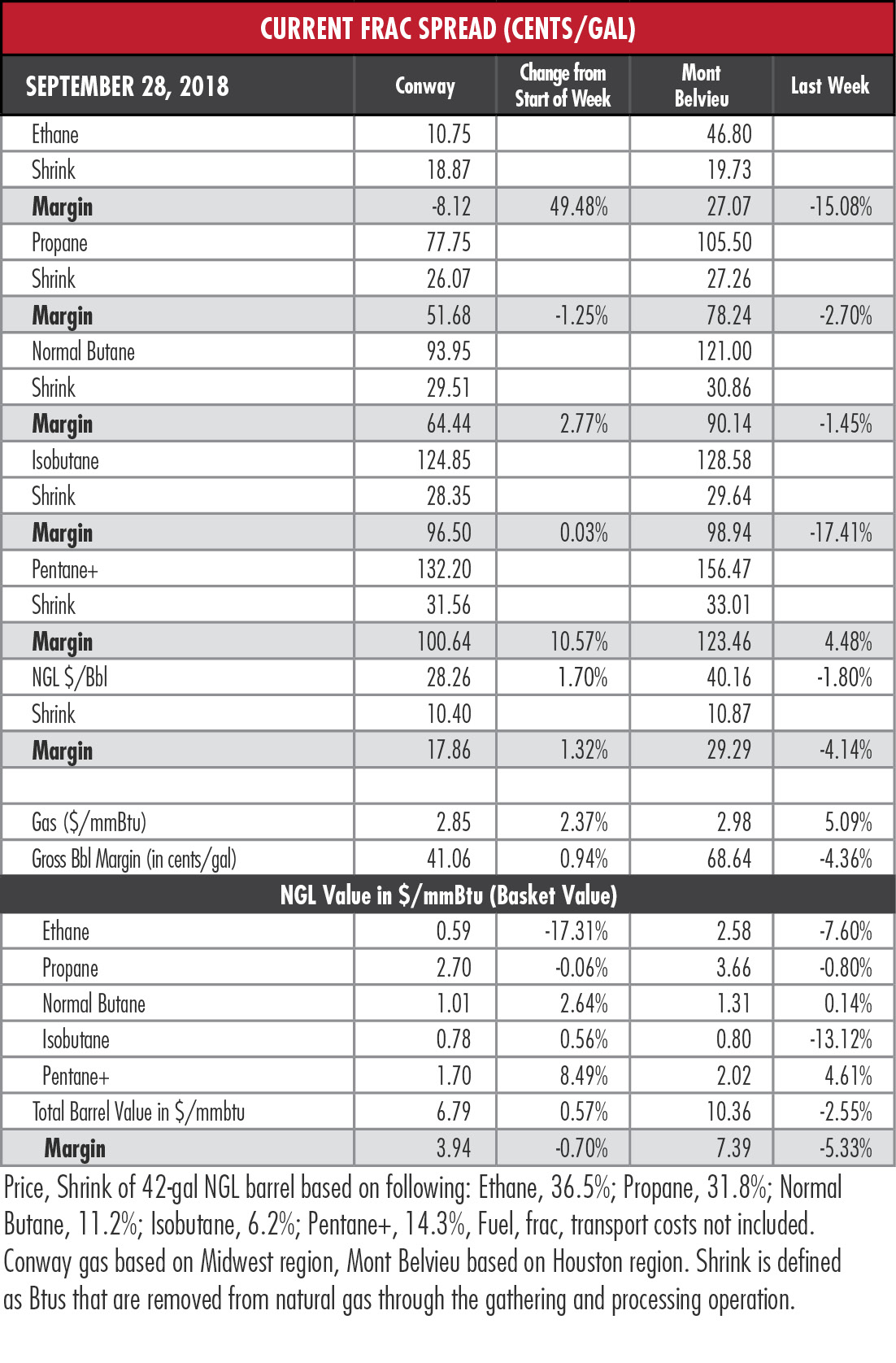

The Mont Belvieu, Texas, hypothetical NGL barrel slipped 1.8% in the past week but remained above $40 as price corrections claimed ethane and isobutane. One week after averaging almost 51 cents per gallon (gal), ethane dropped below 47 cents/gal.

Ethane’s predicament stems from the lack of fractionation capacity at Mont Belvieu. Despite the recent addition of 205,000 bbl/d of capacity, there simply is not enough to handle the volumes flowing in from the Permian Basin, Midcontinent and Rockies, En*Vantage said. That means:

- Cannibalizing storage for NGL products;

- Seeking fractionation elsewhere;

- Increasing ethane rejection to ensure that other NGL are fractionated;

- Keeping Midcontinent ethane where it is in favor of fractionating Permian output at Mont Belvieu; and

- Seeking to sell y-grade to petrochemical companies as ethylene feedstock.

EnVantage also expressed concern over natural gas inventories. Western Canada has experienced a chilly month with about 20 inches of snow falling in the Edmonton, Alberta, region during “Snow-Tember.” When the cold weather spills southward, storage could tighten.

“The market is now considering that storage inventories may not even crack the 3.3 [trillion cubic feet (Tcf)] level going into the winter which would be the lowest since the fall of 2009,” said EnVantage.

“The market is now considering that storage inventories may not even crack the 3.3 [trillion cubic feet (Tcf)] level going into the winter which would be the lowest since the fall of 2009,” said EnVantage.

In the week ended Sept. 21, storage of natural gas in the Lower 48 experienced an increase of 46 billion cubic feet (Bcf), the EIA reported. The figure, compared to the Bloomberg survey’s consensus average of 63 Bcf, resulted in a total of 2.768 Tcf. That is 20% below the 3.458 Tcf figure at the same time in 2017 and 18.3% below the five-year average of 3.389 Tcf.

Joseph Markman can be reached at jmarkman@hartenergy.com or @JHMarkman

Recommended Reading

US Drillers Cut Oil, Gas Rigs for First Time in Six Weeks

2025-01-10 - The oil and gas rig count fell by five to 584 in the week to Jan. 10, the lowest since November.

On The Market This Week (Jan. 6, 2025)

2025-01-10 - Here is a roundup of listings marketed by select E&Ps during the week of Jan. 6.

Perma-Pipe Gets $43MM Contract for Services in Middle East

2025-01-10 - Texas company Perma-Pipe International Holdings specializes in anti-corrosion services for infrastructure.

Shale Outlook: E&Ps Making More U-Turn Laterals, Problem-Free

2025-01-09 - Of the more than 70 horseshoe wells drilled to date, half came in the first nine months of 2024 as operators found 2-mile, single-section laterals more economic than a pair of 1-mile straight holes.

Murphy’s Vietnam Find May Change Investor Views, KeyBanc Analysts Say

2025-01-09 - The discovery by a subsidiary of Murphy Oil Corp. is a reminder of the company’s exploration prowess, KeyBanc Capital Markets analysts said.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.