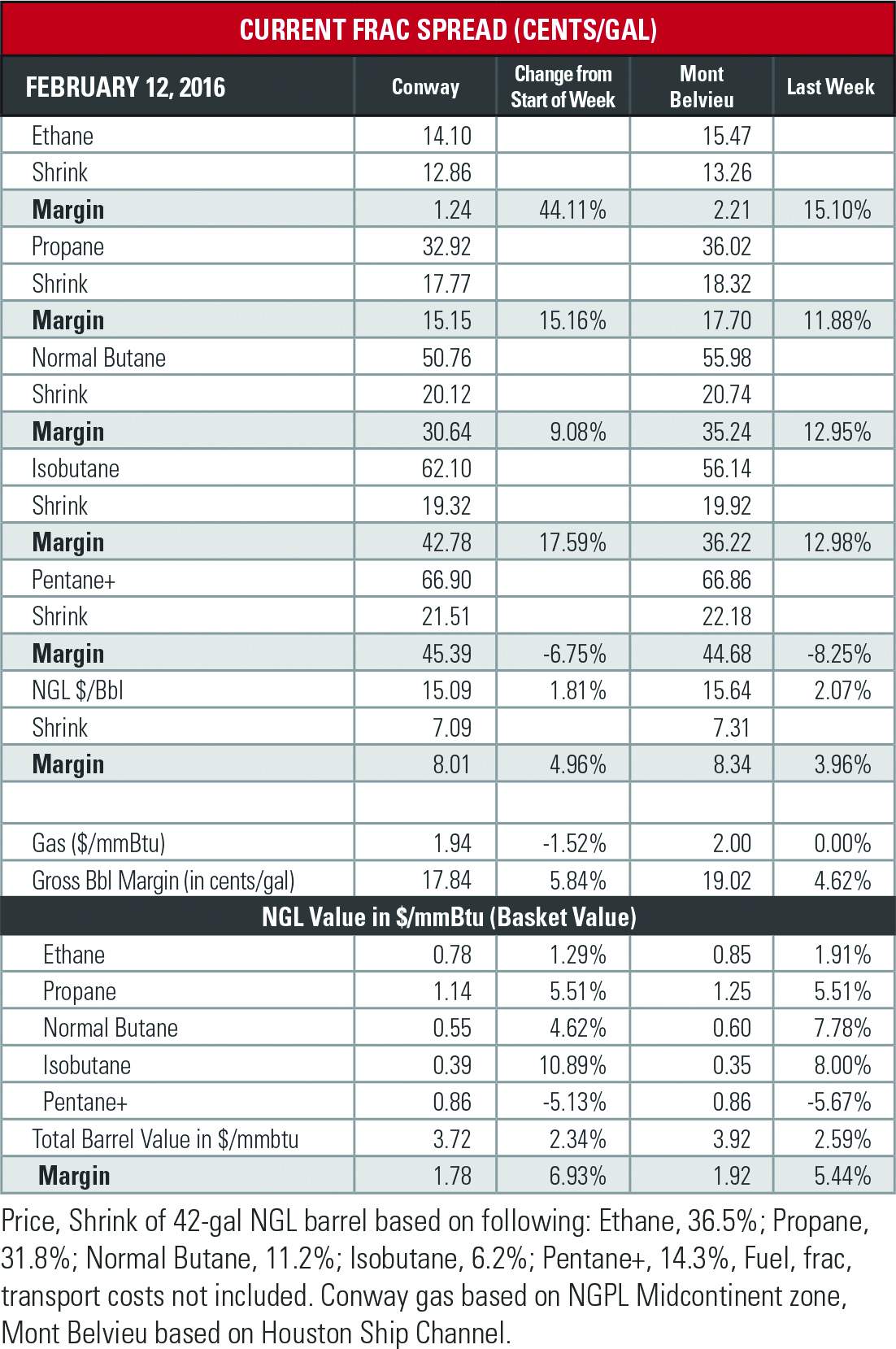

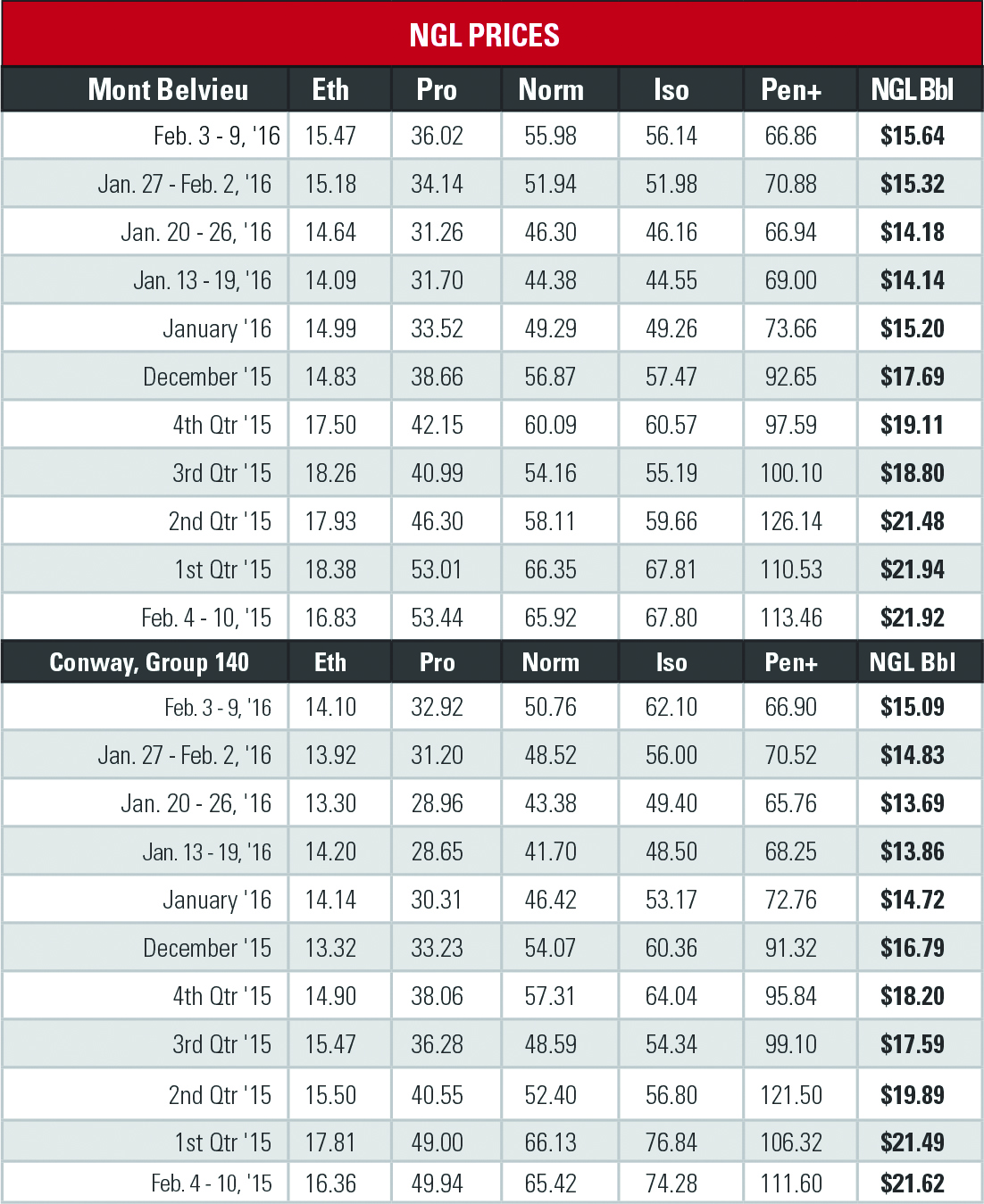

The hydrocarbon commodity market remains challenged with West Texas Intermediate (WTI) crude oil falling below $30 per barrel (/bbl) and natural gas remaining at about $2.00 per million Btu (/MMBtu). However, NGL prices improved this week as the market has benefited from increased heating demand the past few weeks and strong export demand.

While it is also possible that NGL prices hit their floor a month ago, it is likely that more volatility could impact the market as WTI crude may not have found its bottom. Until some semblance of consistency takes hold in the crude market, NGL prices will remain challenged. These challenges will increase as the spring shoulder season approaches. Winter temperatures are expected to turn warmer and there are reports that LPG exports to Asia and Europe may decrease in the next several weeks.

The good news is that it is possible that the market overreacted to news that crude storage at the Cushing, Okla., hub was rapidly increasing. The U.S. Energy Information (EIA) reported that oil stocks rose by 523,000 barrels (bbl). While there have been murmurings that storage at the hub was full, this is not the case based on the data available. “Cushing is not full. According to the U.S. Department of Energy, shell capacity at Cushing is 87 million bbl, working capacity is 73 million bbls vs. the reported 64.7 million bbl,” Tudor, Pickering, Holt & Co. said in a research note.

The investment firm noted that PADD III inventories are well below the working tank capacity and that interconnectivity between Cushing and the Gulf Coast will allow PADD III to absorb incremental crude stocks. Certainly the increase in volumes at Cushing isn’t good news for a struggling crude market, but neither is it the doomsday scenario the sudden decrease in WTI prices would lead you to believe.

The NGL with the closest relationship to crude, C5+ experienced a decrease in value at both hubs in line with the drop in crude. The price was down to 67 cents per gallon (/gal) at both hubs, a 6% drop at Mont Belvieu and a 5% decrease at Conway.

Further precipitating the decline was the deterioration in distillate demand caused by warmer winter temperatures and decreased industrial consumption. Barclays Capital reported that distillate stock levels were the highest for winter in the past decade.

North American diluent demand is also falling as production out of the Canadian oil sands has been lower in accordance with the decrease in prices. The export for diluent may see an uptick in the coming months though with demand improving for the product in Asia and Venezuela.

Flat natural gas prices are likely to continue throughout the rest of the winter as the recent cold front being experienced in the Northeast and Midwest arrived too late in the season to work off the huge storage overhang.

“The gas market started this winter oversupplied, with a record high inventory and a surplus of nearly 400 billion cubic feet (Bcf) versus the previous year. At the time a cold hard winter presented the best chance to correct the supply/demand imbalance through increased heating demand. But weather forecasters instead predicted an exceptionally warm winter due to the effects of El Nino. And sure enough, winter has been largely a no-show so far. Meanwhile, on the supply side, gas production has not given up any ground, and in fact, has even experienced another surge to record levels in recent weeks. This mixture of lower demand and higher supply has meant not as much gas has been withdrawn from storage to meet winter peak needs as usual this year. As a result, the storage surplus has continued to grow,” RBN Energy said in a Feb. 10 research note.

The company stated that balances have to tighten before November since it would be physically impossible to carry even a 300 Bcf surplus over last year through the end of injection season. This is because storage peaked at 4.009 trillion cubic feet (Tcf) on Nov. 20, 2015 and the total U.S. storage capacity is approximately 4.3 Tcf.

“Thus, longer term, the supply/demand balance must tighten compared to where it stands today and shrink the surplus by at least half in order to prevent a catastrophic market event this fall. If inventories end this winter season (March 31, 2016) with a surplus of 600 Bcf versus last year, that would require the balance to tighten by an average 3-Bcf/d over the 215 days of the summer injection season (April-Oct) in order to get back to last year's level near 4,000 Bcf by Nov. 1, 2016,” according to the report.

RBN Energy said that there are several factors that could result in a faster drawdown on storage levels. The first is that demand has been greater this year than last, which if the current rate continued through the summer would put storage levels to within 90% of last year’s figure. In addition, a larger number of exports to Mexico and new LNG export terminals will also help with working storage levels off.

While demand levels are increasing, there is growing evidence that supplies are decreasing as there are less efficiency gains to be created in 2016 than there were in 2015 and production out of the Northeast may be curbed with little new takeaway capacity set to come online until the fourth quarter after storage’s typical peak season.

“These factors could limit the ability for Northeast production to continue offsetting declines in other regions at the same rate that it has so far. Thus, after years of relentless growth, U.S. production volumes may well end up flat to slightly lower this year versus 2015,” the report said.

The latest data from the EIA show that storage volumes were down 70 Bcf to 2.864 Tcf the week of Feb. 5 compared to 2.934 Tcf the previous week. This was 25% greater than the 2.291 Tcf posted last year at the same time and 23% greater than the five-year average of 2.321 Tcf.

Recommended Reading

FERC Gives KMI Approval on $72MM Gulf Coast Expansion Project

2024-11-27 - Kinder Morgan’s Texas-Louisiana upgrade will add 467 MMcf/d in natural gas capacity.

Vivakor Expands Crude Gathering Network in Oklahoma STACK

2024-11-25 - Midstream company Vivakor is building its network following the October acquisition of Endeavor Crude.

EQT, Blackstone Credit Enter $3.5 Billion Midstream Joint Venture

2024-11-25 - Blackstone Credit & Insurance entered a joint venture with EQT Corp. to take a non-controlling interest in the Mountain Valley Pipeline and other infrastructure from the Equitrans transactions for $3.5 billion.

Exclusive: MPLX's Liquid Lines Support Growing NGL Exports

2024-11-19 - MPLX Executive Vice President and COO Greg Floerke delves into the company evolution in Appalachia and the increase in its liquids exports and production scale, in this Hart Energy Exclusive interview.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.