West Texas Intermediate (WTI) crude prices continued to fall the first full week of August as refiners are preparing to switch to winter-grade gasoline production. During this time multiple refineries will be down for maintenance to prepare for the switch. As a result, the price for the week fell below $45 per barrel (/bbl), its lowest level since 2009.

Global crude remains oversupplied but demand growth is most being impacted by a macroeconomics, especially a worrying outlook for the Chinese economy as Asia represents the largest growth driver for crude demand.

“There are more risks to the forecast lift in global economic growth in the second-half of 2015. So far market sentiment has deteriorated more than oil balances. The back of the market has led prices lower as speculators are no longer convinced higher oil prices are required to balance future oil supply and demand,” PIRA Energy Group said in its Aug. 2 Weekly Oil Market Recap. The group noted it disagreed with this sentiment, but stated that prices will remain lower than previously forecast until the market sees balances begin to tighten.

“It is PIRA’s belief that crude oil and product prices are set simultaneously in both the physical and paper markets. Commercial entities that have physical positions, which they hedge in the futures markets, are the connective tissue between these two markets. Post 2003, fears that the world would be running out of crude led speculators to increase their paper length, which raised deferred futures prices enough to allow physical players to find and develop higher cost crude. What is different this time is the role of prime move has shifted from speculators to commercials. This time commercials have become increasingly short, encouraging through lower prices speculators to enter the long side of the market,” PIRA said.

It is likely that crude prices will improve once the refinery maintenance season is over in the fall, but until that time WTI prices could decrease further. This will create another headwind for NGL prices, which will need to wait until winter for both refinery blending and heating demand to begin to see any sustained price uptick.

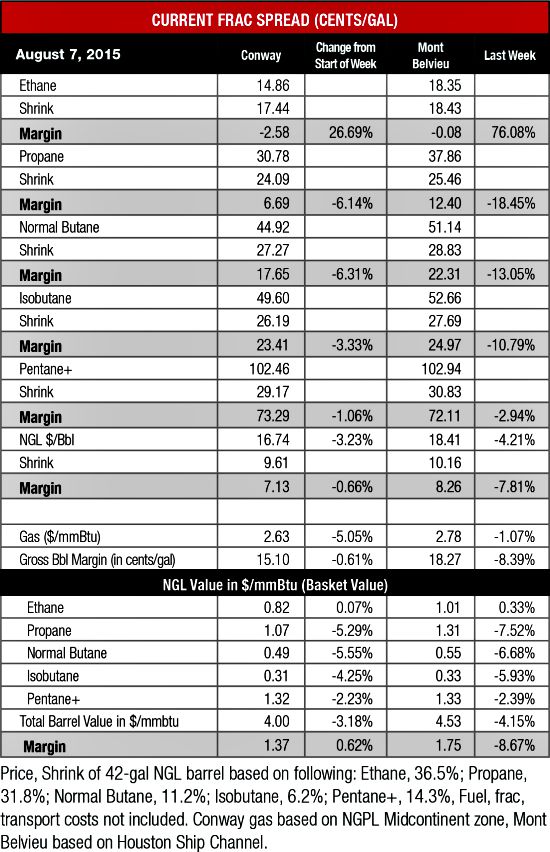

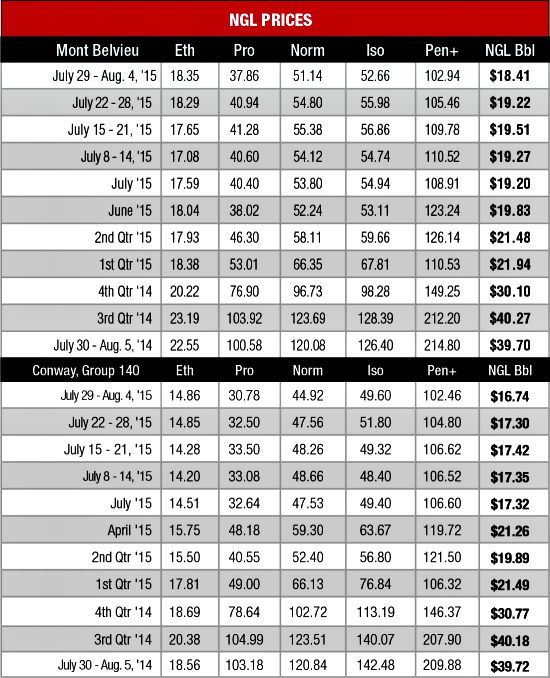

Indeed, heavy NGL prices were down across the board at both Conway and Mont Belvieu with C5+ hitting its lowest levels at each location since January.

There is an equally negative short-term outlook for the light NGL market as propane awaits heating demand to begin to work off its overhang, which is expected to far exceed the five-year average by the time winter begins. Margins remain positive, but are getting thinner, especially at Conway.

Ethane storage levels have been improving, but received some unwanted news as the U.S. Energy Information Administration (EIA) reported that storage declined by 649,000 bbl in May. This put storage levels below their five-year average, but was well off the 1.2 million bbl decline forecast by En*Vantage.

“Reviewing our ethane stock projections for the last few months compared to actual EIA numbers revealed that we were forecasting lesser builds and higher declines than what the EIA was reporting. It occurred to us that there is a new source of ethane reaching the market and this source is the amount of ethane that is de-ethanized from fuel grade propane to make refrigerated propane for exports. With the recent new refrigerated propane export expansions by Enterprise, Targa and Sunoco Logistics the amount of de-ethanized ethane could be as much as 15,000 to 20,000 bbl/d,” the company said in its Aug. 6 Weekly Energy Report. The company anticipates ethane balances tightening through November with prices trading between 18 cents per gallon (/gal) and 22 cents/gal.

Natural gas prices also lost value at both hubs with the Conway price falling 5% to $2.63 per million Btu (/MMBtu) while the Mont Belvieu price dropped 1% to $2.78/MMBtu. High storage levels that are expected to reach 4 trillion cubic feet (Tcf) when heating season begins in the fall are the primary downward pressure on natural gas.

EIA reported that gas in storage grew by 32 billion cubic feet to 2.912 Tcf the week of July 31 from 2.88 Tcf the previous week. This was 23% greater than the 2.377 Tcf posted last year at the same time and 2% above the five-year average of 2.848 Tcf.

Cooling demand is expected to remain mixed the week of Aug. 12 as the National Weather Service’s forecast anticipates cooler-than-normal temperatures in the Northeast and much of the Midwest. This will be countered by warmer-than-normal temperatures along the Gulf Coast, much of the West Coast and the Rockies.

Recommended Reading

SandRidge Recasts Management with New Chairman, CFO

2024-10-03 - SandRidge Energy has appointed Vincent Intrieri as chairman to succeed Jonathan Frates, who will transition to the role of executive vice president and CFO.

Investment Firm Elliot Calls for Honeywell Restructuring in Letter to Board

2024-11-13 - As Honeywell’s largest active investor, Elliott Investment Management’s letter to Honeywell International argued that Honeywell should split into two entities—Honeywell Aerospace and Honeywell Automation.

TC Energy Appoints Two Independent Directors to Board

2024-11-07 - TC Energy Corp. appointed Independent Directors Scott Bonham and Dawn Madahbee Leach to its board, the company announced Nov. 7 in a press release.

Amber CEO Goff Resigns from Exxon Mobil Board

2024-10-22 - The CEO of Amber Energy Inc., the winning bidder of Citgo Petroleum for an auction price of $7.3 billion, resigned from Exxon Mobil Corp.’s board of directors last week.

Carbon Removal Company Equatic Appoints New CEO

2024-11-18 - Equatic appointed a new CEO in preparation to launch the world’s largest ocean-based carbon removal plant.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.