The decline of ethane rejection has blown out the price differential between Conway, Kan., and Mont Belvieu, Texas, and signals a southbound pipeline constraint.

“Before additional infrastructure is operational, pricing at Conway is likely to remain relatively weak,” wrote Marissa Anderson, senior energy analyst for BTU Analytics Inc., in a recent report. “In particular, ethane at Conway will likely be related to regional natural gas prices to encourage ethane rejection.”

Mont Belvieu, by contrast, has experienced an upward swing in ethane prices as new petrochemical facilities open on the Gulf Coast, she wrote. That makes it viable to bypass Conway when moving Rockies gas to Mont Belvieu, even with higher transportation costs.

Mont Belvieu, by contrast, has experienced an upward swing in ethane prices as new petrochemical facilities open on the Gulf Coast, she wrote. That makes it viable to bypass Conway when moving Rockies gas to Mont Belvieu, even with higher transportation costs.

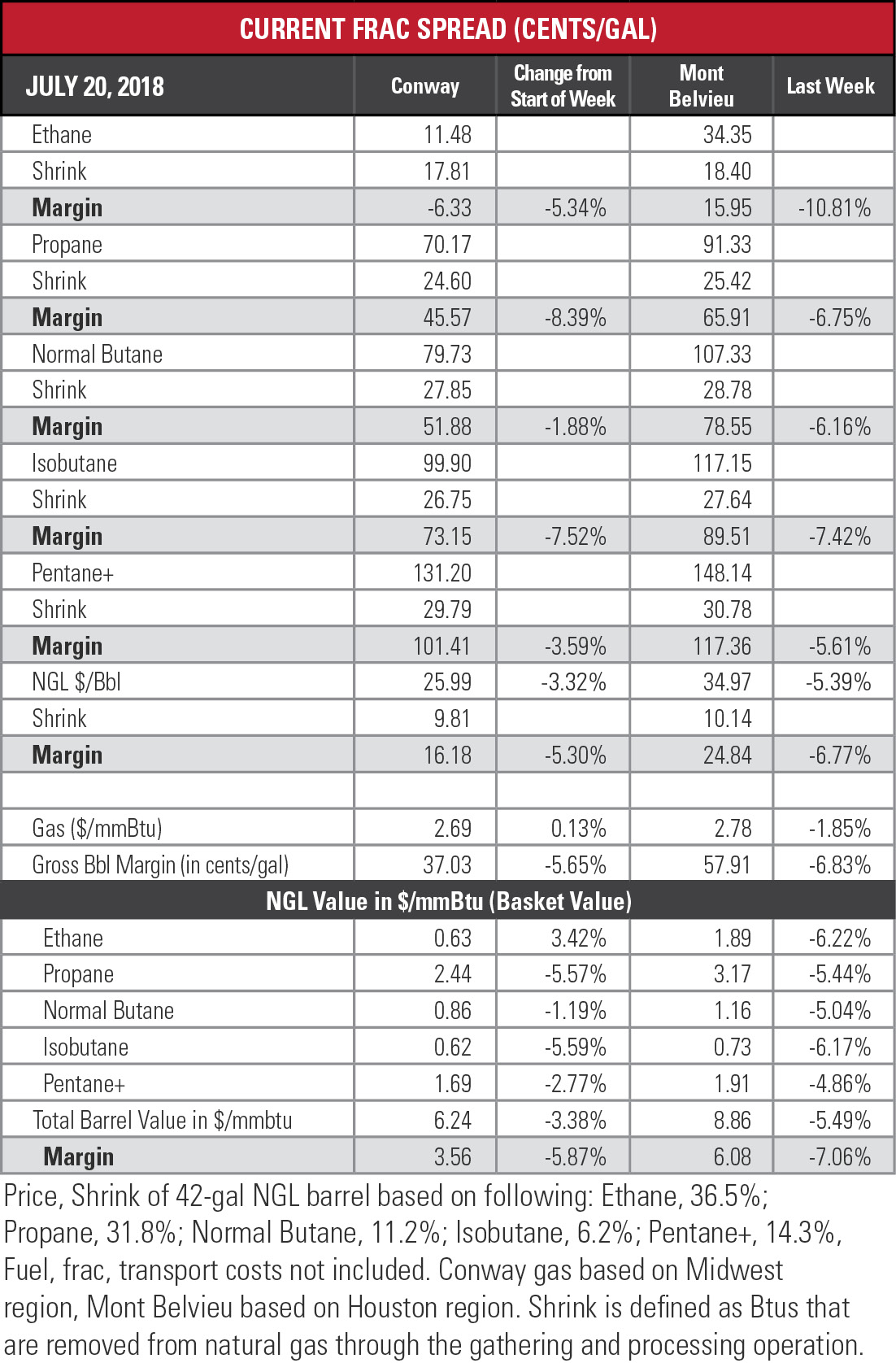

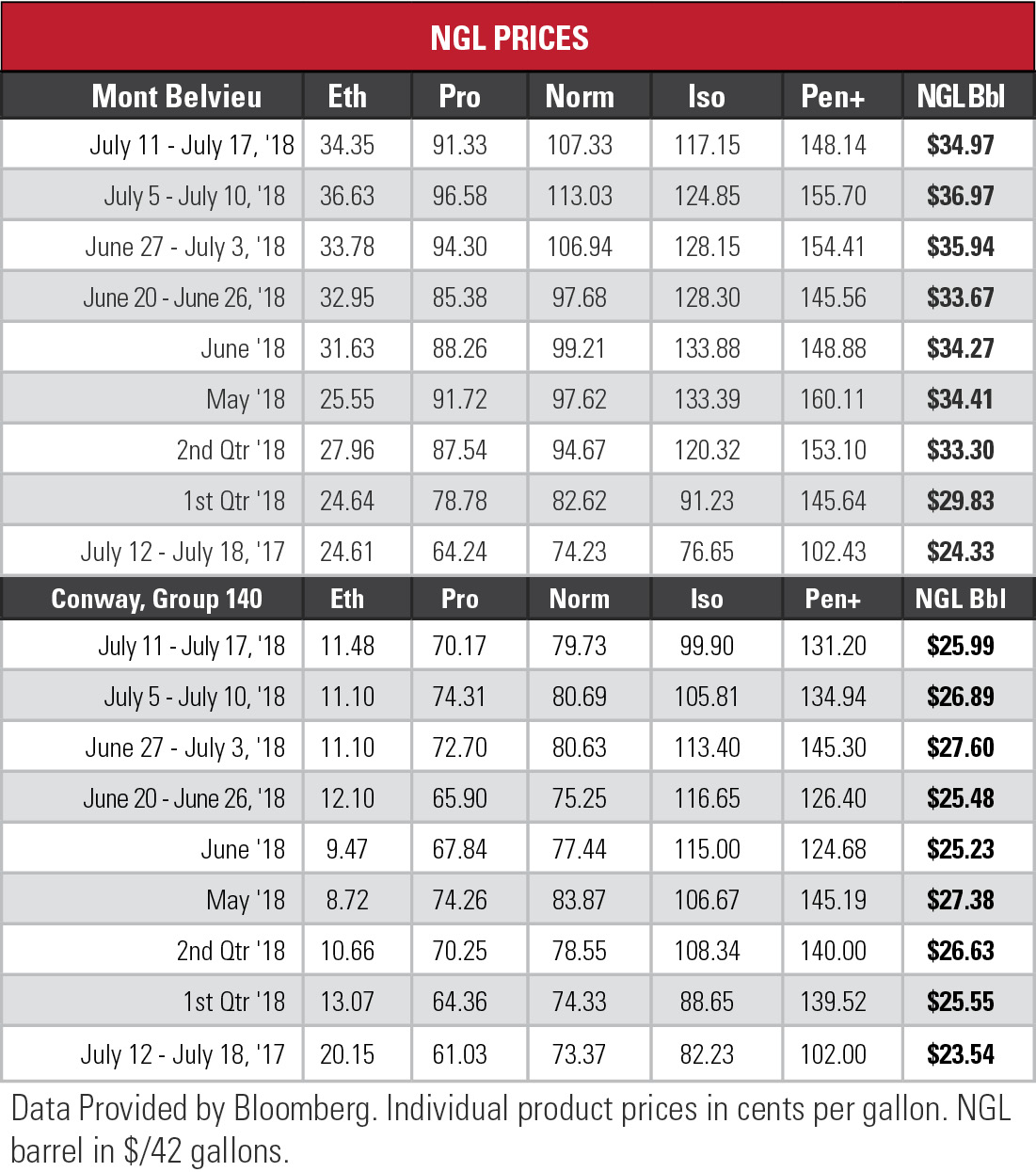

The price differential between the two hubs is 22.8 cents per gallon (gal) or 67%. It narrowed in the last week by 2.76 cents/gal, or 10.8%. The margin differential in the last week tightened by 2.28 cents/gal or 9.3%. Mont Belvieu’s ethane price is 39.6% higher than it was a year ago, while Conway’s price is 43% lower.

Ethane rejection is not increasing, Envantage Inc. contends, countering the opinion of some other analysts. Demand in the second quarter west of the Marcellus-Utica exceeded the analysts’ forecast by about 50,000 barrels per day (bbl/d).

Ethane rejection is not increasing, Envantage Inc. contends, countering the opinion of some other analysts. Demand in the second quarter west of the Marcellus-Utica exceeded the analysts’ forecast by about 50,000 barrels per day (bbl/d).

Envantage sees third-quarter demand increasing as Exxon Mobil’s Baytown, Texas, cracker begins production this summer and Indorama’s Lake Charles, La., facility restarts.

“Between now and 2020, ethane supply-demand balances will be tight, causing spikes in ethane prices at Mont Belvieu from time to time as more demand comes online,” Envantage said. “Bottlenecks will be exposed, such as inadequate takeaway and fractionation capacity, or any brine limitations at Mont Belvieu.”

In the week ended July 13, storage of natural gas in the Lower 48 experienced an increase of 46 billion cubic feet (Bcf), the U.S. Energy Information Administration reported, compared to the Bloomberg consensus forecast of 56 Bcf and the five-year average of 62 Bcf. The figure resulted in a total of 2.249 trillion cubic feet (Tcf). That is 24% below the 2.959 Tcf figure at the same time in 2017 and 19.2% below the five-year average of 2.784 Tcf.

Joseph Markman can be reached at jmarkman@hartenergy.com or @JHMarkman.

Joseph Markman can be reached at jmarkman@hartenergy.com or @JHMarkman.

Recommended Reading

E&P Highlights: Dec. 16, 2024

2024-12-16 - Here’s a roundup of the latest E&P headlines, including a pair of contracts awarded offshore Brazil, development progress in the Tishomingo Field in Oklahoma and a partnership that will deploy advanced electric simul-frac fleets across the Permian Basin.

E&P Highlights: Nov. 4, 2024

2024-11-05 - Here’s a roundup of the latest E&P headlines, including a major development in Brazil coming online and a large contract in Saudi Arabia.

Comstock: Monster Western Haynesville Wildcats Cost $30MM-plus

2024-10-31 - Comstock Resources is flowing back a 13th well currently in the play where the oldest has made 2.2 Bcf per 1,000 lateral feet to date in its first 29 months online.

APA Group to Build Pipeline in Expanding Australian Gas Play

2024-12-17 - APA Group will build and operate a 12-inch, 23-mile natural gas pipeline for a proposed 40-MMcf/d pilot drilling project in Australia.

Falcon, Tamboran Spud Second Well in Australia’s Beetaloo

2024-11-25 - Falcon Oil & Gas Ltd., with joint venture partner Tamboran, have spud a second well in the Shenandoah South Pilot Project in the Beetaloo.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.