NGL prices rose across the board last week as the Middle East heated up and the northern half of the U.S. cooled off.

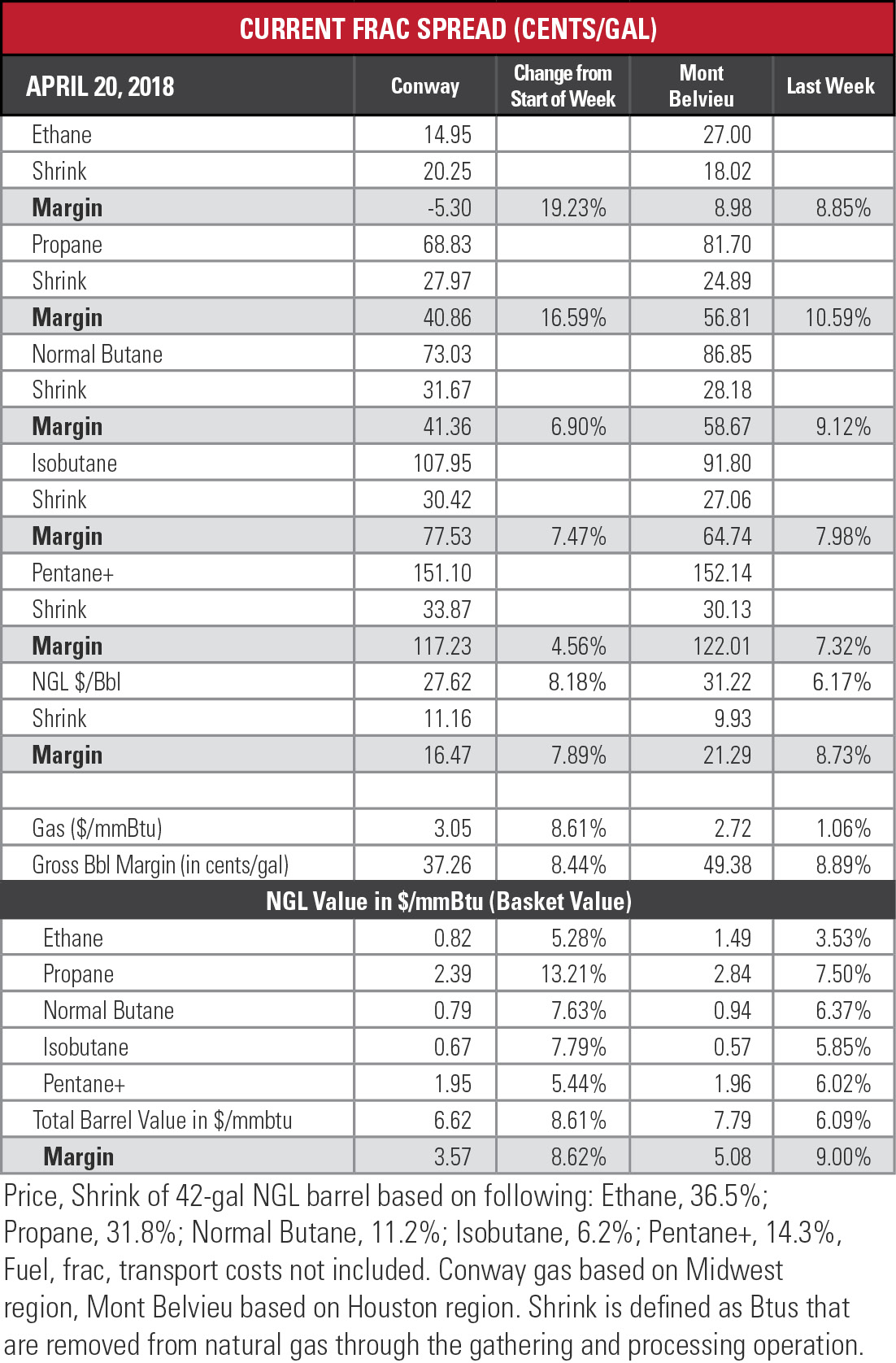

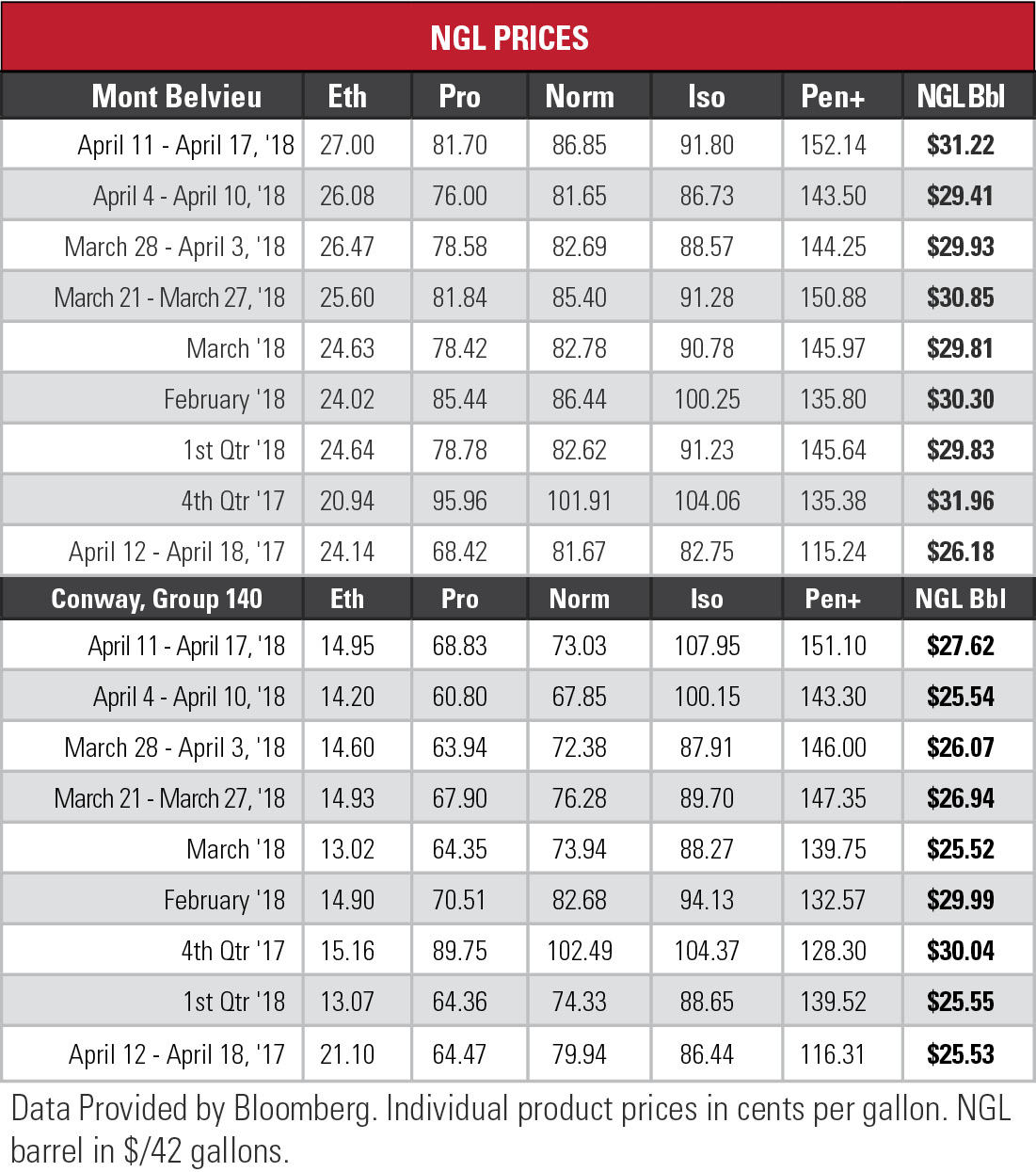

Ethane cracked 27 cents per gallon (gal) at Mont Belvieu, Texas, for the first time since the end of January with the margin improving by 8.85% to about 9 cents/gal. The hypothetical NGL barrel climbed above $31 for the first time in seven weeks.

Traders have a tendency to react to instability in inherently unstable regions but this time, En*Vantage notes, prices should be rising because demand is going up as supply is going down. That statement may seem peculiar because U.S. oil production, particularly in the Permian Basin, is on the upswing. Global production, however, is not because Venezuela continues in a downward spiral, both in production and in social fabric.

Traders have a tendency to react to instability in inherently unstable regions but this time, En*Vantage notes, prices should be rising because demand is going up as supply is going down. That statement may seem peculiar because U.S. oil production, particularly in the Permian Basin, is on the upswing. Global production, however, is not because Venezuela continues in a downward spiral, both in production and in social fabric.

Notice how nobody uses the term “overhang” anymore? Global inventories of crude were 302 million barrels (MMbbl) above the five-year average in January 2017. This January, inventories were only 53 MMbbl above the five-year average. In the U.S., this trend translates to a 25.2 day supply of inventory, compared to the five-year average of 28.9 days, En*Vantage notes.

The natural gas differential is sharper. In the week ended April 13, storage of natural gas in the Lower 48 experienced a decrease of 36 billion cubic feet (Bcf), compared to the Bloomberg consensus forecast of 24 Bcf, the U.S. Energy Information Administration (EIA) reported.

The natural gas differential is sharper. In the week ended April 13, storage of natural gas in the Lower 48 experienced a decrease of 36 billion cubic feet (Bcf), compared to the Bloomberg consensus forecast of 24 Bcf, the U.S. Energy Information Administration (EIA) reported.

The figure resulted in a total of 1.299 trillion cubic feet (Tcf). That is 38.3% below the 2.107 Tcf figure at the same time in 2017 and 25.7% below the five-year average of 1.748 Tcf.

“Based on a forecast of rising production, the EIA forecasts that natural gas inventories will increase by more than the five-year average rate of growth during the injection season (April-October) to reach almost 3.8 Tcf on Oct. 31, which would be 2% lower than the previous five-year average,” the EIA said in its Short-Term Energy Outlook released on April 10.

“The market just doesn’t seem to care (so far),” En*Vantage said. Since the report was released, the Henry Hub benchmark price has drifted between $2.66 per million British thermal units (MMbtu) and $2.74/MMbtu.

The Mont Belvieu price for propane rebounded by 7.5% last week as uncertainty lingered over the timetable for the restart of Mariner East 1. Sunoco Pipeline, a unit of Energy Transfer Partners LP (NYSE: ETP) that operates the pipeline, said it has completed its investigation and that the pipe is safe to go back into operation.

The StateImpact Pennsylvania website reported that the state’s Public Utility Commission had not finished its investigation and there was no timetable to put Mariner East 1 back into service.

Natural gasoline hit its highest level since late November 2014 at Mont Belvieu last week. With shrinking heavy oil imports from Venezuela and Mexico, demand is rising for diluent for Canadian heavy crude.

Natural gasoline hit its highest level since late November 2014 at Mont Belvieu last week. With shrinking heavy oil imports from Venezuela and Mexico, demand is rising for diluent for Canadian heavy crude.

Joseph Markman can be reached at jmarkman@hartenergy.com

Recommended Reading

AI—Just One More Ball for Energy Sector to Juggle

2024-09-30 - AI is yet another challenge for the energy sector to juggle, but if used carefully, could be transformative for the industry, experts discussed during ATCE 2024.

Growing Natgas Supply Up for Grabs, but Extra NGL Headed Overseas

2024-09-25 - The additional growth of the liquids export market will be tied to an unpredictable natural gas market, experts say.

Gas Storage Capacity Needed, But Will Companies Rise to the Challenge?

2024-11-14 - Several projects are on the drawing board to meet the rising demand for natural gas along the Gulf Coast.

Energy Transition’s Big Ticket Item? $1.5T in Natgas Infrastructure

2024-09-19 - Energy executives from companies such as Cheniere and Woodside are planning for the energy transition—and natural gas as part of it.

Exclusive: MET Eyes US LNG as European Natgas Demand Slows

2024-10-03 - Europe's MET Group has its eye on U.S. LNG as European natural gas demand is forecasted to decrease, said Benjamin Lakatos, chairman and CEO of MET Group, at Gastech 2024 in Houston.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.