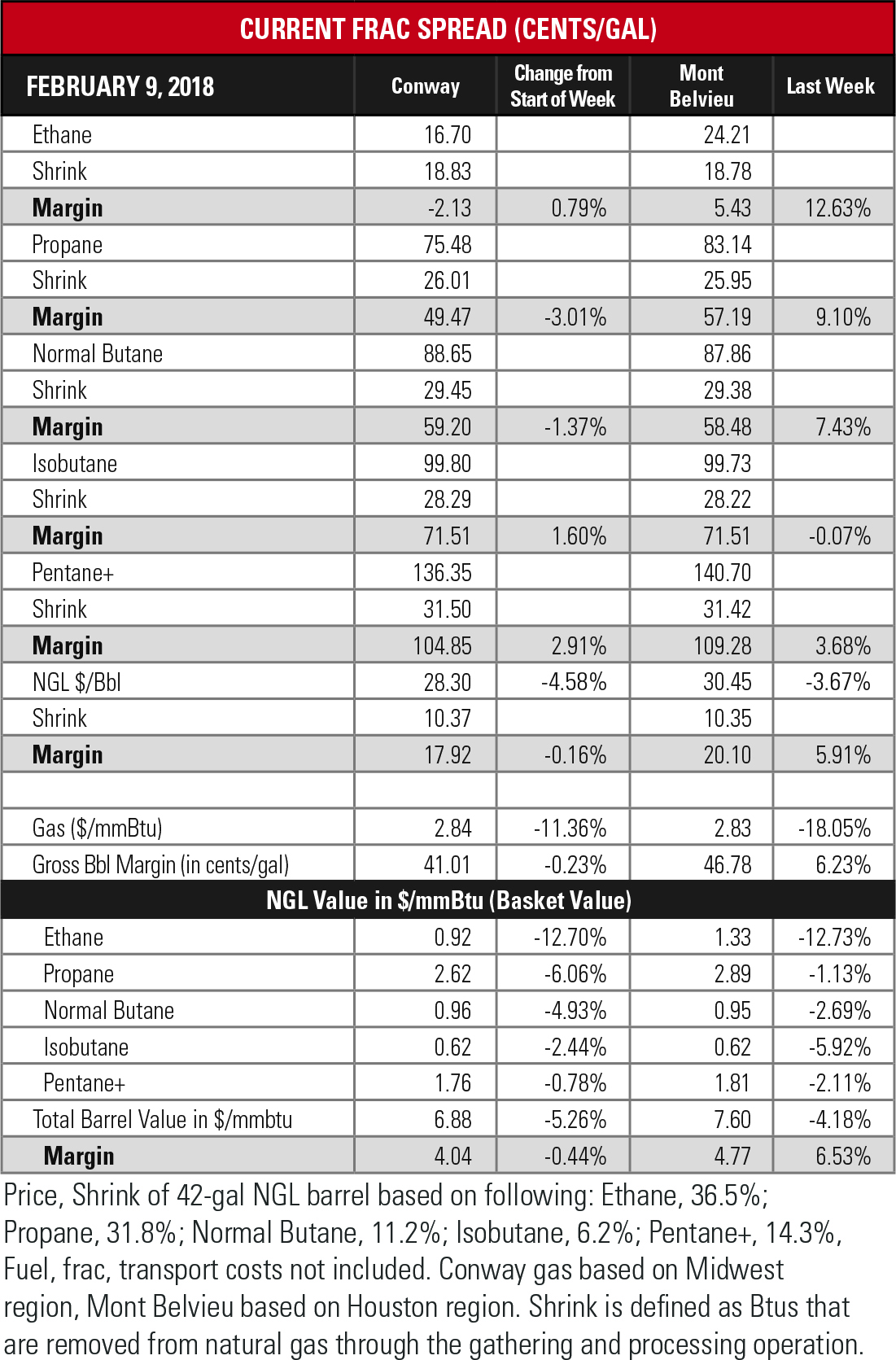

Prices for propane and butane fell back to August levels last week at both Mont Belvieu, Texas, and Conway, Kan., hubs.

En*Vantage surmised that stabilized Asian markets for propane, coupled with a surge of imports on the East Coast could have trimmed domestic demand and led to a lower-than-expected withdrawal from storage.

The price shift in the U.S. comes as Asian propane cracking economics have improved. That creates an opening in the market for U.S. exporters and En*Vantage is seeing some Asian petrochemical companies seeking cargoes.

The price shift in the U.S. comes as Asian propane cracking economics have improved. That creates an opening in the market for U.S. exporters and En*Vantage is seeing some Asian petrochemical companies seeking cargoes.

The various factors in the market will drag propane inventories below 35 million barrels by the end of March, En*Vantage predicts, and strong demand this month could pull the price up to 90 cents per gallon (gal) again.

The prices of butane and isobutene moved pretty much together until the close of 2017. Last week’s 16 cents/gal differential at Mont Belvieu narrowed somewhat this week to a 12 cent/gal premium for isobutene. En*Vantage suggests that international marketers popping in and out of the market have created the split.

The differential could last through the end of February, the analysts say, but in March refiners start producing summertime blends of gasoline and will reduce their purchases of butane, leaving more available to the export market.

Henry Hub natural gas prices tumbled 25% between Jan. 29 and Feb. 7, but a weekend storm on track to hit the central and eastern parts of the U.S. could arrest the fall.

Henry Hub natural gas prices tumbled 25% between Jan. 29 and Feb. 7, but a weekend storm on track to hit the central and eastern parts of the U.S. could arrest the fall.

Chicago-based CME Group (NASDAQ: CME) projected higher natural gas demand for 2018 in its recently released outlook. Incremental growth in the LNG export and residential-commercial sectors will drive the increase. The second wave of LNG export facilities will likely face challenges but expected lower-than-normal temperatures in the Midwest and Northeast will exert pressure on storage.

However, CME sees strong natural gas production as countering the weather premium, resulting in a bearish view of prices. Cold snaps and the ramp-up of LNG exports should trigger price lifts.

While NGL prices have struggled a bit recently, the hypothetical barrel at Mont Belvieu nevertheless finished the five-day tracking period above $30 for the 19th straight week. The last time it registered a run this long was from May 2009 through November 2014. The barrel’s price last week was 95% above the $15.64 recorded at the same time in 2016.

In the week ended Feb. 2, storage of natural gas in the Lower 48 experienced a decrease of 119 billion cubic feet (Bcf), the U.S. Energy Information Administration reported, just above the Bloomberg consensus of a 115 Bcf draw and well below the five-year average of 151 Bcf. The figure resulted in a total of 2.078 trillion cubic feet (Tcf). That is 19.5% below the 2.581 Tcf figure at the same time in 2017 and 15.9% below the five-year average of 2.471 Tcf.

In the week ended Feb. 2, storage of natural gas in the Lower 48 experienced a decrease of 119 billion cubic feet (Bcf), the U.S. Energy Information Administration reported, just above the Bloomberg consensus of a 115 Bcf draw and well below the five-year average of 151 Bcf. The figure resulted in a total of 2.078 trillion cubic feet (Tcf). That is 19.5% below the 2.581 Tcf figure at the same time in 2017 and 15.9% below the five-year average of 2.471 Tcf.

Joseph Markman can be reached at jmarkman@hartenergy.com and @JHMarkman.

Recommended Reading

Scout Taps Trades, Farm-Outs, M&A for Uinta Basin Growth

2024-11-27 - With M&A activity all around its Utah asset, private producer Scout Energy Partners aims to grow larger in the emerging Uinta horizontal play.

E&P Consolidation Ripples Through Energy Finance Providers

2024-11-27 - Panel: The pool of financial companies catering to oil and gas companies has shrunk along with the number of E&Ps.

Utica Oil E&P Infinity Natural Resources’ IPO Gains 7 More Bankers

2024-11-27 - Infinity Natural Resources’ IPO is expected to provide a first-look at the public market’s valuation of the Utica oil play.

Exclusive: Trump Poised to Scrap Most Biden Climate Policies

2024-11-27 - From methane regulations and the LNG pause to scuttling environmental justice considerations, President-elect Donald Trump is likely to roll back Biden era energy policies, said Stephanie Noble, partner at Vinson & Elkins.

FERC Gives KMI Approval on $72MM Gulf Coast Expansion Project

2024-11-27 - Kinder Morgan’s Texas-Louisiana upgrade will add 467 MMcf/d in natural gas capacity.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.