Crude oil traders might end up liking Secretary of State nominee Mike Pompeo more than his predecessor Rex Tillerson, who formerly ran the world’s largest publicly owned oil company.

Tillerson was a voice of moderation in the Trump administration. He wanted to stick with the Paris climate accord, keep the nuclear deal with Iran and take a measured approach to sanctions against Venezuela.

Pompeo, a former U.S. representative from Kansas and current director of the CIA, would bring a tougher approach to the position.

In Iran, hardliners who were opposed to the transaction ending the country’s uranium enrichment program were delighted that it might be closer to an end. Most others were not as thrilled.

In Iran, hardliners who were opposed to the transaction ending the country’s uranium enrichment program were delighted that it might be closer to an end. Most others were not as thrilled.

He is “cowboyish in character and eager to start a war,” wrote Ali Khorram, a former Iranian diplomat, in an op-ed in Arman, a daily newspaper aligned with reformists, the Los Angeles Times reported. After all, Pompeo argued for air strikes against Iran’s nuclear facilities during negotiations for the deal in 2014.

Tension in the Middle East can be counted on to propel global crude prices, which would lead to higher natural gas prices and buoy NGL prices. Sanctions against Venezuela could contribute to that result as well. Or maybe tougher sanctions won’t be needed. That country seems well on its way to a meltdown all on its own.

Oil production in Venezuela is down to 1.6 million barrels per day (MMbbl/d) from a 2.2 MMbbl/d average in 2016. Production is expected to fall to about 1 MMbbl/d this year but if Pompeo were to convince President Donald Trump to enact tougher sanctions then it is possible that the government of Nicolas Maduro could collapse.

That would reduce Venezuela’s expected oil output to roughly … nothing, which would put more upward pressure on world prices.

That would reduce Venezuela’s expected oil output to roughly … nothing, which would put more upward pressure on world prices.

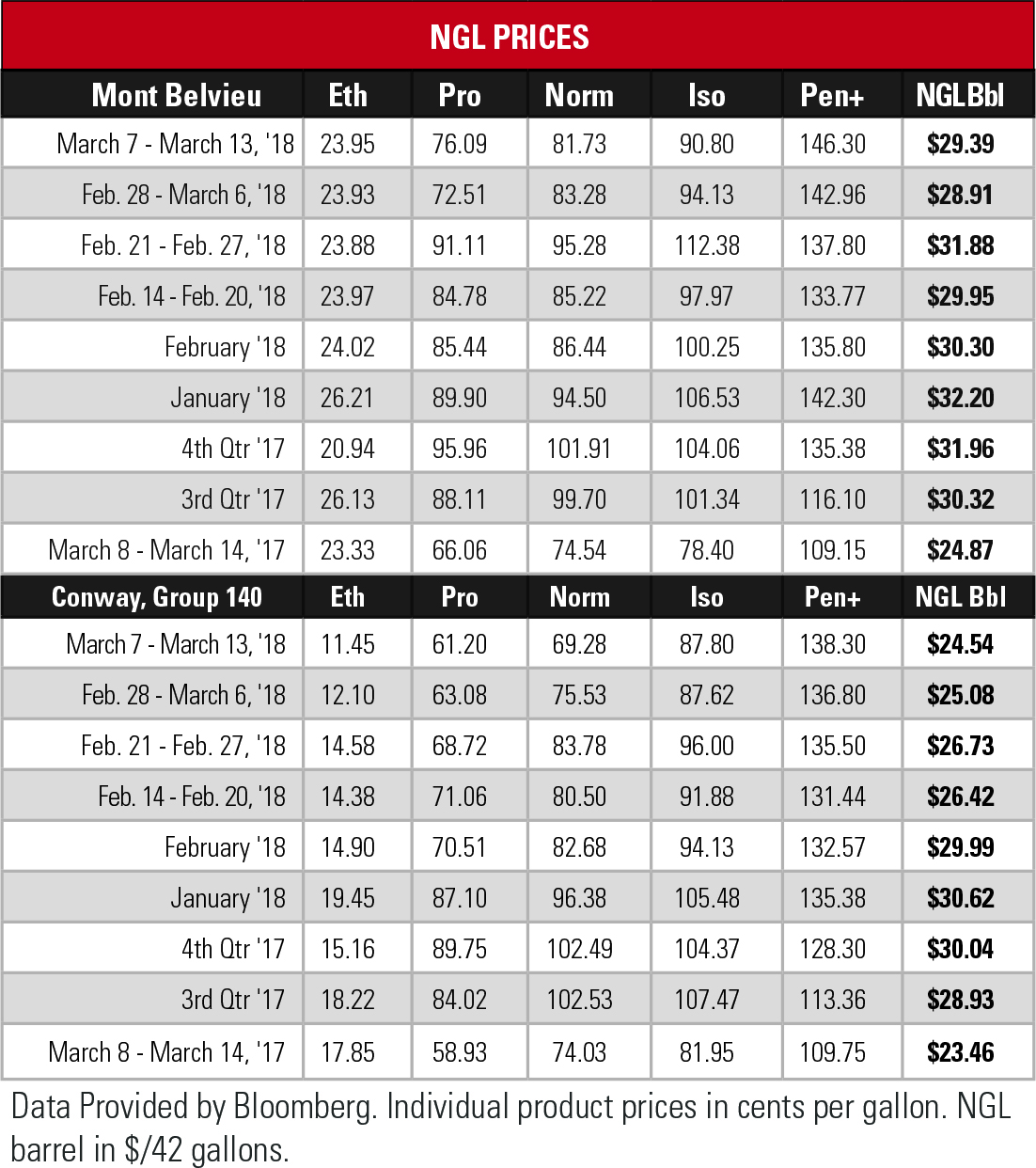

At Mont Belvieu, pentanes-plus edged up 2.3% last week to hit a 40-month high at $1.463 per gallon (gal). The Conway, Kan., rise was 1.1% but that was enough to hit $1.383/gal, its highest point since early December 2014.

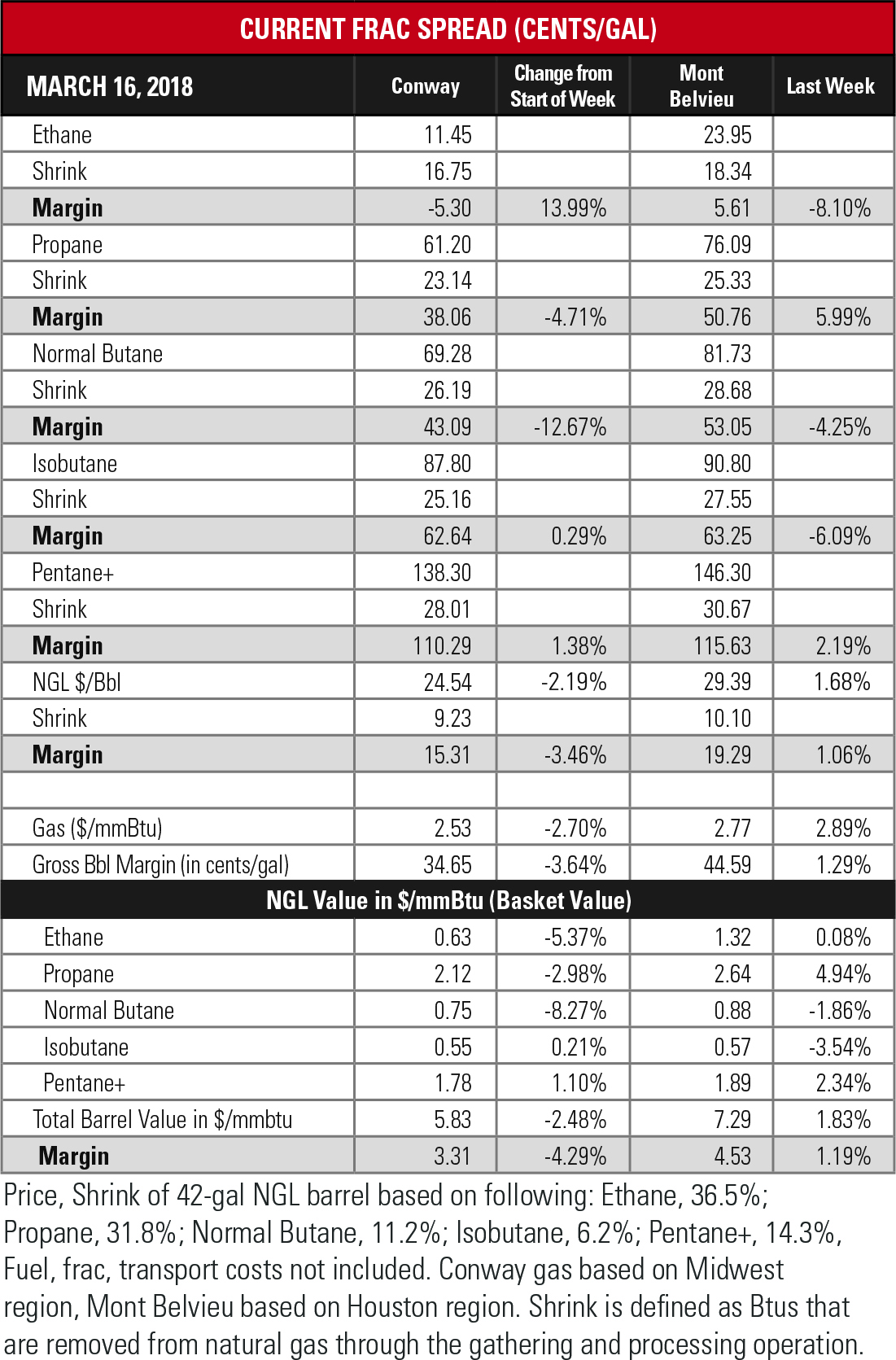

Margins narrowed for all NGL last week except for pentanes-plus and Mont Belvieu, Texas, propane. The spread for the hypothetical NGL barrel tightened by about 2.2% at Conway but expanded by about 1.7% at Mont Belvieu.

Ethane’s Mont Belvieu margin narrowed by 8.1% to under 6 cents/gal. Propane at Mont Belvieu rose by 5% in price with a 6% wider margin. The Pennsylvania Public Utility Commission was expected to meet on March 15 to decide whether to reopen the Mariner East 1 pipeline, which was shut down because of the risk from sinkholes that developed in its vicinity.

En*Vantage Inc. has a bright outlook for ethane, noting that demand set a record of 1.63 million bbl/d in December.

“As a conga line of new crackers becomes operational between now and the end of the year, the overall trend for ethane inventories should be down,” the analysts wrote.

In the week ended March 9, storage of natural gas in the Lower 48 experienced a decrease of 93 billion cubic feet (Bcf), the U.S. Energy Information Administration (EIA) reported, close to the Bloomberg consensus of a 97 Bcf draw and right at the five-year average of 97 Bcf. The figure resulted in a total of 1.532 trillion cubic feet (Tcf). That is 31.9% below the 2.25 Tcf figure at the same time in 2017 and 16.2% below the five-year average of 1.828 Tcf.

In the week ended March 9, storage of natural gas in the Lower 48 experienced a decrease of 93 billion cubic feet (Bcf), the U.S. Energy Information Administration (EIA) reported, close to the Bloomberg consensus of a 97 Bcf draw and right at the five-year average of 97 Bcf. The figure resulted in a total of 1.532 trillion cubic feet (Tcf). That is 31.9% below the 2.25 Tcf figure at the same time in 2017 and 16.2% below the five-year average of 1.828 Tcf.

Joseph Markman can be reached at jmarkman@hartenergy.com and @JHMarkman.

Recommended Reading

Enchanted Rock’s Microgrids Pull Double Duty with Both Backup, Grid Support

2025-02-21 - Enchanted Rock’s natural gas-fired generators can start up with just a few seconds of notice to easily provide support for a stressed ERCOT grid.

US Oil and Gas Rig Count Rises to Highest Since June, Says Baker Hughes

2025-02-21 - Despite this week's rig increase, Baker Hughes said the total count was still down 34, or 5% below this time last year.

Devon, BPX to End Legacy Eagle Ford JV After 15 Years

2025-02-18 - The move to dissolve the Devon-BPX joint venture ends a 15-year drilling partnership originally structured by Petrohawk and GeoSouthern, early trailblazers in the Eagle Ford Shale.

E&P Highlights: Feb. 18, 2025

2025-02-18 - Here’s a roundup of the latest E&P headlines, from new activity in the Búzios field offshore Brazil to new production in the Mediterranean.

Baker Hughes: US Drillers Add Oil, Gas Rigs for Third Week in a Row

2025-02-14 - U.S. energy firms added oil and natural gas rigs for a third week in a row for the first time since December 2023.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.