A slower than expected restart of shipments from Freeport LNG’s Texas Gulf Coast facility has restoked concerns over global LNG supply risk. (Source: Shutterstock)

A slower than expected restart of shipments from Freeport LNG’s Texas Gulf Coast facility has restoked concerns over global LNG supply risk, according to Rystad Energy.

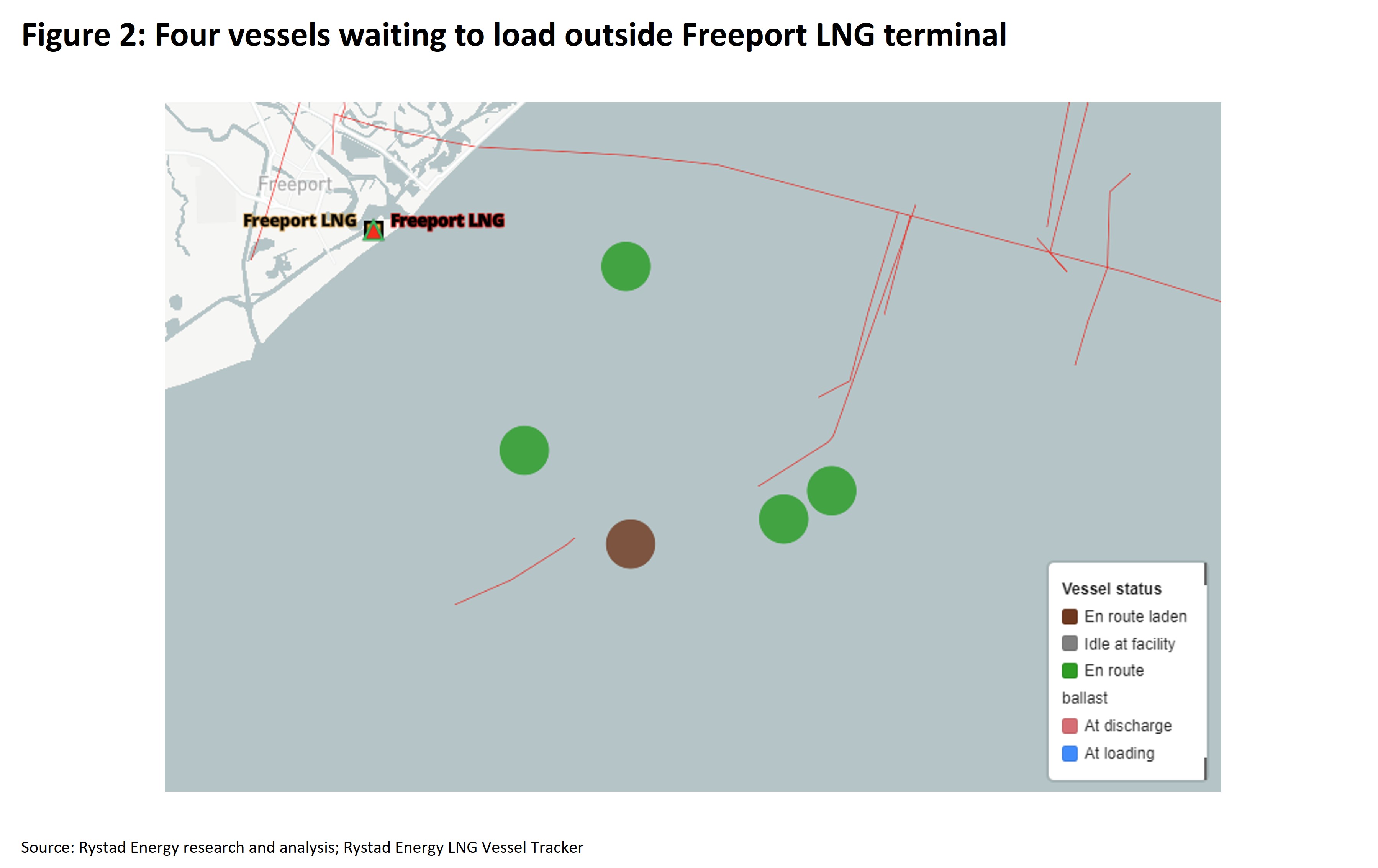

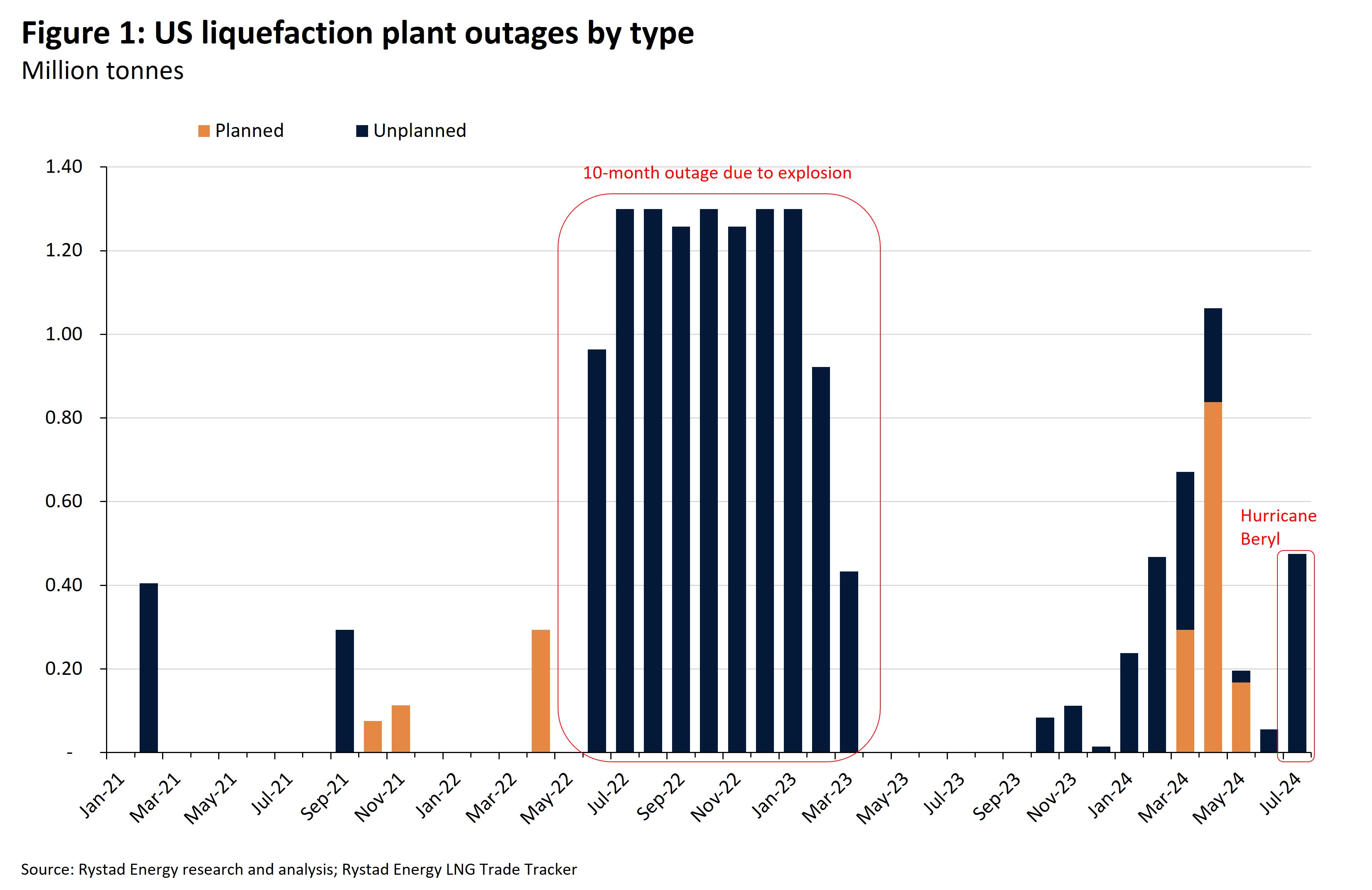

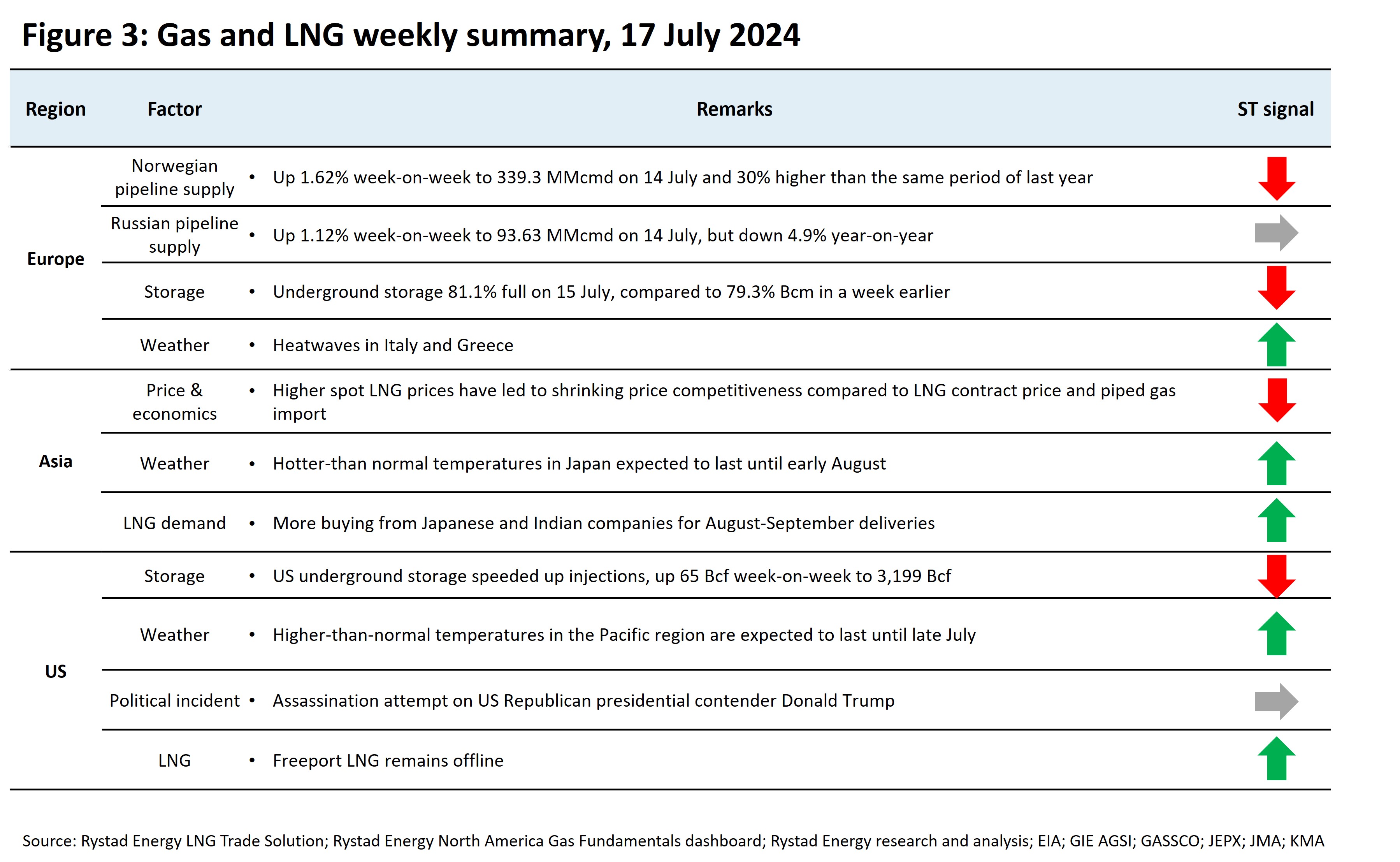

Freeport shuttered operations on its 15 million tonnes per annum (mtpa) facility ahead of Hurricane Beryl, which impacted the Texas coast on July 8. Beryl knocked out electricity for millions of residents across the state, including in Houston, the so-called energy capital of the world.

“Given limited production growth elsewhere, the U.S. LNG plant’s influence on market sentiment can prove crucial in the global market,” Wei Xiong, Rystad’s vice president of gas & LNG research, told Hart Energy in an email.

Freeport has resumed operations and reached about half of its capacity on July 22, according to preliminary LSEG data.

Freeport’s facility on Quintana Island, Texas, is the seventh largest LNG export terminal in the world and the second largest in the U.S. Its capacity is equivalent to 2.2 Bcf/d—enough to power and light a metropolitan area the size of San Antonio for a full day.

A fire-related shutdown at Freeport in June 2022 resulted in the facility being offline for 10 months—at a time when the LNG sector was in scramble mode to boost gas supplies after Russia’s invasion of Ukraine disrupted global gas flows, especially in Europe. There have also been noticeable outages at Freeport this year as well.

“Except for the outages, the strong base of U.S. LNG production has driven supply growth and helped to meet global LNG demand after the outbreak of Russia-Ukraine conflict,” Xiong said. “In the long term, the U.S. is still expected to drive the global liquefaction capacity addition, considering construction and FIDs of liquefaction projects.”

Freeport’s misfires come amid the Biden administration’s ‘pause’ and continued concerns on the future of U.S. LNG. The mandate, officially announced on Jan. 26, formally pauses approvals for new LNG export projects. The future of the pause remains uncertain ahead of the U.S. presidential election on Nov. 7 and a potential change of government.

Xiong reiterated the pause’s limited impact on immediate term activities.

“The impact from Biden's pause is more long-term, while the short-term market is largely unaffected. The balance from 2030 could be affected if the FIDs of the projects are delayed. But looking at the current situation, it remains a question how long the pause will last. This will largely depend on the outcome of the 2024 U.S. election,” Xiong said.

Woodside Energy Group Ltd.’s deal to acquire Tellurian Inc. for $900 million is proof that fully approved projects with massive liquefaction capacity can continue to move forward. With Driftwood LNG, Tellurian’s proposed export project in Calcasieu Parish, Louisiana, Woodside steps into a U.S. project with a potential liquefaction capacity of up to 27.6 mtpa. Initial cargoes from the project are expected to start flowing before the end of this decade.

Moving forward, the outcome of the U.S. election will ultimately set the stage for market changes in coming years, such as the investment outlook of U.S. liquefaction capacities, Xiong said.

Recommended Reading

Berry Announces Jeff Magids as New CFO

2025-01-21 - Jeff Magids was appointed as Berry Corp.’s new CFO on Jan. 21 in replacement of Mike Helm, effective immediately.

Rising Phoenix Capital Launches $20MM Mineral Fund

2025-02-05 - Rising Phoenix Capital said the La Plata Peak Income Fund focuses on acquiring producing royalty interests that provide consistent cash flow without drilling risk.

BP Cuts Senior Leadership Bonuses After Missing 2024 Targets

2025-02-11 - BP will cut performance-related bonuses for its senior leaders to 45% after the company missed some of its financial goals in 2024.

EON Enters Funding Arrangement for Permian Well Completions

2024-12-02 - EON Resources, formerly HNR Acquisition, is securing funds to develop 45 wells on its 13,700 leasehold acres in Eddy County, New Mexico.

BP Pledges Strategy Reset as Annual Profit Falls by a Third

2025-02-11 - BP CEO Murray Auchincloss pledged on Feb. 11 to fundamentally reset the company's strategy as it reported a 35% fall in annual profits, missing analysts' expectations.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.