Fury Resources aims to reduce the amount of merger consideration payable to Battalion’s stockholders. Battalion said it was reviewing the amended terms of a merger agreement announced in December. (Source: Shutterstock.com)

Permian producer Battalion Oil is reviewing an amendment to a planned acquisition by Fury Resources that would lower the deal’s purchase price by nearly 29% per share.

Battalion said Fury’s amendment to the original merger agreement, announced in December, would reduce the amount of merger consideration payable to Battalion’s stockholders from $9.80 per share to $7 per share, the company reported in second-quarter earnings on Aug. 14.

“The modified offer is contingent on the existing holders of the company's Series A through Series A-4 preferred equity rolling 100% of their preferred equity into new preferred equity in the surviving company following the merger in order to help support the transaction,” Battalion wrote in a filing.

Under the original merger terms, Fury would pay $9.80 per share in cash for BATL’s common stock, representing a total transaction value of around $450 million. It’s unclear how much of the original $450 million transaction value was attributable to debt.

Battalion said its board of directors and special committee were reviewing Fury’s amended proposal. Battalion said its preferred stockholders also reported reviewing the amendment.

If the amended terms were adopted, it’s not immediately clear how much the deal’s total value would decline. Hart Energy reached out to Fury Resources and Battalion Oil for more information but did not receive a response by press time.

As the parties work through the details of the merger, Battalion said that it was continuing its strategic alternatives initiative.

RELATED

Delaware Basin E&P Battalion Oil Acquired for $450 Million

Delaware Basin

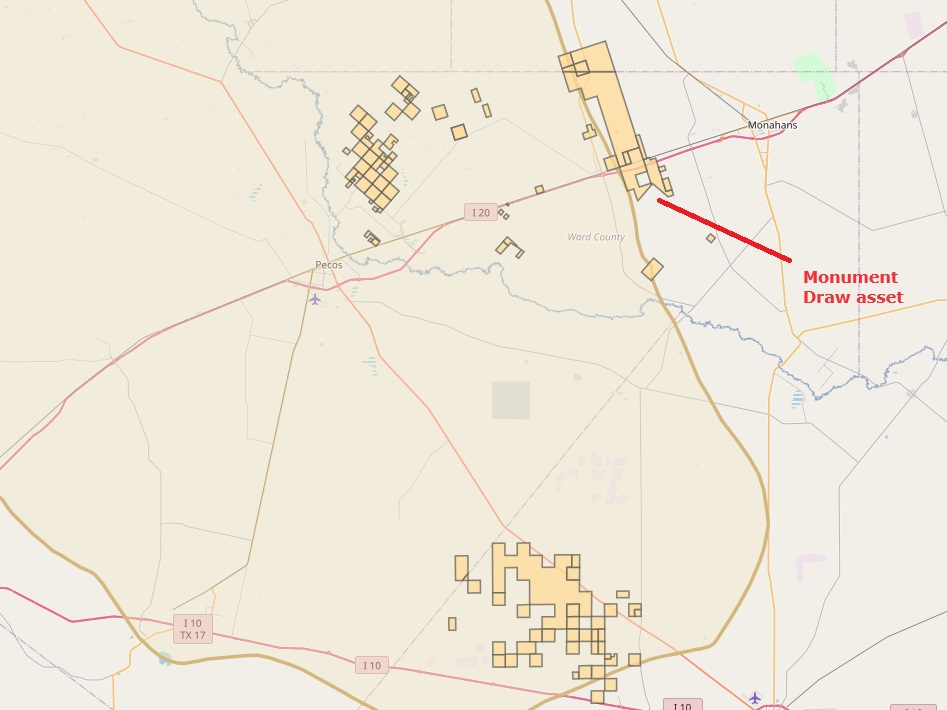

Battalion owns interests in approximately 40,400 net acres in the Delaware Basin, primarily in Pecos, Reeves, Ward and Winkler counties, Texas. Battalion’s main asset—called Monument Draw—sits in the eastern part of the Delaware up against the Permian’s Central Basin Platform.

Battalion produced an average of 12,857 boe/d (49% oil) during the second quarter.

The company must manage large volumes of H2S sour gas on its Delaware Basin asset. During the first quarter, Battalion restarted operations at its acid gas injection (AGI) facility to treat sour gas for sales to midstream offtakers.

During the second quarter, the AGI facility treated approximately 18.2 MMcf/d and returned around 17 MMcf/d of sweet gas to Battalion for sales to midstream partners. That enabled Battalion to lower its operating expenses by $4.26/boe compared to the first quarter.

To date, the AGI facility has processed over 2.7 Bcf of Permian sour gas.

Battalion and its joint venture partner Caracara Services LLC continue to ramp up the facility to full operations. The companies anticipate saving around $2 million per month in gas treatment costs when the project reaches full capacity.

Battalion said the facility processed 26.6 MMcf/d on Aug. 12, which allowed the company “to return wells to production” and realize around 13,500 boe/d (7,500 bbl/d) of net production.

RELATED

Fury Road: Will $450MM Battalion M&A Fuel More Go-private Deals?

Recommended Reading

Oklahoma E&P Canvas Energy Explores Midcon Sale, Sources Say

2025-04-04 - Canvas Energy, formerly Chaparral Energy, holds 223,000 net acres in the Anadarko Basin, where M&A has been gathering momentum.

‘Trump Effect’ Stalls Hydrogen FIDs, Already Killing Projects

2025-04-03 - Billions of dollars in capex have been dedicated to hydrogen projects. But some projects have yet to reach final investment decisions amid continued uncertainty surrounding the Inflation Reduction Act and hydrogen production tax credits.

Appalachia, Haynesville Minerals M&A Heats Up as NatGas Prices Rise

2025-04-03 - Several large Appalachia and Haynesville minerals and royalties packages are expected to hit the market as buyer interest grows for U.S. natural gas.

RPC Acquires Pintail Completions to Expand Permian OFS Operations

2025-04-03 - RPC Inc. paid $245 million in cash and other considerations for the wireline service provider.

Pennsylvania City to Turn Coal-Powered Plant into Gas-Fired Data Center Campus

2025-04-03 - Construction on the Homer City Generating Station is expected to start in 2026.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.