It has been nearly four years since oil prices ranging from $105/bbl to $110/bbl plummeted to today’s prices of $50/bbl to $60/bbl, yet the industry still has not seen any substantial innovative solutions to the industry challenge of economically producing crude oil from small to mid-size deepwater reservoirs. The industry focus continues to be on reducing the cost through optimization of large floating production systems at the expense of the project schedule. This may not be the best solution for maximizing the return on investment for smaller reservoirs.

Over the past two decades, the industry has developed and installed numerous floating production systems (tension-leg platforms, spars and semisubmersibles) in the Gulf of Mexico (GoM) that are connected to a network of deepwater pipelines and further connected to shelf platforms and pipelines. Most of these floating production systems are still operating and have available ullage and boarding capability and have been utilized for local tiebacks (hub and spoke concept).

This has proven to be a very economical solution for fields that are within an acceptable distance (less than 40.2 km [25 miles]) from the host. To extend the acceptable distance to 80.4 km (50 miles) or 161 km (100 miles), the technology would need to be safe, reliable and economical. If these benefits were provided and the front-end spend and schedule from discovery to first oil were reduced, the industry would have an acceptable alternative.

Innovative approach

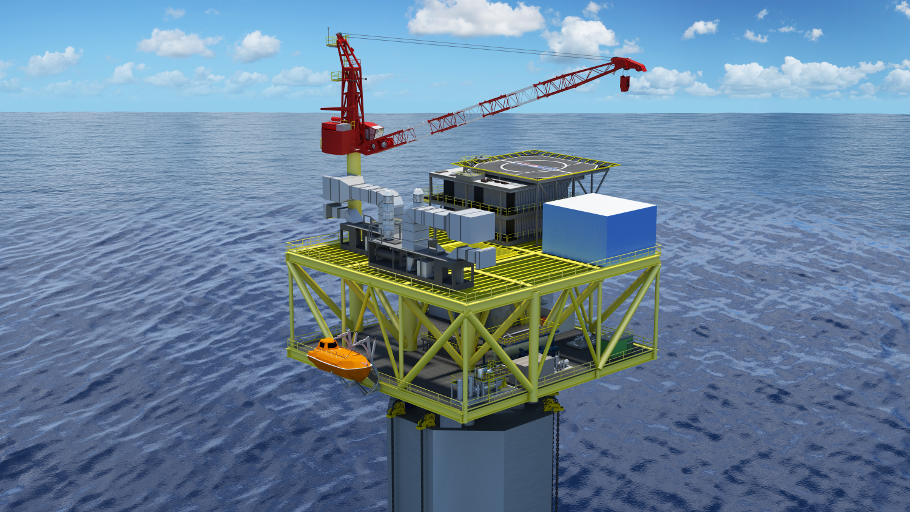

A floating utility system (FUS) has been developed by US Spars, a consortium comprising Audubon Engineering, Atkins/Houston Offshore Engineering, members of the SNC-Lavalin Group and Gulf Island Fabrication (GIF). As the name suggests, the FUS-60 provides the utility services to the field at the well site (Figure 1). It can provide power to subsea booster pumps for production of up to 60,000 bbl/d of crude oil and provide storage and injection for flow assurance chemicals. The FUS also can provide well control, high-integrity pressure protection system support, ROV deployment, accommodation spaces and/or water injection capability. This low-cost standalone floater enables long distance tiebacks to existing floaters while also providing a development option for marginal fields.

The floater developed for this methodology is a sparbased FUS due to its insensitivity to water depth and good motion characteristics. The topsides consist of a two-level deck that is 26 m by 29 m (85 ft by 95 ft) in size, allowing under-the-roof construction and the elimination of the third deck lift and float that are common for conventional three-level spar decks. The deck can provide power for up to 60,000 bbl/d of crude oil mud line pumping, provide 300 bbl of methanol storage along with storage space for five additional chemicals and accommodate up to 20 people onboard. The use of proven, standardized vendor equipment packages reduces risk, schedule and cost. The reduced offshore lift weight (under 2,000 short tons) is within the lift capacity of multiple derrick barges.

Fabrication and installation

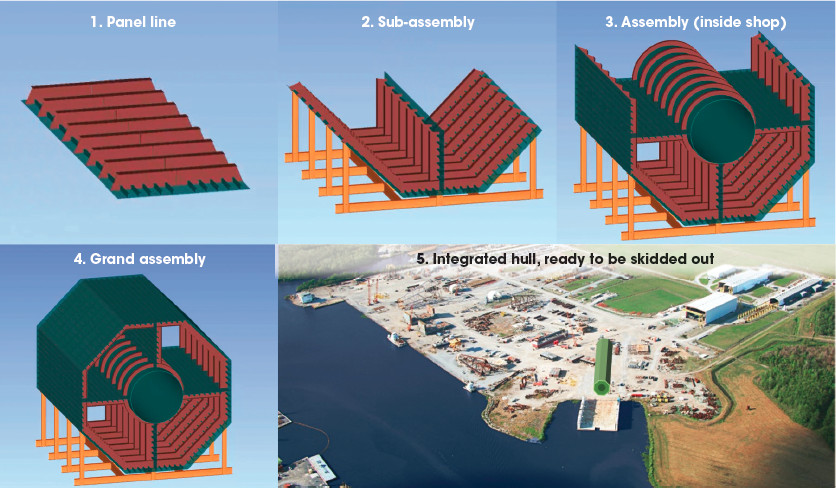

The cross section of the spar hull is octagonal-shaped, providing the benefits of flat plate fabrication. The flat plates are standardized and use the automated panel line facility (conventional barge fabrication) at the GIF yard. Eliminating the need for plate bending and utilizing the automated panel line for most of the hull fabrication reduces man hours needed for hull fabrication.

The fabrication execution plans for the hull and topsides were developed with consideration to the existing yard infrastructure and capabilities. The hull panels are assembled on prefabricated jigs and five out of the eight sides are assembled inside the assembly shop (Figure 2). The fully outfitted hull grand assembly is transported to the skidway by transporters that are available at GIF.

The hull blocks will be integrated on the existing skidway, and the completed hull will be skidded onto GIF’s 122-m-long (400-ft-long) floating drydock. The floating drydock will be moved over a permitted “deep hole” at the fabrication yard and lowered to float-out the hull. As the hull is a classic spar, it will float nearly even keel and thus provide sufficient clearance to wet tow through the channel.

The offshore installation of the FUS-60 will be simpler than conventional spars due to the lower topside weight and fewer mooring lines. The system has a targeted 24-month schedule from project sanction to installation and commissioning.

Traditional production facilities are dependent on the field/reservoir characteristics for final optimization of the design. Changes in production properties, like the gas-oil ratio, result in the production equipment differing among facilities. Because the FUS-60 is standardized and field independent, it can be relocated to a different field after the initial deployment with little to no modifications. The FUS-60 also can be adapted for use as a normally unmanned installation.

Cost breakdown

For a commercial evaluation of the FUS-60, consider a representative GoM reservoir with 100 MMboe reserves in a remote area 80.4 km from the nearest host. The cost breakdown in Table 1 and additional cost assumptions in Table 2 were used to calculate the project’s net present value (NPV) and internal rate of return (IRR).

In addition, the net crude price and cost were inflated at 2% per year. A 10% discount rate and the P-50 production profile were used for NPV and IRR calculations (Figure 3). Maximum production (Year 4) is 72% of system capacity, allowing well and FUS-60 downtime. This evaluation yielded a NPV of $464 million and an 18.8% IRR, attractive for a marginal field that otherwise would have been noncommercial.

Have a story idea for Offshore Solutions? This feature highlights technologies and techniques that are helping offshore players overcome their operating challenges. Submit your story ideas to Group Managing Editor Jo Ann Davy at jdavy@hartenergy.com.

Recommended Reading

Chevron Upgrades Refinery to Expand Light Crude Processing Capacity

2024-12-11 - The retrofit of Chevron’s Pasadena facility increases equity Permian crude processing capacity by 15%.

Trump Ambiguous Whether Canadian-Mexico Tariffs to Include Oil

2025-01-31 - At a news conference, President Trump said that he would exclude oil from tariffs before backtracking to say that he “may or may not” impose duties on crude.

Oil Prices Ease as US Tariffs On Mexico Paused for a Month

2025-02-03 - WTI crude futures were down $0.04, or 0.01%, at $72.49 after climbing as much as 3.7% earlier in the session to reach their highest since Jan. 24 at $75.18.

Predictions 2025: Downward Trend for Oil and Gas, Lots of Electricity

2025-01-07 - Prognostications abound for 2025, but no surprise: ample supplies are expected to keep fuel prices down and data centers will gobble up power.

Australia's Woodside in Talks with at Least Three Partners for Louisiana LNG, Sources Say

2025-02-18 - Woodside Energy has held talks with several potential buyers of stakes in its Louisiana LNG plant, including Tokyo Gas, Japan's JERA and Saudi Aramco-backed MidOcean Energy, multiple sources told Reuters.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.