Since joining Chesapeake Energy, Josh Viets has become much, much more interested in daily temperatures.

“I find myself checking the weather at least a couple of times a day and, unfortunately, this winter we have continued to be disappointed,” Viets, Chesapeake’s COO since 2022, told the audience at the DUG GAS+ Conference and Expo in March. “We just didn’t see it show up.”

December 2023 was one of the warmest Decembers on record, according to the National Oceanic and Atmospheric Administration. A polar vortex in mid-January was not enough to bring average temps for the month down below normal. February finished among the top 10 warmest on record for the month.

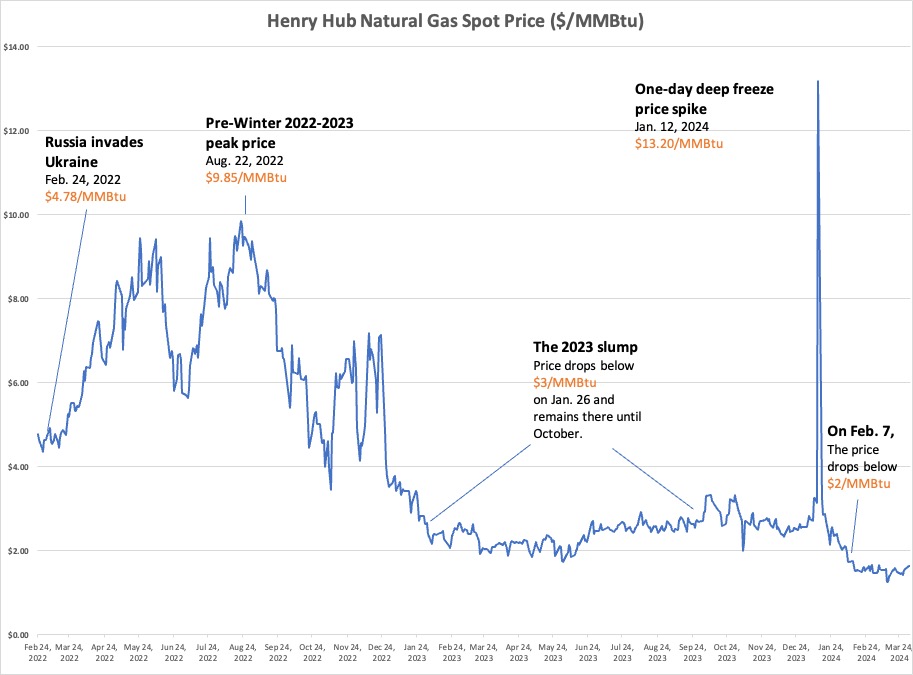

With record amounts in storage and production hitting new highs, the price of gas tanked in January to below $2.50/MMBtu at Henry Hub, and under $2/MMBtu in February and March, a price not seen since the COVID era in 2020. Most analysts believed the prices would remain low in the short term, with differing ideas on when the market would finally pull natural gas out of the doldrums.

“All of us that are in the natural gas business are pinching as many pennies as possible,” Viets said.

Natural gas-focused companies have been pinching pennies for close to two years, and the latest price drop did not come as a surprise to people who watch the industry.

Henry Hub natural gas prices climbed above $9/MMBtu in August 2022. Russia had invaded Ukraine six months earlier and European countries were searching for non-Russian natural gas sources ahead of the winter. However, the winter of 2022-2023 was almost as mild as 2023-2024, and prices fell under $3/MMBtu by the end of January and stayed there for most of 2023.

In October 2023, NOAA recategorized the ongoing El Niño as “strong,” which generally means warmer winters for residential heating customers in the northern regions of the country. In December, researchers at East Daley Analytics predicted natural gas prices would hit $2.50/MMBtu in the first or second quarter of 2024.

But other factors sway the market beyond the weather. One is supply.

In March, the Energy Information Administration (EIA) reported that the U.S. produced an average of 124 Bcf/d of natural gas, a new record for the month. Overall for 2023, gas production hit a new record of 37,883 Bcf, despite dropping prices.

Permian’s downward pressure

The Permian Basin produced about one-fifth of U.S. natural gas in 2023, according to the EIA. In 2023, gross natural gas production in the Permian rose by 2.6 Bcf/d to an average of 23.3 Bcf/d. Permian Basin gas is almost all produced in association with crude extraction.

The price for a barrel of WTI crude fell to $68.61/bbl on Dec. 12, 2023, and had risen above $80/bbl by mid-March. Break-even prices for Permian crude through 2023 averaged about $60/bbl, according to a Dallas Fed survey, so producers kept extracting crude and the gas that came along with it.

“Roughly a third of all the gas produced in the U.S. is coming from associated gas, primarily in the Permian, where you have break-evens (for natural gas) that are essentially zero,” Viets said.

Prices at the Waha hub, a regional price point near Pecos, Texas, went negative in early March, trading below $1/MMBtu. Natural gas takeaway capacity from the Permian is usually running at capacity, said Jack Weixel, senior director at East Daley Analytics.

The negative prices popped up during midstream company Kinder Morgan’s maintenance on the El Paso Natural Gas Pipeline, one of the key takeaway lines for the region, combined with windy days driving up electrical production from the region’s wind turbines, resulting in a reduction in the power load needed for West Texas electrical plants.

“You’ve got a really tight Permian market,” said Jimmy McNamara, senior vice president at Enverus Intelligence Research, at the DUG GAS+ Conference. “It’s going to continue to be the case in the Permian until they can get additional takeaway to the Gulf.”

Other basins’ different routes

Other gas-producing plays in the U.S. have reacted much more strongly to the market prices.

“We’ve seen suppliers respond pretty aggressively to lower prices in March,” McNamara said. According to Enverus, natural gas supply fell by about 7 Bcf/d over the first three months of the year, primarily by producers in the Haynesville and Appalachia shales holding back on production.

Producers in each basin have taken paths to deal with a low market.

According to Viets, Chesapeake has continued work on its wells in Appalachia, creating an inventory of about 80 DUCs that can be brought online quickly once the market provides a more worthwhile price.

Other Appalachia producers are doing the same, while the number of DUCs in the Haynesville, located in Texas and Louisiana, has started to drop, McNamara said, thanks to a difference in the production costs in the basins.

Since prices started falling in 2023, Haynesville producers are down to about 32 active rigs, which is below maintenance level, McNamara said. The play would need about 40 rigs to keep current production levels flat.

Within the basin, private operators tend to aggressively raise and lower well completions more than the public companies. The Haynesville tends to be more responsive to prices, as the break-even margins in the basin are higher than in other gas-focused areas. S&P Global estimated a $2.67/MMBtu break-even price in the Haynesville in February, as the Henry Hub price remained below $2/MMBtu.

“Private operators have really been driving and chasing price more than public operators,” McNamara said.

In the Appalachia’s Marcellus and Utica basins, different rules tend to apply. Production has remained flat even as prices have dropped. The basins in the Northeast have a lower cost of production, but far more takeaway constraints than the Haynesville, McNamara said. Production has therefore remained steady.

In February, Chesapeake announced it would cut production by about 20% in both the Haynesville and Appalachia regions to a total of about 2.7 Bcf/d. The disclosure came after similar announcements from Antero Resources, Comstock Resources and EQT.

Overall, natural gas producers in the U.S. have spent the last 18 months riding out thinning margins, positioning themselves for what it expected to be a massive increase in demand starting either at the end of 2024 or sometime in 2025.

A survey from advisory firm RBN Energy revealed that 12 natural gas-focused producers saw their profits decrease 87% from 2022 to 2023, from $47 billion to $6 billion, as a result of the decline in commodity prices.

“Adding insult to injury, many of the Appalachian hubs saw natural gas prices fall more than 70% and average less than $2/MMBtu in 2023,” RBN analyst Nick Cachionne wrote in the report.

However, the 11 of the 12 gas-producing companies managed to post a profit in 2023, the report said, with only Southwest Energy reporting a loss, which was tied to an impairment charge the company took prior to its proposed merger with Chesapeake Energy, which was announced in January. (An FTC probe into the merger was expected to delay the deal until the latter half of 2024.)

Gas producers have practiced cost discipline to keep finances steady, RBN reported. In 2023, depreciation, depletion and amortization (DD&A) costs were $5.18/boe, only 1% higher than 2022.

However, gas-focused and diversified E&Ps are in a difficult position compared to crude-focused companies, RBN wrote. “Both groups’ fortunes will depend on the degree to which the gas shut-ins are successful in bringing supply and demand into closer balance.”

Waiting for the boom

U.S. producers are waiting for the balance to come around in a market that remains uncertain.

“For natural gas prices to trade better, that’s a tricky one,” said Hinds Howard, CBRE Group portfolio manager. “The simplest answer is time for the demand to catch up to supply.”

The U.S. began to export LNG in earnest beginning in 2016. In January 2024, exports totaled 396 Bcf, according to the EIA. In 2023, the U.S. exported more LNG than any other nation, averaging 11.9 Bcf/d over 12 months. By 2030, current export capacity is expected to grow to just under 25 Bcf/d, as multiple LNG export terminals along the Gulf Coast and in Mexico are slated to come online.

Analysts agree the trading price of natural gas will generally increase in the near future, but have different ideas on the timing.

East Daley Analytics expects Henry Hub prices to reach above $3.50/MMBtu by year-end 2024. The current low prices should help the U.S. begin to drain the high level of natural gas in storage, which has been well over the five-year average since November 2023, according to the EIA. About 6 Bcf/d of LNG export capacity is expected to come online by October 2025.

Enverus’ McNamara said he did not expect Henry Hub prices to go above $3/MMBtu before several months into 2025.

“It’s going to take some time to wear down on the inventory levels,” he said.

LNG abroad

Analysts are also unsure how foreign competitors will adjust in the same time period. The five countries that export the most LNG after the U.S. are: Australia, Qatar, Russia and Malaysia.

Qatar, which fights for second place in LNG exports with Australia, announced in February that it plans to expand its export capacity 85%, to 142 million tonnes per annum (mtpa) by 2030, or about a quarter of the world’s LNG supply. Some market analysts believe the expansion could threaten the funding of several U.S. LNG projects that are waiting for permits from the U.S. Department of Energy, Reuters reported.

President Joe Biden’s administration put a pause on LNG permitting in January.

Russia, which drew U.S. and European sanctions following its invasion of Ukraine, is struggling to maintain its current level of exports and may soon run into more trouble with moving product to the market.

Russia’s Arctic LNG 2 suspended operations at the end of March in response to Western sanctions and a shortage of tankers, Reuters reported. Project managers had hoped to start commercial deliveries within first-quarter 2024. Russia is currently the world’s fourth-largest LNG exporter at 32.6 mtpa.

Europe, which had been Russia’s largest LNG customer, is considering further steps of separation.

At the end of March, European natural gas storage levels were at 58%, a record for the end of the heating season, according to Gas Infrastructure Europe. The surplus is causing pressure to grow from within the European Commission, where some players are calling to ban Russian LNG. (Russian newspaper Kommersant reported in April that the country’s European LNG exports were actually increasing.)

Rising domestic demand

Beyond the international market, producers are also seeing increasing demand at home, corresponding to the rapid growth of data centers and continuing retirement of coal-fired power plants. However, the growth in both sectors is difficult to predict, McNamara said.

Like natural gas, many utilities see coal as a cheap option which they are reluctant to eliminate, despite public pressure to decrease emissions of carbon and particulates. According to Enverus, whenever gas prices move above $4/MMBtu, utilities use more coal, causing the gas consumption to drop by about 1/Bcf/d.

“The main point we want to talk about here is just that, despite capacity going down, coal utilization is still pretty sticky,” McNamara said.

The power increase caused by artificial intelligence (AI) data centers is more difficult to predict. There has been a “ton of hype around AI,” McNamara said.

AI has received a great deal of attention from the energy industry because a rapid continual growth of the sector would require a massive increase in power supplies. In an October 2023 interview with the Scientific American, data scientist Alex de Vries said that if everyone started using ChatGPT for internet queries instead of Google, the extra power requirements would be like adding a country the size of Ireland to the world’s power grid.

However, determining the size of the electrical demand and a corresponding rise in gas demand has been difficult for analyst to calculate so far.

“We don’t have certainty about what our power demand forecast would be for AI,” McNamara said. “We’re still running our numbers. There’s definitely some uncertainty there.”

What to look for

The problem for the natural gas industry’s commodity prices, Howard said, is waiting for the factors to finally line up in its favor.

“Demand is longer cycle than supply growth,” he said, “And will hinge on things like LNG export facility buildout, re-shoring of manufacturing that will lead to more industrial demand and hopes for demand growth due to generative artificial intelligence and data center growth.”

With an almost certain increase in gas demand expected over the next year, Chesapeake is optimistic about its position for the industry’s future, Viets said. Producers are keeping their eyes open to start taking advantage of their preparations to provide a larger supply.

“We need to see a few things happen,” he said. “The timing of this is going to remain uncertain.”

Recommended Reading

The Evolving Federal State of Energy Under Trump 2.0

2025-03-04 - What happens when the Trump wrecking ball swings into the bureaucratic web of everything that touches oil and gas?

Haynesville Shale’s Got the Gas but Pipeline Disputes Stall Egress

2025-03-03 - Gas producers such as Chevron Corp. and Expand Energy have seen a host of problems—predominantly due to legal challenges lead by Energy Transfer.

E&P Highlights: March 3, 2025

2025-03-03 - Here’s a roundup of the latest E&P headlines, from planned Kolibri wells in Oklahoma to a discovery in the Barents Sea.

Trump Says 25% Canada, Mexico Tariffs to Take Effect March 4

2025-03-03 - Financial markets fell on news that President Donald Trump would enact 25% tariffs on Mexico and Canada and both countries promised to respond.

Valeura Boosts Production, Finds New Targets in Gulf of Thailand

2025-03-03 - Valeura Energy Inc. has boosted production after drilling three development wells and two appraisal wells in the Gulf of Thailand.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.