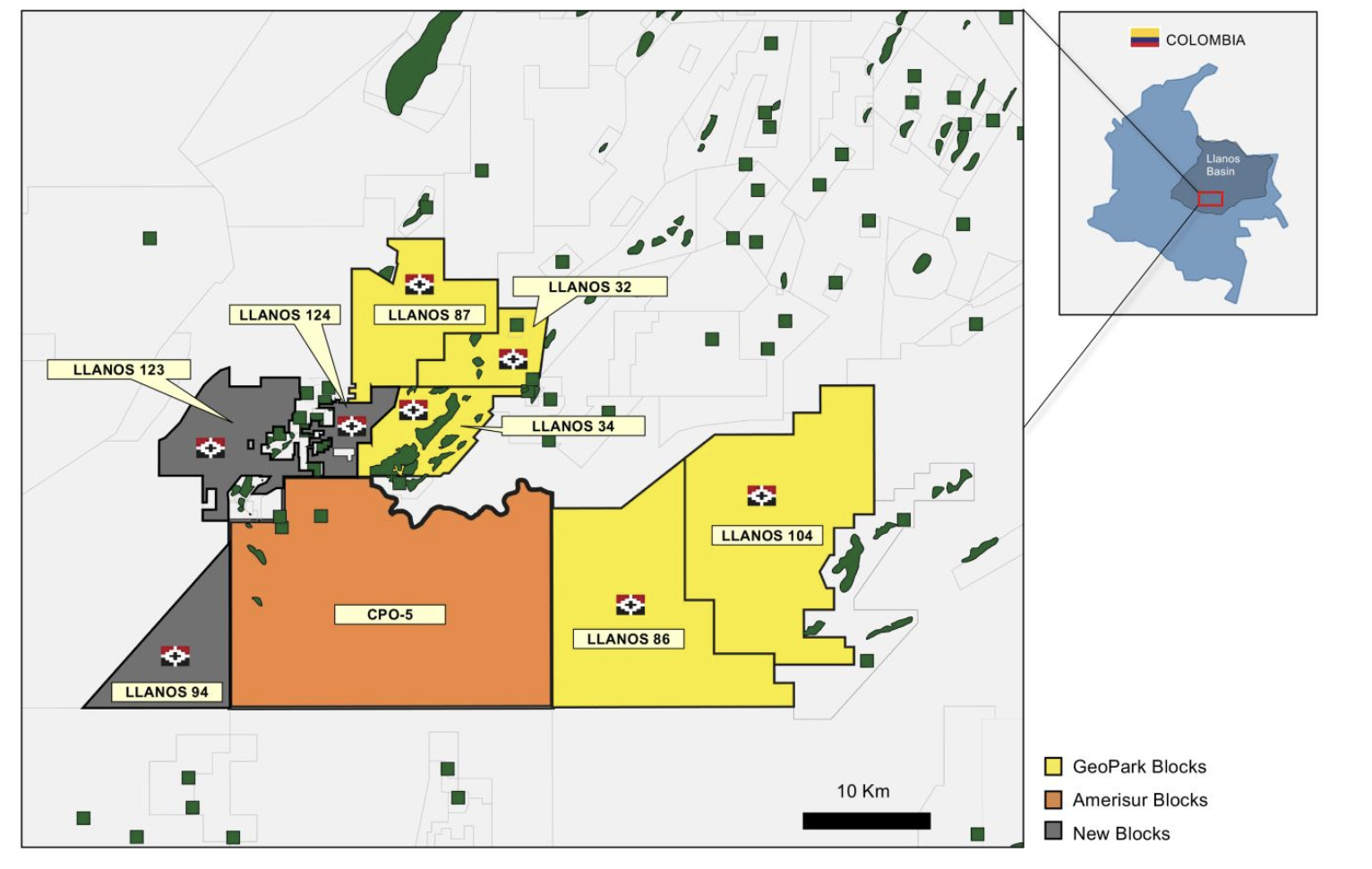

GeoPark operations in the Llanos 34 Block. (Source: GeoPark Limited Image Library)

Latin American E&P GeoPark Ltd. signed an offtake and prepayment agreement with energy and commodity company Vitol, according to a May 9 press release.

Under the agreement, GeoPark will sell and deliver to Vitol a minimum of 20,000 bbl/d of oil from the Llanos 34 Block in Colombia, which GeoPark holds 45% working interest.

GeoPark will also obtain immediate access to committed funding from Vitol for up to $300 million, with an option to increase by another $200 million—a total of $500 million in prepaid future oil sales over the contract’s period.

GeoPark expects to improve its price realizations by US$0.15/bbl compared to the current agreement, or by US$0.60/bbl compared to the average price realizations since January 2021, the release stated.

The offtake agreement will start on July 1 and will last between 20 months to 36 months.

Recommended Reading

What's Affecting Oil Prices This Week? (Feb. 3, 2025)

2025-02-03 - The Trump administration announced a 10% tariff on Canadian crude exports, but Stratas Advisors does not think the tariffs will have any material impact on Canadian oil production or exports to the U.S.

Michael Hillebrand Appointed Chairman of IPAA

2025-01-28 - Oil and gas executive Michael Hillebrand has been appointed chairman of the Independent Petroleum Association of America’s board of directors for a two-year term.

Murphy Shares Drop on 4Q Miss, but ’25 Plans Show Promise

2025-02-02 - Murphy Oil’s fourth-quarter 2024 output missed analysts’ expectations, but analysts see upside with a robust Eagle Ford Shale drilling program and the international E&P’s discovery offshore Vietnam.

Confirmed: Liberty Energy’s Chris Wright is 17th US Energy Secretary

2025-02-03 - Liberty Energy Founder Chris Wright, who was confirmed with bipartisan support on Feb. 3, aims to accelerate all forms of energy sources out of regulatory gridlock.

Exxon Slips After Flagging Weak 4Q Earnings on Refining Squeeze

2025-01-08 - Exxon Mobil shares fell nearly 2% in early trading on Jan. 8 after the top U.S. oil producer warned of a decline in refining profits in the fourth quarter and weak returns across its operations.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.