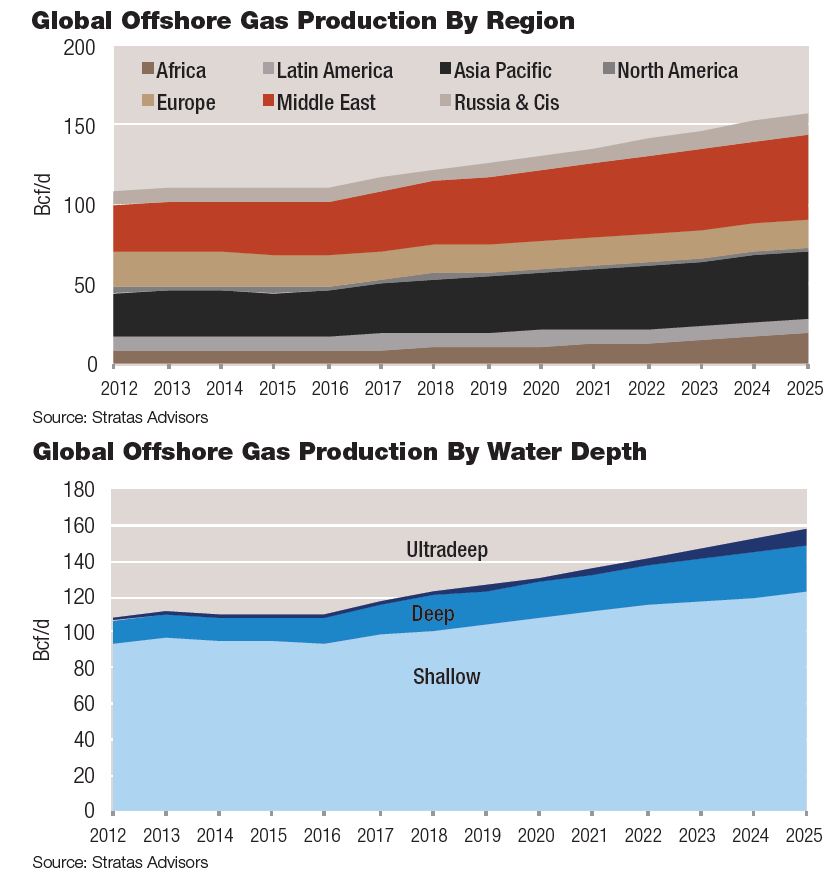

Global offshore production has contributed about 110 billion cubic feet per day (Bcf/d) of dry gas since 2012 which accounts for about one-third of the global total. The Middle East, Asia Pacific and Europe have been the top three regions in offshore gas production with a combined capacity of about 82 Bcf/d, or about 74% of the global total.

In the past five years, about 86% of offshore production, approximately 95 Bcf/d, has been produced from shallow water—water depth less than 1,000 feet. Deepwater—water depth deeper than 1,000 feet but less than 5,000 feet—production has been steady at around 14 Bcf/d. Ultradeepwater—water depth greater than 5,000 feet—production has only contributed less than 2 Bcf/d.

With the tailwind momentum of the long investment cycles, offshore is expected to continue to grow at a speed of about 4% annually in the next several years by the end of the decade. The growth will be driven by new developments and field expansions in offshore Africa, Asia Pacific, and the Persian Gulf in the Middle East and the Caspian Sea in Russia & CIS. Stratas Advisors expects that global natural gas production from offshore will reach 130 Bcf/d by 2020 and 157 Bcf/d by 2025.

Offshore gas production accounted for about 60%, or 29 Bcf/d, of the total gas production in Asia Pacific over the past five years. Australia, Malaysia and Indonesia are the top producers in the region with a combined production of about 15.5 Bcf/d. The region will produce about 10 Bcf/d more gas from offshore than in 2017 to reach 41.8 Bcf/d by 2025. Most of the region’s offshore production—about 81%—comes from shallow water; however, deepwater production is expected to grow faster in the near future, increasing from 6.8 Bcf/d in 2017 to 11.2 bcf/d by 2025.

Offshore gas production in the Persian Gulf has accounted for about 62%, or 32 Bcf/d, of the Middle East’s total gas production in the past five years. About 80% of the offshore production comes from two countries, Iran and Qatar. The Persian Gulf is expected to produce about 54 Bcf/d by 2025—17 Bcf/d higher than in 2017.

In the past five years, Africa has produced about 7.5 Bcf/d of gas from offshore fields, about 40% of the continent’s total gas output. Egypt and Nigeria are the top offshore producers with a combined production of about 5.2 Bcf/d, or about 70% of Africa’s offshore total. Shallow water has been the main producing area of offshore Africa and accounts for 75%, or 5.7 Bcf/d, of the continent’s total offshore gas production. Driven by Egypt and East Africa gas developments, the region will produce about 10 Bcf/d more gas from offshore than in 2017 to reach 18 Bcf/d by 2025.

Offshore gas production in Russia and CIS is mostly from the top two producers, Russia and Azerbaijan. The two combined produced about 93% of offshore gas, or 7.7 bcf/d, in the last five years. Production in the region will continue to grow in the next 10 years driven by these two countries as well as Kazakhstan. It could reach 12.7 Bcf/d by 2025 from about 8 Bcf/d in 2017.

Offshore gas production from the rest of world, including the U.S. Gulf of Mexico, Latin America and North Sea, have been in a declining mode for the past five years as the producing base matures. Total production is down to 31 Bcf/d in 2017 from 34 Bcf/d in 2012. Lacking major gas developments, new source gas projects in these regions cannot provide sufficient fuel for the regions to grow. The total offshore gas production in these three regions is expected to remain around 30 Bcf/d for the next 10 years.

Recommended Reading

Chris Wright: Natural Gas Key to Trump’s Energy Policy Goals

2025-03-10 - U.S. Energy Secretary Chris Wright aims to streamline regulatory processes for building energy projects and boost U.S. LNG exports, he said during the 2025 CERAWeek conference.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.