First, the good news from a panel discussing natural gas finances at the recent IHS CERAWeek conference in Houston:

“The current problems are probably, over the long run, the best thing that could have happened to gas in some sense,” said Alastair Maxwell, managing director for Goldman Sachs. “The real challenge for the business at hand is cost and economics.”

See? This is good for us. Would you like some cod liver oil to go with that second helping of low commodity prices?

Duncan Caird, managing director and head of project and export finance, Americas, for HSBC Securities, offered a laundry list of items to address:

“We’ve seen the price of equity completely change, so people are going to have to reprice how they do that—on LNG, on pipelines, on terminals,” he said. “We will see overall cost probably go up. We then need to look at the synthetic form of cost to capital, which is, what is the cost of my steel, my unions, my labor, the technology that I’m bringing to it? And those things all need to improve.”

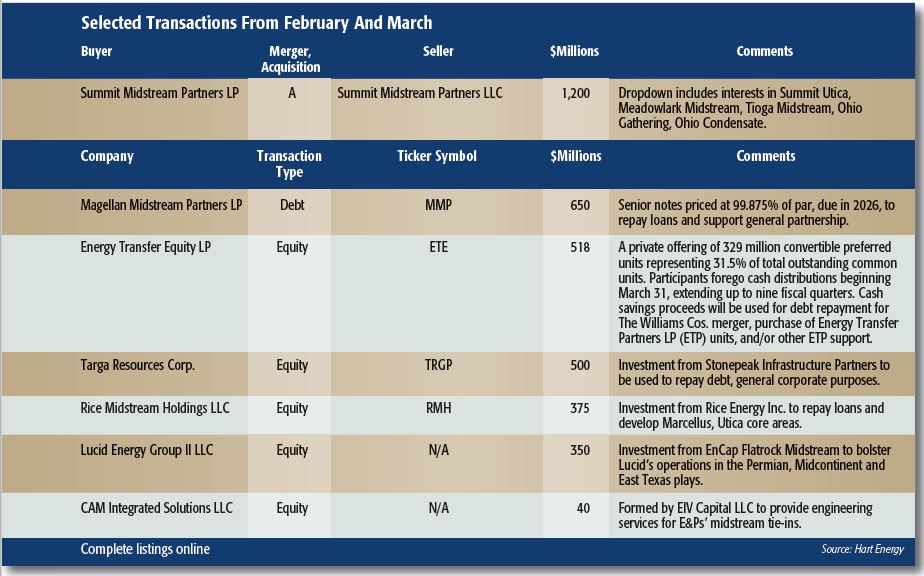

The transaction list this month tilts toward generation of funds, with only one acquisition: Summit Midstream Partners LLC’s $1.2 billion dropdown of operating assets to Summit Midstream Partners LP. The general partner will receive an initial payment of $360 million, with a deferred payment due in 2020.

Repaying debt is the stated purpose of the cash infusion for several companies listed below. A conservative capital structure is a necessary component of managing through the downcycle and ultimately, as they say, it’s good for us.

Recommended Reading

Matador May Tap Its Haynesville ‘Gas Bank’ if Prices Stabilize

2024-10-24 - The operator holds 8,900 net Haynesville Shale acres and 14,800 net Cotton Valley acres in northwestern Louisiana, all HBP, that it would drill if gas prices stabilize—or divest for the right price.

Comstock: Monster Western Haynesville Wildcats Cost $30MM-plus

2024-10-31 - Comstock Resources is flowing back a 13th well currently in the play where the oldest has made 2.2 Bcf per 1,000 lateral feet to date in its first 29 months online.

Coterra Takes Harkey Sand ‘Row’ Show on the Road

2024-11-20 - With success to date in Harkey sandstone overlying the Wolfcamp, the company aims to make mega-DSUs in New Mexico with the 49,000-net-acre bolt-on of adjacent sections.

Classic Rock, New Wells: Permian Conventional Zones Gain Momentum

2024-12-02 - Spurned or simply ignored by the big publics, the Permian Basin’s conventional zones—the Central Basin Platform, Northwest Shelf and Eastern Shelf—remain playgrounds for independent producers.

Matador’s U-lateral Delaware Tests Outproduce 2-mile Straight Holes

2024-10-30 - Matador Resources' results from eight Loving County, Texas, tests include two 2-mile U-turn laterals, five 2-mile straight laterals and one 1-mile straight lateral, according to state data.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.