When feeling insecure, it’s good to have a friend to count on. And when it comes to energy insecurity, it’s really good when that friend has 168 Bbbl of proved crude oil reserves and other energy riches it is more than willing to share.

But in the case of the U.S. and Canada, domestic politics can strain that friendship.

“Any legislation or executive orders that could impact our market access such as domestic content requirements, those are what are worrisome for Canadians,” said Jennifer Jabs, the Government of Alberta’s assistant deputy minister of jobs, economy and trade, at the Offshore Technology Conference (OTC) in Houston. “For example, [with] ‘buy American’ and pool legislation, which is the country-of-origin labeling, we need to ensure that there are carve-outs for Canada. Our trade relationship is built on longstanding binational supply chains, and cross-border economic integration is a win-win for both countries.”

Economic security, Jabs stressed, is impossible without energy security. “By energy security, I mean security of affordable supply that also maintains a high level of national security.”

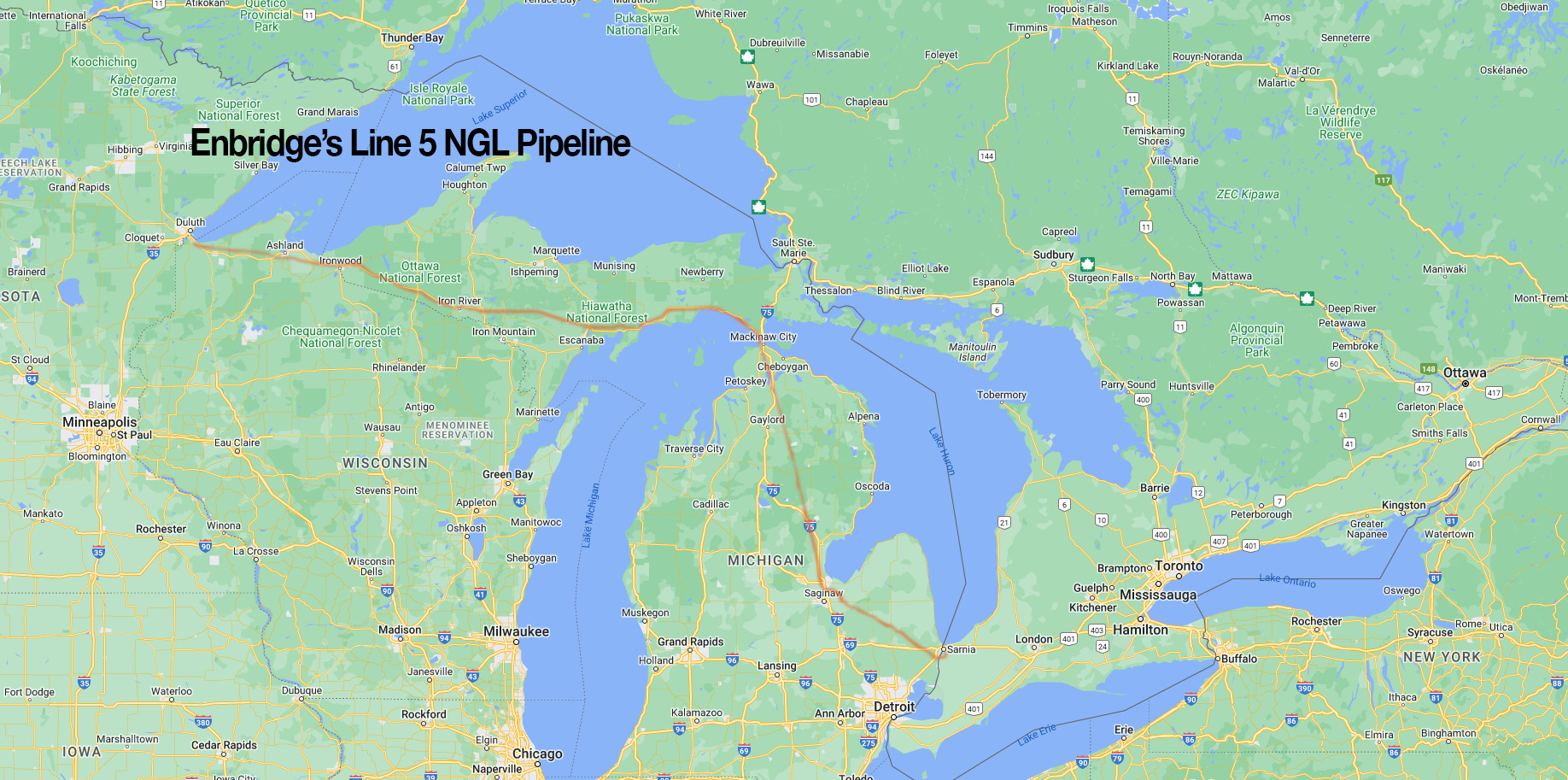

Case in point: Enbridge’s Line 5 NGL pipeline

“It’s a 1,038-kilometer, 30-inch diameter pipeline that travels through Michigan’s upper and lower peninsulas, originating in Wisconsin and terminating in Sarnia, Ontario,” she said. “If it were to be shut down, the region of Michigan, Ohio, Pennsylvania, Ontario and Quebec would see a 14.7 million U.S. gallons a day supply shortage of gas, diesel and jet fuel. It would cut more than half of the jet fuel supplies for the Detroit Metro Airport.”

A shutdown of the pipeline would not just reduce the energy supply in both Canada and the U.S. but lead to job losses and increased energy prices impacting roughly 85 million people on both sides of the border, Jabs said.

A good match

Energy-rich Canada is the largest supplier of crude oil and refined products to the U.S. The province of Alberta alone accounts for 90% of the energy products exported to the U.S. to feed American refineries.

“Canadian production has historically and continues to be a critical piece of U.S. oil supply. In the last year, Canadian Western Sedimentary Basin (WCSB) exceeded record production levels of 4.6 MMbbl/d,” East Daley Director of Energy Analytics Kristine Marie Oleszek told Oil and Gas Investor (OGI) in May. “In tandem, the U.S. imported a record amount of oil from Canada in January 2024 at 4.184 MMbbl/d. However, Canadian producers have hit a ceiling on production growth due to egress limitations and Canadian net-zero policies.”

The U.S. Midwest, specifically, is heavily reliant on Canadian flows, Mark Oberstoetter, Wood Mackenzie’s head of Americas (non-Lower 48) upstream research Canada, told OGI.

“Heavy barrels also flow to the large U.S. Gulf Coast (USGC) refining sector,” he said. “That particular market is more dynamic as heavy imports can come from the Middle East or elsewhere.”

“With Venezuela declining and diverting to China, Canada has filled a hole in the USGC refining sector, but other heavy producing regions can always step in at a higher price. Of the heavy oil producing regions, Canada does stand out for its friendly above-ground relationship with the U.S. and carbon pricing and regulations,” Oberstoetter said.

Canada’s proved oil reserves trail only Venezuela (303.8 Bbbl) and Saudi Arabia (297.5 Bbbl), according to the Statistical Review of World Energy. Canada ranks as the world’s fourth-largest producer of oil, trailing the U.S., Russia and Saudi Arabia. Alberta is responsible for the bulk of Canada’s crude oil production, but additional significant volumes also come from Saskatchewan and offshore Newfoundland and Labrador, according to Natural Resources Canada.

Canada has 16 refineries with a total combined crude oil processing capacity of 1.85 MMbbl/d as of 2021, according to the U.S. Energy Information Administration (EIA). Eastern Canada has seven refineries with 1.07 MMbbl/d of capacity (58% of total capacity), while Western Canada has nine refineries with 784,000 bbl/d of capacity (42% of total capacity).

Canada’s crude oil production exceeds its domestic refining capacity. Even though Canada imports some crude oil and products, it’s a net exporter of both, mainly to the U.S. American refineries that are designed to process heavy oils such as oil sands. In recent years, the U.S. has replaced heavy oil imports from Venezuela with those from Canada owing to U.S. oil sanctions placed on Venezuela beginning in 2019.

And Canada doesn’t just produce crude oil. The country is also the fourth-largest producer of natural gas, according to Natural Resources Canada. Nearly all of Canada’s gas production is from the Alberta and British Columbia (BC) provinces. Saskatchewan is Canada’s third-largest gas-producing province, and uranium from the province is used to generate electricity for about one in 20 U.S. homes.

“Canadian production is an effective match for the USGC refining slate and since [Enverus Intelligence Research] doesn’t anticipate a peak in demand anytime soon, every barrel is important in keeping markets somewhat balanced to 2030,” Enverus Intelligence Research Director Al Salazar told OGI.

Trade buddies Alberta and Texas

While Alberta and Texas are at opposite ends of the weather extreme, they do share something in common by way of significant energy resources and the economic benefits that come from their commercialization. Alberta is a major trade partner with Texas, which was lifted into the ranks of hydrocarbon exporter as a result of the shale revolution.

“Alberta has a major interest in Texas. We have bilateral trade of $16 billion per year between Alberta and Texas, and Texas is Alberta’s second-largest U.S. trading partner,” Jabs said.

Russia’s invasion of Ukraine in 2022 led to a drastic decline in Russian energy exports to Europe and the U.K., and prompted a major energy crunch that was felt around the world.

“With geopolitical instability and risk of inward-facing policies, we may see a decreased appetite for energy imports from the U.S. [But] Alberta’s a trusted, reliable partner in bolstering energy security while maintaining high environmental standards,” Jabs said. “And Alberta can help reduce North American dependence on foreign energy and critical mineral supply chains while supporting the global energy transition.”

Such a downward move in oil production would expose the Alberta government, which received Cdn$16.9 billion in oil sands royalties alone in its last fiscal year. The funds cover a large portion of their provincial budget spanning healthcare to education, according to Wood Mackenzie’s Oberstoetter.

If anything, the Ukraine war has shifted the attention of world leaders to securing energy supply and the energy trilemma—a framework of three objectives including security, sustainability and affordability.

Canada’s energy security and that of the U.S. are arguably one and the same. U.S. refiners are in a good place most of the time, but not without concerns as they have also come to rely on the oil sands-heavy blends to run the more complex coking refineries and provide optimized products, Oberstoetter said.

“The landlocked refineries in the U.S. Midwest no longer have pipelines flowing north to access international crudes,” Oberstoetter said. “So, in a scenario where oil sands production goes completely away, those refineries would be challenged to source other heavy blends and would need to shut down certain components of a refinery or even the entire facility.”

Canada’s oil sands make up over 95% of the country’s total oil reserves, and are concentrated in three areas: Athabasca, Peace River and Cold Lake in the provinces of Alberta and Saskatchewan, according to the U.S. based-Energy Information Administration (EIA).

Saskatchewan is Canada’s second-largest oil producing province behind Alberta, and is the sixth-largest onshore producer in Canada and the U.S., according to the Canada Energy Regulator.

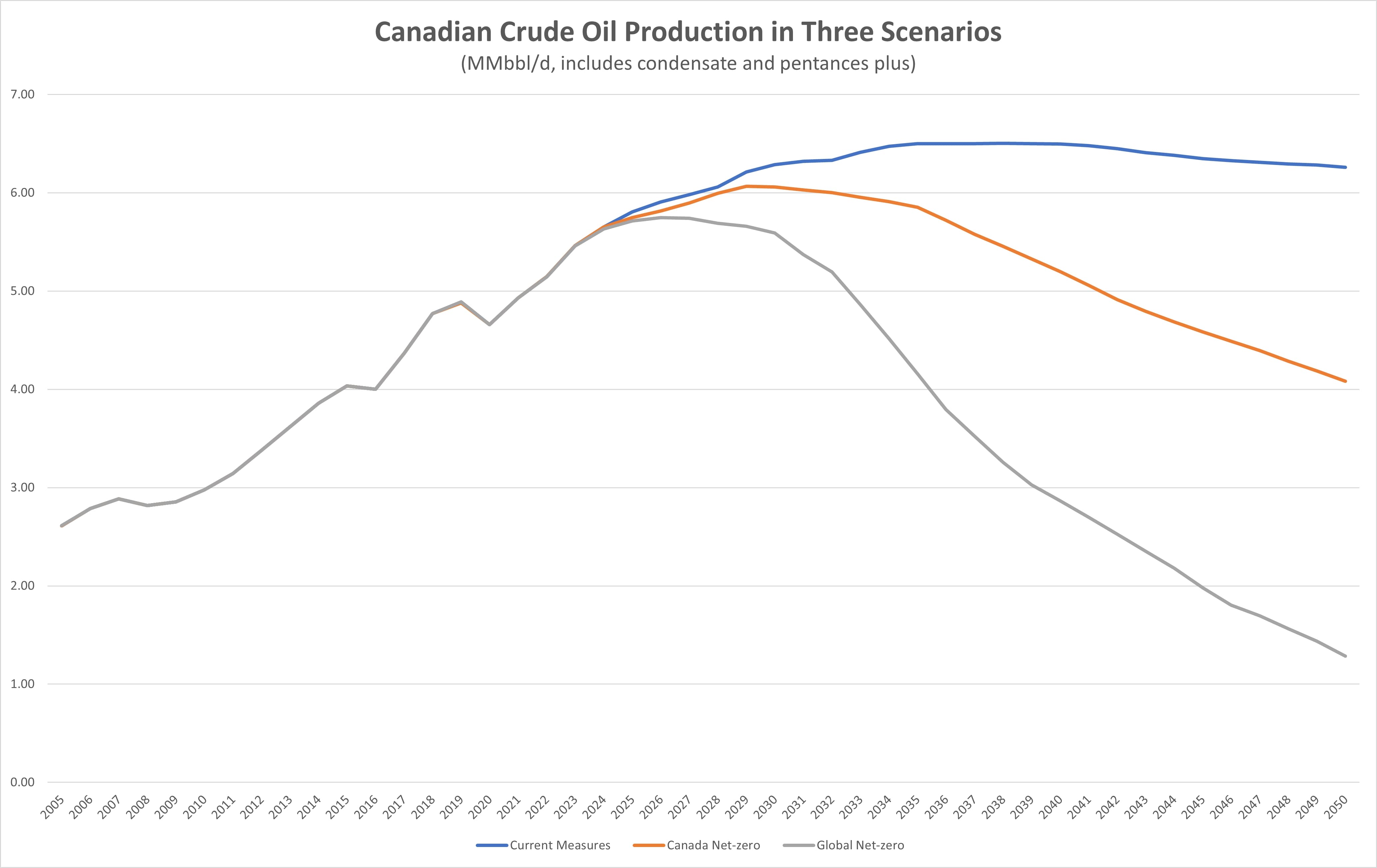

In recent years, Canadian crude oil production has steadily grown. Production rose 87% from 2005 to 2019 before declining 5% to average 4.66 MMbbl/d in 2020, largely due to the COVID-19 pandemic, according to the Canada Energy Regulator. Since, oil production has been on an upward trajectory. Production averaged 4.93 MMbbl/d in 2021, 5.15 MMbbl/d in 2022, and reached its highest level ever at 5.46 MMbbl/d in 2023.

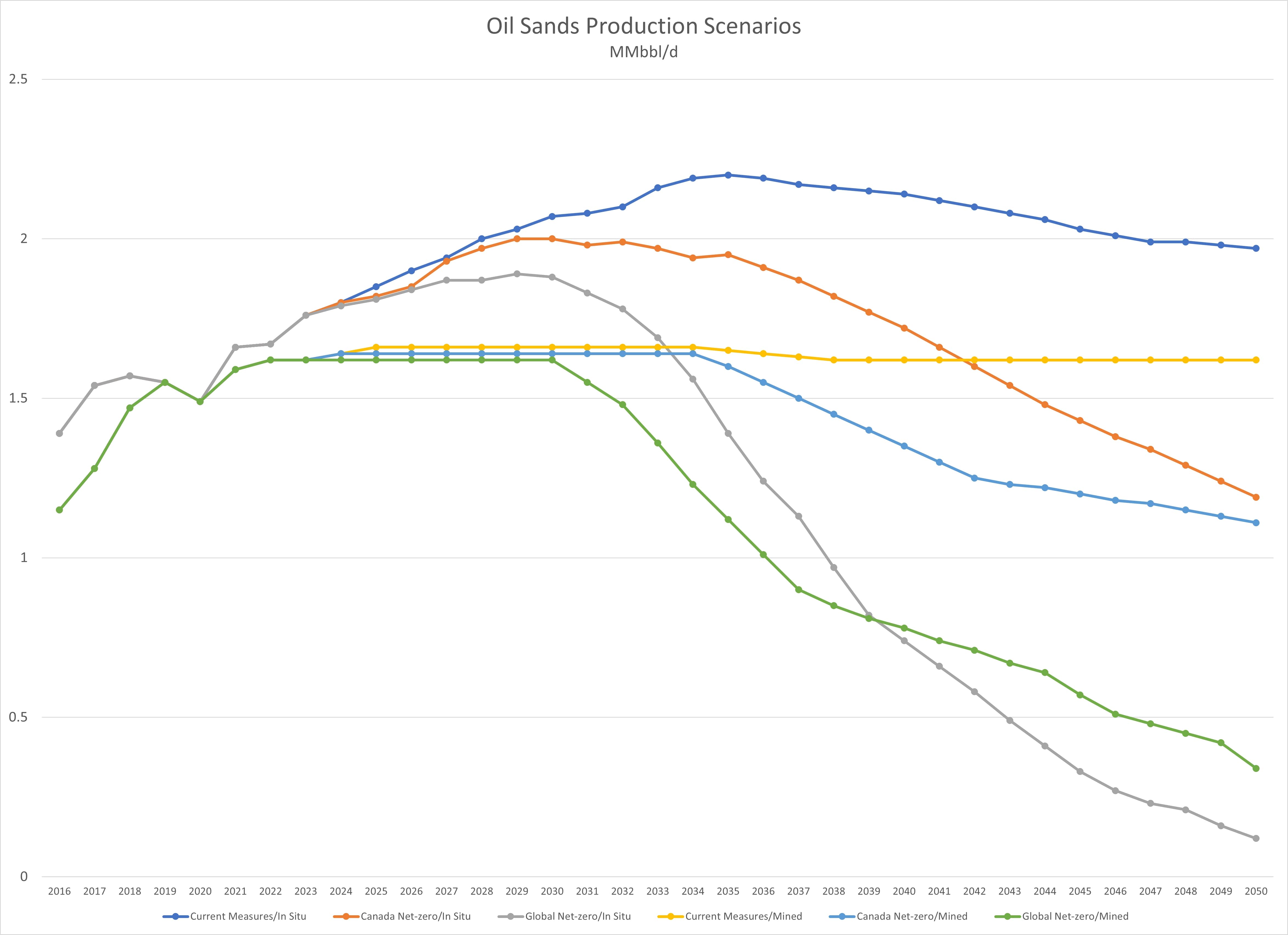

Canada’s oil sands production, which primarily comes from bitumen deposits in Alberta, made up 62% (32% in-situ and 30% mined) of Canada’s crude oil production in 2023, according to the Canada Energy Regulator. Canada’s bitumen is either mined in surface pits or produced using wells and steam (called in-situ production), according to the entity.

In-situ extraction recovers bitumen that’s too deep beneath the surface for mining (greater than 75 m underground), according to Natural Resources Canada. And the lion’s share of Canada’s bitumen is extracted using the in-situ methods, such as steam assisted gravity drainage. In contrast, open-pit mining is similar to traditional mineral mining operations and largely employed where oil sands reserves are closer to the surface (less than 75 m underground).

Under current measures, Canada’s crude oil production is expected to peak at 6.5 MMbbl/d in 2035 and plateau at that level until 2040. Thereafter production is expected to start its decline. In 2035, oil sands production is expected to average 3.85 MMbbl/d, representing 59% of Canada’s total crude oil production in that year.

While operating costs have moved lower, and production has continued even with low prices during the pandemic, Wood Mackenzie doesn’t envision Canada’s production declining, nor does it forecast production above the ceiling set by the Canada Energy Regulator in its current measures scenario, Oberstoetter said.

“The appetite for large-scale greenfield expansion has dimmed with the consolidation and operational focus of the past decade,” Oberstoetter said. “Corporate capital discipline, takeaway and rail constraints and uncertain regulatory policy will all contribute to any ceiling view, besides oil price and project economics (greenfield projects tend to be challenged when oil prices are below US$60/bbl).”

The Canada Energy Regulator has established three scenarios to create its Canadian crude oil production forecasts. The scenarios differ depending on the pace of Canada’s and the rest of the world’s climate actions. The “current measures scenario” doesn’t assume additional action to reduce greenhouse gas (GHG) emissions beyond those in place today. The Canada and global net-zero scenarios share the premise that the future pace of climate action in Canada is consistent with Canada reaching net-zero GHG emissions by 2050.

Under Canada’s net-zero and the global net-zero scenarios, the country’s crude oil production is expected to peak and start declining much earlier than 2035, which is the case in the regulator’s current measures scenario.

Under the Canada net-zero scenario, crude oil production is expected to peak at 6.07 MMbbl/d in 2029 with oil sands representing 60% of the total crude oil production. Under the global net-zero scenario Canada’s crude oil production will peak at 5.75 MMbbl/d in 2026 with oil sands representing 60% of the total crude oil production.

Company interest and funding headwinds

While Canada’s crude oil production will vary under different scenarios—trending down in the net-zero scenarios—heightened interest in the sector remains among companies considering consolidation options, and especially for five producers that account for around 81% of the total oil sands production, Oberstoetter told OGI.

“For Cenovus Energy, Suncor Energy, Canadian Natural Resources, Imperial Oil and MEG Energy, this is their essential resource theme and they will rely on oil sands as the primary pieces of their portfolios for the next two decades,” Oberstoetter said. “Some do have other production regions or downstream assets, but most of their value and shareholder distributions is locked into the oil sands.”

But for Enverus Principal Analyst Trevor Rix and Enverus Director Al Salazar, capital is an issue.

“Within Alberta, there have been challenges with Pathways Alliance CCUS proceeding due to the federal government’s lack of willingness to backstop a carbon price which creates elevated political risk that further impairs the ability and/or willingness to invest in additional greenfield projects,” Rix said.

“Again—under the assumption that global liquids demand does not peak and under a backdrop of limited OPEC global supply growth outside of Brazil and Guyana-Suriname, higher prices should be a green light to increase oil sands production,” Salazar said. “Unfortunately, capital to fund such long-lead expansions will be tough to come by, especially with the heightened attention to environmental and energy transition themes.

“European banks and some funds refuse to fund Canadian oil sands projects. In short, the need will be there for more barrels. However, finding capital that is willing to stomach the long-lead times and payout periods and perhaps another round of midstream constraints could be tough to find. Likewise, it is extremely difficult to license new export pipelines through BC.”

Canada’s pipeline and takeaway headwinds

The upward trend in Canada’s crude oil production in recent years is in great part due to several factors: the Alberta government rescinded mandatory production curtailments established in 2019, and the addition of export pipeline capacity. The latter point is arguably the main focus of the current spotlight on Canadian pipeline infrastructure. Some progress has been made to boost Canada’s overall pipeline infrastructure.

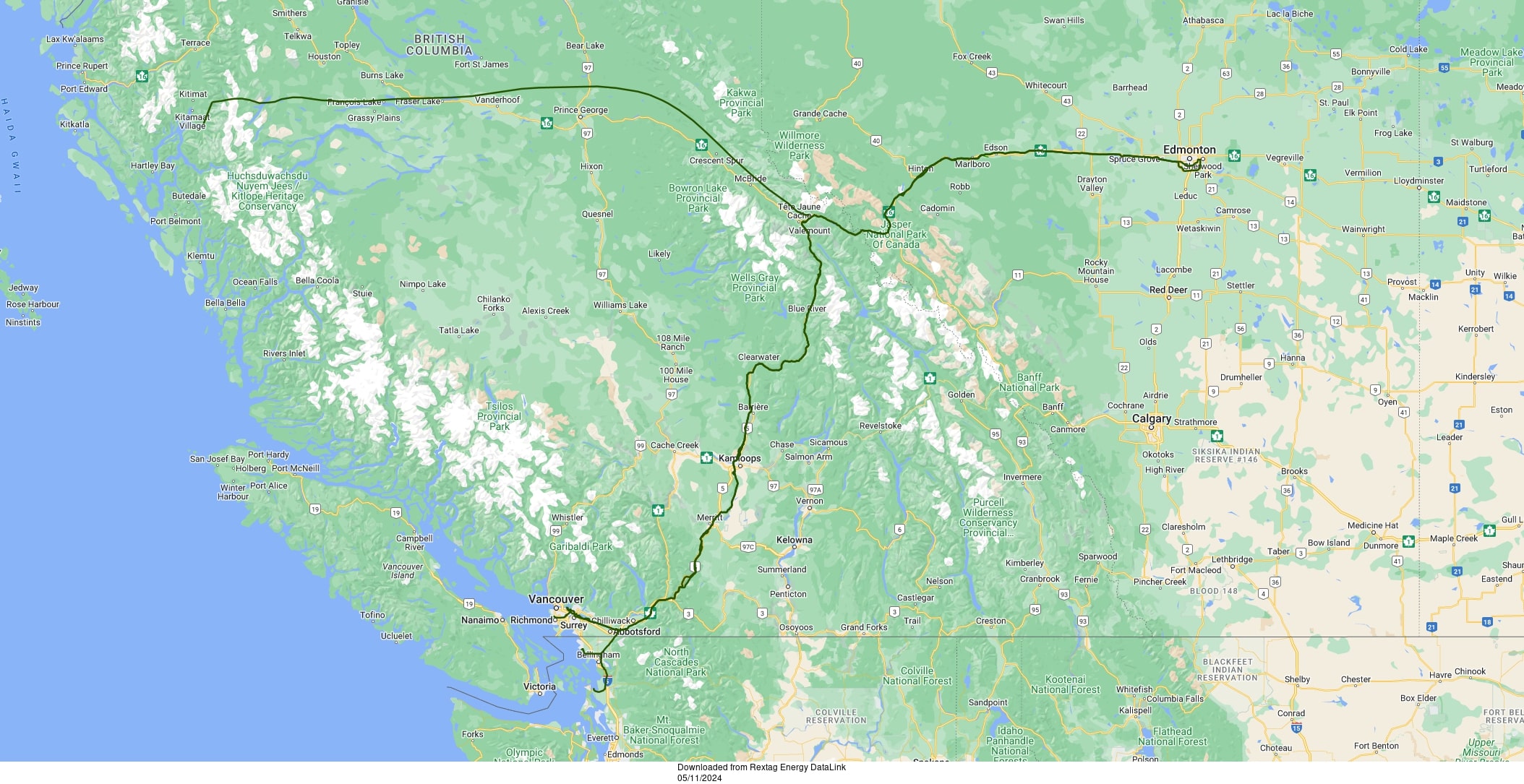

On May 1, Trans Mountain Corp.’s Trans Mountain pipeline expansion project began commercial operations, creating a pipeline system with 890,000 bbl/d of capacity compared to 300,000 bbl/d earlier, according to Trans Mountain.

The event was met with applause from top executives with a number of Canadian producers.

“Completion of infrastructure projects, such as TMX, are crucial to the competitiveness and growth of the country’s energy industry and the strength of the Canadian economy,” Imperial Oil Chairman, President and CEO Brad Corson said during the company’s first-quarter earnings call. “Going forward, we do expect to see a narrower [Western Canadian Select] differential that will further support strong value delivery from our upstream and a net benefit to Imperial.”

The original Trans Mountain Pipeline was constructed in 1953. The Canadian government approved the Trans Mountain Expansion Project in June 2019, which would essentially twin the existing 1,150-km pipeline between Strathcona County (near Edmonton), Alberta and Burnaby, BC.

The Trans Mountain expansion will boost shipments from the British Columbia coast to Asia and the U.S. West Coast, and compete with Enbridge’s Mainline and TC Energy’s Keystone pipeline, which take Canadian crude to U.S. refineries.

“The addition of Canada’s own international market will allow WCSB production to receive better netbacks for its production as the U.S. market has historically seen wide differentials due to the large distance to get the bbl to market and numerous bottlenecks and congestion along the way,” East Daley’s Oleszek said. “East Daley’s production model forecasts WCSB oil production to fill TMX’s added egress by year-end 2026. As this happens Canada will once again be at egress constraints limiting production growth with the only viable option being rail opportunities. East Daley believes it is very unlikely Canada will see a crude oil project of TMX’s stature in the future to alleviate egress constraints.”

“It is great for industry and Canada to have that tremendous asset available,” MEG Energy Corp. Senior Vice President of Marketing Erik Alson said during the company’s first quarter earnings call. “With this critical infrastructure now complete, we anticipate that light heavy differentials will remain narrow for years while Canadian egress remains unconstrained. Before TMX fills, I think you’ll see additional egress from an Enbridge mainline expansion. And while I don’t see another pipeline being built, I believe there’s debottlenecking of other existing pipelines that will occur.”

Canadian oil has long been heavily discounted because it only had one outlet—the U.S. Gulf Coast, which was often congested, Salazar said. Trans Mountain provides options to Canadian producers looking to international markets.

“At an astonishing cost of approximately $34 billion, it would make sense that this pipeline be used to its fullest,” he said. “This, coupled with Venezuelan uncertainty, should mark an easing of such discounts. Ultimately, as a U.S. refiner in need of Canadian crude, it must feel a bit uncomfortable to know that its former dance partner now has multiple suitors.”

The change is appreciated by Jon McKenzie, CEO of Cenovus Energy.

“With this critical piece of infrastructure now complete, we anticipate light-heavy differentials will remain narrow for years, while excess egress capacity exists,” he said during the company’s first-quarter webcast.

The Enbridge Mainline is North America’s largest crude oil pipeline network. It transports light and heavy oil, NGLs and refined products from Edmonton, Alberta to different markets in Canada and the U.S. Midwest. The Canadian Mainline includes six adjacent pipelines with a combined operating capacity of 3.2 MMbbl/d that connect with the Lakehead System at the Canada-U.S. border, as well as five pipelines that deliver crude oil and refined products into eastern Canada, according to Enbridge.

TC Energy’s 4,900-km liquids pipeline system, consisting of the Keystone Pipeline, directly connects the Western Canadian Sedimentary Basin to the largest refining market with 14 MMbbl/d of capacity in the U.S. Midwest and Gulf Coast.

Pembina Pipeline Corp.’s pipeline division manages a transportation capacity of 2.9 MMboe/d in key market hubs in Canada and the U.S. Pembina’s oil sands and heavy oil assets transport heavy and synthetic oil produced within Alberta to the Edmonton area and offer associated storage, terminaling and rail services.

But, despite having the energy-hungry U.S. on its side logistically and commercially, Canadian crude oil producers still don’t have everything easy.

Crude oil supply in Western Canada exceeds pipeline transport capacity that serves international markets. Since Canada’s oil export pipelines operate at full capacity and the timing of new capacity additions is uncertain, Canadian producers have to lean increasingly on railroad transportation to ship crude oil to market, according to the EIA.

“With Trans Mountain starting, there is now adequate pipeline egress for current production levels. But a few years of incremental growth will see pipeline capacity become a constraint on further growth,” Oberstoetter said. “There is rail loading capacity of approximately 600,000 bbl/d but that is not all located in the optimal locations and peak rail usage was 412,000 bbl/d in February 2020. [But] Rail capacity could be added if economics improve.”

Recommended Reading

IBAT CEO: Lithium Extraction in Smackover ‘Almost Child's Play’

2025-03-24 - Iris Jancik, the CEO of International Battery Metals, said the company aims to work with oil and gas companies to explore lithium extraction projects.

BKV Applies Refrac Playbook to Potential M&A Targets

2025-04-03 - BKV Corp. applies its refrac playbook—tried and true in the Barnett Shale—to potential M&A targets as it looks to gain contiguous acreage, Upstream President Eric Jacobson told Hart Energy at DUG Gas.

Exclusive: India’s Cairn to Deliver First Shale Well in Summer

2025-03-23 - India's Cairn Oil & Gas, part of Vedanta Group, plans to deliver its first shale well using U.S. shale techniques honed by oilfield service companies, in June or July.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.