As midstream MLPs released earnings reports, they quickly trended toward “the fourth quarter was pretty good, but we’re lowering guidance for 2015.”

MLPs are now using an average of $50 to $60 per barrel for crude oil to make their estimates and warn against continued commodity price volatility. Among midstream businesses, gathering and processing (G&P) tends to be the most sensitive to commodity prices.

ONEOK Partners LP is a G&P and NGL pipeline company that recently reduced guidance. It expects to grow its distribution 3% to 5% in 2015, not the 8% announced late last year. This reduction is directly influenced by a 58% decrease in expected capex as development of gas processing plants is suspended in the Williston Basin, Midcontinent and Powder River Basin. Given the continued flaring of gas, especially in the Bakken, these projects can be resumed whenever volume and price projections improve.

MarkWest Energy Partners LP, another MLP with significant G&P exposure, also lowered near-term distribution growth expectations, dropping 2015 expectations to 4.5% from 7% and 2016 expectations to 7.3% from 10%. Capex forecasts fell 17% for the current year, reflecting the revised drilling plans of customers.

But it’s worth noting that the cost of labor, materials and equipment is falling as engineering and construction companies compete for a smaller number of projects, which enhances the returns of those projects that move forward. Also on a positive note, MarkWest announced expected annual distribution growth of 10% for 2017 to 2020, providing guidance further out than ever before.

However, both ONEOK Partners and MarkWest are large companies, which are generally better able to weather price swings by virtue of financial liquidity and geographic diversification. Smaller G&P companies like Crestwood Midstream Partners LP, which has a market cap of just over $3 billion, have had a tougher time. Crestwood had planned on resuming distribution growth toward the end of 2014 but has conservatively decided to increase coverage throughout 2015 instead. The company has also reduced 2015 growth capex as its customers have slashed their drilling budgets, as well as initiated a company-wide consolidation and reduction in workforce.

In contrast, EQT Midstream Partners reaffirmed its previously issued guidance and intends to continue to increase distributions by at least three cents per unit each quarter through 2016, implying minimum distribution growth rates of 22% in 2015 and 18% in 2016.

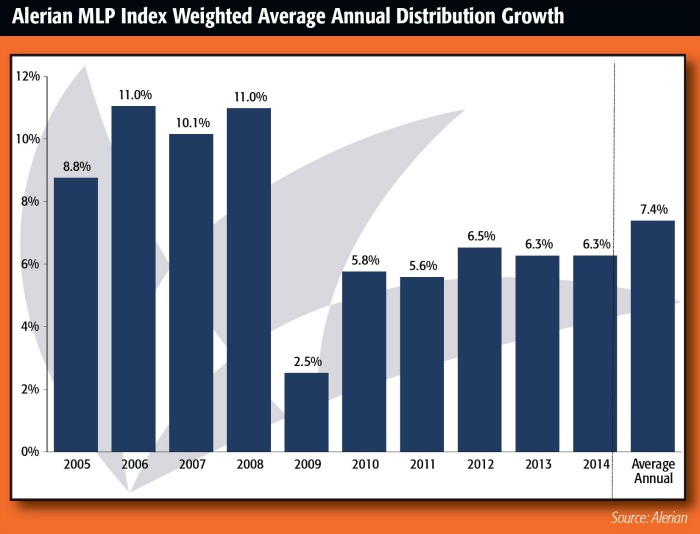

For the past several years, Alerian has provided conservative estimates of what investors can expect from MLPs over the long term—namely, 5% to 7% yield plus 4% to 5% distribution growth for an annualized return of 9% to 12%. MLPs are still on track to beat those estimates this year. Should commodity prices stabilize and even inch upward in 2015, MLPs may very well exceed their revised expectations.

Maria Halmo and Emily Hsieh, CPA, are directors for Alerian, an independent provider of MLP and energy infrastructure market intelligence. Over $19 billion is directly tied to the Alerian Index Series. For more information, visit www.alerian.com/alerian-insights.

Recommended Reading

East Daley: New Pipelines Could Open Permian Floodgates

2024-12-18 - Led by the opening of the Matterhorn Express, a slew of projects is set to battle regional bottlenecks in the Permian Basin region but power generation may be the catalyst for newly announced pipelines.

Shale Outlook: Power Demand Drives Lower 48 Midstream Expansions

2025-01-10 - Rising electrical demand may finally push natural gas demand to catch up with production.

Gas & Midstream Weekly: Cushing Crude Storage Levels Near All-Time Lows

2025-01-16 - Low levels of crude in storage could cause problems across the U.S. supply chain; a "gas super-cycle" may be coming; and Liberty Energy's Chris Wright testifies to the Senate.

Energy Transfer Shows Confidence in NatGas Demand with Pipeline FID

2024-12-11 - Analyst: Energy Transfer’s recent decision to green light the $2.7 billion Hugh Brinson line to Dallas/Fort Worth suggests electric power customers are lining up for Permian Basin gas.

Delek to Buy Permian's Gravity Water Midstream for $285MM

2024-12-13 - Delek Logistics' purchase of Permian-focused Gravity Water Midstream adds more than 200 miles of permanent pipeline and 46 saltwater disposal facilities.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.