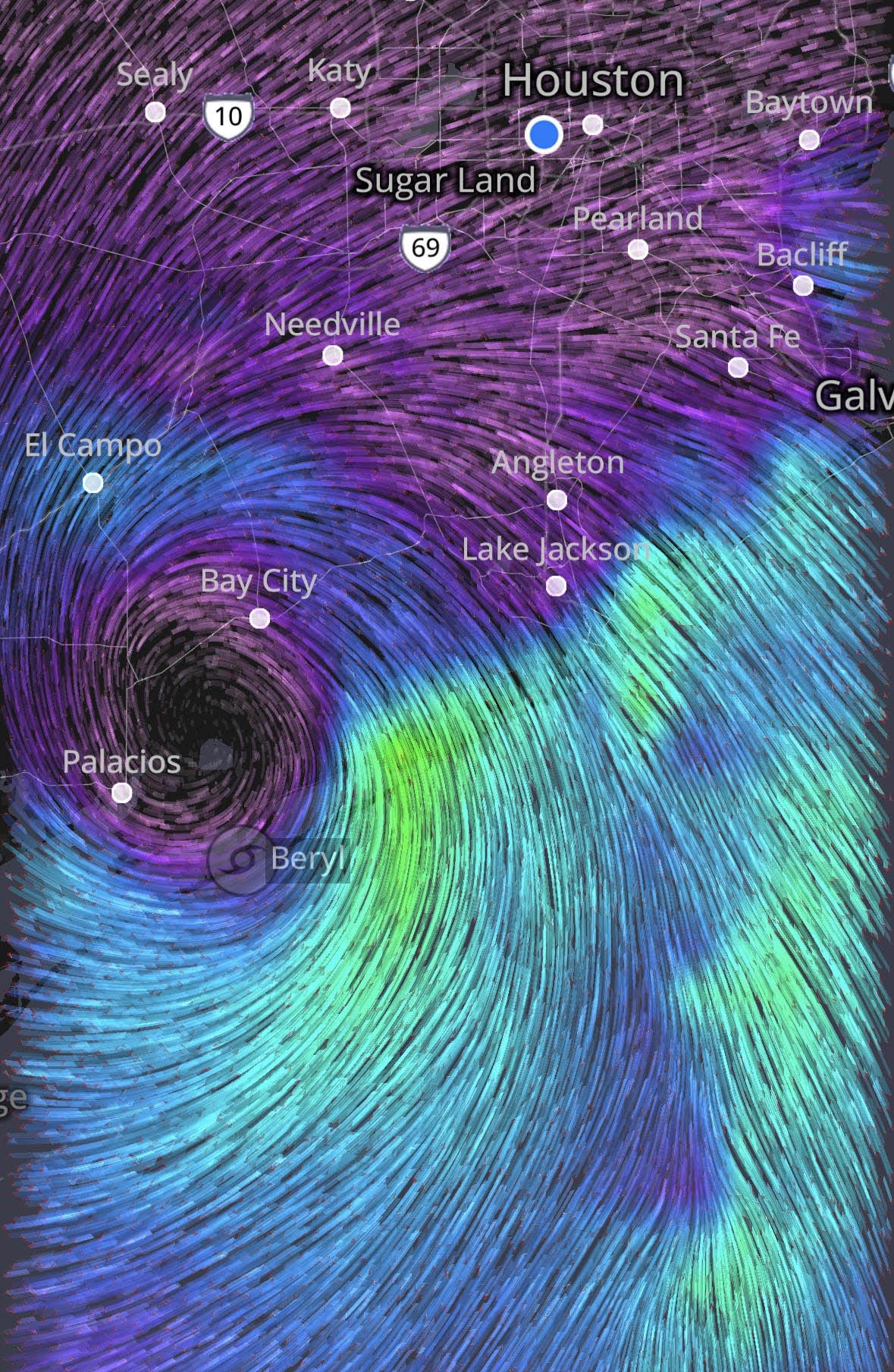

Hurricane Beryl made landfall in Texas in the early hours of July 8, wreaking havoc along its path. Now a tropical storm, Beryl is making its way towards the east coast. (Source: Shutterstock)

By the time Hurricane Beryl barreled across the Texas coastline battering everything in its path, the storm was weakening into a tropical storm. Its wrath remained in force, however, bringing LNG water transport to a halt and exposing millions without power to perilous Texas summer temperatures.

(Source: MyRadar)

The port of Corpus Christi reopened on July 8 in the aftermath, according to VesselFinder. And two LNG tankers were loading at the Cheniere LNG facility by July 9 at Corpus.

LNG terminals at Sabine Pass and Lake Charles had also reopened. Three LNG tankers were at berth at Cheniere Energy’s docks at Sabine on July 9. At Lake Charles, no LNG tankers were at berth or underway in the morning for Calcasieu Pass LNG or the Sempra Energy facility there.

Meanwhile, the port at Freeport and the Houston Ship Channel remained closed the morning of July 9, according to VesselFinder. Tankers that had returned on July 8 were staged offshore at anchor awaiting reopening. LNG tankers for loading at Freeport LNG were among those poised to launch.

The storm had blown through Matagorda Bay, west of Houston, continuing north into Robertson County, where Comstock Resources and Aethon Energy have deep Haynesville Shale wildcats underway, according to MyRadar.

RELATED

Oil Companies in Texas Restoring Operations Following Hurricane Beryl

Oil Slips as Concerns Over Hurricane Damage Ease

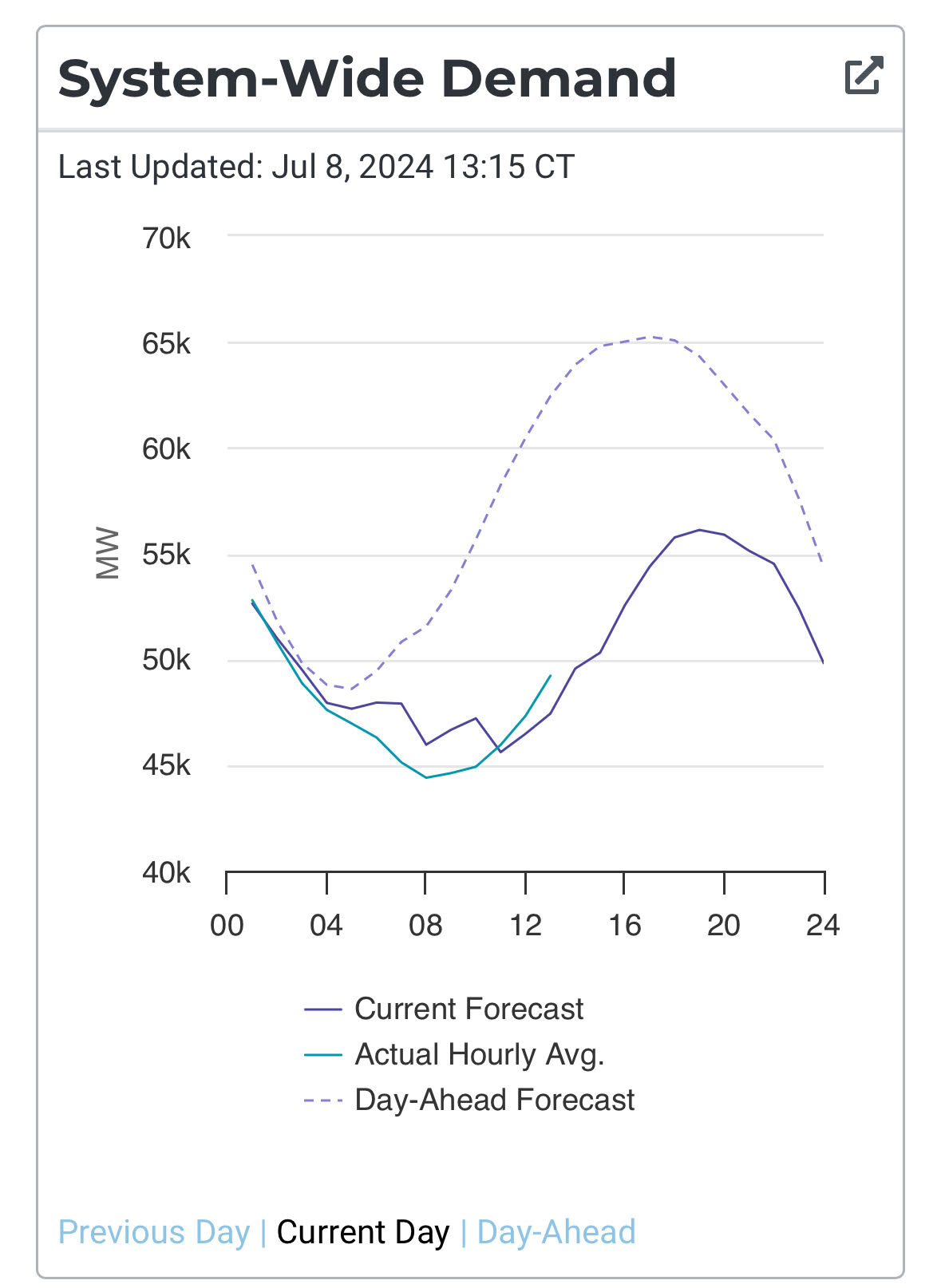

The Electric Reliability Council of Texas, or ERCOT, reported July 9 that Texas power demand within its ISO borders was 15% less than previously expected.

More than 2 million customers remained without power in Houston and throughout CenterPoint Energy’s service area on July 9, according to its post to social media platform X. CenterPoint is the regulated utility that owns most of the power transmission and other infrastructure in the path of Beryl.

The company posted on the social media platform that power would be restored to 1 million customers by July 10.

However, by the morning of July 9, no trucks were in Houston yet , according to local television station KHOU, citing CenterPoint, in an X post.

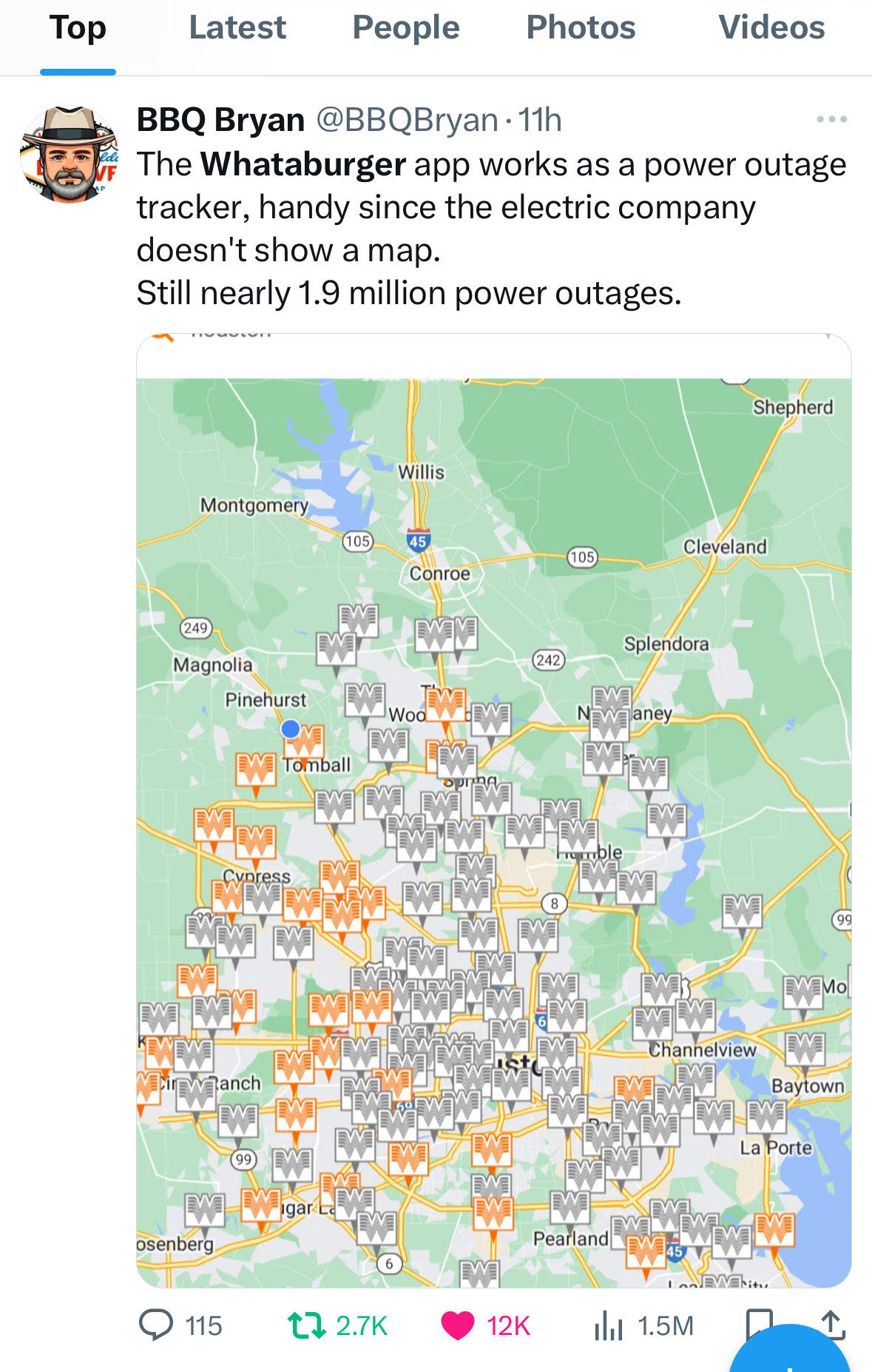

CenterPoint turned off its power outage tracker in May after a weather event that crumbled main transmission infrastructure and left 2 million accounts without power.

Most of East Texas went dark on the morning and throughout the day of July 8.

The outage tracker PowerOutage.US noted that in counties CenterPoint serves, the utility was not reporting its outage locations. Instead, it provided estimates, and its numbers were likely underestimated.

In a workaround, X poster BBQ Bryan reported on the evening of July 8 that the Whataburger restaurant app could be used as an outage tracker, showing locations lit in orange and dark in gray.

The tip was trending through the morning of July 9.

An X poster wrote, “Using the Whataburger app to track power outages after a hurricane Is probably the most Houston thing I can possibly imagine.”

Whataburger is a Texas-born chain.

Recommended Reading

LNG, Data Centers, Winter Freeze Offer Promise for NatGas in ‘25

2025-02-06 - New LNG export capacity and new gas-fired power demand have prices for 2025 gas and beyond much higher than the early 2024 outlook expected. And kicking the year off: a 21-day freeze across the U.S.

First US-Owned LNG Tanker to Serve Puerto Rico

2025-03-18 - LNG Tanker American Energy takes on a new mission 31 years after its construction.

Gulf South Pipeline Cuts Gas to Freeport LNG's Texas Plant After Lightning Strike

2025-03-24 - The incident has slashed gas usage at Freeport LNG's plant, which can process up to 2.4 Bcf/d of gas, to 450 MMcf/d from previous expectations of almost 1.8 Bcf/d, according to LSEG data.

Charif Souki Plans Third US NatGas Venture, Including E&P Team

2025-03-25 - Charif Souki, co-founder of the Lower 48’s first and largest LNG exporter, has his sights set on a third natural gas venture after his exit from Tellurian Inc.

US LNG Exporter Venture Global's Shares Dip After IPO

2025-01-24 - Venture Global’s pre-IPO pricing at $25 a share valued the Gulf Coast LNG operator at some $65 billion, but shares fell below $25 by about 3% in trading Jan. 24.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.