A natural gas well pad in Harrison County, Ohio, where Gulfport Energy owns leasehold. (Source: Shutterstock)

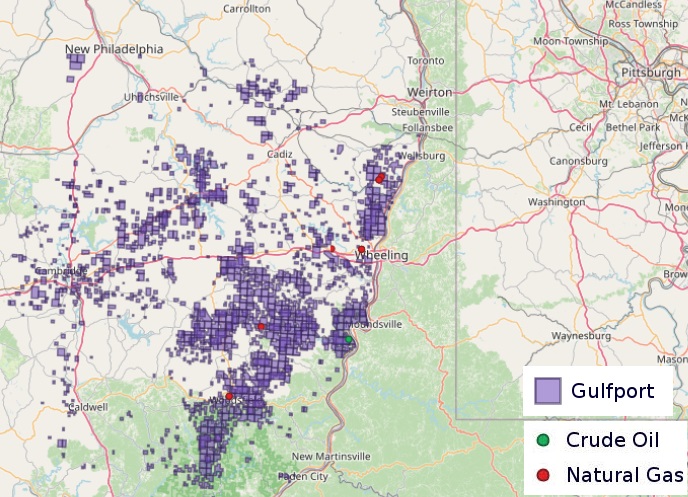

Gulfport Energy might be one of Ohio’s larger gas producers, but the company wants to see greater liquids volumes from new wells drilled this year.

With natural gas prices hovering near record lows, Gulfport is cutting gas-weighted drilling activity and deferring certain completion activities to the back half of the year, the Oklahoma City-based E&P said in first-quarter earnings after markets closed April 30.

Pushing back drilled and completed (D&C) activity should have little impact on Gulfport’s overall gas production, however.

Gulfport reaffirmed its full-year 2024 production guidance of 1,045 MMcfe/d to 1,080 MMcfe/d.

The company’s output averaged 1,053.7 MMcfe/d during the first quarter, including 831.3 MMcfe/d in the Ohio Utica and Marcellus shales and 222.4 MMcfe/d in the Midcontinent’s SCOOP play.

First-quarter volumes included about 92% natural gas, 6% NGL and 2% oil and condensate.

Gulfport’s plan to shift D&C activity to the back half of 2024 echoes similar plans laid out by other major gas producers, like EQT Corp., Chesapeake Energy, Range Resources and CNX Resources.

Henry Hub spot prices fell by 60% to average $2.63/Mcf last year on increasing dry gas production, near-record volumes of associated gas from oil basins like the Permian and Bakken, elevated gas storage inventories and mild winter weather.

Natural gas prices have been so low that experts believe operators in higher-cost basins, such as the Haynesville Shale in East Texas and northern Louisiana, are struggling to drill new wells profitably.

Efforts by Gulfport and its peers to curtail gas production and defer D&C activity in gassy basins aren’t yet moving the needle on prices, analysts say.

But operators and experts believe prices should get a lift later this year and into next year as new U.S. LNG export projects start to come online.

The U.S. Energy Information Administration’s latest forecasts have Henry Hub averaging $2.24/Mcf this year before rising to average $3.01/Mcf in 2025.

Instead of drilling new natural gas wells, Gulfport is focusing investment into areas of its portfolio with a higher mix of oil and liquids.

“Despite today's volatile commodity backdrop, the company continues to forecast robust adjusted free cash flow generation during 2024, driven by improving capital efficiencies and our focus on more liquids-rich development throughout the year,” Gulfport President and CEO John Reinhart said in a release.

RELATED

Analysts: Why Are Investors Snapping Up Gulfport Energy Stock?

Oily Ohio

Gulfport aims to bring its spending down 10% to approximately $400 million this year while targeting more oil-, NGL- and condensate-rich drilling opportunities.

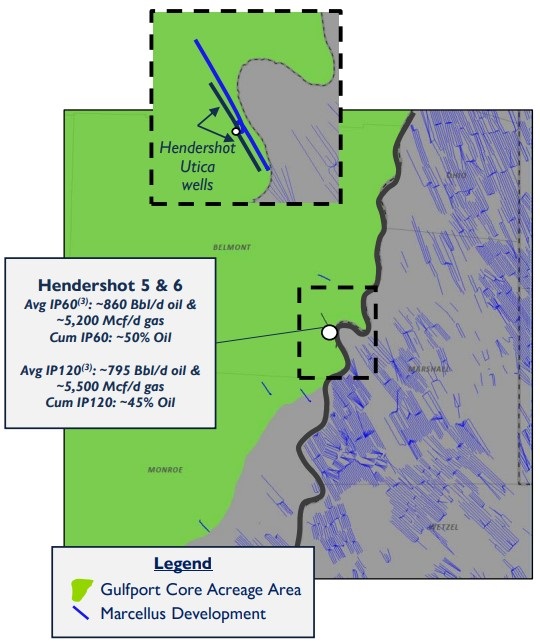

The company continues to see “strong oil production” from a two-well Hendershot pad drilled in Belmont County, Ohio, that came online last year.

Hendershot 5 and 6, targeting the Marcellus Shale, produced around 795 bbl/d of oil and 5,500 Mcf/d of gas through its first 120 days in production (~45% oil), Gulfport said in an investor presentation.

During Gulfport’s May 1 earnings call, Reinhart said the company’s liquids-focused development going forward will be more “tweaking” and less delineating, given the vast quantities of data on Marcellus well completions in the area.

“It was more about identifying liquids yields, NGL yields, ‘what’s the condensate look like?’” Reinhart said on drilling the Hendershot wells.

“All that information is really there to help us start looking at the midstream solutions and looking at the productivity,” he said.

Initial results from the Hendershot wells suggest between 50 and 60 incremental liquids-rich drilling locations across Gulfport’s existing acreage position—about two years of drillable inventory.

Moving forward this year, Gulfport plans to continue testing ways to optimize spacing and stimulation techniques for liquids development.

The company is currently planning a four-well Marcellus project on an existing Utica pad beginning in early 2025, Reinhart said.

Gulfport expects its overall production to trend a bit more liquids-rich exiting this year because of the E&P’s development plan.

But Gulfport will still be “largely a gas company,” despite the boost in liquids productivity, executives said on the earnings call.

Gulfport’s oil and condensate production averaged 3,329 bbl/d during the first quarter—down by about 30% from 4,729 bbl/d during first-quarter 2023.

NGL volumes averaged 10,031 bbl/d, down by about 29% from 14,096 bbl/d during the same period last year.

Gulfport isn’t the only producer getting in on the oily Ohio action. E&Ps EOG Resources, Ascent Resources, Encino Resources and Infinity Natural Resources are leading exploration and delineation activity in the Ohio Utica oil window.

RELATED

Recommended Reading

Bottlenecks Holding US Back from NatGas, LNG Dominance

2025-03-13 - North America’s natural gas abundance positions the region to be a reliable power supplier. But regulatory factors are holding the industry back from fully tackling the global energy crisis, experts at CERAWeek said.

NatGas Shouldering Powergen Burden, but Midstream Lags, Execs Warn

2025-02-14 - Expand Energy COO Josh Viets said society wants the reliability of natural gas, but Liberty Energy CEO Ron Gusek said midstream projects need to catch up to meet demand during a discussion at NAPE.

FERC Chair: Gas Needed to Head Off US Grid’s ‘Rendezvous with Reality’

2025-03-13 - Federal Energy Regulatory Commission Chairman Mark Christie is pushing natural gas to feed U.S. electrical grids before a “rendezvous with reality” occurs.

US NatGas Prices Jump 9% to 26-Month High on Record LNG Flows, Canada Tariff Worries

2025-03-04 - U.S. natural gas futures jumped about 9% to a 26-month high on record flows to LNG export plants and forecasts for higher demand.

LNG Leads the Way of ‘Energy Pragmatism’ as Gas Demand Rises

2025-03-20 - Coastal natural gas storage is likely to become a high-valued asset, said analyst Amol Wayangankar at Hart Energy’s DUG Gas Conference.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.