(Source: Shutterstock.com)

Harbour Energy Plc is expecting to close its acquisition of Wintershall Dea’s upstream assets earlier than expected, the U.K.-based oil and gas company announced Aug. 27.

Previously planned for fourth-quarter 2024, the $11.2 billion cash-and-stock transaction is now expected to close in early September.

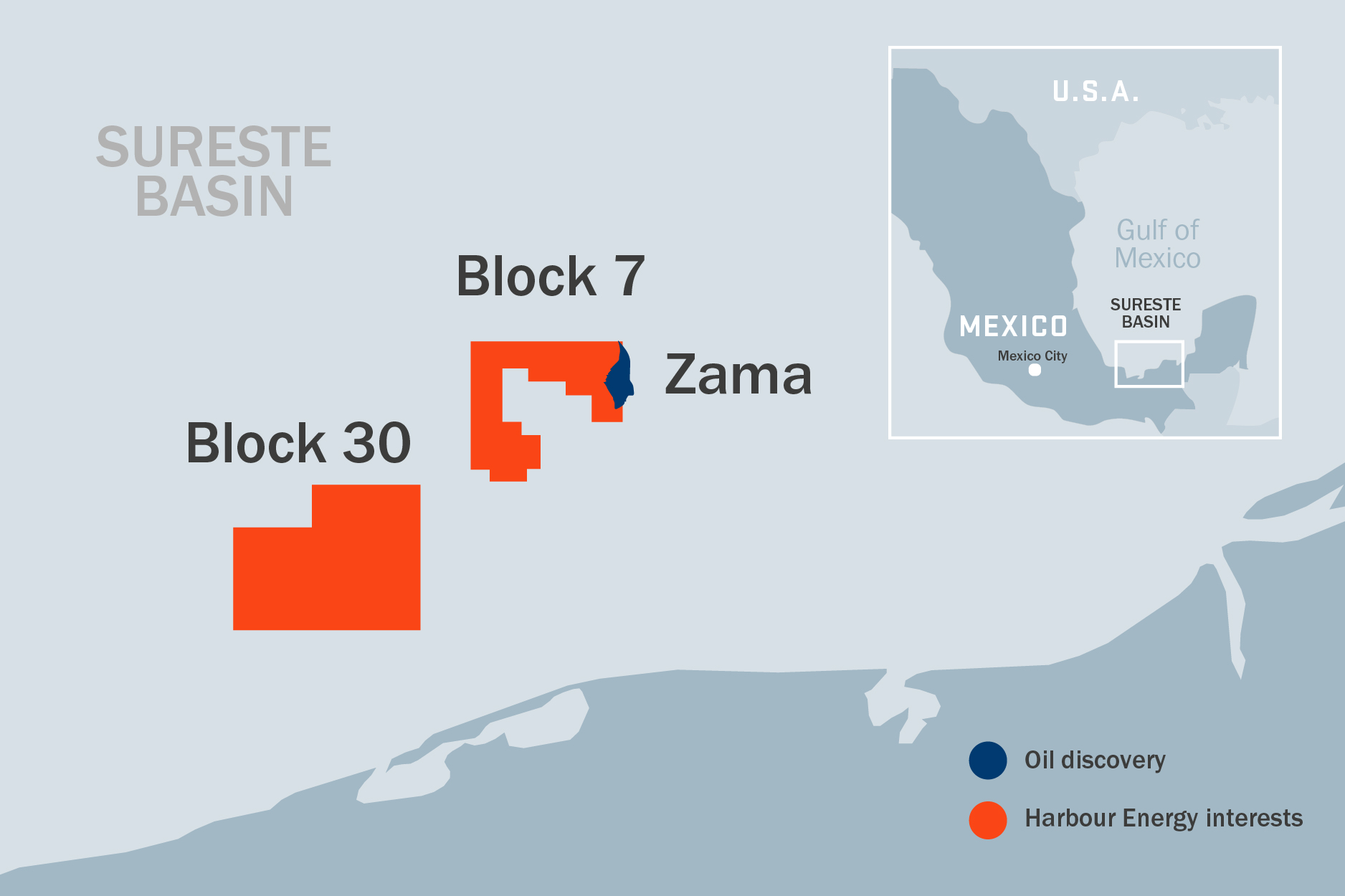

Harbour cited progress on satisfying closing conditions, including recent regulatory consents in Mexico, as reasons for the quicker close.

Finalization of the deal, announced in December 2023, will increase Harbour’s production to almost 500,000 boe/d and add significant positions in Norway, Germany, Argentina and Mexico—including growing its interest to 32% in the Zama shallow water development offshore Mexico.

RELATED

IOCs See Opportunity in Offshore Mexico, Despite Potential for Policy Changes

“The acquisition is expected to transform Harbour into one of the world’s largest and most geographically diverse independent oil and gas companies, adding material gas-weighted portfolios in Norway and Argentina and complementary growth projects in Mexico,” Harbour had said in a press release when it first announced the deal.

Recommended Reading

Exclusive: Mesa Minerals IV to Reload in Haynesville, Permian, Other Basins

2025-03-19 - Mesa Minerals IV, backed by NGP funds, is launching to acquire mineral and royalty interests in the Permian and Haynesville, said Mesa President and CEO Darin Zanovich at DUG Gas.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.