ENGenious will bring together technology and business leaders from across a diverse range of industries and academia to explore, share and learn about emerging and future digital technologies. (Source: BP)

Digital transformation is dominating industry dialogue. From harnessing the power of Big Data to robotics and automation, the digital narrative is inescapable. However, how much action has followed that discussion? Not enough—especially when one considers the increased demand for the oil and gas industry’s output.

The industry is fortunate that the world continues to need the products it develops. In fact, energy demand is expected to increase by more than 30% by 2040. Moreover, recently oil prices have recovered from the lows of the past two years. However, the industry must not lose discipline just because the price of oil is stabilizing.

BP is determined to decouple costs and oil price. It is a major undertaking, requiring possibly more transformation than what was delivered during the painful years of sub-$50/bbl oil.

The industry needs to work differently with partners from within and beyond the industry. The industry must continuously challenge the cost base through simplification, standardization and automation. It also needs to equip and empower its people with the latest tools and capabilities to innovate at pace.

Digital army

The industry is fortunate as an army of digital knights is standing by with many of the technologies and techniques to help it transform.

Some are familiar and need to be scaled up; others may initially appear threatening to the industry’s way of life. Although there will undoubtedly be winners and losers in this battle, transformation on this scale across the industry is good for all. It will secure the best players in the industry, make it leaner, fitter and more resilient to future challenges.

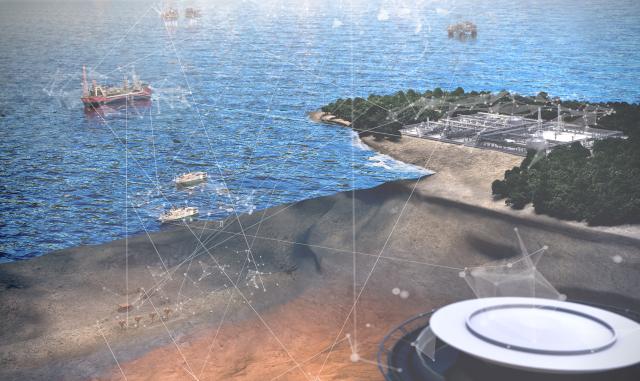

This transformation will see BP pair the architects of its offshore infrastructure with the architects of its data lakes, subsurface engineers with cloud engineers and installations with their digital twins.

Digital transformation

Connected Upstream is BP’s Industrial Internet of Things—connecting its people with its data, connecting physical and digital assets, and connecting machine intelligence to business decisions. The Connected Upstream represents a marked shift in how BP runs its business, one intended to modernize the company, drive a focus on margins and create value through major project acceleration, while all the time keeping a laser focus on safety.

Connecting people and data

Last year BP began deploying a new production optimization system, APEX, across its global asset portfolio. This scale of global deployment has been achieved within a year because APEX is a standard tool built on cloud architecture. It is delivering value today, and last year it helped add about 30,000 bbl/d of point-in-time production.

Underpinning APEX is a major transformation in how the company collects, stores and shares its data. All data, both historical and real-time, on BP’s wells (outside the Lower 48) are stored in one system, accessible globally. This is reaping the rewards through global well activity reviews that can be conducted at any time, rather than with months of preparation.

Connecting physical and digital assets

APEX is a digital twin of BP’s production system, one of several the company is building that enable it to plan changes and interventions in the digital world before making them in the real world.

Plant Operations Advisor is another such digital twin, this time focused on plant reliability and facility uptime. Developed in collaboration with Baker Hughes, a GE company (BHGE), the technology is now deployed across the company’s entire deepwater Gulf of Mexico (GoM) business.

Embracing technologies like these are critical to delivering the transformation the sector needs. As demonstrated by BP’s collaboration with BHGE, it changes the relationships the company has with its service company partners, where there is a mutual interest in making technology successful and accelerating deployment.

Uncovering fields within fields

In seismic imaging, algorithms, complex code and high-performance computing are the tools for improving the quality of images captured of the subsurface. The company made a huge breakthrough in seeing through salt in the GoM last year by developing a new full waveform inversion (FWI) algorithm that ultimately led to much higher quality images of the subsurface. This unlocked hundreds of millions of barrels around existing assets, essentially uncovering fields within fields.

FWI requires massive processing capacity and specialist capabilities to harness its power. BP’s Center for High Performance Computing in Houston is one of the largest supercomputers in the world dedicated to commercial research. This is where BP’s researchers from seismic to petrophysics and from reservoir engineering to computational fluid dynamics come together to test out their ideas and explore the unknown.

Connecting machine intelligence and brainpower

Arguably, the biggest value from digital comes when the company augments its people’s know-how with machine and artifi cial intelligence (AI) to perform in ways that neither could undertake alone.

A good example of the Connected Upstream at work is in Alaska, where the company has about 1,700 km (1,056 miles) of pipeline and an inspection program that takes multiple years to complete. Manual inspection is not the most effi cient method. Moreover, in subzero temperatures, this work puts staff in harm’s way. Machine learning is being used to pore over four decades of pipeline data, including geometry, materials, angles, age, inspection record, location and weather to help improve the effectiveness of inspections while also automating them.

From Mars to upstream

To translate machine learning into autonomous reasoning and decision-making, the company has invested in a new digital knight for the industry, the cognitive computing company Beyond Limits, which supported the Mars Rover landing. Cognitive computing has the potential to drive new levels of operational insight in the sector. Technologies like these can be transformational and could unleash a fresh wave of productivity and profitability improvements.

Transformation often involves hard choices, and the industry needs to be prepared to make them for the long-term competitiveness of the industry. Despite this, it is also an incredibly exciting time to be part of the upstream industry.

Connected industry

The excitement and sense of opportunity around the digital discussion will take center stage at ENGenious, which takes place Sept. 4-6 in Aberdeen. However, more than that, it will bring together technology and business leaders in action, from across a diverse range of industries and academia to explore, share and learn about emerging and future digital technologies.

ENGenious will create countless opportunities to collaborate and fi nd new solutions together to make the industry safer, more competitive and modern, and to accelerate the digital transformation the industry needs to assemble and deploy its digital knights.

Editor’s note: Ahmed Hashmi is the global head of upstream technology at BP and the ENGenious co-chair.

Have a story idea for Industry Pulse? This feature looks at big-picture trends that are likely to affect the upstream oil and gas industry. Submit story ideas to Group Managing Editor Jo Ann Davy at jdavy@hartenergy.com.

Recommended Reading

BlackRock’s Fink Calls for Reliable US Power Grid—Now

2025-03-31 - “That starts with fixing the slow, broken permitting processes in the U.S. and Europe,” Larry Fink, the co-founder, chairman and CEO of $12 trillion investment-management firm BlackRock Inc., told shareholders March 31.

E&P Highlights: March 31, 2025

2025-03-31 - Here’s a roundup of the latest E&P headlines, from a big CNOOC discovery in the South China Sea to Shell’s development offshore Brazil.

US Drillers Cut Oil, Gas Rigs for First Time in Three Weeks

2025-03-28 - The oil and gas rig count fell by one to 592 in the week to March 28.

BP Earns Approval to Redevelop Oil Fields in Northern Iraq

2025-03-27 - The agreement with Iraq’s government is for an initial phase that includes oil and gas production of more than 3 Bboe, BP stated.

DNO ‘Hot Streak’ Continues with North Sea Discovery

2025-03-26 - DNO ASA has made 10 discoveries since 2021 in the Troll-Gjøa exploration and development area.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.