U.S. oil production growth is expected to be driven by the Permian Basin (pictured) for the foreseeable future. (Source: Shutterstock.com)

President-elect Donald Trump routinely led supporters in chants of ‘drill, baby, drill’ on the campaign trail, promising to free U.S. energy from political and regulatory shackles holding back the industry.

But wildcatting legend Harold Hamm, executive chairman of Continental Resources and a major Trump donor, says the U.S. faces legitimate challenges to expanding production growth, even under a second Trump presidency.

“People think that we’re going to raise [production] 3 [MMbbl/d] to 4 [MMbbl/d],” Hamm said in an interview with Hart Energy. “But in my opinion, from a geologist’s perspective, you’re not going to see that.”

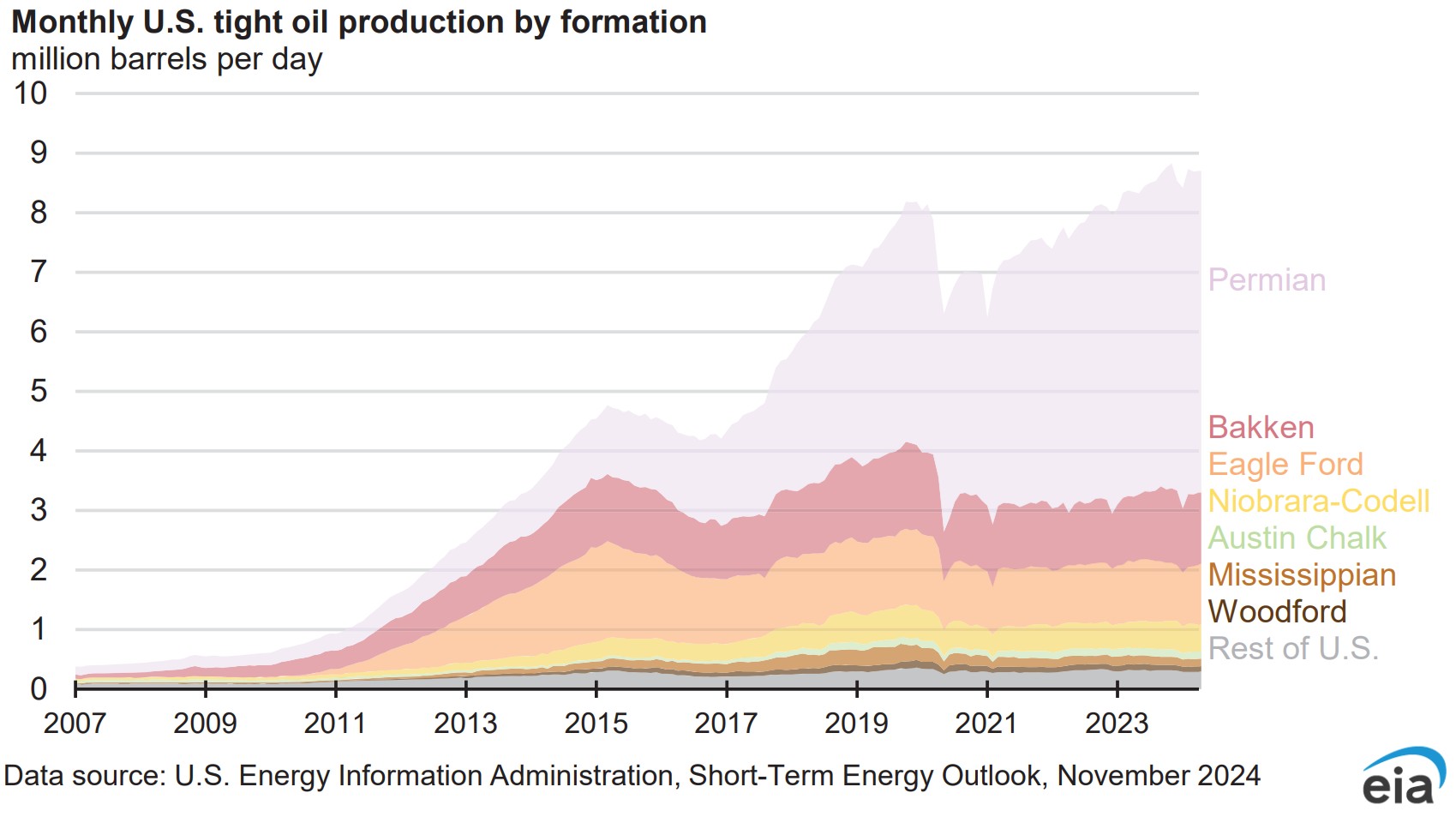

A more realistic trajectory would be raising U.S. output between 1 MMbbl/d to 2 MMbbl/d over the next five to six years, driven almost entirely by gains from the Permian Basin, Hamm said.

Hamm does argue that D.C. regulation stymies the day-to-day business of the oil and gas industry. He wants to see a laundry list of changes when Republicans retake the White House and Congress in January.

But even a fully unleashed U.S. energy sector would struggle to overcome output declines from maturing shale fields, he said.

Continental is active across the Lower 48 today, with holdings in the Permian, Bakken, Anadarko and Powder River basins.

“You look at the Bakken, it looks pretty flat,” Hamm said. “Maybe flat to down.”

“If you look at the Anadarko Basin, it’s not going tremendously,” he continued.

Wyoming’s Powder River Basin also isn’t seeing a tremendous amount of production growth, Hamm said.

Industry executives, Hamm included, see the Permian as the nation’s top driver of production growth going forward.

But the Permian might only have around 1.5 MMbbl/d to 2 MMbbl/d of growth capacity left to give.

RELATED

Continental Resources Makes $1B in M&A Moves—But Where?

“So, where’s it at? California?” he quipped. “Maybe you go find something else? This country’s been searched over pretty good.”

Producers have extracted more than 24 Bbbl of crude oil from the Lower 48 since 2019, according to U.S. Energy Information Administration (EIA) figures. “Eventually, you start using up a whole lot of resources,” Hamm said.

The U.S. is already producing more oil than any country in world history, driven by growth from tight shale basins. Total U.S. output averaged 13.4 MMbbl/d in August, per EIA data.

Many majors and large-cap U.S. E&Ps aren’t necessarily in a hurry to grow production even further.

Most producers are holding output relatively flat to churn out healthy levels of free cash flow, make distributions to shareholders and preserve the valuable shale inventory they have left.

Producers are also measuring growth and spending plans against a weakening global economic backdrop, falling crude prices and uncertainty over the direction of the OPEC+ cartel.

WTI oil prices averaged $71.99/bbl in October, down 16% year-over-year. Forward strip pricing shows WTI averaging around $66/bbl in 2025.

Weak prices, soft oil demand and rising global supply could force OPEC+ to delay a planned production increase in December by a month, according to media reports.

RELATED

Liberty Energy’s Chris Wright is Harold Hamm's Top Choice for Energy Secretary

A time to explore

Hamm, who led Continental Resources from one well-service truck in the 1960s to a more than $10 billion producer today, knows a thing or two about onshore exploration.

Production from the Bakken shale grew rapidly with horizontal drilling and fracking techniques pioneered by Continental and industry peers in North Dakota and Montana.

The past decade has been dominated by growth from the Permian Basin of West Texas and New Mexico.

Continental was a relatively late entrant into the Permian when it acquired Delaware Basin assets from Pioneer Natural Resources for $3.25 billion in 2021.

To its credit, Continental continues to deploy exploration capital into the Permian: It’s one of the leading operators testing the Permian’s Woodford and Barnett shale benches.

But future growth prospects for domestic producers aren’t promising. Explorers won’t magically unearth another Permian Basin or Bakken yet to be discovered, Hamm said.

“They’re going to be smaller targets that people go look for,” he said. “There’ll be some other ideas, but the magnitude is not going to be the same.”

RELATED

Liberty Energy’s Chris Wright is Harold Hamm's Top Choice for Energy Secretary

Recommended Reading

Kinder Morgan to Build $1.7B Texas Pipeline to Serve LNG Sector

2025-01-22 - Kinder Morgan said the 216-mile project will originate in Katy, Texas, and move gas volumes to the Gulf Coast’s LNG and industrial corridor beginning in 2027.

Williams’ CEO: Pipeline Permitting Costs Twice as Much as Steel

2025-03-12 - Williams Cos. CEO Alan Armstrong said U.S. states with friendlier permitting polices, including Texas, Louisiana and Wyoming, have a major advantage as AI infrastructure develops.

Entergy, KMI Agree to Supply Golden Pass LNG with NatGas

2025-02-12 - Gas utility company Entergy will tie into Kinder Morgan’s Trident pipeline project to supply LNG terminal Golden Pass LNG.

Intensity Infrastructure Partners Pitches Open Season for Bakken NatGas Egress

2025-02-04 - Analysts note the Bakken Shale’s need for more takeaway capacity as Intensity Infrastructure Partners launches an open season for a potential 126-mile natural gas transport line out of the basin.

FERC Reinstates Permit for Williams’ Mid-Atlantic Project

2025-01-27 - The Federal Energy Regulatory Commission’s latest move allows Williams’ Transco natural gas network to continue operations after a D.C. court shot down the expansion plan.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.