For the foreseeable future, the Permian Basin is the Alpha and the Omega of unconventional oil and gas production, producing more than 2.5 MMbbl/d so far in 2017, according to the Energy Information Administration (EIA). But operators are not sleeping on other major plays, namely the Haynesville and the Eagle Ford.

According to the EIA, production in the Eagle Ford has climbed back to more than 1.2 MMbbl/d for the first time since early 2016, and Baker Hughes, a GE company (BHGE), reported that the Eagle Ford rig count has increased more than 83% over the past year, from 37 active rigs in 2016 to 68 by the end of September. Through late September Eagle Ford production has eclipsed 320.8 MMboe, although still far below its 2015 peak of about 584 MMbbl/d, according to the EIA. However, production in the Eagle Ford took a hit when many wells were taken offline as Hurricane Harvey impacted the Gulf Coast, and particulary south Texas, in August and September.

In the Haynesville gas production has increased 4 MMcm/d (143 MMcf/d) monthover- month, according to the EIA. In addition, BHGE reported that the Haynesville rig count also has seen a steady climb from 19 rigs in September 2016 to 45 in September of this year. Through September, the Haynesville has produced 212 Mcm/d (7.5 MMcf/d), according to the EIA.

This graph shows the top oil producers by barrels of oil equivalent through September in the Eagle Ford. EOG Resources has been the play’s top performer, producing more than 41 MMboe as of September. (Source: Hart Energy Mapping & Data Services)

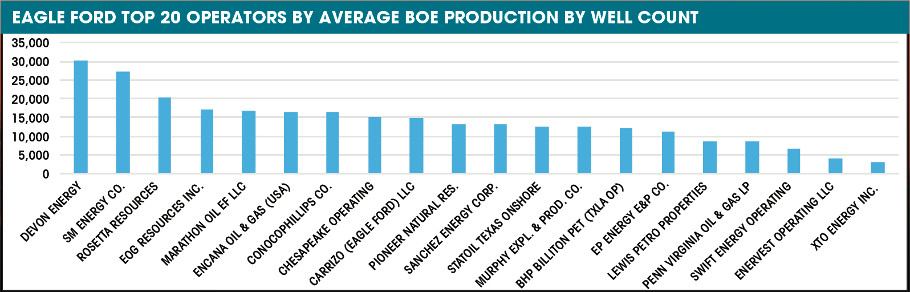

This graph reflects the companies operating in the Eagle Ford that average the highest production per well. As of September, Devon Energy has produced an average of 30 Mboe for its wells. (Source: Hart Energy Mapping & Data Services)

This graph shows the top oil and gas producers by barrels of oil equivalent through September in the Haynesville. Chesapeake Energy Corp. has been Haynesville’s top performer, producing more than 28 MMboe as of September. (Source: Hart Energy Mapping & Data Services)

This graph reflects the companies operating in the Haynesville that average the highest production per well. As of September, Chesapeake Energy has an average production of 43 Mboe from more than 600 wells. (Source: Hart Energy Mapping & Data Services)

Recommended Reading

DNO to Buy Sval Energi for $450MM, Quadruple North Sea Output

2025-03-07 - Norwegian oil and gas producer DNO ASA will acquire Sval Energi Group AS’ shares from private equity firm HitecVision.

Hunting Buys EOR Technology Rights from Its Founding Shareholders

2025-03-07 - Hunting Plc is acquiring the rights to organic oil recovery, an EOR technology—including 25 patents and distribution rights—from its founding shareholders.

Vitesse Energy Closes $220MM Acquisition of Bakken Pureplay Lucero

2025-03-07 - Vitesse Energy Inc. agreed to purchase Bakken E&P Lucero Energy Corp. in December in an all-stock transaction valued at $222 million.

Amplify Updates $142MM Juniper Deal, Divests in East Texas Haynesville

2025-03-06 - Amplify Energy Corp. is moving forward on a deal to buy Juniper Capital portfolio companies North Peak Oil & Gas Holdings LLC and Century Oil and Gas Holdings LLC in the Denver-Julesburg and Powder River basins for $275.7 million, including debt.

Ring Sells Non-Core Vertical Wells as it Closes in on Lime Rock

2025-03-06 - Ring Energy Inc. said it sold non-core vertical wells with high operating costs as it works to close an acquisition of Lime Rock Resources IV’s Central Basin Platform assets.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.