Hibernia Resources IV is wildcatting the Dean sandstone near the Dawson-Martin County line in the northern Midland Basin, Texas state records show. (Source: Shutterstock.com)

Private equity-backed Hibernia Resources IV is wildcatting the Dean sandstone near the Martin-Dawson County line, Texas state records show.

Hibernia IV is one of a handful of operators pursuing Dean sands development in the northern Midland Basin, including EOG Resources, SM Energy and privately held producers Birch Resources and Ike Operating.

Hibernia Resources IV, backed by NGP funds, is the latest iteration of the Hibernia companies; Hibernia III sold its assets in Upton and Reagan counties, Texas, to Civitas Resources for $2.25 billion in mid-2023, fueling Civitas’ entrance into the Permian Basin.

By early 2024, Hibernia IV was already off to the races—scooping up leases and producing assets in the Permian Basin, Texas Railroad Commission (RRC) data show.

While Hibernia III focused more toward the southern end of the Midland Basin, Hibernia IV has turned its sights north.

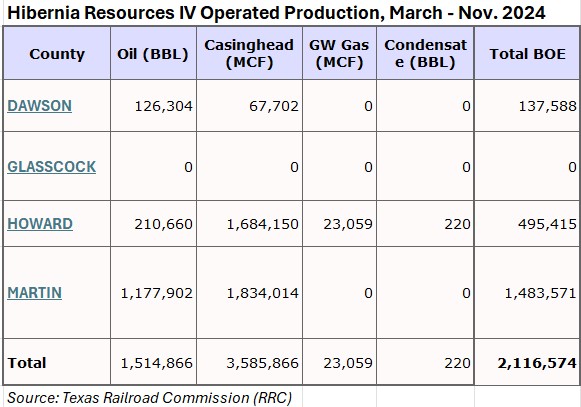

Hibernia IV produced more than 2.1 MMboe (~72% liquids) from March through November 2024, according to the RRC’s most recent figures. Production came from Martin, Howard and Dawson counties.

RELATED

Birch Resources Mows Dean Sandstone for 6.5 MMbbl in 15 Months

Legacy Reserves wells

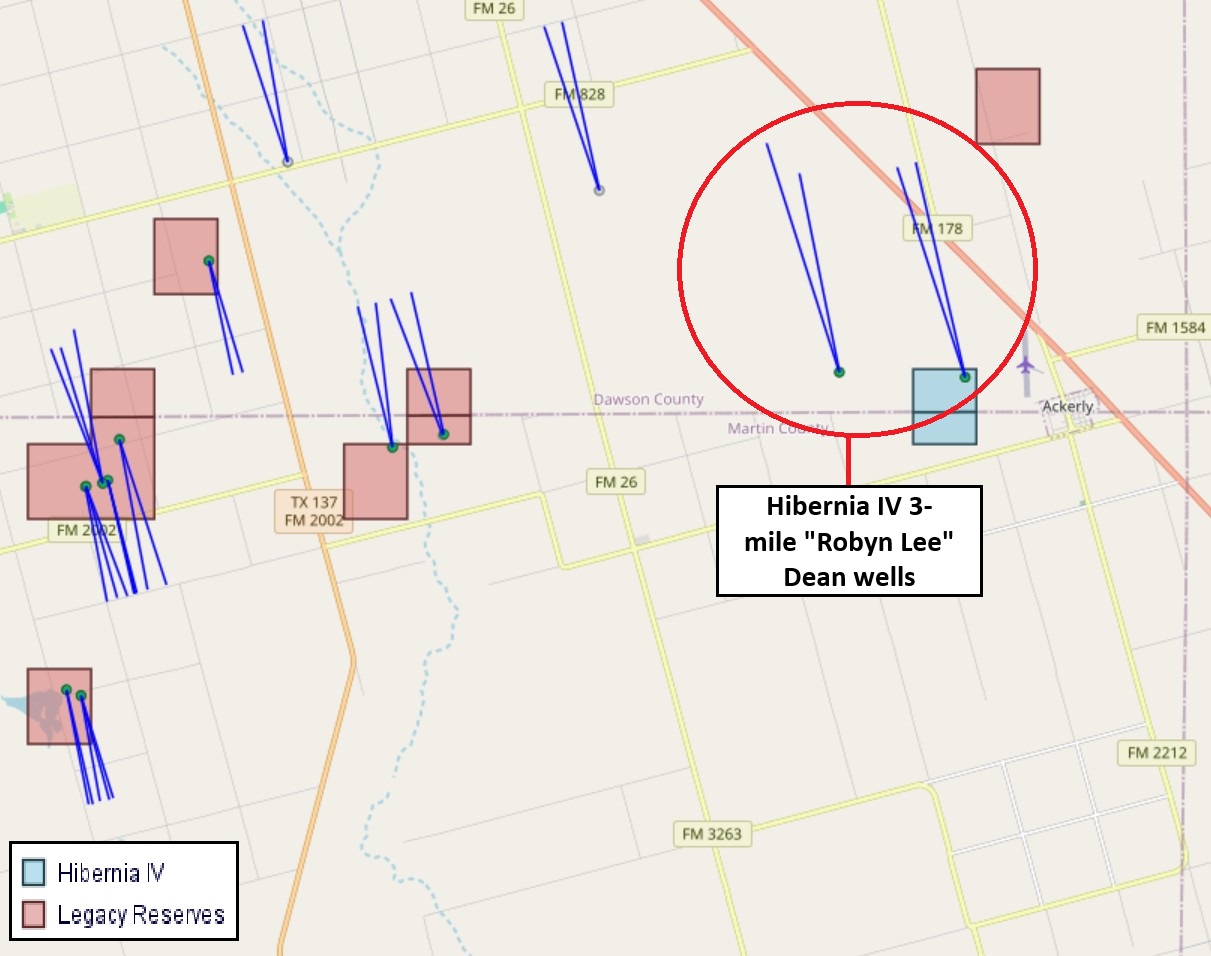

Hibernia IV has picked up several leases and wells previously operated by Revenir Energy, the E&P company formerly known as Legacy Reserves. Revenir sold off the remainder of its northern Midland Basin assets in May 2024.

Revenir built its 25,000 net acre position in the northern Midland Basin by making over 100 transactions. The company was an early entrant into the Dean play along the Martin-Dawson County line, Revenir said after the sale closed last year.

Dean sandstone, at around 8,000 ft in southeastern Dawson and northeastern Martin counties, lies under the Spraberry formation—at about 6,500 ft—and above the Wolfcamp zones.

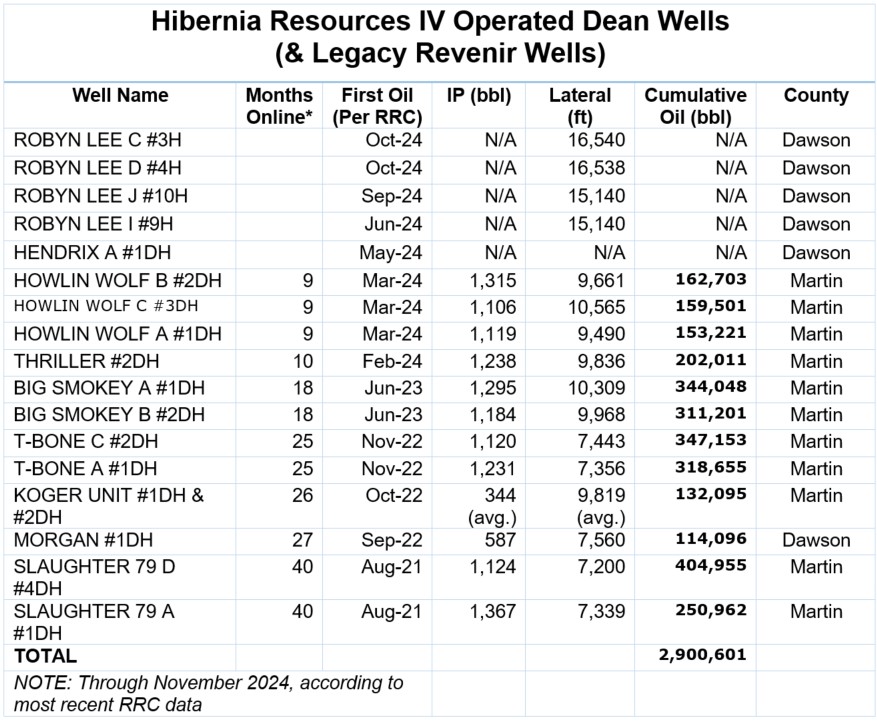

The Dean wells that Revenir drilled and completed now make up foundational pieces of Hibernia IV’s portfolio, RRC data show.

Several have been Hibernia’s top-producing assets since first reporting operated production to the state last March.

Revenir brought online three Dean wells on the “Howlin Wolf” DSU in Martin County last spring, shortly before the sale of its Midland Basin assets:

- Howlin Wolf A #1DH (9,490-ft lateral) IP’ed at 1,119 bbl;

- Howlin Wolf B #2DH (9,661-ft lateral) IP’ed at 1,315 bbl; and

- Howlin Wolf C #3DH (10,565-ft lateral) IP’ed at 1,106 bbl.

The three Howlin Wolf Dean wells have produced a cumulative 475,425 bbl of oil since coming online in March 2024.

A month before, Revenir had brought online the Thriller #2DH (9,836-ft lateral) not far east of the 3-well Howlin Wolf pad.

- After IP’ing at 1,238 bbl, Thriller #2DH has churned out around 202,000 bbl since coming online in February 2024; Gas volumes totaled 151.6 MMcf;

- Oil production from Thriller averaged 1,088 bbl/d over 31 days in March.

The Revenir Dean wells that Hibernia IV now operates have produced a cumulative 2.9 MMbbl since the first wells came online in the summer of 2021, according to a Hart Energy analysis.

EOG, SM, Birch and Ike all have Dean wells with their own promising results near Hibernia’s acreage.

Privately held Birch has been drilling the Dean with horizontals in 13 contiguous sections in southeastern Dawson County starting in mid-2022. Birch’s 16 Dean wells had produced nearly 6.5 MMbbl during the past 15 months ending in October.

SM Energy touted results from two new Dean wells in its third-quarter earnings; IP 30-day rates for the two unidentified wells averaged 918 boe/d per well (93% oil).

RELATED

SM Kicks Off Dean Wildcatting With 918 Boe/d Choked IPs

Going longer

Picking up where Revenir left off, Hibernia IV has submitted initial data to regulators on five of its own Dawson County Dean wells.

Filings indicate that Hibernia IV is drilling longer laterals for its own Dean wells. Lateral lengths provided for four of the wells average 15,840 ft—or three miles.

Laterals for the legacy Revenir Dean wells averaged 8,879 ft—or 1.68 miles.

Hibernia landed two 15,140-ft Dean laterals from a single pad on a “Robyn Lee” DSU in southeastern Dawson County, according to the RRC’s geolocator GIS viewer.

Robyn Lee I #9H reported first oil in June; Robyn Lee J #10H in late September.

Production data for the new Hibernia wells has not yet been verified by the RRC. State records list each as a “shut-in producer.” Texas and most states’ rules allow producers to “tight hole” post-completion well results for six months before making the data public.

Drilling permits suggest Hibernia IV isn’t done drilling in the area: The company is approved for eight additional Dawson horizontals.

Though permitted for Dawson’s broad Spraberry (Trend Area) Field—which include the Spraberry and Wolfcamp— the permits allow for a total depth of 9,000 ft, around the target depth for Dean sands.

Hibernia IV did not respond to Hart Energy’s inquiries by press time.

RELATED

M&A Target Double Eagle Ups Midland Oil Output 114% YOY

Recommended Reading

CPP Wants to Invest Another $12.5B into Oil, Gas

2025-03-26 - The Canada Pension Plan’s CPP Investments is looking for more oil and gas stories—in addition to renewable and other energies.

Italy's Intesa Sanpaolo Adds to List of Banks Shunning Papua LNG Project

2025-02-13 - Italy's largest banking group, Intesa Sanpaolo, is the latest in a list of banks unwilling to finance a $10 billion LNG project in Papua New Guinea being developed by France's TotalEnergies, Australia's Santos and the U.S.' Exxon Mobil.

What's Affecting Oil Prices This Week? (Feb. 3, 2025)

2025-02-03 - The Trump administration announced a 10% tariff on Canadian crude exports, but Stratas Advisors does not think the tariffs will have any material impact on Canadian oil production or exports to the U.S.

Phillips 66’s NGL Focus, Midstream Acquisitions Pay Off in 2024

2025-02-04 - Phillips 66 reported record volumes for 2024 as it advances a wellhead-to-market strategy within its midstream business.

Q&A: Where There’s a Williams, There’s a Way for Gas

2025-04-09 - Midstream giant Williams Cos. leads the natural gas bulls on the great infrastructure buildout, President and CEO Alan Armstrong tells Hart Energy.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.