U.S. utilities regulators are facing criticism because of volatile prices in natural gas and electricity markets, but they aren’t necessarily to blame. At least not entirely. Market fundamentals, such as increased demand due to Russia’s invasion of Ukraine, have driven some of the volatility. Regulated market designs, even in “deregulated” markets, are driving the rest of the volatility.

Meanwhile, the nation’s public service commissioners and federal regulators are positioned to address issues only after they become problems. In that sense, the regulators are always trying to clean up the mess rather than getting in front of changing economic conditions. Consumers and taxpayers end up paying the price.

Today, forecasts are for electricity demand to increase by 50%, with natural gas demand also expected to grow, despite efforts to decarbonize the energy system.

Rules generally prohibit the bodies that regulate utility systems from making direct investments in those systems, so regulators—concerned about meeting future demand—are limited to finding ways to accommodate investments in new generators and natural gas supplies.

(Source: Ed Hirs)

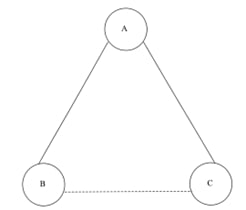

At the micro level, the regulators deal with connections across grids of wires and pipelines. At each of these connections, or nodes, regulators evaluate the commodity price and who has physical or financial control of the spigot. This is what drives most regulatory decision making. Unfortunately, focusing on the market at the individual spigots means regulators are often surprised when their actions create other bottlenecks across the larger market.

In “The Unsustainable Costs of Partial Deregulation,” the late energy markets economist Paul MacAvoy described a simple network economy consisting of a triangle of nodes A, B, and C. If the nodes were connected by a pipe or a wire, then the product could flow efficiently from one to the other, and the impact of adding supply at one node or changing consumption at another would impact the markets at each of the other nodes. If bottlenecks were present, these would be immediately obvious by price differences at the nodes.

Energy professionals depend upon interconnected markets and often profit from arbitrage opportunities long before market participants and regulators can effectively address them. In 2000-2001, natural gas entered Waha at $2.50/Mcf and exited in Southern California at $12.50/Mcf. Had there been sufficient pipeline capacity between the nodes, the 2000-2001 California energy crisis may have been averted.

In the winter storm of February 2021, natural gas and electricity markets across the nation reeled from the extraordinary spike in natural gas prices in Texas—even in those states that are themselves net exporters of natural gas and electricity to the rest of the nation. One regulator asked, “Was this price gouging or anti-competitive, monopolistic behavior by bad actors?” The answer is yes.

It is a cinch that if Buc-ee’s had raised the price of gasoline from $3.50 per gallon to $1,000 per gallon during the winter storm, the ferocious public outcry would have been heard from Austin to Midland to Washington, D.C. But when the same thing happened to natural gas prices, regulators and legislators simply passed along the price increases to consumers in the form of government mandated bailouts. The Home Depot should pay heed so that it avoids sanctions for jumping the price of plywood from $60 per sheet to $300 per sheet the next time a hurricane threatens a community.

Of course, the defining characteristic of both price gouging and monopoly is a large price-over-cost margin. In markets characterized by low price-cost margins, it is because the sellers really are competing on price or because there is effective or even too effective price regulation. Several states across the nation have joined private parties to sue natural gas traders, marketers and pipelines due to the massive jump in natural gas prices during the winter storm of 2021 and subsequent storms.

MacAvoy showed that regulated electricity and natural gas transmission companies do not earn a return on capital that is competitive on Wall Street. That is, Wall Street will choose other industries such as software, or consumer goods, or defense, or tech, or food, rather than investing in additional transmission capacity. Obvious bottlenecks that would be relieved by new wires or pipes have persisted for decades. Therefore, consumers suffer. And state regulators across the nation are looking to clamp down on profiteering rather than addressing the root cause.

Government price regulation, even in “deregulated” markets, causes energy bottlenecks and eliminates profit opportunities for infrastructure companies. The traders and hedge funds gain more arbitrage opportunities.

A prime example is the ERCOT market in Texas. In 2023, the market overcharged consumers more than $12 billion through November. Had Texas made a one-time investment of $12 billion in new natural gas power plants, that overcharge may not have happened. Texans will face that same skewed market design for the foreseeable future.

State regulators in Texas and across the nation are stuck. Building infrastructure will certainly cost consumers and taxpayers money, but not building it is costing them even more. To meet current and future needs, state legislators and Congress must revisit their market designs now. Regulators cannot keep up with the growth in consumer demand and the evolving energy supply portfolio.

Recommended Reading

Oxy Aims to Expand Lithium Tech to Arkansas

2024-11-26 - Occidental Petroleum CEO Vicki Hollub confirms the Arkansas leases with its TerraLithium subsidiary that could expand its joint venture with Warren Buffett’s BHE Renewables.

Exxon Enlists Baker Hughes to Support Uaru, Whiptail Offshore Guyana

2025-02-03 - Baker Hughes’ will provide specialty chemicals and related services in support of the Uaru and Whiptail projects in the Stabroek Block.

Suriname's Staatsolie Says Exxon has Withdrawn from Offshore Block

2024-11-20 - Suriname's state-run oil company Staatsolie said on Nov. 20 that U.S. oil giant Exxon Mobil has withdrawn from its offshore block 52, and block operator Petronas Suriname E&P will take over its 50% stake.

Classic Rock, New Wells: Permian Conventional Zones Gain Momentum

2024-12-02 - Spurned or simply ignored by the big publics, the Permian Basin’s conventional zones—the Central Basin Platform, Northwest Shelf and Eastern Shelf—remain playgrounds for independent producers.

Chevron Delivers First Oil from Kazakhstan Project

2025-01-24 - Chevron Corp.’s newest plant at Kazakhstan’s Tengiz Field is expected to ramp up output to 1 MMboe/d.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.