HollyFrontier Corp.’s (HFC) aim is simple: get higher values at the bottom of the barrel.

A pair of deals is the latest step in incrementally upping the company’s take home pay.

Affiliate Holly Energy Partners LP (HEP) said Sept. 3 it has acquired a 50% interest in Frontier Pipeline Co., owner of the Frontier Pipeline of Wyoming, from an affiliate of Enbridge Inc. (ENB).

HollyFrontier also executed a dropdown to Holly Energy that gives it a stake in a refinery locked in with Cushing, Okla.

The Frontier Pipeline Co. will continue to be operated by an affiliate of MLP Plains All American Pipeline LP (PAA), which owns the remaining 50% interest.

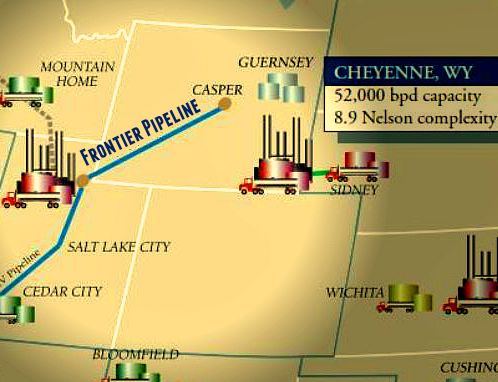

The 296-mile crude oil line runs from Casper, Wyo., to Frontier Station, Utah. It has a 72,000 barrel per day (bbl/d) capacity. The line supplies Canadian and Rocky Mountain crudes to Salt Lake City area refiners through a connection to the SLC Pipeline. Holly owns 25% of the SLC Pipeline.

The purchase price was not disclosed. Documents filed with the Federal Energy Regulatory Commission (FERC) on Sept. 3, which use Plains All American’s corporate address, list the value of its carrier property interests at $79.8 million before depreciation and other expenses.

FERC documents show the pipeline received 5.1 MMbbl of oil as of September and delivered 4.4 MMbbl, leaving 709 Mbbl of oil terminated on trunk lines. Sources to the line include the Express, Big Horn and local crude gathering.

Holly Energy’s parent company, Dallas-based HollyFrontier Corp. (HFC), expects the nonoperating interest to eventually generate $6- to $7 million in EBITDA for Holly. The deal has an effective date of Aug. 31.

In 2001, Enbridge acquired an additional 34% interest in the Frontier Pipeline Co. for US$28.9 million, or $38.9 million when adjusted for inflation. That increased Enbridge’s interest to 77.8%. It’s unclear when Plains was able to gain 50% of Frontier.

In a separate transaction, Holly Energy Partners and HollyFrontier said Holly Energy would purchase a newly constructed naphtha fractionation and hydrogen generator units at HollyFrontier’s El Dorado refinery in Kansas.

The refinery is one of the largest in the plains states and the Rocky Mountain region with crude oil capacity of 135,000 bbl/d. More importantly, the refinery has the capability to process several types of crude oil because of its direct access to the Cushing hub, which is connected by pipelines to Canada.

The HollyFrontier dropdown to Holly Energy is expected to close during the fourth quarter of 2015.

Holly Energy and HollyFrontier are expected to enter into 15-year tolling agreements, said Mark Reichman, director of research covering MLPs for Simmons & Co. International. HollyFrontier expects the tolling agreements to generate $6.9 million in 2016 EBITDA.

The transaction is expected to be immediately accretive to Holly Energy distributable cash flow, he said.

Contact the author, Darren Barbee, at dbarbee@hartenergy.com.

Recommended Reading

Halliburton Secures Drilling Contract from Petrobras Offshore Brazil

2025-01-30 - Halliburton Co. said the contract expands its drilling services footprint in the presalt and post-salt areas for both development and exploration wells.

AIQ, Partners to Boost Drilling Performance with AI ROP Project

2024-12-06 - The AI Rate of Penetration Optimization project will use AI-enabled solutions to provide real-time recommendations for drilling parameters.

Small Steps: The Continuous Journey of Drilling Automation

2024-12-26 - Incremental improvements in drilling technology lead to significant advancements.

Understanding the Impact of AI and Machine Learning on Operations

2024-12-24 - Advanced digital technologies are irrevocably changing the oil and gas industry.

From Days to Minutes: AI’s Potential to Transform Energy Sector

2024-11-22 - Despite concerns many might have, AI looks to be the next great tool for the energy industry, experts say.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.