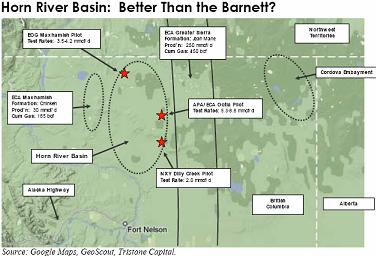

The Horn River basin covers 1.2 million hectares, more than 3 million acres. Most activity has been in the Horn River Basin; however, a second depositional environment exists in the Cordova Embayment to the east where operators are aggressively acquiring land. The Muskwa shale is the most notable with depth ranging from 2,500-3,000 meters, similar to the Fayetteville and Woodford, but not as deep as the Haynesville. The shale in the Horn River is thicker than the Barnett with higher storage capacity resulting in higher OGIP per section. The British Columbia Government expects the Horn River to contain up to 250 Tcf of original gas-in-place.

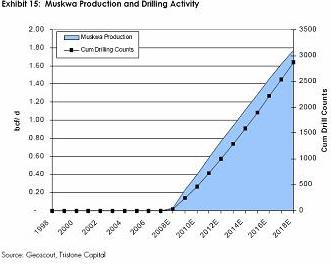

While the royalty framework is favorable, challenges include winter access, lack of infrastructure, high capital costs and the basis differential. Initial well production ranges from 2-8.8 MMcfd according to a recent Tristone Capital Inc. study. The study estimates ultimate gas recovery from 4-6 bcf/section. Current estimates indicate recoverable resources in Horn River shale gas play of 37 Tcf which could increase to over 50 Tcf if the play becomes economic over most of the leased acreage according to a Wood Mackenzie analyst. The Montney shale play is ahead of the Horn River play because it has year-round access for drilling. The first commercial production of CBM from the Hudson Hope area is expected to start this year.

In 2004 the B.C. government commissioned a study of the Horn River shale to encourage exploration, jump starting the unconventional rush. The net profit royalty system introduced in 2008 will reduce royalty payments in the early stages of unconventional development, with royalties calculated on a sliding scale ranging from 2% of revenue at the start of production until all capital costs have been recovered, rising to 35% of profit after capital costs plus 105% have been generated. The province has also provided both deep drilling and directional drilling incentives, and improved its corporate tax structure. B.C. additionally, put C$120 million into an infrastructure partnership with industry to build roads and bridges to make exploration in remote areas possible.

The large players in the Horn River are EOG in the Maxhamish Area, Apache/Encana and EOG in the Ootla area and Nexen in the Dill Creek area. EOG’s early drilling results indicate that the shale in EOG's Horn River Basin play in Canada is better than the Barnett Shale (See table below). The company estimates its net potential reserves in the Horn River Basin are about 6 trillion cubic feet.

Recommended Reading

The Private Equity Puzzle: Rebuilding Portfolios After M&A Craze

2025-01-28 - In the Haynesville, Delaware and Utica, Post Oak Energy Capital is supporting companies determined to make a profitable footprint.

Buying Time: Continuation Funds Easing Private Equity Exits

2025-01-31 - An emerging option to extend portfolio company deadlines is gaining momentum, eclipsing go-public strategies or M&A.

Utica Liftoff: Infinity Natural Resources’ Shares Jump 10% in IPO

2025-01-31 - Infinity Natural Resources CEO Zack Arnold told Hart Energy the newly IPO’ed company will stick with Ohio oil, Marcellus Shale gas.

Artificial Lift Firm Flowco’s Stock Surges 23% in First-Day Trading

2025-01-22 - Shares for artificial lift specialist Flowco Holdings spiked 23% in their first day of trading. Flowco CEO Joe Bob Edwards told Hart Energy that the durability of artificial lift and production optimization stands out in the OFS space.

Artificial Lift Firm Flowco Seeks ~$2B Valuation with IPO

2025-01-07 - U.S. artificial lift services provider Flowco Holdings is planning an IPO that could value the company at about $2 billion, according to regulatory filings.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.