While sagging oil prices are making headlines right now, a lack of production efficiency may be the underlying issue for profitability in the oil and gas industry. Ironically, improving production efficiency may offer a way to combat declining oil prices.

A 2014 report from McKinsey and Co. stated, “With the substantial production volumes of offshore production platforms, even small improvements in production efficiency will have a meaningful financial impact as additional throughput translates directly into more revenue. In the low-volume regimes of current unconventional mature assets—oil sands, for example—carefully targeted automation steps can cut costs and, more importantly, can also improve the reliability of production equipment, leading to higher revenues that can extend an asset’s economic life.”

The report concluded that improving production efficiency by 10% can yield a $220 million to $260 million bottomline impact on a single brownfield asset. But to benefit, oil and gas companies have some catching up to do. Based on an analysis of North Sea offshore platforms, McKinsey found that average production efficiency dropped in the past decade, while the performance gap between industry leaders and other companies widened, from 22% in 2000 to around 40% in 2012.

So if automation can drive production efficiency, why is the industry lagging behind? There are certainly challenges associated with improving production efficiency in oil and gas, regardless of location. And historically, the industry has struggled to keep pace with certain advanced technologies such as automation.

Given the drop in oil prices, it can no longer afford to fall behind. For oil and gas in particular, getting it right is critical on several fronts. Hundreds of thousands of dollars, as well as employees’ lives, are at stake.

Keeping a watchful eye

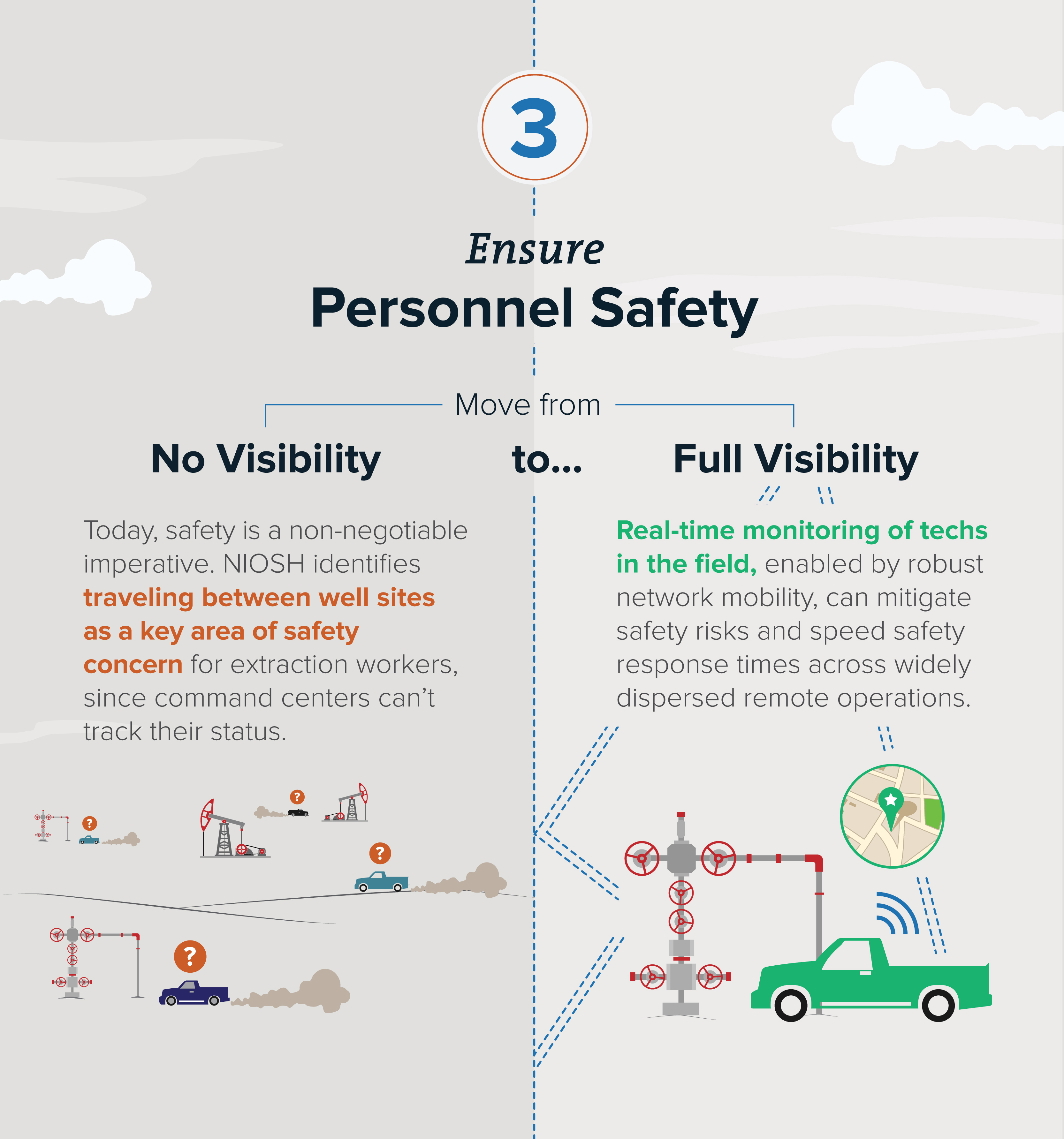

Monitoring and automating job sites both show great potential for driving efficiency improvements, which are not only beneficial from a profit standpoint but also create a safer work environment. Real-time monitoring can protect employees from equipment failure and catastrophic events.

Disastrous events are a very real possibility when employees and management are not aware of what is happening in the field. In the wake of these incidents, as well as changes in transportation and worker safety, the industry is pushing the use of monitoring technology heavily.

Real-time analytics can monitor activity on a job site and help users avoid dangerous and costly scenarios such as equipment breakdowns and explosions. By eliminating delays in monitoring, users gain the ability to increase safety as well as efficiency because the technology gives them the ability to be proactive instead of reactive. They can solve problems before they become a liability. Risks of delayed information include the loss of equipment and lives as well as regulatory violations and hefty fines.

The oil and gas industry has been pursuing a viable real-time analytics solution for years but has struggled to get a handle on the technology. In previous models, users had to download data from multiple, sometimes hundreds, of production sites as

well as download the stored files from USB drives. They then had to analyze the data and wait anywhere from days to weeks to obtain the results. Any number of incidents could occur in the meantime. For example, a $200,000 pump on the verge of failure could burn up before users were able to review data that predicted this outcome.

Fortunately, continuous technological advancements have created better monitoring solutions for the industry. Implementing a kinetic mesh network to send data across the wireless network from sensors is one option. In a mesh network, nodes use channels to create multiple delivery paths for data.

When the network needs to overcome temporary interference, the nodes will detect the quickest and most robust path of delivery to send the information. And by using intelligent path selection, nodes are able to change frequency trajectories to avoid interference and maintain connectivity. This ensures the system sends and receives the data in true real time, eliminating delays regardless of conditions. The mesh is able to “heal” itself, plus there is no single point of failure due to the nodes, so it can work around nearly any issue.

Kinetic mesh networks tied to sensors on equipment deliver data back to the

Kinetic mesh networks tied to sensors on equipment deliver data back to the

operations center, thereby reducing the need for personnel to visit each equipment

location to capture needed information. (Source: Rajant Corp.)

Self-sufficient equipment

Oil and gas companies can improve production efficiency in many ways by automating equipment. Maintenance is a major part of this initiative. For example, tracking equipment activity with sensors allows applications to monitor equipment conditions.

Organizations that use kinetic mesh networks can place the wireless nodes on their wellhead sites, creating a durable connection from the command center to their remote monitoring applications. These applications can carry out predictive maintenance and automated operation shutdowns, reducing the risk of equipment failure and downtime. Well-maintained equipment and decreased downtime both contribute to production efficiency improvements.

Each wireless radio or node in a kinetic mesh network is fully independent and can convey

Each wireless radio or node in a kinetic mesh network is fully independent and can convey

voice, video and data applications back to the network operations center, eliminating any single point of failure. (Source: Rajant Corp.)

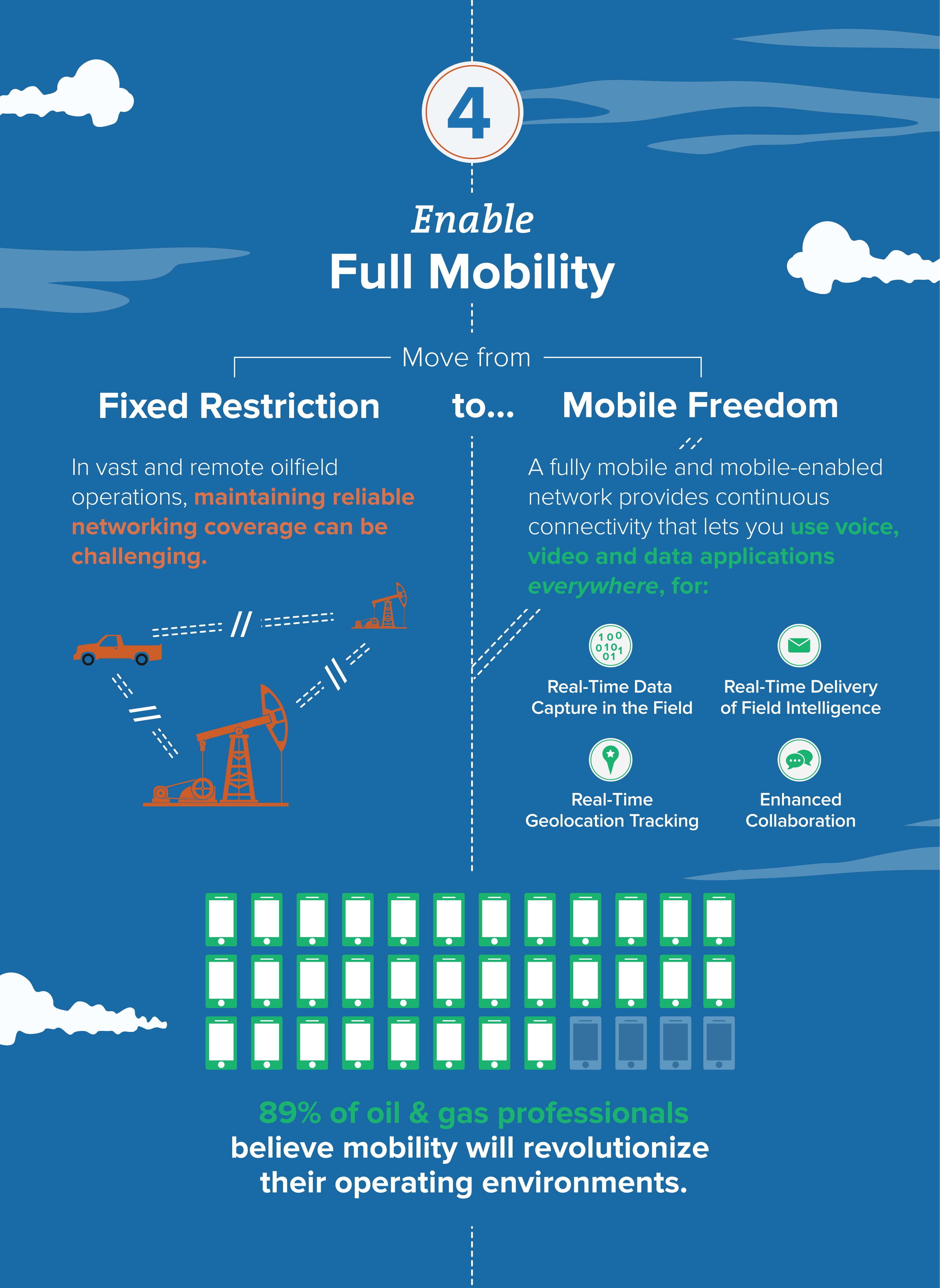

While automation has proven a challenge for the industry, some companies are overcoming it by converting existing networks into mesh networks to make them more resilient, fl exible and free of a single point of failure. Automation is a major benefi t of mesh and offers the industry a powerful tool for preserving revenue and lives.

One compelling example of the safety features of kinetic mesh networks is the ability to automatically shut down portions of the pipeline where the threat of a leak or explosion arises, preventing a catastrophic event.

Automation is useful in other tasks as well. In recent years high-precision drilling has been using robotics and automation with increasing frequency to change how equipment reacts to data generated by drilling activity. The drill can adjust itself to work more efficiently according to pressure and density feedback.

And if the drill is experiencing technical issues, the network can send it information—instructions of sorts—to correct technical issues, allowing the equipment to continue functioning. Automation also provides a backup; if one tool is faltering or shuts down completely, the system can cue another tool to take its place, avoiding costly downtime.

The industry has stood at a turning point with monitoring and automation for several years—from working with delayed data and reacting to trends to leveraging real-time data to control pumps from thousands of miles away. The industry has reached

the point now where, sensing an increasingly urgent need for innovation, it is investing more money and development efforts into solutions like kinetic mesh networks and analytics. This trend is set to accelerate over the next few years.

Despite a slow start, the industry is steadily inching toward adopting technologies that will allow companies to improve job site effi ciency and reduce costs, ultimately making the industry more profi table across the board.

Kinetic mesh networks are fully mobile and empower professionals to deliver service excellence without worrying about a compromised network communications infrastructure. (Source: Rajant Corp.)

Recommended Reading

CEO: TotalEnergies to Expand US LNG Investment Over Next Decade

2025-02-06 - TotalEnergies' investments could include expansion projects at its Cameron LNG and Rio Grande LNG facilities on the Gulf of Mexico, CEO Patrick Pouyanne said.

DOE Secretary Wright Grants Delfin LNG Extension for Exports

2025-03-10 - Delfin LNG's floating LNG export project in the Gulf of Mexico is authorized to export up to 1.8 Bcf/d, U.S. Energy Secretary Chris Wright said at CERAWeek.

Belcher: Trump’s Policies Could Impact Global Energy Markets

2025-01-24 - At their worst, Trump’s new energy policies could restrict the movement of global commerce and at their best increase interest rates and costs.

Belcher: Tariff Growing Pains Will Help US Achieve Energy Dominance

2025-04-03 - Tariffs may bring short-term pain, but Trump is aggressively pursuing goals that benefit the U.S., says Cornerstone Government Affairs’ Jack Belcher.

DOE Approves Non-FTA Permit Extension for Golden Pass LNG

2025-03-05 - Golden Pass LNG will become the ninth U.S. LNG export facility following the U.S. Department of Energy’s approval for an extension of its non-free trade agreement permit.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.