Oilfield service companies are providing a multitude of diverse tools and systems to help operators solve the latest well completions challenges. (Source: Jason Hallmark/Hallmark Photos/Liberty Oilfield Services)

The saying “good enough is the enemy of perfection” is meant to convey the idea of never settling for good enough. The North American hydraulic fracturing industry represents the epitome of that dynamic, not being merely satisfied with being the catalyst behind one of the greatest oil production booms the world has ever seen. The driving mindset in the industry is that there is more to be had: more oil, more gas and at less cost.

Operators and service companies are looking closer at the details of every well completed, every fracture job and every fracture stage. They are finding more efficiencies and that more production can be gained through, for example, ensuring each fracture produces the most hydrocarbons, and by getting the right amount of fluids to the right places in the wellbore at the right time.

However, these operational efficiencies and the desire to drain a reservoir as completely as possible are bringing new problems, chiefly among them fracture hits. The search for answers to these challenges is leading companies to discover many systems offer operational flexibility—they can solve more than one problem. Diverters, for instance, can push fluid into a specific fracture while simultaneously helping avoid interference with another well.

In another example, a Woodford operator applied Reveal Energy Services’ pressure-based fracture maps to achieve a better understanding of fracture sequence, which improved fracture coverage of the upper horizon. A second operator working in the Bakken was able to understand the effect of a parent well on fracture growth of neighboring child wells. According to Reveal Energy Services, the operator minimized the parent well/child well interference and maximized production. In addition, a Permian Basin operator applied the pressure- based fracture maps to optimize downspacing.

“Understanding how each parameter affects the fracture growth allows operators to fine-tune the completion design and the treatment schedule to maximize production from every well while minimizing overall completion costs,” said Sudhendu Kashikar, CEO of Reveal Energy Services.

Fracture fluids

As fracture jobs become more sophisticated and customized, so too are the needs and uses for fracture fluids. Operators looking to place high amounts of proppant into specific fractures are turning to specialized fluids and friction reducers.

Chad Leier, vice president of sales and marketing at Calfrac Well Services, explained how the most widely used fluid systems are water-based, and in most cases, simple friction-reduced water is most effective for a fracture job.

“As a result, the largest focus in our business right now is the utilization of produced or flowback water,” Leier said. “In certain regions, it is not always viable to reuse water. In other areas, it might be harder to obtain freshwater.”

Calfrac Well Services has been offering several fluid technologies that help operators overcome proppant placement issues, said Mark Ellingson, vice president of sales and marketing, U.S. Division.

“One of the best examples of this is CalVisc, our high-viscosity slickwater system,” Ellingson said. “CalVisc’s properties allow for the generation of viscosity through a simple increase in additive loading. We took what was already one of the most robust friction reducers available in the market (in that it works with varying water qualities and bottomhole temperatures) and enhanced the properties.”

BJ Services’ fracturing product line director, Carla Lewis, explained how the company’s ThinFrac MP friction reducer is designed for enhanced proppant transport.

“Conventional slickwater treatments do not always carry proppant effectively into the fracture network,” she said. “In response, BJ engineered a multipurpose friction reducer that offers better proppant carrying capacity and can produce excellent friction reduction without damaging the formation.”

Lewis said that is achieved through the versatility of the technology.

“Tunable technology lets you adjust the fluid properties in real time,” she said. “ThinFrac MP is versatile and provides greater flexibility for rapid design changes. It can be used at low concentrations for slickwater applications and at high concentrations as a nondamaging guar alternative to linear and even crosslinked gels. It can also reduce NPT [nonproductive time] due to shutdowns and screenouts related to irregular well conditions by adjusting the concentration on the fly.”

Lewis said that although high-viscosity friction reducers are an emerging technology in unconventionals, they tend to perform poorly with produced water.

“Using produced water can be challenging because the water quality could be inconsistent even in the same job. Therefore, determining chemistry compatibility can be difficult,” she said.

To address such an issue, Lewis said BJ Services is designing friction reducers that can be used in multiple water sources, including produced waters with total dissolved solids up to 300,000 ppm.

“Predictable, effective performance in varying produced water qualities minimizes fluid design changes and the need to carry different products in a job and allows the operator to use more produced water saving freshwater and disposal costs,” she said.

Evaluating diverter technology

The essential goal for every fracturing job is to get the most out of each stage and each cluster. Finding the right fracturing recipe can help achieve even flow distribution and cluster efficiency, both of which can help contribute to increased production.

“You want to ensure that you’re engaging the different clusters within a stage effectively and trying to get even flow across those clusters,” said Scott Gale, senior strategic business manager, production enhancement at Halliburton. “Customers are willing to pay for outcomes that impact cluster efficiency. For example, some of those types of products have been diverters. There’s been a lot of activity around using diverters in the industry. You want to have as many holes open as possible. You want to engage as much of the rock as possible.”

Terry Palisch, global engineering adviser at CARBO, said that over the years the oil and gas industry has realized that, in most cases where it has been measured, only 30% to 60% of the perforation clusters in a wellbore are providing measurable production.

“The goal of diverters has been to increase this effectiveness,” Palisch said. “In addition, some operators have been experimenting with performing longer stages, but with more clusters in order to save money.”

Palisch provided an example of a current completion design containing five clusters in a 60-m (200-ft) stage with 16-m (50-ft) spacing. The operator could reduce the number of stages in half by increasing the spacing to 120-m (400-ft) and doubling the number of perforation clusters to 10, he said.

“The problem is that without some sort of diversion, it will be extremely difficult to effectively stimulate this many clusters,” he said. “But by using diverter technology, they can spread the stimulation out across all or most of the clusters. The latter is still very much a work in progress for the industry.”

Nick Koster, director of engineering design for DiverterPlus, said diverter technologies have significantly improved in recent years to a point where some of the initial objections, such as inconsistencies in exactly how much diverter to actually use and problems with the diverter degrading in certain temperatures and chemistries, have been resolved to a point where operators are more comfortable using them.

“Even though the activity has slowed down, in the Bakken [diverters] have been generally embraced from the start,” he said. “That’s because a couple of flagship operators have really seen the benefit of diverter technology. And then there are areas like the Permian where more and more people are starting to use diverters as they’ve seen operators have great success. And the ones that in the past might have had a bad experience are starting to come back and say, ‘You know, maybe there is something to this diverter.’”

Koster said diverters can help increase cluster efficiency by making sure the equivalent amount of fluid is traveling into every cluster by intentionally “shutting off” certain clusters when they have reached their target amount of fluid in proppant.

Parsley Energy recently evaluated the use of diverter technology in its Wolfcamp Shale play. The process and its results were documented by Parsley Energy’s Jennifer Harpel in the Society of Petroleum Engineer (SPE) paper, “Improving the Effectiveness of Diverters in Hydraulic Fracturing of the Wolfcamp Shale.” Among the goals of the project were to reduce overall completion time and associated costs and to test the effectiveness of engineered diversion in improving cluster efficiency.

Harpel looked to determine if the applied diverter was able to stop fluid injection into a dominant cluster and force fluid into other clusters where more of the reservoir could be contacted, which therefore, and ideally, would increase production. Additionally, if a stage could be effectively pumped with diversion without having to slow pump rates and the number of wireline runs could be reduced, she examined if it would be possible to save time on wireline and fracturing operations.

For the study, pads were selected where at least two wells were completed in the same producing zone and that had no direct offset wells that might have caused depletion in one of the test wells, according to Harpel. Well A-1 was stimulated with a typical completion design for the pad and well A-2 was stimulated using an engineered diversion. Meanwhile, both wells in the second pad, or B wells, were stimulated using an engineered diversion. An offset well was drilled and completed with a standard nondiversion design and was used as a direct comparison for production and operational efficiency analysis.

“After the learnings made on well A-2, the subsequent B wells had an overall reduction in completion and mill-out time of 10% versus the direct offsets,” Harpel wrote. “Thus, this methodology can be used to significantly reduce completion time.”

Regarding the effects of total costs, she found the methodology resulted initially in slightly increased costs, but learnings on the initial stimulated wells were applied to the B well, which resulted in a reduction in completion times.

The study reported that production results on the A-1 and A-2 wells showed a “slight improvement” when compared to the offset well’s production rate.

“Treatment pressures in the target wells show that almost 85% of diverter drops had positive indications of effective diversion into new rock, which is significantly better than the 50% to 60% effectiveness reported in other literature,” Harpel reported. “Based on this analysis, the engineered diversion design had a positive effect in achieving the primary goals of this project.”

Service companies offering diverting agents have subsequently designed their technologies to address the challenge of achieving better cluster efficiency and enhanced production.

Additionally, simply determining the diverter effectiveness has proven costly and elusive.

For example, CARBO offers CARBOBALLS, biodegradable ball sealers that provide a positive diversion of individual perforation as well as DIVERTAPROP, a particulate diverter that combines a biodegradable binding agent with multiple sizes of ceramic proppant.

Palisch said CARBOBALLS are tailored to the specific temperature of the well and are designed to divert the fracture and then quickly dissolve to allow production to commence. DIVERTAPROP allows the diversion of fractures (rather than perforations) during the fracturing treatment, he said. After the binding agent in the diverter agent dissolves, the fractures are left with proppant to provide near-wellbore conductivity.

Meanwhile, Reveal Energy Services’ pressure-based fracture maps of half-length, height, asymmetry and azimuth, which also show how fast those dimensions grow, can also evaluate diversion effectiveness.

“This fracture geometry understanding confirms whether a specific diversion design is fully stimulating each stage, enhancing cluster efficiency and improving fluid distribution across the stage,” Kashikar said. “This knowledge of diverter effectiveness leads to a new understanding of the diversion process and enables near-real-time optimization where the results of a diverter stage are used to adjust the diversion design for the following stages.”

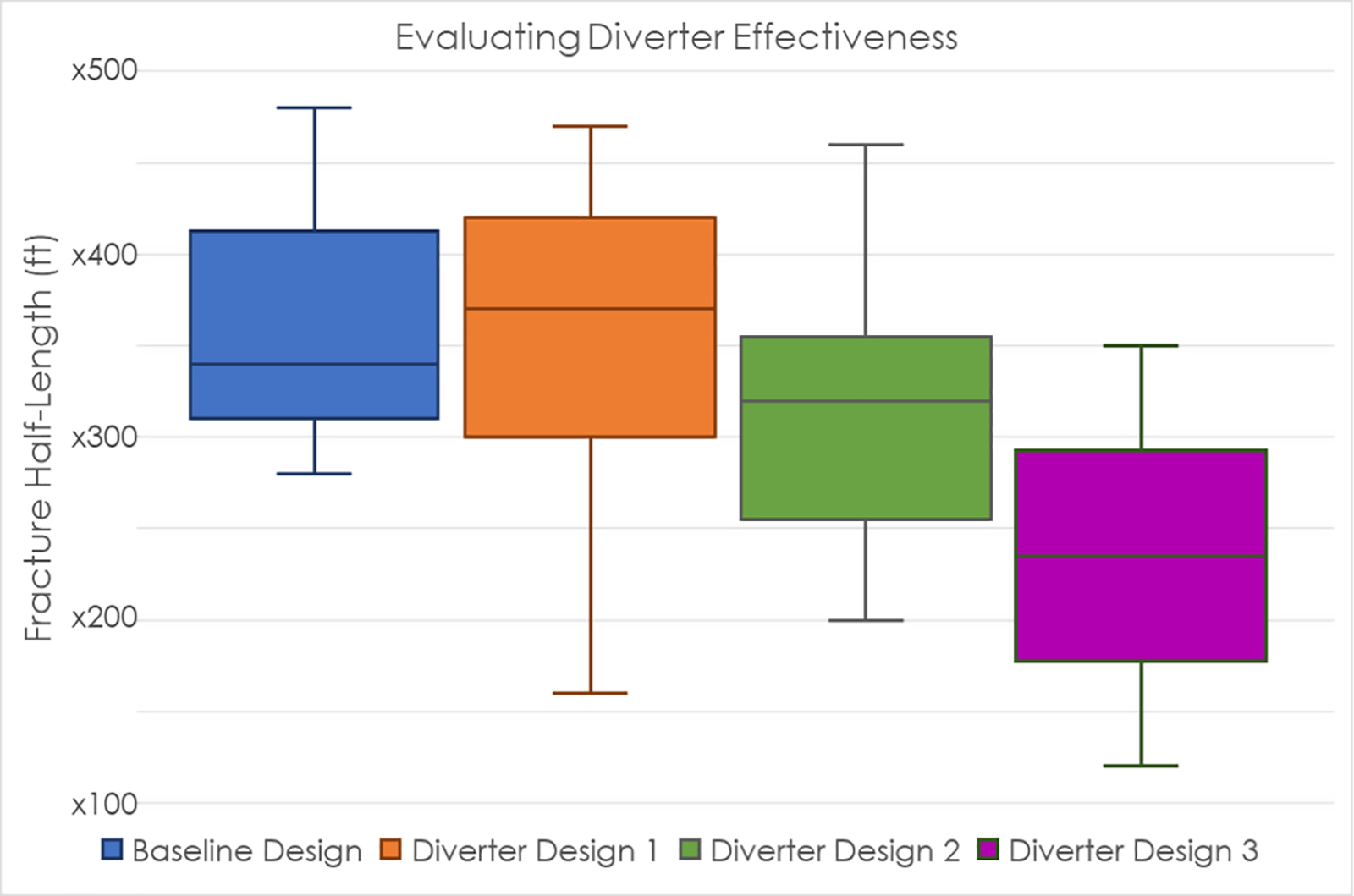

Kashikar explained that a typical diversion design includes four key parameters: diverter material, the quantity of the diverter material per drop, the number of diverter drops per stage and timing of the diverter drop.

This chart depicts the evaluation of three diversion designs compared with a baseline design. Diversion designs 1 and 2 show minimal improvement in fracture half-length compared with the baseline design. Design 3 shows a significant improvement in diversion and cluster efficiency, as shown by a reduction in fracture half-length. (Source: Reveal Energy Services)

“The proper combination of all four parameters is required for effective diversion,” he said. “The legacy diagnostic techniques have been insufficient to permit rigorous testing of these parameters to find an optimized diversion design.”

The company’s DiverterSCAN technology can be applied in near-real time for feedback of diversion design effectiveness, Kashikar said. The system allows multiple diversion designs to be tested and evaluated quickly, resulting in finding and confirming the optimized design before all stages have been fractured.

“Operators are making decisions in near-real time to adjust one or more diversion design parameters for the maximum value at the lowest cost,” he said.

Solving the fracture hit challenge

With the advent of extended laterals combined with multiwell pad development, operators often work to ensure their infill wells perform as well or better than the existing parent wells, taking lessons learned from lease-holding parent wells and applying them to infill, or child, wells.

As a result, the industry is facing its latest challenge to maximizing a well’s production—fracture hits.

In his SPE paper, “Frac Hit Induced Production Losses: Evaluating Root Causes, Damage Location, Possible Prevention Methods and Success of Remedial Treatments,” George King, former Apache Corp. adviser and lead author of the paper, defined fracture hits as a “fracture-initiated well-to-well communication event that can create production losses (or gains), and on occasion, mechanical damage when frac energy from a stimulated well extends into the drainage area or directly contacts an adjacent or offset well.”

“If you look at the child/parent well interference, recent published literature indicates a drop in parent well production by 60%,” said Ajay Kshatriya, CEO of Biota Technology. “At that level of economic loss, you’re looking at millions of dollars per section if you don’t get control over frac hits.”

King identified some potential factors as causes for fracture hits such as in situ stress alteration potential, the timing of fracture closers, near-wellbore proppant loss, liquid loading, rock-fluid interactions, sludges and wetting factors.

“There also may be a connection with low-viscosity fluid, high frac pump rates and quick application of injection rate and pressures that tend to produce long-reaching planar fractures, especially in formations with predominantly closed natural fractures,” King noted.

Kshatriya said there are several potential techniques to reduce the number of frac hits a well might be experiencing, including how adjacent wells are pressurized and minimizing palpitation patterns of known stresses. He said well spacing and the timing and sequencing of fractures across paths should be analyzed to possibly avoid well interference.

“One of the key questions to clarify the issue of frac hits is understanding the root cause of the interference,” Kshatriya said. “Producers can focus on two different issues: There’s the pressure response, and then there’s fluid communication. You might, for example, have a pressure response from a child-to-parent well, but there may not be fluid from the child well flowing into the parent well. Our customers can measure pressure response with gauges, but fluid communication is more challenging.”

Kshatriya said Biota recently published work with EP Energy in a case in which the operator was experiencing fracture hits and was able to isolate the occurrences to a set of wells but could not determine which of the wells was causing the interference.

“By deploying our production surveillance offering, we could analyze the DNA signature of the parent well before and after the frac hit,” he said. “And by monitoring the pad of child wells in conjunction with this baseline, we can determine if fluid communication occurred and which well was driving the production interference.”

To help their customers avoid fracture hits, Liberty Oilfield Services identifies effective well distances and coverage through fracture modeling calibrated with microseismic fracture mapping, said Leen Weijers, vice president of engineering for Liberty.

“We put fracture growth modeling in tandem with reservoir modeling where we can see interaction between wells on the production side, so you can get a better idea of how you can properly cover that space between wells,” he said. “Of course, you can go to a diverter strategy where you are trying to do a better job in diverting fluid flow between different perf clusters. It’s quite a big problem. We are trying to address it.”

King explained in his paper that what makes predicting fracture hits so difficult is that the qualitative differences in basins—such as mineralogy, flow paths, natural fracture swarms and modified stresses—have so far not been well described by accurate reservoir modeling.

Occasionally wells experiencing fracture hits might see an increase in production, but the production changes are often “overwhelmingly negative” in some basins, and in some cases, they could lead to physical damage of well equipment, King noted.

“Physical damage to the well equipment might be controlled in some cases by pressurizing the wellbore, allowing the well to build up pressure, or by incorporation of pressure controlling devices in the well completion,” he noted. “Increasing distance between wells or use of offset perforations to minimize fracture pressure communication have also shown successful application in some areas.”

Reveal Energy Services is commercializing a service to monitor and quantify the severity and type of frac hits in real time.

The service is based on measuring pressure in one or more offset wells as a child well is fractured, Kashikar said. He explained that the pressure response recorded in each of the monitor wells is classified into one of four categories. The first is a direct frac hit, which entails the transfer of fluids and pressure from the child well to a parent well. The second is a diffusive response, in which the increase in wellbore pressure in the parent well is primarily caused by the diffusion of fluid in the interwell space. Kashikar said this could be a result of a fracture connecting into a system of natural or induced fractures, but no fluid transfer occurs between the child well and the parent well.

The third is a poroelastic response, in which the pressure change in the parent well is caused primarily by the stress changes in the rock matrix, which are caused by newly created fractures in the child well. And the last is no pressure response at all.

“This analysis allows operators to understand if the frac hit could be detrimental to the parent well production and take appropriate corrective action,” Kashikar said.

Pressure pumping

Similar to nearly every other component of a fracturing job, recent trends in pressure pumping have focused on more efficiency and more horsepower. Today’s multiwell pad completion designs featuring longer laterals, more stages and operators’ desires to shorten the time to production and avoiding unplanned downtime are driving the need for efficiency.

“Lateral lengths, flow rates and treating pressures all contribute to increasing completions intensity,” said BJ Services’ Lewis. “The expectation is that pumps must operate harder for longer times without downtime.”

Lewis explained how, with that goal in mind, BJ Services redesigned the company’s blender with proprietary features to enable high-rate pumping while reducing downtime. She said the company’s first re-engineered blender pumped more 330 MMlb of sand in a little more than eight months with no instances of unplanned downtime.

“The BJ engineering team has redesigned our equipment by measuring how each individual component impacts the entire system to address potential premature failures before they occur in the field,” she said. “They are optimizing components, such as manifolds, discharge pumps, valves, fluid ends and more in order to extend the life of the components and improve the overall reliability of the system.”

Moreover, BJ Services has fit-for-purpose equipment especially designed to operate under specific conditions. For example, to meet the requirements of higher pressure environments, BJ Services’ Gorilla high-pressure pump provides up to 2,700 hhp at pressures up to 20,000 psi, Lewis said.

Liberty’s Weijers explained how more hydraulic fracturing jobs need more horsepower and, subsequently, more divergent power to distribute the fracture system successfully across an entire lateral section or subsection of the lateral. Similar to what the industry is learning about proppant quantities—that there might be a limit to how much is economically feasible to pump—so too might those lessons apply to stage spacing, Weijers said.

“The industry has gone from an average of 55 barrels per minute to about 77 barrels per minute for maximum reported rate per well in just a five-year period,” he said. “I don’t see an end to that yet. But what I do see an end to is how small our stages are becoming with respect to their lateral footage. Some operators are now increasing the foot per stage metric as they have become better in diverting fluid and proppant across each lateral section.”

Like nearly all sectors of the upstream oil and gas industry, hydraulic fracturing is rapidly moving into automation and digitalization. In August 2018, Halliburton unveiled its Prodigi Intelligent Fracturing platform, which envisions completely automated fracturing operations. Halliburton’s Gale said that through the fall of 2018, the first commercial iteration (Prodigi AB) had been run on more than 1,100 stages in all major U.S. basins.

“Prodigi AB is delivering rates automatically during those initial pumping conditions to better achieve even flow distribution across the interval,” Gale said. “And we think that if we do that in the right way that you’re going to dramatically increase the likelihood of having even flow distribution through the remainder of the job. So Prodigi AB gets you up to the targeted treatment rate automatically. Then from there, we hand the controls back over to the pump operator to finish up the job.”

Among the benefits to the Prodigi AB service that he cited were lower overall treating pressures and more quickly achieving the fracture treatment rate.

“A lot of the things the industry has accepted is that you chase rate and get to pressure as quick as possible, and it’s just all about hitting the reservoir as hard as you can and just powering through,” Gale said. “And that’s been effective, but it comes with collateral issues. One of the reasons for automating a frac job is that you can achieve engineered outcomes more consistently, more effectively and more reliably.”

References available. Contact Brian Walzel at bwalzel@hartenergy.com for more information.

Read the other hydraulic fracturing cover stories featured in the January edition of E&P magazine:

Operators Find Efficiencies In Hybrid Fracture Plug Completions by Schlumberger

Cost and value of a dissolvable frac plug by Halliburton

Recommended Reading

The Chicken or the Egg? Policy and Tech Needed to Enable Hydrogen Market

2025-04-11 - Hydrogen project developers ask themselves the famous ‘chicken or the egg’ conundrum as they lean on policy, incentives and technology to bridge cost gaps.

California Resources Continues to Curb Emissions, This Time Using CCS for Cement

2025-03-04 - California Resources’ carbon management business Carbon TerraVault plans to break ground on its first CCS project in second-quarter 2025.

API’s Multi-Pronged Approach to Lower Carbon Operations

2025-01-28 - API has published nearly 100 standards addressing environmental performance and emissions reduction, which are constantly reviewed to support low carbon operations without compromising U.S. energy security.

Could EPA’s GHG Rule for Power Plants Give CCS a Boost?

2025-03-05 - Economics and policy are impacting the pace of carbon capture and storage project growth in the U.S. but some companies are pressing ahead.

Energy Transition in Motion (Week of Feb. 21, 2025)

2025-02-21 - Here is a look at some of this week’s renewable energy news, including a record for community solar capacity in the U.S.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.