The E&P labor market is very difficult today, says Norsk Hydro ASA's Gulf of Mexico business chief. Professionals are trading camps like soccer players-they're with BP (NYSE: BP) one year and ExxonMobil (NYSE: XOM) the next, Helge Hove Haldorsen told Norwegian American Chamber of Commerce members in Houston recently. Norway-based Norsk Hydro (NYSE: NHY) made a giant splash in the Gulf of Mexico last year, acquiring Houston-based, Gulf-focused Spinnaker Exploration Co. for cash in a deal valued at some $2.5 billion. Its newly expanded Gulf business unit, Houston-based Hydro Gulf of Mexico LLC, now has 80 employees. Additional people used to be a problem for E&P companies when making acquisitions, he said; many had to be laid off. Today, buyers depend on people coming with the assets they buy. Norsk Hydro is expected to apply a great deal of the expertise it has gained from operating in the North Sea and elsewhere offshore to the new Gulf unit. It acquired production of some 23,000 BOE per day from Spinnaker, and total reserves of 129 million BOE. More key in the deal is Spinnaker's extensive exposure to Gulf exploration acreage. There have been challenges since closing, however. Gulf dayrates have soared in the past several months, and finding a rig available for work is difficult at any price. "They're sold out," Haldorsen said. Also, insurance costs have rocketed since hurricanes Katrina and Rita. "Anyone here from an insurance company?" he asked the audience. "How can you do it to us?" And, other risks remain, such as dry holes. Haldorsen presented an image of Edward Munch's "The Scream" in his slide show to reflect sentiment about that. "This is how you feel." As for continued hurricane-related risks, an "easy button" would be the use of FPSOs (floating production, storage and offloading vessels) with a quick-disconnect feature, he said. Eventually, offshore operations may be bound to the ocean floor, and there is no super-surface facility. And, there are other ideas that may be costly but worthwhile. "The cost of doing nothing different is probably higher than the cost of doing something different."

Recommended Reading

Quantum’s VanLoh: New ‘Wave’ of Private Equity Investment Unlikely

2024-10-10 - Private equity titan Wil VanLoh, founder of Quantum Capital Group, shares his perspective on the dearth of oil and gas exploration, family office and private equity funding limitations and where M&A is headed next.

ConocoPhillips Hits Permian, Eagle Ford Records as Marathon Closing Nears

2024-11-01 - ConocoPhillips anticipates closing its $17.1 billion acquisition of Marathon Oil before year-end, adding assets in the Eagle Ford, the Bakken and the Permian Basin.

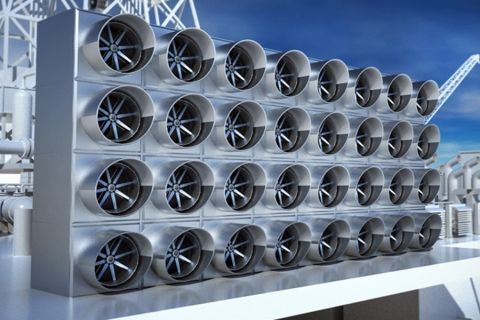

Optimizing Direct Air Capture Similar to Recovering Spilled Wine

2024-09-20 - Direct air capture technologies are technically and financially challenging, but efforts are underway to change that.

Twenty Years Ago, Range Jumpstarted the Marcellus Boom

2024-11-06 - Range Resources launched the Appalachia shale rush, and rising domestic power and LNG demand can trigger it to boom again.

Sheffield: E&Ps’ Capital Starvation Not All Bad, But M&A Needs Work

2024-10-04 - Bryan Sheffield, managing partner of Formentera Partners and founder of Parsley Energy, discussed E&P capital, M&A barriers and how longer laterals could spur a “growth mode” at Hart Energy’s Energy Capital Conference.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.