Tulsa-based Intensity Infrastructure Partners launched an open season Feb. 3 to determine support for a natural gas transport line in the Bakken Shale, a basin with a growing need for natural gas egress. (Source: Shutterstock)

Tulsa-based Intensity Infrastructure Partners launched an open season Feb. 3 for a natural gas transport line in the Bakken Shale, a basin with a growing need for natural gas egress.

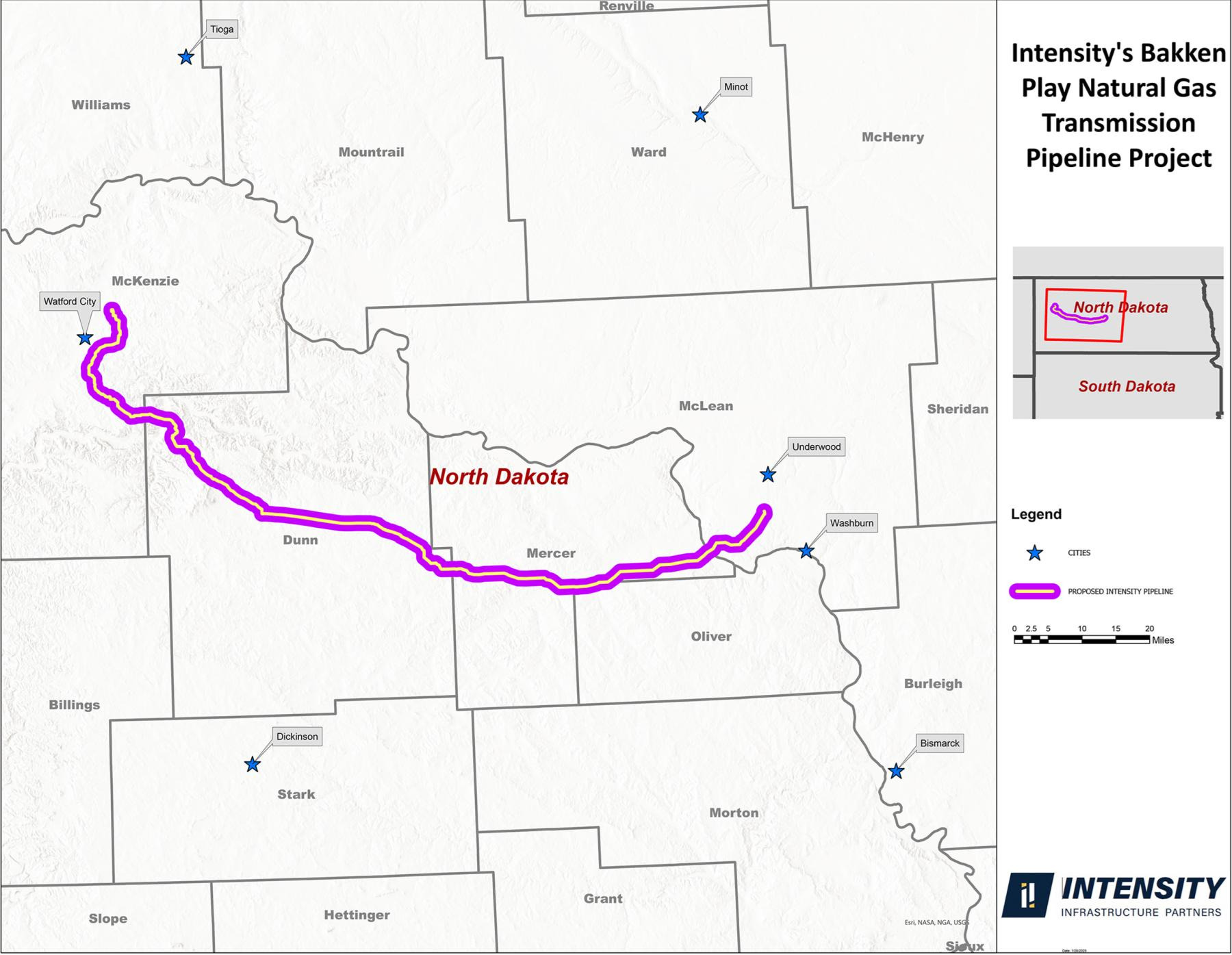

If built, the Intensity Pipeline will be a 126-mile, 42-inch diameter line with a 1.5 Bcf/d capacity. The intrastate route would take natural gas from production zones in western North Dakota to its terminating point in southern McLean County.

The open season ends at 1 p.m. CST on March 7. In its press release, Intensity announced its intention to “facilitate transparent and meaningful consultation with all stakeholders (landowners, community leaders, government agencies and potential customers).”

EIV Capital backs the company.

Production growth in the Bakken stressing the region’s energy supply has long been noticed by analysts. In May 2024, East Daley Analytics published a report titled “Gas Constraints May Limit Bakken Production Growth.”

The Bakken is a miniature version of the Permian Basin, an oil-focused production area producing an increasing amount of NGL-rich natural gas as it matures.

East Daley’s Bakken forecast “indicates gas demand is not increasing within the basin, leaving producers beholden to new pipeline expansions to move supply growth.” Natural gas production in the basin averaged just under 3.6 Bcf/d in 2023 and 2024, according to the U.S. Energy Information Administration.

If built, the Intensity line could follow another pipeline project in the region. The Federal Energy Regulatory Commission (FERC) approved permits for a natural gas project by two midstream players, TC Energy and Kinder Morgan, in October 2024.

TC Energy and Kinder Morgan’s Wyoming Interstate Co. (WIC) have planned a pipeline network project that would connect the Bakken with the Cheyenne hub in the Denver-Julesburg Basin. The project would add 430 MMcf/d of natural gas egress from the Bakken and is expected to be in service by the spring of 2026, according to the FERC application.

Recommended Reading

Ring Energy Bolts On Lime Rock’s Central Basin Assets for $100MM

2025-02-26 - Ring Energy Inc. is bolting on Lime Rock Resources IV LP’s Central Basin Platform assets for $100 million.

Diamondback Acquires Permian’s Double Eagle IV for $4.1B

2025-02-18 - Diamondback Energy has agreed to acquire EnCap Investments-backed Double Eagle IV for approximately 6.9 million shares of Diamondback and $3 billion in cash.

IOG Resources II Buys Non-Op Utica Shale Interests

2025-02-26 - IOG Resources II is expanding in Appalachia with an acquisition of Utica working interests in eastern Ohio.

Obsidian to Sell Cardium Assets to InPlay Oil for US$225MM

2025-02-19 - Calgary, Alberta-based Obsidian Energy is divesting operated assets in the Cardium to InPlay Oil for CA$320 million in cash, equity and asset interests. The company will retain its non-operated holdings in the Pembina Cardium Unit #11.

Crescent Energy Closes $905MM Acquisition in Central Eagle Ford

2025-01-31 - Crescent Energy’s cash-and-stock acquisition of Carnelian Energy Capital Management-backed Ridgemar Energy includes potential contingency payments of up to $170 million through 2027.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.