The U.K. sector of the North Sea produced more than 4 million bbl. of oil equivalent per day in 2003, and attracted $6.2 billion in capital expenditures, says the U.K. Offshore Operators Association Ltd., in its 2003 activity survey. Production in 2004 is projected to be around 3.7 million barrels equivalent per day, continuing a gradual decline. Overall investment in drilling, facilities, projects and new-field development will rise, however, to $6.37 billion this year. The problem: development and operating costs are surging, but increased spending in these categories does not add new reserves. Indeed, drilling activity in 2003 was much lower than in recent years, with projected year-end totals of 40 exploration and appraisal wells and 200 development wells. This is a sharp decline from the 44 E&A wells and 249 development wells drilled in 2002, and 2001's 60 E&A and 282 development wells. Long-term, lower production volumes and increased capital spending are expected to continue. The industry intends to invest more than $32.7 billion between 2003 and 2010 in the U.K. sector, but production in 2010 may be below 2.5 million barrels equivalent per day. To remain globally attractive, the U.K. industry must reduce production decline, raise exploration and appraisal drilling activity, and find new ways to economically develop remaining reservess, says the association. 1 Canada Construction on ConocoPhillips Surmont oil-sands project in Alberta will begin soon, and production will start in 2006. The $1.1-billion project is expected to produce more than 100,000 bbl. of bitumen per day by 2012, says the company. The project will use the steam-assisted gravity-drainage (SAGD) method of production, in which steam is injected into the oil sands to melt the bitumen, which is then pumped to the surface. ConocoPhillips operates Surmont and has a 43.5% interest in the project, Total has 43.5% and Devon Energy has the remaining 13%. The project site is about 60 kilometers southeast of Fort McMurray. 2 Trinidad & Tobago In January, Trinidad & Tobago's energy ministry received 18 bids for 10 offshore blocks from eight different companies. The proffered blocks included shallow-water concessions off both coasts of the country, midwater-depth shelf blocks, and deepwater blocks off the northeastern coast. Winning bidders will be announced shortly. In separate activity, ExxonMobil signed a three-year exploration contract with Petrotrin + the state-owned oil company, to drill three exploratory wells in the Soldado area in the Gulf of Paria, off the country's west coast. The major will spend $25 million on drilling, seismic and training. 3 Bolivia Empresa Petrolera Chaco has drilled a successful outpost and a discovery, says IHS Energy. In the Chimore I Block in the Foothills Belt of the Chaco Basin, the Kanata X-3D outpost tested 10.3 million cu. ft. of gas, 914 bbl. of condensate and 12 bbl. of water per day. The well was drilled to a total depth of 4,045 meters, about 2.5 kilometers north of the Kanata X-1 discovery. In addition, Chaco has discovered a 5-million-bbl. accumulation at its Kanata Norte X-1 wildcat. The 3,830-meter well is separated by a major fault from the Kanata discovery well. Chaco, which is owned in part by BP and Bridas, expects to spend $100 million in the Chimore I Block through 2006. 4 Norway Statoil and 1Norske Shell plan to extend until 2009 their joint exploration efforts in deepwater areas in the Norwegian Sea. In 2001, the partners began exploring the Møre and Vøring basins west of the Haltenbanken area. Now, the companies have renewed the arrangement and enlarged their area of mutual interest to cover the northeastern part of the Vøring Basin. Last year, the partners discovered oil in the Ellida License within their AMI. In separate activity in the Norwegian sector of the North Sea, Statoil intends to develop its Gulltop discovery by drilling a production well with a total measured depth of 32,810 ft. The well will be a sidetrack from an existing well on the Gullfaks A platform. Estimated recoverable reserves are 25 million bbl. of oil and 17.7 billion cu. ft. of gas. 5 Chad EnCana Corp., Calgary, has kicked off a two-well exploration program in the Bongor Basin, reports IHS Energy. The company has spudded its Mimosa 1 on Permit H, Zone du Chari block. Total depth is projected to 2,000 meters at the well, which is targeting Lower Cretaceous sediments. The second test, Bersay 1, will also test Lower Cretaceous to a depth of 3,000 meters. Petroleum production in Chad commenced in mid-2003, following completion of the 665-mile Chad-Cameroon pipeline. ExxonMobil Corp. currently has an aggressive drilling program under way in the Doba Basin in southern Chad. 6 South Africa Denver-based Forest Oil Corp. has found natural gas in two of its first three wells in a drilling program in the Ibhubesi project area, offshore the western coast of South Africa. The #3 well, 40 kilometers from wells drilled by the company in 2001, encountered 11.4 meters of gas pay and tested at the rate of 31 million cu. ft. of gas equivalent per day, with a flowing tubing pressure of approximately 2,400 psi. The #2 well, eight kilometers from the #3, encountered 4.9 meters of gas pay but was not tested. The first well was drilled to a depth of 3,325 meters at a location 6.7 kilometers due west of the #2 and was plugged and abandoned. The company is now drilling a delineation well to the discovery. Forest operates the project and holds a 53% working interest; PetroSA has a 24% interest; and Anschutz has 23%. Four to six wells are planned in this program, which kicked off in September. Forest has a full carried working interest in the $30-million venture. 7 Israel Noble Energy Inc., Houston, is producing gas from its Mari-B Field, 15 miles offshore Israel in the Mediterranean Sea. Gas flow from the field, which is being used to fire an electric power plant, is expected to reach 100 million cu. ft. per day shortly. Noble, which discovered Mari-B Field in 2000, estimates that recoverable gas reserves are more than 1 trillion cu. ft. The company also has an undeveloped discovery, Noa, which contains more than 200 billion cu. ft. of gas. That field will be developed in the future via a subsea tieback to the Mari-B platform. Noble operates the project and holds a 47.059% working interest; 1Avner Oil Exploration LP Í" , 23%; Delek Drilling LP, 25.5%; and Delek Investments & Properties Ltd., 4.441%. 8 Pakistan BHP Billiton says its Zamzama East well, an appraisal well drilled in the company's Zamzama Field in Sindh Province, encountered 36.3 meters of net gas-bearing Pab sandstone within a 61.3-meter gross gas column. The well, drilled to a depth of 4,051 meters, flowed gas at the rate of 40 million cu. ft. per day. BHP also recently drilled the Zamzama North appraisal well, which confirmed a 127-meter gross gas column with 79 meters of net pay. That well flowed 41 million cu. ft. per day. The Phase I development at Zamzama Field is currently producing 300 million cu. ft. of gas per day. BHP operates the field and holds a 38.5% interest; Government Holdings (Private) Ltd. has 25%; PKP Exploration Ltd. a jointly owned company between Kufpec and Premier Oil has 18.75%; and Eni has 17.75%. 9 India U.K. independent Cairn Energy Plc has made a significant oil discovery at its N-B-1 exploration well, drilled in the onshore northern Rajasthan Basin. The well, 60 kilometers north of Saraswati, encountered 22 meters of net pay in the Barmer Hill formation and 85 meters of net pay in the Fatehgarh. Cairn says initial estimates for recoverable reserves range from 50- to 200 million bbl. Cairn holds a 100% interest in the 5,000-square-kilometer Block RJ-ON-90/1. Oil & Natural Gas Corporation Ltd. has a right to 30% of any development area resulting from a commercial discovery on the block. 10 Myanmar Daewoo has made a gas discovery of up to 6 trillion cu. ft. in offshore Block A-1 in the Bay of Bengal. The block is off the Rakhine coast, which borders Bangladesh and India. It estimated the field will have a daily production capacity of more than 500 million cu. ft. Daewoo holds a 60% stake in Block A-1; Oil & Natural Gas Corp. Ltd. and the Gas Authority of India Ltd.‚ hold the remaining interests. 11 East Timor ConocoPhillips has begun producing gas from two wells on its Bayu-Undan Field in the Bonaparte Basin, reports IHS Energy. First condensate production from the field is expected in April 2004, and will reach around 115,000 bbl. per day by the end of the year. The $1.5-billion project includes a gas pipeline from the field to Darwin, Australia, and construction of a liquefied natural gas facility. Bayu-Undan was discovered in 1995 and is on permits 03-12 and 03-13 in the Joint Petroleum Development Area between East Timor and Australia. Recoverable reserves are estimated at 400 million bbl. of condensate and LNG, plus 3.4 trillion cu. ft. of gas. ConocoPhillips' partners in the project are Santos Ltd., Inpex,Toyko Electric Power Co. Inc. and Tokyo Gas Co. Ltd. 12 Australia Five new exploration permits have been awarded by the Australian government. In the prolific Carnarvon Basin offshore Western Australia, 1Woodside Petroleum ´´ has received permit WA-350-P and 1BHP Billiton M• has received permit WA-351-P. Also offshore Western Australia, Chimelle Petroleum Ltd., a subsidiary of Voyager Energy Ltd., has taken permit WA-349-P in the Perth Basin. In the lightly explored Sorell Basin offshore western Tasmania, permit T/36P was awarded to 1Santos Ltd. and Unocal. And, 1Kerr-McGee Corp. has taken deepwater permit EPP 33 in the Otway Basin, offshore South Australia.

Recommended Reading

The ABCs of ABS: Financing Technique Shows Flexibility and Promise

2024-07-29 - As the number of ABS deals has grown, so have investors’ confidence with the asset and the types of deals they are willing to underwrite.

Investor Returns Keep Aethon IPO-ready

2024-10-08 - Haynesville producer Aethon Energy is focused on investor returns, additional bolt-on acquisitions and mainly staying “IPO ready,” the company’s Senior Vice President of Finance said Oct. 3 at Hart Energy’s Energy Capital Conference (ECC) in Dallas.

The ABCs of ABS: Financing Technique Shows Flexibility and Promise

2024-07-29 - As the number of ABS deals has grown, so have investors’ confidence with the asset and the types of deals they are willing to underwrite.

Aethon, Murphy Refinance Debt as Fed Slashes Interest Rates

2024-09-20 - The E&Ps expect to issue new notes toward redeeming a combined $1.6 billion of existing debt, while the debt-pricing guide—the Fed funds rate—was cut on Sept. 18 from 5.5% to 5%.

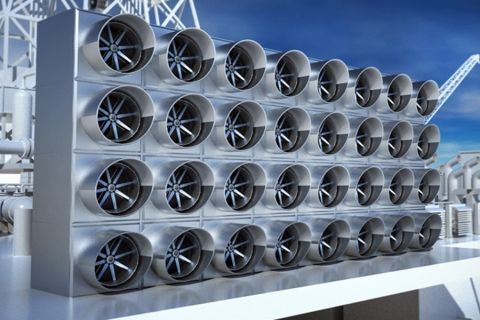

Optimizing Direct Air Capture Similar to Recovering Spilled Wine

2024-09-20 - Direct air capture technologies are technically and financially challenging, but efforts are underway to change that.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.