In the Lower 48, NOV’s onshore activities were robust in the Permian Basin, but production curtailments by gassy E&Ps and the effects of widespread consolidation are being felt. (Source: Shutterstock)

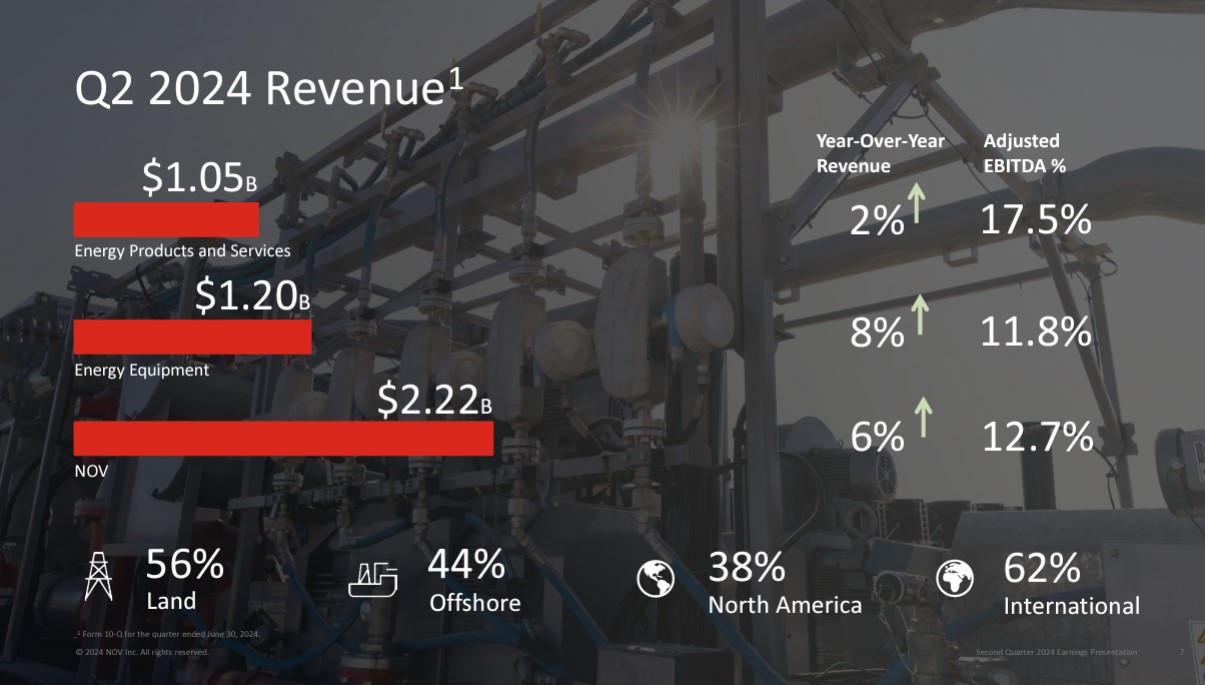

Despite weakness in North American drilling activity, NOV’s second-quarter 2024 revenue grew to $2.22 billion — a 6% increase year-over-year (yoy), the company reported in its July 26 earnings report. The rise was spurred by the company’s higher technology adoption and gains in international markets.

NOV’s performance internationally and offshore more than offset a modest 1% decline in North American sales, Evercore ISI analysts said in a July 26 commentary.

Even with successes internationally, second-half 2024 still presents a “challenging picture,” for the company in North America, said Clay Williams, president and CEO of NOV, during a July 26 earnings call.

In the Lower 48, NOV’s onshore activities were robust in the Permian Basin, but production curtailments by gassy E&Ps and the effects of widespread consolidation are being felt. That’s led to reduced wellhead revenues and diminished cash flows for operators, impacting NOV’s drilling economics.

“Growth in the Permian offset declines in other areas of the U.S., resulting from lower activity in gas basins and the cooling effect consolidation among oil and gas producers continues to have on activity,” NOV CFO Jose Bayardo said during the call. “Internationally, bit rentals and borehole enlargement services improved slightly on increasing activity in the Middle East, more than offsetting lower activity in Latin America.”

In the second quarter, NOV reported an 8% yoy decline in energy equipment revenues in the U.S., reducing its share of segment revenue to 25%.

Despite that, NOV managed to achieve a 3% yoy revenue increase in its energy products and services segment. The increase was driven by market share gains from new products and technologies and revenue from the January acquisition of energy services and equipment company, Extract.

“While we are increasingly cautious about continued headwinds in North America, we think continued rising demand in offshore and international space will yield a book to bill greater than one for the second half of 2024,” Williams said.

NOV also highlighted a record-setting achievement. The company’s advanced drilling technologies helped a Bakken producer set a new speed record for a drilling a 3-mile lateral. NOV said the well was drilled 8% faster than the previous record.

Williams said that exploration in new offshore basins, greenfield and brownfield offshore development for both oil and gas and international development of unconventional resources “are emerging as the primary growth drivers for NOV, as the strength and duration of this cycle remains on display.”

More globally, stable oil prices and strong long-term outlook for natural gas and LNG are supporting E&P investments, Williams said.

NOV’s outlook suggests a surge in offshore projects increasing demand for offshore production assets. National oil companies are also planning higher spending to meet production goals, which will benefit the company.

As a key player in the drilling equipment business, NOV supports much of the global offshore drilling fleet and is experiencing strong order levels for its products and services. The company is seeing high demand due to reactivating and retrofitting drilling rigs, as well as providing corrosion-resistant equipment and production technologies.

For international land developments, NOV sees operators needing newer and more advanced drilling and production technologies similar to those used in North American shale.

NOV reported that its automation and robotics suite is gaining traction, with multiple system orders secured for rigs worldwide, including land rigs in North America and deepwater rigs in South America and Southeast Asia.

NOV also announced a series of strategic agreements and technological advancements that underscore its role in the oil and gas sector.

The company signed a framework agreement with a major Norwegian oil and gas operator to deploy its Downhole Broadband Solutions wired drill pipe technology across all the operator’s North Sea rigs. NOV also secured orders for eight third-generation all-electric cranes and a contract for slewing and tilting systems for sail masts, helping a European client reduce its shipping fleet’s carbon footprint.

In the Middle East, NOV expanded its data aggregation and delivery services with two major orders, supplying its RigSense technology for 10 newbuild rigs and providing upgrades for 27 offshore rigs. Additionally, NOV received maintenance and licensing orders for its OrionNET, Max Completions and Cerberus well intervention software, showcasing its advancements in surface sensors and well intervention technologies.

Earnings overview

NOV’s net income rose to $226 million in the quarter, up from $155 million yoy. Adjusted EBITDA grew 15% yoy to $281 million, reflecting a 12.7% margin, the company’s highest since 2015.

NOV’s backlog is the highest since 2015 and free cash flow increased to $350 million. The company accelerated shareholder returns and is also repurchasing shares and increasing dividends.

Recommended Reading

Hydrogen Hopefuls Advised to Focus on Offtake Amidst Funding Turbulence

2025-04-09 - Hydrogen is one way to reduce emissions when used in place of higher-emissions fossil fuel sources where feasible, but costs and infrastructure pose challenges.

Baker Hughes CEO: Expect ‘Volatility, Noise’ Around Energy Transition

2025-03-12 - Baker Hughes and Linde executives spoke about lower carbon resources such as hydrogen and geothermal, which will be part of the energy mix but unlikely to displace natural gas.

API’s Multi-Pronged Approach to Lower Carbon Operations

2025-01-28 - API has published nearly 100 standards addressing environmental performance and emissions reduction, which are constantly reviewed to support low carbon operations without compromising U.S. energy security.

Energy Transition in Motion (Week of March 14, 2025)

2025-03-14 - Here is a look at some of this week’s renewable energy news, including a record-breaking year for solar capacity additions.

CF Industries Form JV to Build $4B Low-Carbon Ammonia Project in Louisiana

2025-04-08 - CF Industries has reached a FID with JERA and Mitsui for an ammonia production facility in Louisiana. CF Industries sealed a deal with Occidental’s 1PointFive to capture and store CO2 from the facility.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.