North Dakota’s Lake Sakakawea provides a backdrop for Dakota Plains’ Pioneer Terminal at New Town. All photos courtesy of Dakota Plains Holdings Inc.

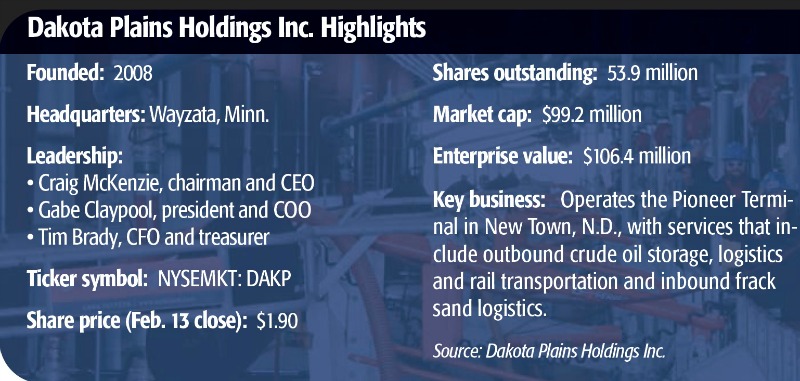

Dakota Plains Holdings, based in Wayzata, Minn., owns and operates the Pioneer Terminal at New Town, N.D., one of the largest crude-by-rail transloading operations in the Williston Basin. Its CEO discusses the future of the Bakken/Three Forks plays in general and crude by rail in particular.

MIDSTREAM: Your career has been in the energy industry. Has it been a challenge for you to learn the railroad business?

McKENZIE: Well, I’m still in the energy business! It’s just that instead of moving oil from underground to a surface facility, I’m moving it from that point to the refinery. I’m very closely linked to E&P activity in the basin and certainly our suppliers; I can relate to when they have upsets. Also, it weighs into discussions we have about building future supplies.

At the end of the day, we’re a small-cap midstream company that’s growing at a fast pace, so we’re having to be very disciplined in our governance of the company—also just as carefully managing the balance sheet. It’s very easy for a small-cap to get out over its skis, so we are very conscious that we must work at a fast, but measured pace consistent with the demand flow of what we do.

MIDSTREAM: Dakota Plains’ Pioneer Terminal has grown very fast since it started up in early 2009. How have you managed that rapid expansion?

McKENZIE: The customer demand is what was driving the phases of expansion and we’re expanding again, today, with our storage capacity growing from 180,000 barrels (bbl) to 270,000 bbl. We have construction underway, notwithstanding we’re in the dead of winter.

Craig McKenzie is CEO of Dakota Plains Holdings Inc.

We didn’t have a single down day in our operations this past year. We started up a new facility last January, we have run it very prudently and we’ve made it very reliable with the latest technology. We have redundancies built into it. Therefore when we have upsets—there are always unplanned events—we have room to move and as such, we’ve been very consistent in providing customer service. Our customers seem to be happy with our performance.

MIDSTREAM: You recently bought out your joint-venture partner and refinanced your debt. How have these changes impacted your growth and operations plans?

McKENZIE: The transactions that we just completed were transformational for the company. They allowed us to take control of our own destiny instead of being subject to operations run by our partners in some cases. They allow us to essentially own all the assets and make a very simple business model.

We’ve been able to exit from trucking and from marketing and concentrate on our core capability, which is transloading. We elected to take our rail car fleet as part of this transaction because it’s an enabler to getting more customers into our transloading business. We are able to now offer the use of our rail fleet to new customers who may be short of their own cars.

This is a great place for us to be now. We now have line of sight on significant growth. We are many times oversold in terms of demand for throughput, it’s really all about volume and we need to continue to increase.

The transactions we just completed, there were four of them altogether, unlock all this potential. Otherwise, we were always one step away from this success.

MIDSTREAM: Trucking is an important link in the midstream. How is it changing in your service region?

McKENZIE: First, our involvement in trucking was more about security of supply. We wanted to ensure that the barrel was delivered in a timely manner from the wellhead to our facility, and if you look back in time, trucking was irregular in the basin. We did not enter trucking to make it a core business or to make a lot of money but rather to just ensure that the other parts of our business could make money with the ontime delivery of barrels.

The New Town terminal has emerged as a transportation hub for the currently most-active area of the Bakken play.

That model worked, but as we evolved we thought it was prudent to go ahead and take an extra step and simplify the company. The entire basin is becoming more efficiently connected by pipeline, and trucking will not hold the market share that it did just a couple years ago.

Pipelines are more efficient in terms of cost and reliability, especially in inclement weather conditions. We think it was a smart move for us to just remove ourselves, to exit trucking altogether, and focus on our terminal and focus on pipeline deliveries. Any trucking that we need done, we can simply contract it.

MIDSTREAM: Your terminal handles a substantial volume of frack sand in addition to oil. Is it difficult to coordinate inbound sand and outbound oil through the same terminal?

McKENZIE: No, it’s not. The volume of oil that we move far exceeds the sand. We bring in about 230 cars of sand per month. That’s in contrast to 22 or so unit trains of oil, outbound, per month.

It does take some coordination in planning with Canadian Pacific Railway and frack sand producer UNIMIN Corp.—because the sand is on behalf of UNIMIN. We’re able to bring in the sand timely, safely, and offload it, then store the empty cars on site until they’re picked up by Canadian Pacific. With the scale we’re talking about, sand has not been a problem.

We have four ladder tracks that are not in use. These used to be how we moved all outbound traffic before we commissioned the Pioneer Terminal’s double loop, and we’ve kept these tracks in reserve for future business. That future business could be expansion of the UNIMIN Terminal. We’ve been in discussions for other commodity materials, such as NGLs outbound, which we think our site is well situated for—as well as other commodity materials inbound, such as pipe or bulk drilling materials.

That said, we haven’t made any decisions. We have open dialogue with Canadian Pacific so we can all plan together. We all have to move in unison and make sure that it works.

We are aware of traffic problems, but what we’re talking about in terms of traffic is not anything like what we hear the BNSF Railway experiences every day in the basin.

MIDSTREAM: Is it a plus to be served by Canadian Pacific?

McKENZIE: Yes, and where the Bakken terminals are located tells the story. There are 11 on BNSF and there are three on Canadian Pacific, so when each of these terminals is trying to deliver a unit train every day or every other day—depending on which terminal you’re talking about—that’s a lot of inbound and outbound because they go out full, they come back empty. You have traffic going both ways in addition to other goods that are using these same railways for the farmers or other customers.

MIDSTREAM: The decline in crude prices has narrowed the spread between Bakken crude and marker crudes, such as West Texas Intermediate and Brent. Do you expect the Bakken to remain a growing play in the foreseeable future, given the current price environment?

McKENZIE: The Bakken is producing over a million barrels a day (bbl/d). It stands to have decades-more growth based on its potential. It’s certainly the largest, and possibly the most attractive basin, in all of North America. It won’t go away easily, even in a pricing-stressed environment. The East Coast refineries are demand centers for this oil and they have a choice between waterborne bbl, which are Brent priced, or continental bbl that come from a number of areas. But Bakken is their primary source based on the rail infrastructure.

There has to be a viable value chain to stay in place and, as such, the continental barrels need to be cost competitive. And with the value chain component in the middle, the supplier and the end user have to give and take if Bakken is going to be cost competitive to Brent. We’re in an interesting situation right now where the give on the part of the Bakken producers is now approaching their operating costs.

It’s a unique situation. I don’t have a silver bullet for it, but I would say, ultimately, the oil’s going to move, and the bigger producers in the Bakken are well situated to weather the storm and still produce oil basically at close to cost, ensuring that the oil gets to market for the sake of cash flow. They have their own drilling commitments on acreage and rig contracts and so forth.

If this current situation lasts for a long period of time—I’m talking years, not months—the whole system needs to change. And then in that case, maybe costs get driven out of the value chain and everyone takes a reduced margin just to ensure that the value chain stays in place.

MIDSTREAM: The railroads have struggled with traffic congestion coming out of the Bakken. How are they accommodating the industry?

McKENZIE: The railroads have been improving their infrastructure, which in some cases means doubling the tracks or putting in more sidings. They’ve also been struggling to keep personnel in place to deal with the growing demand. In the case of Canadian Pacific, which we are more familiar with, it went through a personnel expansion this past fall and, as a result, it enables them to add more dedicated locomotives to our service. And with more locomotives, with a larger staff that is more stable, it allows trains to remain more on schedule. That in itself removes some of the congestion in the intersection centers, such as Chicago.

MIDSTREAM: What market trends do you see for Bakken crude? Where are the greatest growth prospects?

McKENZIE: It would seem that the West Coast is attempting to grow but it is meeting resistance from an environmental standpoint. The East Coast is more established and there are expansions underway there. It’s really about creating the most costefficient channel to get oil from the Bakken to the East Coast.

The Gulf Coast, obviously, has a large, integrated complex of refineries that coordinate with one another, and it’s certainly a huge demand center. We have an advantage to the East Coast based on the Canadian Pacific network. We’re at par going to the Gulf Coast, and we are slightly disadvantaged going to the West Coast. A lot of our time is focused on the East Coast and that’s where we have our customer base right now.

Our customers are the shippers and refineries, they’re not E&P producers. The E&P producers are the suppliers for those contracts but our actual contracts are with the destinations or the shippers who are managing the destinations, and we have much more alignment to the East Coast vs. anywhere else.

MIDSTREAM: How are the Bakken and Three Forks plays changing?

McKENZIE: In terms of the Bakken itself, the trend has been moving to the southwest. It’s moved through Mountrail County, N.D., where we’re located and then moved across the river into McKenzie County, N.D., and continues to trend in that direction. We’re well situated because there’s no rail infrastructure in that region.

We are in New Town where there is the Four Bears Bridge. It’s the nearest bridge over the Missouri River for 70 miles. And, we are connected with the Hiland Partners gathering system, which has connectivity to this area with its pipeline infrastructure south of the river, then goes north along the river to the east and down to us. Also south of us on the peninsula, we have Pelican Gathering Systems that is allowing us to receive production from this new, growing area. We’re ideally situated as the closest terminal to the growth hotspots.

MIDSTREAM: How will proposed changes in tank car standards change your operations?

McKENZIE: We’re indifferent to which cars come through—as long as they’re regulatory compliant. So as such, whether the existing cars remain in place or regulations come out for a new standard, our operations remain unchanged. We have flexibility built into our design to adapt to any car that comes through our facility.

We’ve been watching this very closely and engaging some of the lawmakers in the course of their discussions, but it would seem that the new standard is going to be decided sometime this year. We imagine there to be a grandfathering, for some sort of transition for the older rail car types. We think any transition is going to span several years and certainly manufacturing of any new standard cars would take some time in its own right. There would be a backlog of orders. I see all of this continuing through the back half of this decade to where we reach a point when everyone is operating with new cars.

MIDSTREAM: Will growth continue for the Bakken and Three Forks plays?

McKENZIE: E&P producers will give you a better answer than I can because I simply speak to them and read the papers, in terms of watching the trends. We’ve looked at the operators near us and can identify 15,000 well locations to be drilled within a 30-mile radius of us—and that’s probably a conservative number. That is, until the most recent downturn in oil prices and reduced drilling activity.

I think all these wells will get drilled; it just may not be at the same pace as before. That’s a tremendous amount of new volume coming online in our area. Any barrel in the entire Williston Basin is cost effective to reach our terminal.

In January, there were over 600 Bakken wells waiting on completion, to come online; oil behind the pipe. Each would come on at about 1,000 bbl/d—that is very significant. Every single company will have the incentive to finish those wells and hook them up, on top of a 1.1 million bbl/d base. So even with the curtailed capital programs that are being announced, we still expect oil to grow or at the least stay flat for this year.

MIDSTREAM: Do you expect crude by rail to remain the dominant method for getting Bakken oil to market?

McKENZIE: This is where the lower oil price is actually, in some ways, in our favor. These pipelines have their own resistance for environmental reasons and stakeholders in the areas just don’t want new pipelines. In this low oil-price environment, the pipelines have another hurdle, which is the financing.

Capital funding for these multibillion dollar projects is pretty tight. It’s certainly tighter than it’s been for the last year or two. And secondly, the E&P producers do not want to commit several years into the future for throughputs because—in this environment—they like having flexibility. Rail offers that.

We’ve seen a lot of change here in the last several months but for us, it creates a barrier of entry. The Enterprise pipeline was canceled because there was not enough sign-up. The Energy Transfer Partners pipeline is going through what appears to be an extended public hearing process because of resistance to it. Therefore, it creates a bit of uncertainty for producers to sign up. The Sandpiper Pipeline going through Minnesota, where we are, is in the papers quite a bit. They are contemplating route changes that would add years to the construction and also a lot more to the cost.

Rail is the primary way for Bakken oil to get to market and that’s for a reason—it’s actually the most efficient way for reaching markets that are far away, where there’s not enough pipeline infrastructure. The East Coast is an example. As long as we stay cost competitive for both the producer and the refinery—the end user and the supplier—then it absolutely stands to reason that it will be the dominant method for getting oil to market for the near future, I would speculate for at least the next five years.

MIDSTREAM: How can your business grow?

McKENZIE: We have take-or-pay contracts and we have a fee-based business, so our model is very simple: It is margin times volume. We have an incentive to grow the volume. With that comes some additional economies of scale and therefore, it reinforces us to become even more competitive as we get larger.

Based on the demand that we have for our Pioneer Terminal, we’re running 50,000 bbl/d, and we have a goal to grow it to about 80,000 bbl/d day toward the back half of the year. Beyond that, we have a goal to double it again. We have the capacity with another capital project to double the entire sustainable rate of the facility to 160,000 bbl/d. That’s two unit trains a day.

It’s wonderful being a fee-based business. It simplifies the model, and I have a customer base that is stable and has term contracts and I can have line of sight on our supply.

Paul Hart can be reached at pdhart@hartenergy.com or 713-260-6427.

Recommended Reading

FERC Gives KMI Approval on $72MM Gulf Coast Expansion Project

2024-11-29 - Kinder Morgan’s Texas-Louisiana upgrade will add 467 MMcf/d in natural gas capacity.

Midstreamers Say Need for More Permian NatGas Pipelines Inevitable

2024-11-26 - The Permian Basin’s associated gas output could outstrip the region’s planned capacity well before the end of the decade, pipeline company executives said.

Vivakor Expands Crude Gathering Network in Oklahoma STACK

2024-11-25 - Midstream company Vivakor is building its network following the October acquisition of Endeavor Crude.

EQT, Blackstone Credit Enter $3.5 Billion Midstream Joint Venture

2024-11-25 - Blackstone Credit & Insurance entered a joint venture with EQT Corp. to take a non-controlling interest in the Mountain Valley Pipeline and other infrastructure from the Equitrans transactions for $3.5 billion.

Exclusive: MPLX's Liquid Lines Support Growing NGL Exports

2024-11-19 - MPLX Executive Vice President and COO Greg Floerke delves into the company evolution in Appalachia and the increase in its liquids exports and production scale, in this Hart Energy Exclusive interview.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.