Offshore oil and gas platform in the Gulf of Mexico. (Source: Shutterstock)

MEXICO CITY— Venezuela is closed for business. Rumblings from Colombia suggest its president isn’t a fan of fossil fuels. Elsewhere in Latin America, Guyana has largely been overtaken by the omnipresence of Exxon Mobil’s offshore development in the Stabroek Block.

But for international oil companies (IOCs), that doesn’t mean there isn’t a place in Latin America for exploration and upstream success. Despite recent elections in Mexico throwing a wrench of uncertainty into the environment, five IOCs are seeing opportunities with one of the U.S.’ closest energy trading partners.

IOCs already active in Mexico’s upstream sector include Australia’s Woodside Energy Ltd., Germany’s Wintershall Dea, Italy’s Eni SpA, U.S.’ Talos Energy and the U.K.’s Harbour Energy.

Mexico’s historic legislative energy reform, launched under former president Enrique Peña Nieto (2012-2018), opened the country’s oil, gas and energy sectors to foreign investment, attracting foreign and domestic players looking to enter the market.

That momentum stopped under president Andrés Manuel López Obrador (2018-2024), a proponent of Mexico’s energy sovereignty. His nationalistic stance has often come at the cost of the foreign and domestic private sector.

In particular, AMLO favors continued support for Mexico’s state-owned electrical utility, the Federal Electricity Commission (CFE), and state-owned oil and gas company Petróleos Mexicanos (Pemex).

Policy changes for domestic production aren’t likely going to change under the Morena Party’s next president Claudia Sheinbaum Pardo (2024-2030).

Pemex, which dominates Mexico’s upstream sector, produced an average 1.78 MMbbl/d of liquids in June 2024, down 27% from an average 2.43 MMbbl/d in 2014, according to details in a recent Pemex investor presentation.

But overall, Mexico’s lack of an energy reform hasn’t stopped IOCs with strong balance sheets and know-how from participating offshore, where Pemex has the lesser hand. Projects pursued by IOCs hold potential to counter long-term production declines from Mexico.

Talos: Game-changing potential

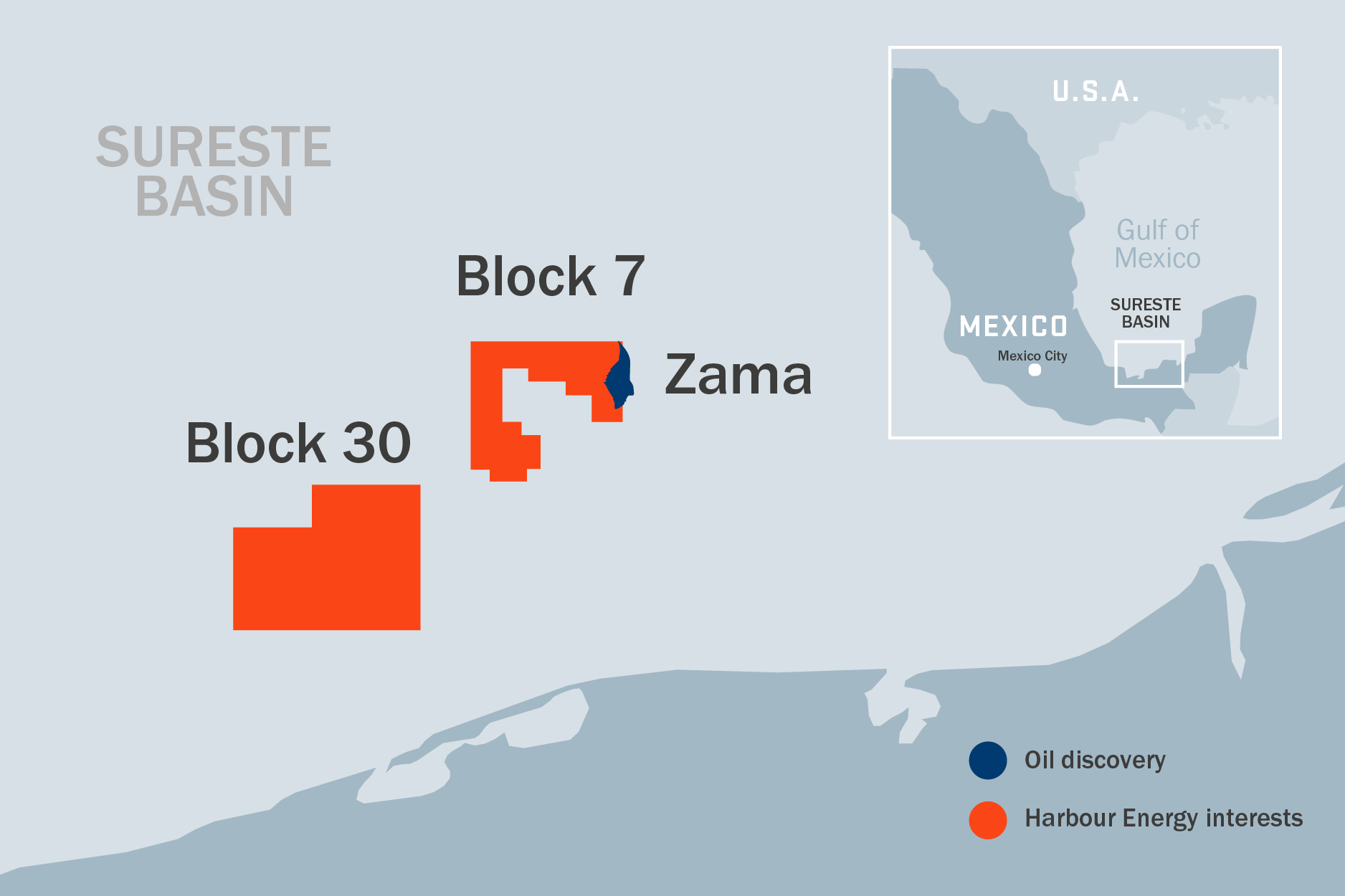

Houston-based Talos’ area of focus in Mexico is the Block 7, Zama Unit segment located within the Sureste (Southeast) Basin. Block 7 is a prolific proven hydrocarbon province in the shallow waters off the coast of Mexico’s Tabasco state.

Identified in 2017, the Zama field discovery was the first in Mexico announced by an international consortium. At the time, Talos was the project’s operator, along with partners Sierra Oil and Gas and Premier Oil Plc. Today, Talos is joined by Pemex, now at the helm of the Zama project after being designated as operator by Mexico’s Energy Secretariat (Sener), Harbour, Wintershall Dea and Mexico’s Grupo Carso.

RELATED

Mexico’s Zama Drama Eases, but Not Over for Talos, Other IOCs

The Block 7 consortium partners could take final investment decision (FID) for Zama in late 2024 or sometime in 2025, according to experts at Welligence Energy Analytics, Enverus Intelligence Research and Pickering Energy Partners. However, the Paris-based International Energy Agency (IEA) concurs with the 2025 date.

Zama is one of the world’s largest shallow water discoveries in the past 20 years. The project has been granted “strategic project” status by both Mexico’s federal government and Pemex.

Initial production of up to 180,000 bbl/d could start by 2030, according to independent estimates published by the consortium partners. For its part, the IEA has pegged Zama’s peak production at 150,000 bbl/d. Production is expected to be 94% oil of “excellent quality,” with API gravities between 26° API and 29° API, according to Talos.

Wintershall Dea: Fastest growing business unit

Hamburg-based Wintershall Dea first moved into Mexico in 2017. The German company has since been active in numerous exploration, development and production projects onshore and offshore Mexico, including Zama, Hokchi, Ogarrio, Block 29 and Block 30—making the country Wintershall’s fastest growing business unit.

Wintershall is a partner in the Zama field, and like other partners in the project, is eyeing FID this year or next.

In March 2023, Wintershall acquired a material interest in the shallow-water Hokchi field. The field boasts gross production of around 24,500 boe/d. Wintershall holds a 37% non-operated interest in the field, making it the second largest interest holder after operator Hokchi Energy.

Hokchi is developed as a subsea tie-back of the producing wells to two offshore platforms: Hokchi Central and Hokchi Satellite. Hokchi was brought online in May 2020 following an appraisal campaign.

In 2018, Wintershall received a 50% license share and the operatorship of the Ogarrio onshore oil field. Ogarrio was discovered in 1957 and currently has around 80 active wells. The field is located about 107 km west of Villahermosa, in the state of Tabasco, Mexico.

Ogarrio’s main reservoirs are in the Miocene and Pliocene rocks. A waterflood project has been initiated and matured and is expected to improve the overall recovery of the Ogarrio field.

In May 2020, Wintershall Dea and its partners announced two oil discoveries: Polok and Chinwol. The former opened a new play within Mexico’s Salina Basin in the Sureste Basin and was appraised in 2021. Partners in both discoveries are all on board for a drilling and completion strategy within an FPSO development concept.

In April 2023, Wintershall made a major oil discovery at its first owned and operated offshore exploration well, Kan, located in the shallow waters of the Salina Basin. The well may contain between 200 MMboe to 300 MMboe in place, according to the Germany company.

The Block 30 appraisal plan was submitted to Mexico’s National Hydrocarbon Commission (CNH) at the end of 2023 and approved in February 2024.

Wintershall Dea operates Block 30 with a 40% interest with partners Harbour (30%) and Sapura OMV (30%).

Harbour: Potential to materially add to reserves

London-based Harbour announced an agreement on Dec. 21, 2023 to acquire substantially all of Wintershall Dea’s upstream oil and gas assets for $11.2 billion. The acquisition will be funded through porting of existing investment grade bonds from Wintershall Dea, Harbour equity and cash.

The Wintershall transaction will mark Harbour’s fourth major acquisition since the U.K. company’s creation in 2014 and represents the most transformational deal in the company’s short time in existence. The acquisition, slated for completion in fourth-quarter 2024, will increase Harbour’s production to close to 500,000 boe/d and adds significant positions in Norway, Germany, Argentina and Mexico.

In Mexico, Harbour is already active in the Zama development and Block 30 and will assume positions in the country held by Wintershall Dea including interests in Zama, Hokchi, Ogarrio, Block 29 and Block 30.

Harbour participates in Zama with a 12.39% non-operated interest. After the Wintershall Dea deal closes, Harbour’s interest will rise to 32%. An FID at Zama would result in close to 75 MMboe of 2C resources moving into the 2P reserve category, which would replace over a year of Harbour’s current production.

Harbour participates in Block 30 to the southwest of Zama with a 30% non-operated interest. As a result of the Wintershall Dea acquisition, Harbour will become operator of Block 30 with a commanding 70% interest.

In 2023, Harbour completed two exploration wells, which targeted the Kan and Ix prospects.

The Kan-1 well was an oil discovery and resulted in the addition of 29 MMboe to Harbour’s 2C resources at the end of 2023. A plan to appraise the Kan discovery in 2024 has been approved by regulator CNH.

Harbour’s second commitment well, Ix-1EXP, was unsuccessful and has been plugged and abandoned.

Eni: Mexico a core country for organic growth

Rome-based Eni is currently one of the main foreign operators in Mexico. The company holds rights in eight E&P blocks in the Sureste Basin, of which it serves as an operator for seven of them. Mexico is a core country in Eni’s push for organic growth.

Eni established its presence in Mexico in 2006. In 2015, Eni formed its wholly-owned subsidiary Eni Mexico S. de RL de CV and commenced activities in the Gulf of Mexico (GoM) with the purchase of Area 1 in the Sureste Basin. Current production from the Area 1 phased development, expected to be finished by 2025, is over 30,000 boe/d, according to Eni. In 2021, Eni said it expected Area 1 production to reach a plateau of 90,000 boe/d in 2025.

Successful results between 2020-2024 at Block 9 (Yopaat-1), alongside the discoveries in Eni-operated Block 7 (Yatzil-1) and Block 10 (Sayulita-1 and Saasken), point to estimated resources in place that exceed 1.3 Bboe. Such resources will allow Eni to advance with studies towards a potential future “hub” development, including discoveries and other prospects present in the area, in synergy with the infrastructures located nearby.

In July 2024, Eni announced a discovery at the Yopaat-1 EXP exploration well in Block 9. Yopaat-1 is located 63 km off Mexico’s coast in the mid-to-deep waters of the Cuenca Salina in the Sureste Basin. Yopaat-1 was drilled in a water depth of 525 m and reached a total depth of 2,931 m.

The well found around 200 m of net pay of hydrocarbon bearing sands in the Pliocene and Miocene sequences, subject to an intense subsurface data acquisition campaign. Preliminary estimates indicate a potential of 300 MMboe to 400 MMboe in place.

Eni operates Block 9 with a 50% participating interest. Spain’s Repsol SA holds the remaining 50%.

In March 2023, Eni announced the Yatzil-1 discovery in Block 7 contained an estimated 200 MMboe in place. Yatzil-1 was the second commitment well on Block 7 and the eighth successful one drilled by Eni in the Sureste Basin.

Yatzil-1 found in excess of 40 m of net pay sands with good quality oil in the Upper Miocene sequences with excellent petrophysical properties confirmed by an extensive subsurface data collection.

Eni operates Block 7 with a 45% interest. Other partners in Block 7 include Capricorn (30%), formerly known as Cairn Energy PLC, and Citla Energy (25%).

Yatzil-1 followed successful discoveries in Block 10 at the Sayulita-1 exploration well and the Saasken exploration well in 2020. Eni operates Block 10 with a 65% interest with partners Lukoil (20%) and Capricorn (15%).

In 2021, Sayulita-1 found 55 m of net pay of good quality oil in the Upper Miocene sequences. The reservoirs show excellent petrophysical properties. According to preliminary estimates, the discovery may contain 150 MMboe to 200 MMboe in place.

In 2020, Saasken-1 found 80 m of net pay of good quality oil in the Lower Pliocene and Upper Miocene sequences. Eni estimates the find contains 200 MMboe to 300 MMboe in place.

Woodside: Mexico’s first deepwater production

Perth, Australia-based Woodside, following its merger with BHP Petroleum, is active offshore Mexico in the Trion field. Trion was discovered by Pemex in 2012, and in 2017 BHP and Pemex signed an agreement for its development.

Woodside announced Trion’s $7.2 billion FID in June 2023. It represented Woodside’s first major investment decision following its merger with BHP. Trion checks key production, climate and financial boxes for Mexico, the project’s operator Woodside (60% interest) and its partner Pemex (40% interest).

Trion is located in the Perdido Fold Belt in the GoM. The project is set in a water depth of 2,500 m and located 180 km off the Mexican coastline and 30 km south of the U.S./Mexico maritime border. Trion is a greenfield development and would represent the first oil production to come from Mexico’s deepwater. Future discoveries have potential to be tied back to Trion facilities.

Trion represents Woodside’s fourth major project in the U.S./Mexico GoM. The others being Shenzi, Atlantis and Mad Dog on the U.S. side of the maritime border.

RELATED

Woodside’s $7.2 Billion Bet on Deepwater Mexico Potential

A floating production unit (FPU) with a nameplate capacity of 100,000 bbl/d will be used to process Trion’s production. According to Woodside, the FPU can process up to 120,000 bbl/d in the early producing years of the field with no water breakthrough. First oil is expected in 2028.

Trion will have an all-in breakeven below $50/bbl and then below $43/bbl, excluding the Pemex capital carry, according to Woodside. Trion is also expected to deliver an IRR that exceeds 16%. Excluding the Pemex capital carry, the IRR exceeds 19%.

Trion’s average carbon intensity is expected to average 11.8 kg CO2e/boe during the life of the field, which is lower than the global deepwater oil average.

Recommended Reading

More Players, More Dry Powder—So Where are the Deals?

2025-03-24 - Bankers are back and ready to invest in the oil and gas space, but assets for sale remain few and far between, lenders say.

Kissler: Gas Producers Should Still Hedge on Price

2025-03-27 - Recent price jumps and rising demand don’t negate the need to protect against future drops.

Italy's Intesa Sanpaolo Adds to List of Banks Shunning Papua LNG Project

2025-02-13 - Italy's largest banking group, Intesa Sanpaolo, is the latest in a list of banks unwilling to finance a $10 billion LNG project in Papua New Guinea being developed by France's TotalEnergies, Australia's Santos and the U.S.' Exxon Mobil.

Oil, Gas and M&A: Banks ‘Hungry’ to Put Capital to Work

2025-01-29 - U.S. energy bankers see capital, generalist investors and even an appetite for IPOs returning to the upstream space.

Argent LNG, Baker Hughes Sign Agreement for Louisiana Project

2025-02-03 - Baker Hughes will provide infrastructure for Argent LNG’s 24 mtpa Louisiana project, which is slated to start construction in 2026.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.