Eni’s deal to acquire Ithaca Energy marks a “strategic move to significantly strengthen its presence” on the U.K. Continental Shelf and “ticks all of the boxes” for the Italian energy company. (Source: Shutterstock.com)

A deal to combine Eni SpA’s U.K. E&P activities with England’s Ithaca Energy “ticks all of the boxes” for the Italian company and creates a new satellite in the company’s portfolio, Eni CFO Francesco Gattei said during its first quarter 2024 webcast.

In the deal revealed, announced on April 23, the two companies agreed to combine substantially all of Eni’s upstream assets in the U.K. with Ithaca, excluding East Irish Sea assets and carbon capture utilization and storage (CCUS) activities.

“We believe that the hydrocarbon potential of the U.K. Continental Shelf (UKCS) remains relevant, and we have immediately leveraged on our enhanced U.K. portfolio after the acquisition of Neptune [Energy Group Ltd.] to further reinforce our long-term positioning in the country,” Gattei said April 24 in his opening remarks during the webcast.

Eni said the deal marked a “strategic move to significantly strengthen its presence” on the UKCS, the company said in its first-quarter 2024 financial press release. The deal is valued at about $938 million, according to Reuters.

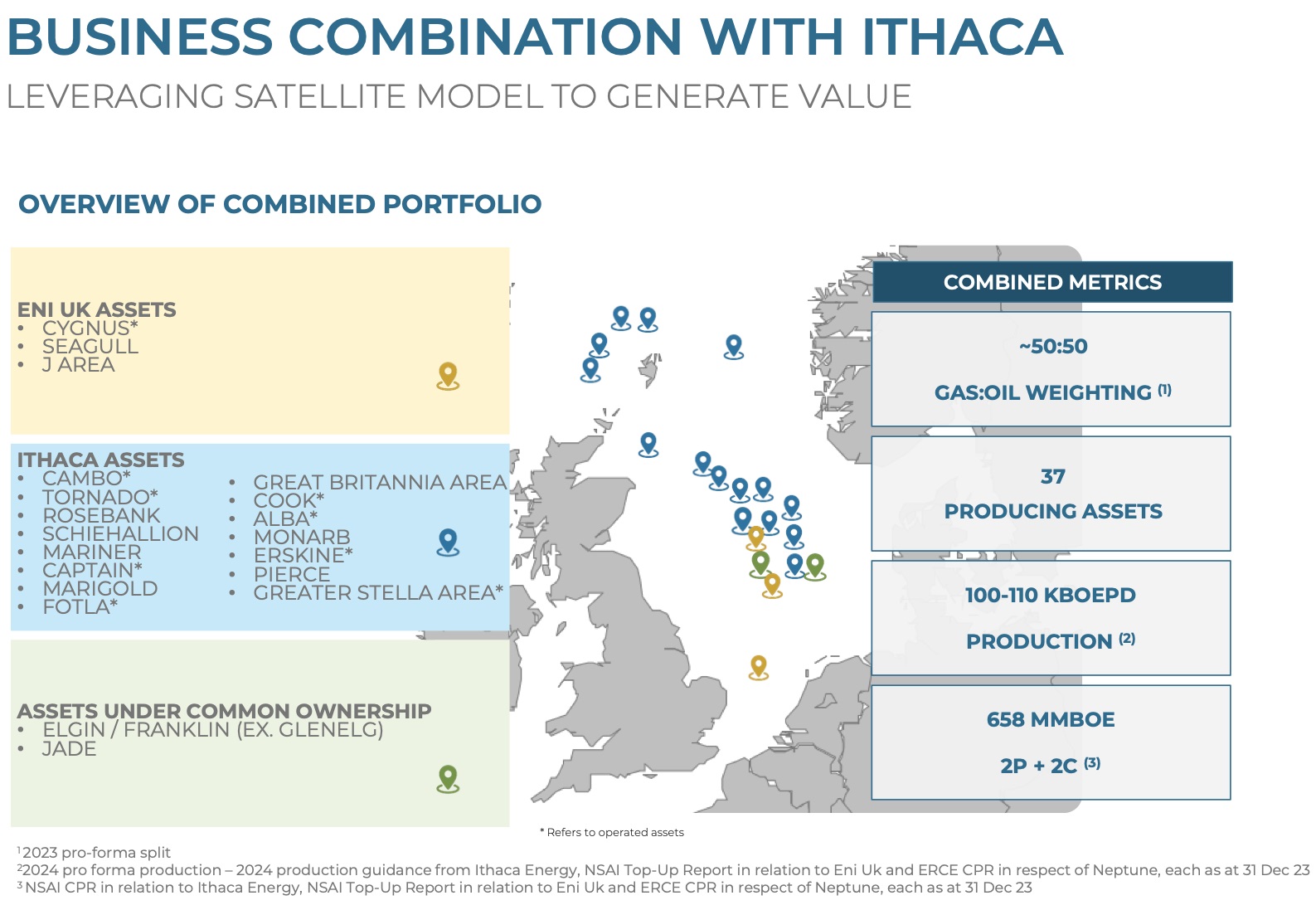

The combined company will be one of the largest oil and gas companies in the UKCS and play a key role in regional energy supply security, according to Eni. “The combination is aimed at replicating the previous successful execution of upstream combinations that Eni has formed using its distinctive Satellite Model,” the company said.

The combined company will have long-life proved plus probable (2P) reserves and estimated contingent resources of 658 MMboe, with resource life in excess of 15 years based on 2023 pro-forma production. It will also retain interests in 37 producing assets and stakes in six of the 10 largest fields on the UKCS (including Rosebank, Cambo, Schiehallion, Mariner Area, Elgin/Franklin and J-Area).

The combination immediately creates a company with 2024 pro-forma production of between 100,000 boe/d and 110,000 boe/d. The assets have the potential to organically grow production to 150,000 boe/d by the early 2030s, Eni said.

Eni will transfer its U.K. business in exchange for 38.5% of Ithaca’s share capital. Existing shareholders in Ithaca own the other 61.5% of the combined new company. The deal is expected to close in third-quarter 2024. The effective date of the deal is June 30.

In June 2023, Eni and Vår Energi ASA reached an agreement to acquire Neptune, an independent E&P company with a portfolio of gas-oriented assets and operations in Western Europe, North Africa, Indonesia and Australia. Eni acquired assets in Neptune’s entire portfolio except for its operations in Germany and Norway.

“In the first quarter 2024, we have accelerated in executing the transformation of our portfolio through different high value platforms of growth in both the legacy and transition businesses,” Eni reported in its first quarter 2024 press release, citing CEO Claudio Descalzi. “With the closing of the acquisition of Neptune and the announced U.K. focused combination with Ithaca in the upstream, we will reinforce our exposure to gas and to OECD countries.”

With the acquisition of Neptune, which Eni completed in January 2024, and now the proposed acquisiton of Ithaca, Eni is moving from a mature and marginal position in the U.K. to a leading status in terms of production, Gattei said.

RELATED Eni, Vår Energi Wrap Up Acquisition of Neptune Energy Assets

When the deal closes, Gattei said Eni will have access to operating and cost synergies and the optionality needed to succeed in a mature basin.

“Together with our existing activities in carbon capture and storage (CCS), which were also boosted with the Neptune purchase, and our participation in the giant Dogger Bank wind farm development, we are establishing ourselves as a significant participant in the U.K. energy industry as it grows and decarbonizes,” Gattei said.

Recommended Reading

Aris CEO Brock Foresees Consolidation as Need for Water Management Grows

2025-02-14 - As E&Ps get more efficient and operators drill longer laterals, the sheer amount of produced water continues to grow. Aris Water Solutions CEO Amanda Brock says consolidation is likely to handle the needed infrastructure expansions.

Halliburton, Sekal Partner on World’s First Automated On-Bottom Drilling System

2025-02-26 - Halliburton Co. and Sekal AS delivered the well for Equinor on the Norwegian Continental Shelf.

E&P Highlights: March 3, 2025

2025-03-03 - Here’s a roundup of the latest E&P headlines, from planned Kolibri wells in Oklahoma to a discovery in the Barents Sea.

How DeepSeek Made Jevons Trend Again

2025-03-25 - As tech and energy investors began scrambling to revise stock valuations after the news broke, Microsoft Corp.’s CEO called it before markets open: “Jevons paradox strikes again!”

Pair of Large Quakes Rattle Texas Oil Patch, Putting Spotlight on Water Disposal

2025-02-19 - Two large earthquakes that hit the Permian Basin, the top U.S. oilfield, this week have rattled the Texas oil industry and put a fresh spotlight on the water disposal practices that can lead to increases in seismic activity, industry consultants said on Feb. 18.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.