Source: Hart Energy

Barring second thoughts or a last-minute deal, private Southern Delaware E&P Jagged Peak Energy plans to launch an IPO Jan. 27 that could raise nearly $800 million in capital and value the company at $3 billion.

Backed by private-equity firm Quantum Energy, Jagged Peak’s acreage lies on the eastern edge of an area that has seen intense A&D activity by Parsley Energy Inc. (NYSE: PE), Diamondback Energy Inc. (NASDAQ: FANG), Callon Petroleum Co. (NYSE: CPE) and most recently Noble Energy Inc. (NYSE: NBL). The company said it expects net proceeds of about $420 million from the IPO.

Jagged Peak will be a test case for a region where public companies have made purchases and then made public equity offerings to pay for them. The company would be the first Delaware Basin company to make it to market—others that contemplated IPOs were bought out before launching them.

Bob Brackett, an analyst at Bernstein Research, questioned whether the company’s IPO is priced too high. Deals near to the company’s acreage have priced between $25,000 and $40,000 per acre.

“We estimate that the midpoint of the indicated price range [of $17 per share] would put a price of $50,000 per acre on [the company’s acreage],” Brackett said.

But other analysts said that’s been a theme of Permian deal making: buy high and go to the market even higher.

Denver-based Jagged Peak is led by Joseph N. Jaggers, who served as president and CEO of Ute Energy LLC and president and CEO of Bill Barrett Corp. (NYSE: BBG). The company was formed in 2013.

The company holds roughly 67,000 net acres and average working interest of 92% on contiguous blocks in Winkler, Ward, Reeves and Pecos counties, Texas. In September, the company entered purchase and swap agreements that added 6,389 net undeveloped acres to its position, according to Securities and Exchange Commission (SEC) filings.

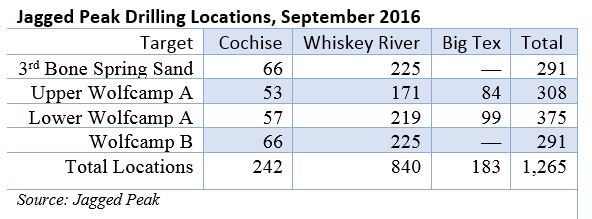

As of September, the company estimated an inventory of 1,265 gross horizontal drilling locations with an average lateral length of 7,426 ft, without taking into account its recent transactions.

Jagged Peak drilled and completed 16 horizontal wells through 2016. The company operates about 98% of its acreage position.

Based on the wells the company and other operators have drilled, Jagged Peak considers the Lower Wolfcamp A, Upper Wolfcamp A, Wolfcamp B and 3rd Bone Spring Sand formations “significantly delineated” across its acreage.

The company more than doubled oil production through the first nine months of 2016 and, compared to the same period in 2015, revenues were 123% or $28.4 million higher.

Worth It?

Brackett said two recent Permian companies considering IPOs didn’t come close to Jagged Peak’s asking price.

Brigham Resources Operating LLC, for instance, fetched a price of roughly $24,000 per acre from Diamondback in December. Centennial Resource Production LLC was purchased at $35,000 per acre, he said.

Jagged Peak hasn’t been purchased, and Brackett said it’s because the asking price is “aggressive.”

“In our coverage, the read across from the … IPO is most relevant to Noble Energy,” which was purchased at $32,000 per acre, he said.

Sam Burwell, an analyst at Canaccord Genuity, told Hart Energy he considered Jagged Peak a potential acquisition candidate for Noble Energy, which said Jan. 16 it will acquire Clayton Williams Energy Inc. (NYSE: CWEI) for $3.2 billion.

Burwell said public Permian companies trade at substantially richer valuations of about $50,000 per acre than private E&Ps, which tend to be valued at $20,000 to $40,000 per acre.

The broader story of the Permian A&D has been that differential—public E&Ps trading at high multiples chasing deals with private companies.

Public companies can make the argument that their attractive asset bases, good balance sheets and production growth can make a $40,000 per acre acquisition profitable.

With commodity prices high enough, they can add rigs, grow production and get cash flow back quickly enough that the value of an acquired asset will be greater than the purchase price.

“That equity is very highly valued and it allows them to sell that equity to finance acquisitions of relatively undervalued private companies,” Burwell said. “So there’s been this sort of arbitrage going on where the public companies sell their stock to buy these privately held assets and they’ve been able to do it accretively.”

Brackett said that should Jagged Peak close at its asking price, it would suggest that Noble got a good deal for Clayton Williams.

“If the IPO is a bust, we would interpret this not as a condemnation of the basin, but more as a disagreement on price,” he said.

Darren Barbee can be reached at dbarbee@hartenergy.com.

Recommended Reading

Cummins, Liberty Energy to Deploy New Engine for Fracking Platform This Year

2025-01-29 - Liberty Energy Inc. and Cummins Inc. are deploying the natural gas large displacement engine developed in a partnership formed in 2024.

Diversified, Partners to Supply Electricity to Data Centers

2025-03-10 - Diversified Energy Co., FuelCell Energy Inc. and TESIAC will create an acquisition and development company focused on delivering reliable, cost efficient net-zero power from natural gas and captured coal mine methane.

E&P Highlights: Jan. 21, 2025

2025-01-21 - Here’s a roundup of the latest E&P headlines, with Flowserve getting a contract from ADNOC and a couple of offshore oil and gas discoveries.

E&P Highlights: Feb. 18, 2025

2025-02-18 - Here’s a roundup of the latest E&P headlines, from new activity in the Búzios field offshore Brazil to new production in the Mediterranean.

E&P Highlights: April 7, 2025

2025-04-07 - Here’s a roundup of the latest E&P headlines, from BP’s startup of gas production in Trinidad and Tobago to a report on methane intensity in the Permian Basin.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.