The second quarter survey ran from June 14 to June 28 and included 30 responses from firms in Colorado, Kansas, Nebraska, Oklahoma, Wyoming, northern New Mexico and western Missouri. (Source: Shutterstock)

Even as the price of natural gas slipped to a two-month low on July 15, producers saw somewhat better times in the upcoming winter, according to the Federal Reserve Bank of Kansas City’s most recent energy survey.

The survey, released on July 12, painted a less than rosy current price environment for natural gas. Since breaking $3/MMBtu in mid-June, Henry Hub prices have declined steadily. On July 23, prices had sunk $2.23/MMBtu.

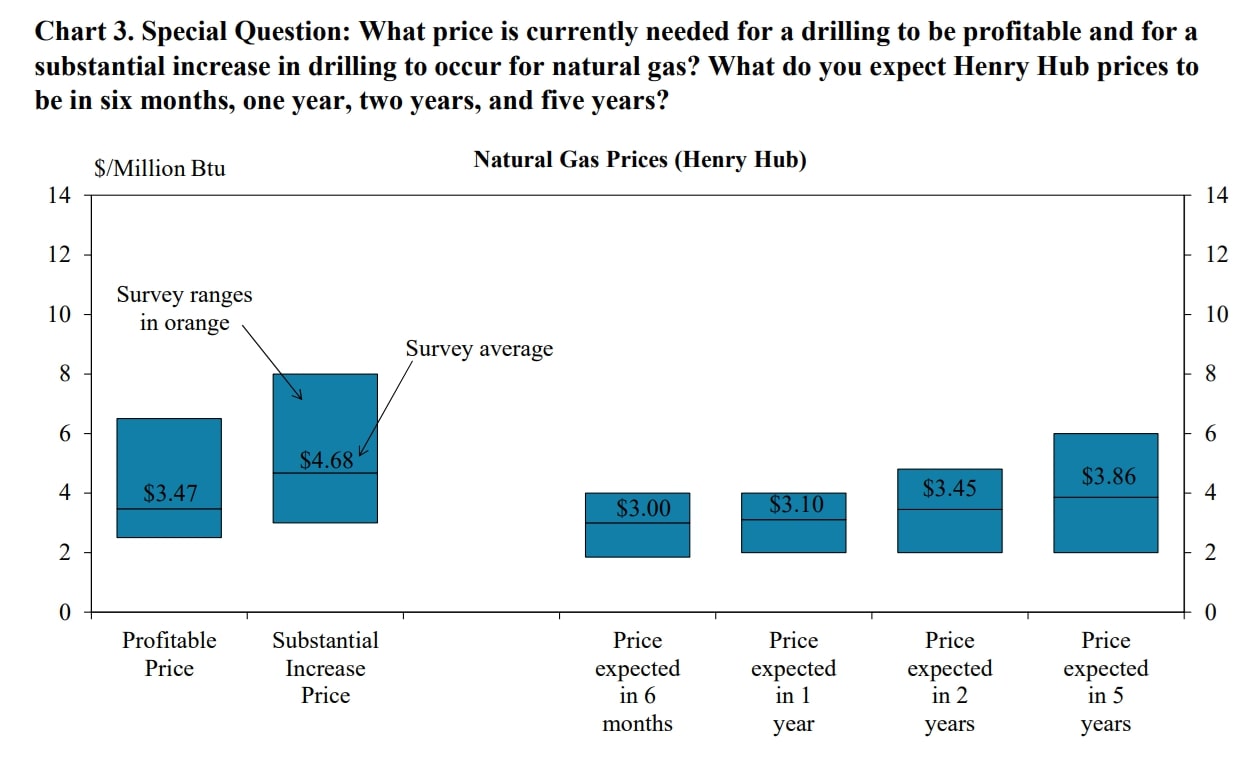

Those prices contrast with what respondents said they needed on average for drilling to be profitable across the fields in which they are active: $3.47/MMBtu.

“Gas prices in the Rockies are so low, we are shutting in production,” said one of the respondents.

Said another: “Natural gas is a small part of our business, but even so we are going to reduce production due to historically low prices. Oil prices seem to have a bottom and reside at a comfortable level.”

The survey includes a snapshot of a wide swath of states. Survey respondents offered their take on an oversupplied natural gas market and their expectations for LNG, as well as their view of other topics such as the Permian Basin’s gas potential.

The second quarter survey ran from June 14 to June 28 and included 30 responses from firms in Colorado, Kansas, Nebraska, Oklahoma, Wyoming, northern New Mexico and western Missouri.

Energy firms largely expect oil prices to remain close to $80/bbl for the next 12 months, according to the survey. Executives were more optimistic on natural gas prices, saying the Henry Hub price would rise to $3/MMBtu by the end of 2025.

Respondents’ expectations on natural gas prices are in line with what other producers have said regarding demand. As more LNG export demand comes online and electrical demand rises with the construction of data centers and growth in the electric vehicle market, the gas market is expected to tighten.

“LNG export capacity will increase as new plants are commissioned. This should stabilize the market price swings to a degree,” said one survey respondent. The Fed released several comments along with the survey press release, but did not identify who made the input.

In the second quarter, overall activity in the district declined, according to the survey. The survey’s drilling activity index showed drilling activity, revenues and profits fell. Capex also fell, but firms reported better access to capital than at this point last year.

Respondents said the greatest risks confronting them are increased regulation, slowing economic activity and production decisions by OPEC.

“District drilling and business activity posted a decline for the sixth consecutive quarter in Q2, but is expected to rebound in coming months along with natural gas prices,” Chad Wilkerson, senior vice president at the Kansas City Fed bank, said in the press release.

Regarding activity, one survey respondent said, “We are maintaining cadence and offsetting inflationary pressures with improved efficiency and innovation.”

Firms were also asked what prices were needed for a substantial increase in drilling to occur across the fields in which they are active. The average oil price needed was $91/bbl and an average natural gas price needed was $4.68/MMBtu.

Some respondents also offered differing takes on their operations in the Midcontinent compared to the Permian and Appalachian basins.

“The MidCon is less distressed than any time in the past six years. We are seeing more competition move here from the Permian,” one respondent told the survey.

Another executive, however, observed, “Appalachia and the Permian can fully supply the USA needs for natural gas.”

Another respondent, without context from the survey, offered, “Geothermal drilling is promising; we are doing some now.”

Recommended Reading

E&P Highlights: Jan. 27, 2025

2025-01-27 - Here’s a roundup of the latest E&P headlines including new drilling in the eastern Mediterranean and new contracts in Australia.

E&P Highlights: Feb. 24, 2025

2025-02-24 - Here’s a roundup of the latest E&P headlines, from a sale of assets in the Gulf of Mexico to new production in the Bohai Sea.

E&P Highlights: Jan. 6, 2025

2025-01-06 - Here’s a roundup of the latest E&P headlines, including company resignations and promotions and the acquisition of an oilfield service and supply company.

E&P Highlights: Feb. 3, 2025

2025-02-03 - Here’s a roundup of the latest E&P headlines, from a forecast of rising global land rig activity to new contracts.

E&P Highlights: Jan. 13, 2025

2025-01-13 - Here’s a roundup of the latest E&P headlines, including Chevron starting production from a platform in the Gulf of Mexico and several new products for pipelines.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.