Hart Energy

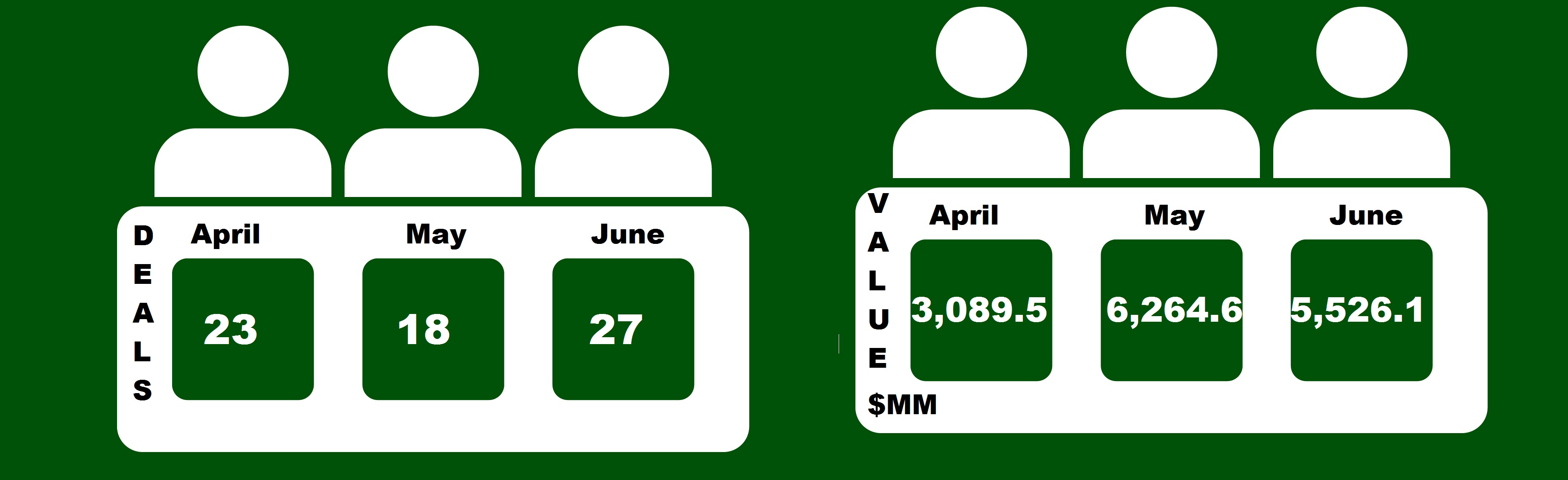

The second-quarter 2016 scorecard for A&D activity added more deals and value, although the year’s overall trend is likely to result in another muted season for transactions.

Total deal value in the quarter was $9.3 billion, with 28 oil-weighted transactions accounting for $7.1 billion. Another 10 gas-weighted deals made up $2.1 billion in value. Continental Resources Inc. (NYSE: CLR) also sold 132,000 net acres, identified as coalbed methane producing assets, in April for $110 million.

Through second-quarter 2016, deals have totaled $19 billion, including $13.7 billion in asset deals. In 2015, total deal value was $34.87 billion, with $17.9 billion in asset deals.

A report from Mergermarket analyzing merger trends in Southern states, including Texas, Oklahoma, Louisiana and other states, noted that the energy sector did not have the same positive outlook as other sectors in first-half 2016.

“Supporting the downturn trend shown by Mergermarket data, experts noted that energy, as well as service providers supporting energy firms, have become a turn-off for some clients in the region,” Mergermarket said.

Not surprisingly, Permian Basin activity and values continue to lead the way as, overall, 39 onshore asset transactions of at least $20 million took place in the quarter, according to Raymond James.

Across the Midland and Delaware basins, more than 180,000 acres changed hands in 13 deals. At a price of roughly $3.1 billion, an acre of Permian land cost an average of $17,000.

In its race to divest more than $3 billion in assets, Devon Energy Corp. (NYSE: DVN) was the most active, divesting assets in the Permian Basin, the Midcontinent and East Texas worth $2 billion. On July 14, just after the second quarter ended, the company also divested its Access Pipeline assets for $1.1 billion to Wolf Midstream Inc., a portfolio company of the Canada Pension Plan Investment Board.

On June 15, Devon sold assets in the Midland Basin in two deals totaling $858 million. The transaction included its upstream assets in the southern Midland Basin as well as undeveloped leasehold in Martin County, Texas.

Showing just how valuable the Permian Basin is perceived, a deal in late June saw QEP Resources Inc. (NYSE: QEP) purchase 9,400 net acres from RK Petroleum for $600 million. After adjusting for production, analysts said the acreage went for $58,000 to $59,362 per acre.

Prior to the deal, RSP Permian Inc. (NYSE: RSPP) had shelled out the most in a publicly disclosed deal. In August 2015 RSP purchased 6,600 net acres for $313 million at an estimated $39,000 per acre.

The acreage, in the northern Midland Basin in Martin County, Texas, is 98% HBP to the base of the Wolfcamp Formation or deeper. Net production is about 1,400 barrels of oil equivalent per day (boe/d), about 83% crude oil, from 96 vertical wells.

The value of liquids in the Permian also rose in the second quarter. Prices averaged $182,414/boe/d, largely on the back of the QEP Deal and Pioneer’s purchase of Devon’s Midland Basin assets in June, Raymond James said.

Midcontinent, Stack

In the Midcontinent, five asset deals were announced, with the largest centered on Blaine, Canadian and Kingfisher counties, Okla. Newfield Exploration Co. (NYSE: NFX) spent $470 million to acquire Chesapeake Energy Corp.’s (NYSE: CHK) Stack assets. The position, which is 90% HBP, includes 42,000 net acres and production of 3,800 boe/d.

Marathon Oil Corp. (NYSE: MRO) also acquired roughly 200,000 net surface acres from PayRock Energy for $888 million. The deal included more than 430 horizontal drilling locations over four horizons—the Wolfcamp A, Wolfcamp B, Middle Spraberry and Spraberry Shale—with additional potential in deeper and shallower horizons.

Raymond James also noted an uptick in Rockies transactions. One notable deal: Synergy Resources Corp. (NYSE: SYRG) added to its core Wattenberg holdings with a 33,100-acre acquisition from Noble Energy Inc. (NYSE: NBL). At a value of $505 million, the purchase was equivalent to about half of Synergy’s market capitalization at the time.

At closing, Synergy will have interests in about 47,200 net acres in its defined Wattenberg fairway and another 22,000 net acres of other Wattenberg acreage.

Darren Barbee can be reached at dbarbee@hartenergy.com.

Recommended Reading

Small Steps: The Continuous Journey of Drilling Automation

2024-12-26 - Incremental improvements in drilling technology lead to significant advancements.

Understanding the Impact of AI and Machine Learning on Operations

2024-12-24 - Advanced digital technologies are irrevocably changing the oil and gas industry.

Permanent Magnets Emerge as a Game-Changer for ESP Technology

2024-12-19 - In 2024, permanent magnet motors installations have ballooned to 11% of electric submersible pump installations, and that number is growing.

Novel EOR Process Could Save Shale from a Dry Future

2024-12-17 - Shale Ingenuity’s SuperEOR, which has been field tested with positive results, looks to remedy the problem of production declines.

Exclusive: Novi Labs’ Ludwig on AI Preventing Costly Drilling Mistakes

2024-12-12 - Novi Labs President and Co-Founder Jon Ludwig gives insight on how AI and machine learning allow diverse applications for oil and gas operations and less risk for cataclysmic failure, in this Hart Energy Exclusive interview.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.