Kimbell Royalty Partners said the Buckhorn acquisition is expected to add roughly 86,000 gross (400 net) royalty acres producing about 270 boe/d. (Source: Hart Energy/Shutterstock.com)

Kimbell Royalty Partners LP added to its growing mineral and royalty position through an all-equity acquisition on Nov. 12 worth about $31.8 million.

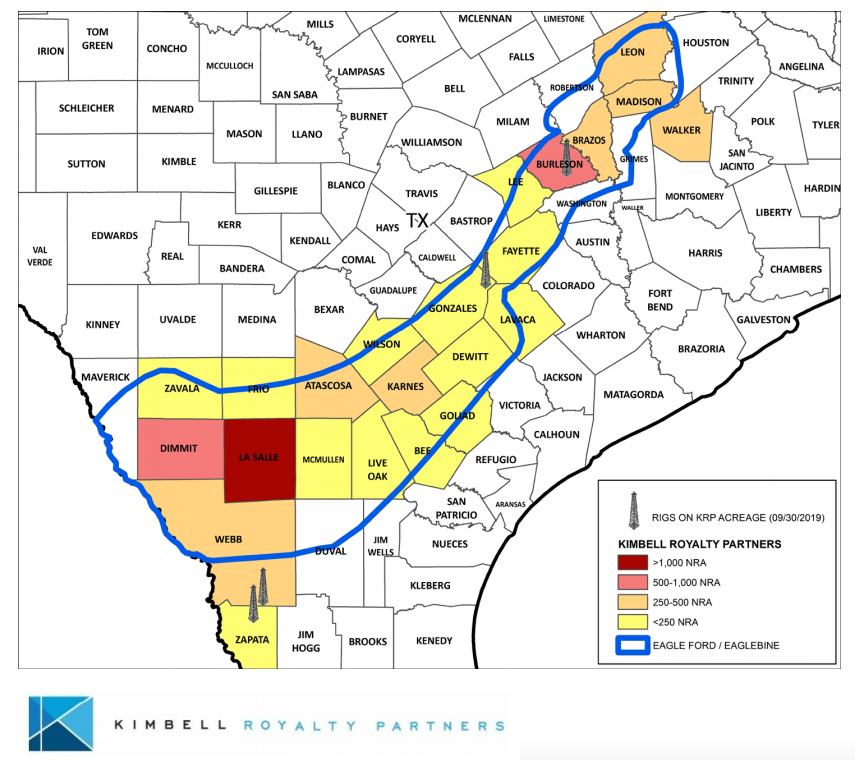

The acquisition, with privately-held Buckhorn Resources LLC and its affiliates, includes certain mineral and royalty assets with an oil-focused production mix and about 90% of the net royalty acres located in the core of the Eagle Ford Shale in La Salle and McMullen counties, Texas.

Kimbell is a publicly-traded company based in Fort Worth, Texas. Since its IPO in 2017, the company has been a major player in the trend in recent years of consolidation within the oil and gas mineral and royalty space, completing over $700 million worth of transactions.

Not including the Buckhorn acquisition, Kimbell owns mineral and royalty interests in about 13 million gross acres in 28 states and in every major onshore U.S. basin.

Kimbell said the Buckhorn acquisition is expected to add roughly 86,000 gross (400 net) royalty acres. Production on a 6:1 basis is about 270 barrels of oil equivalent per day comprised of roughly 83% oil, 11% natural gas and 6% NGL.

The acquisition also includes 504 producing wells, 38 drilled but uncompleted wells and 519 additional upside drilling locations. Two rigs are also actively drilling on the acreage.

The top operator of the acquired assets by total PV-10 value is EOG Resources Inc., according to the company release.

In the Eagle Ford, Kimbell’s current Eagle Ford position covers roughly 532,100 gross (6,300 net) royalty acres and represents about 4% of the company’s acreage portfolio. The position also has about 2,400 producing wells and four rigs operating, according to Kimbell’s Winter 2019 investor presentation published on Nov. 7.

The transaction, expected to close in late December, has July 1 effective date, with Kimbell entitled to revenues from production on and after such date. As part of the all-stock agreement, Kimbell will issue about 2.2 million newly issue units to Buckhorn, a Houston-based company investing primarily in the Permian Basin and Eagle Ford Shale.

The transaction is one of several all-stock acquisitions made by publicly-traded companies in the oil and gas mineral and royalty space so far this year. Others have included the closing of Kimbell’s acquisition of Phillips Energy Partners from EnCap Investments LP and, more recently, Viper Energy Partners LP’s transaction with Santa Elena Minerals LP.

Recommended Reading

‘Golden Age’ of NatGas Comes into Focus as Energy Market Landscape Shifts

2025-03-31 - As prices rise, M&A interest shifts to the Haynesville Shale and other gassy basins.

Improving Gas Macro Heightens M&A Interest in Haynesville, Midcon

2025-03-24 - Buyer interest for Haynesville gas inventory is strong, according to Jefferies and Stephens M&A experts. But with little running room left in the Haynesville, buyers are searching other gassy basins.

Aethon: Haynesville E&Ps Hesitate to Drill Without Sustained $5 NatGas Prices

2025-03-12 - Operators are looking to the Haynesville to fill rising natural gas demand for U.S. LNG exports. Haynesville E&P Aethon Energy says producers need sustained higher prices to step up drilling.

Hirs: Investing for 2025—Growth by Acquisition

2025-01-29 - Fundamentals will push against increased production and a buyers’ market will rule.

Streaming On-Demand: Expand Shifts to Just-in-Time NatGas TILs

2025-03-07 - Expand Energy’s just-in-time TIL model—turning new wells inline into sales—could shorten receipt of returns by up to two years.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.