Kinetik Holdings added natural gas gathering and processing capacity in the Delaware Basin with the acquisition of Durango Permian LLC. (Source: Shutterstock/ Kinetik Holdings)

Kinetik Holdings closed its acquisition of Durango Permian LLC, a platform of gas gathering and processing assets in the northern Delaware Basin.

The transaction significantly enhances Kinetik’s presence in the New Mexico Delaware, the company said in a June 24 release.

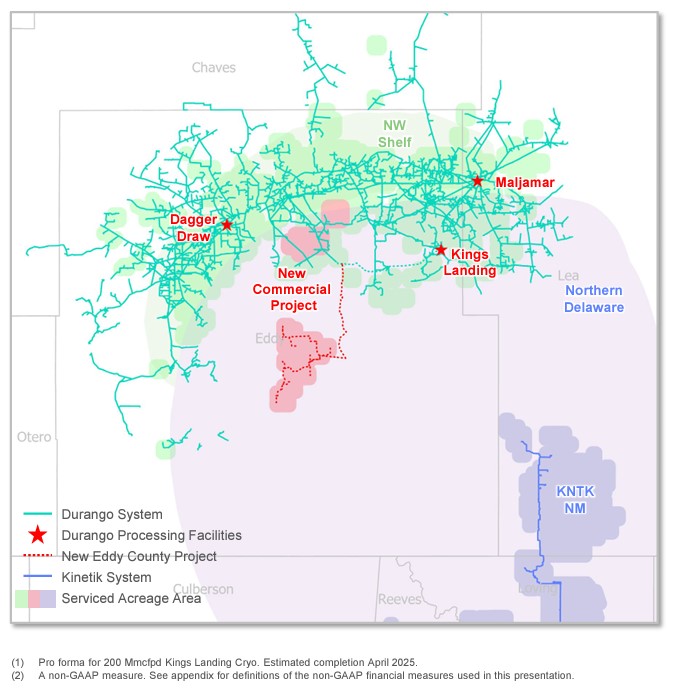

Durango’s assets in Eddy, Lea and Chaves counties, New Mexico, include approximately 2,400 miles of natural gas gathering pipelines and 220 MMcf/d of processing capacity.

When the deal was announced in early May, Kinetik agreed to pay an aggregate of $765 million in cash and equity for the Durango assets.

Kinetik agreed to pay $315 million in cash and 11.5 million shares of Class C common stock, some of it deferred until July 2025, to seller Morgan Stanley Energy Partners.

Kinetik financed the cash consideration of the deal with proceeds from a divestiture of its 16% interest in the Gulf Coast Express (GCX) pipeline, completed earlier this month.

ArcLight Capital Partners paid $540 million for the GCX interest.

With the sale of its interest in GCX, Kinetik is now a purely Delaware Basin midstream provider.

The Durango acquisition and the GCX divestiture “are immediately deleveraging” with Kinetik’s leverage ratio at 3.4x after closing, Kinetik said.

RELATED

Recommended Reading

Kissler: Can ‘Drill, Baby, Drill’ Trump Inventory, Capex Constraints?

2025-01-27 - President Trump continues to push E&Ps to “drill, drill, drill,” but producing an extra 3 MMbbl/d is easier said than done.

Hirs: Expansive Energy Policies Set to Shape 2025 Markets

2025-01-02 - The incoming administration’s policies on sanctions, tariffs, regulations and deportations will impact the oil and gas industry.

The Evolving Federal State of Energy Under Trump 2.0

2025-03-04 - What happens when the Trump wrecking ball swings into the bureaucratic web of everything that touches oil and gas?

Hirs: The High Cost of Overreaching Regulation, Secrecy

2024-12-12 - Energy regulators have withheld critical information that’s resulted in damage to markets and competition.

US Offshore Driller Asks Judge to Block Insurers' Demands for $250MM Collateral

2024-12-12 - W&T Offshore has asked a federal judge to block insurance companies' demands for $250 million.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.