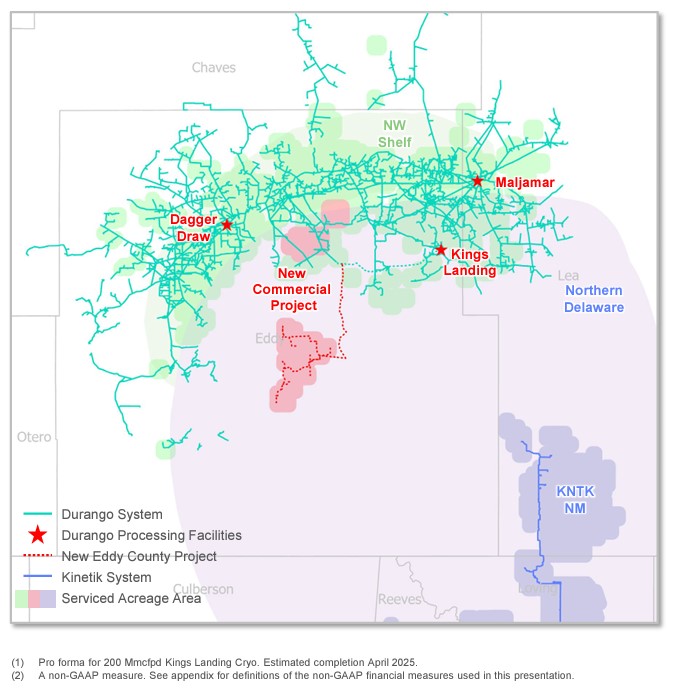

Kinetik Holdings added natural gas gathering and processing capacity in the Delaware Basin with the acquisition of Durango Permian LLC. (Source: Shutterstock/ Kinetik Holdings)

Kinetik Holdings closed its acquisition of Durango Permian LLC, a platform of gas gathering and processing assets in the northern Delaware Basin.

The transaction significantly enhances Kinetik’s presence in the New Mexico Delaware, the company said in a June 24 release.

Durango’s assets in Eddy, Lea and Chaves counties, New Mexico, include approximately 2,400 miles of natural gas gathering pipelines and 220 MMcf/d of processing capacity.

When the deal was announced in early May, Kinetik agreed to pay an aggregate of $765 million in cash and equity for the Durango assets.

Kinetik agreed to pay $315 million in cash and 11.5 million shares of Class C common stock, some of it deferred until July 2025, to seller Morgan Stanley Energy Partners.

Kinetik financed the cash consideration of the deal with proceeds from a divestiture of its 16% interest in the Gulf Coast Express (GCX) pipeline, completed earlier this month.

ArcLight Capital Partners paid $540 million for the GCX interest.

With the sale of its interest in GCX, Kinetik is now a purely Delaware Basin midstream provider.

The Durango acquisition and the GCX divestiture “are immediately deleveraging” with Kinetik’s leverage ratio at 3.4x after closing, Kinetik said.

RELATED

Recommended Reading

BP to Buy Out Bunge’s Stake in Brazilian Biofuels JV

2024-06-20 - BP’s acquisition of Bunge’s stake in BP Bunge Bionergia is expected to close by year-end 2024, pending regulatory approvals.

Fervo Executes Two Geothermal Agreements with Southern California Edison

2024-06-26 - The two 15-year power purchase agreements will provide carbon-free geothermal energy for the equivalent of 350,000 homes across Southern California.

FortisBC, EverGen Ink 20-year RNG Deal

2024-06-25 - FortisBC will purchase up to 160,000 gigajoules of RNG from EverGen Infrastructure’s biogas facility in British Columbia, according to a news release.

SLB, Ormat Technologies Form Geothermal Partnership

2024-06-25 - As part of the partnership, SLB also will license Ormat’s enhanced geothermal systems patent.

CORMETECH, Ozona to Develop Flue Gas CCUS System

2024-06-19 - CORMETECH and Ozona CCS’ system includes integrated nitrogen oxide reduction and aims to capture, transport and sequester CO2 from flue gas, which is generated from natural-gas powered engines.