Kinetik Holdings will buy Durango Permian infrastructure for $765 million, excluding contingency payments, and sell its interests in the Gulf Coast Express pipeline to AcrLight Capital Partners for $540 million. (Source: Shutterstock.com, Kinetik)

Kinetik Holdings announced a series of transactions on May 9, led by a cash-and-stock deal to acquire Durango Permian infrastructure for an aggregate $765 million. In a related move, Kinetik will divest its 16% equity interest in the Gulf Coast Express (GCX) pipeline to ArcLight Capital Partners for $540 million cash.

The Durango acquisition—along with a new, long-term gathering and processing contract, represents approximately $1 billion of new investment for the company, said Jamie Welch, Kinetik’s president and CEO.

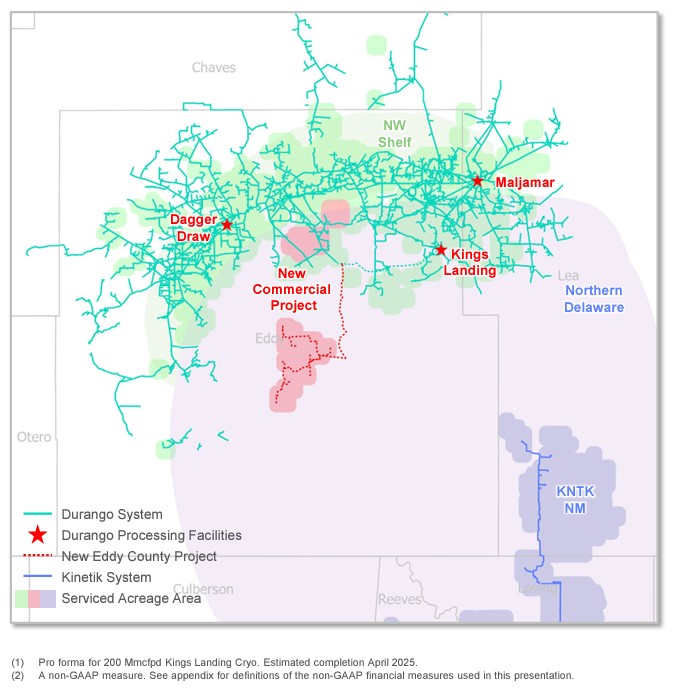

“Following the Durango acquisition and the expected completion of Kings Landing, Kinetik will own and operate over 2.4 billion cubic feet per day of processing capacity, entirely in the Delaware Basin, and approximately 4,600 miles of pipelines across eight counties,” Welch said.

The Durango deal will expand the company’s presence as a pure-play midstream provider in the northern Delaware Basin. Kinetik will pay $315 million in cash and 11.5 million shares of Class C common stock, some of it deferred until July 2025, to seller Morgan Stanley Energy Partners.

Durango’s assets in Eddy, Lea and Chaves counties, New Mexico, include approximately 2,400 miles of gas gathering pipelines and approximately 220 MMcf/d of processing capacity. The Durango assets also bring aboard more than 60 new customers, many private operators, Kinetik said.

Kinetik’s Durango transaction includes a $75 million contingent payment tied to the capital cost for the Kings Landing complex, which is currently under construction. Kings Landing is a new 200 MMcf/d greenfield processing complex in Eddy County, which is expected to be completed in April 2025. The complex will increase Durango’s processing capacity to 420 MMcf/d.

To offset the purchase price, Kinetik is selling its interests in GCX, the company said in a May 9 press release. The purchase price is comprised of $510 million in upfront cash and an additional $30 million deferred cash payment due upon a final investment decision (FID) on a capacity expansion project.

Additionally, Kinetik announced a 15-year agreement to provide gathering and processing services in Eddy County for approximately $200 million. Kinetik will construct low- and high-pressure gathering infrastructure, which is expected to be approximately $200 million of aggregate capital through 2026.

Kinetik anticipates an approximately 5x run-rate EBITDA investment multiple. The contract begins at the end of 2024, starting with gathering services. It extends to processing services starting in the second quarter of 2025.

“Following on from our tremendous success with our recent Lea County, New Mexico system expansion, we are delighted to now announce this series of strategic transactions that further our expansion into New Mexico and significantly increase our footprint across the Northern Delaware Basin,” Welch said.

“Proceeds from the GCX sale and the aggregate issuance of $450 million of Kinetik Class C shares, in two installments, will be reinvested into projects at a mid-single digit EBITDA multiple,” Welch said. “These actions efficiently and accretively recycle cash proceeds from a non-operated asset into highly strategic, operated assets.”

The transactions are expected to be over 10% accretive to free cash flow per share starting in the second half of 2025, with the level of accretion increasing thereafter, which coincides with an expected acceleration of capital returns to shareholders.

The Durango acquisition and new Eddy County agreement also offer full control of plant products, including more than 350 MMcf/d of residue gas and more than 60,000 bbl/d of natural gas liquids. The volumes will provide “significant additional upside value via system optimization, modifications to existing commercial contracts and integration with our pipeline transportation segment,” Welch said.

Recommended Reading

Huddleston: Haynesville E&P Aethon Ready for LNG, AI and Even an IPO

2025-01-22 - Gordon Huddleston, president and partner of Aethon Energy, talks about well costs in the western Haynesville, prepping for LNG and AI power demand and the company’s readiness for an IPO— if the conditions are right.

Blackstone Buys NatGas Plant in ‘Data Center Valley’ for $1B

2025-01-24 - Ares Management’s Potomac Energy Center, sited in Virginia near more than 130 data centers, is expected to see “significant further growth,” Blackstone Energy Transition Partners said.

E&P Highlights: Dec. 16, 2024

2024-12-16 - Here’s a roundup of the latest E&P headlines, including a pair of contracts awarded offshore Brazil, development progress in the Tishomingo Field in Oklahoma and a partnership that will deploy advanced electric simul-frac fleets across the Permian Basin.

Q&A: How EthosEnergy Keeps the Oil and Gas World Spinning

2024-12-04 - EthosEnergy CEO Ana Amicarella says power demands and tools are evolving onshore and offshore and for LNG and AI.

E&P Highlights: Dec. 30, 2024

2024-12-30 - Here’s a roundup of the latest E&P headlines, including a substantial decline in methane emissions from the Permian Basin and progress toward a final investment decision on Energy Transfer’s Lake Charles LNG project.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.