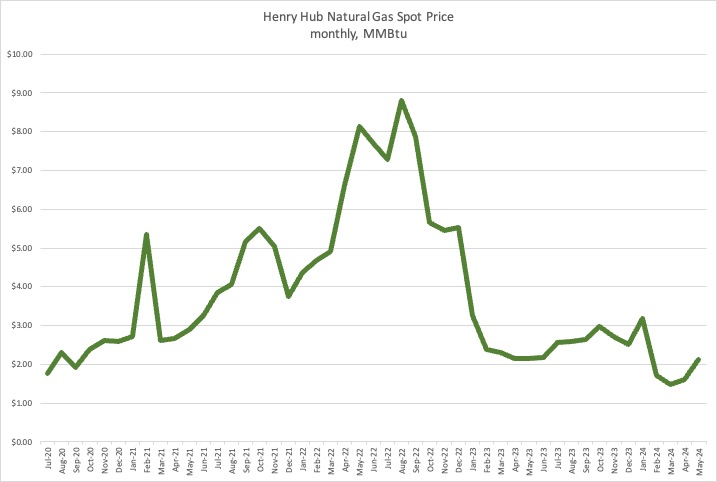

Natural gas prices have been subdued for most of the first half of 2024, and with good reason: overproduction, coupled with light weather-related demand. However, as we go into summer and the second half of the year, there has been some speculation that the lows that we’ve been seeing will reverse.

First, here’s where we stand right now. As of mid-June, storage is still near a 30% overage of the five-year average. Any seasoned trader would tell you that a surplus of this size will keep a bearish tone to prices in the longer term. Still, buyers remain waiting in the weeds for a cheap entry to one of the most dynamic trading products of the commodity complex.

Meanwhile, gas futures prices are almost impossible to trade in the short-term because they’re so heavily influenced by weather. Traders have an old saying: When it’s extremely cold, natgas prices get extremely hot!

That saying rings as true as ever. For example, this past winter, a two-week cold spell in January took prices up more than 34%. That’s even with all the supply surplus we had. However, this price gain didn’t last. By late February, prices were back to making new lows near $1.50/MMBtu.

What happened? On one hand, volatility is in a commodity’s nature. Still, on the other hand, even the most educated fundamental economist can look like a third-grader when trying to explain how an oversupplied product can move up 34% in price in just a few days. A jump of that size just doesn’t seem to make sense, given the fundamentals.

The short answer is that price extremes to the downside can cause supply gaps or perceived supply gaps in the near future. We witnessed this effect when Chesapeake Energy and EQT Corp. curtailed new production and slowed drilling programs because of unfavorable prices. In EQT’s statement, released in early March, the company cited warm winter weather and consequentially elevated storage inventories as its reason for curtailing nearly 1 Bcf/d of gross production beginning in late February and continuing through March. As one might expect, gas prices rose on the news.

However, that drop in production wasn’t the only factor driving up prices; the other is the increased adoption of green energy. Because it’s seen as a cleaner alternative to burning coal, natural gas is increasingly being used to power underdeveloped electric grids in most parts of the globe, including the U.S.

That’s been positive for U.S. exports. In fact, the current volume of U.S. LNG exports is near 12 Bcf/d, up over 12% from 2022 levels. By 2027, the volume of North American LNG exports is expected to rise to 22-25 Bcf/d, depending on who you ask. Personally, I believe the upper end of those numbers is the most likely scenario.

So, what does all this mean for prices through the remainder of the year? As of mid-June, prices remain historically low and the downside price pattern looks limited.

Nevertheless, weather, as always, is the wild card. A warmer-than-normal summer followed by a colder-than-normal winter could create a price shock to both traders and consumers.

On the flip side, a mild weather pattern could keep the brakes on prices and, given the abundance in storage, keep a tight lid on any rallies. That said, one thing is for sure: the longer prices stay historically low, the larger the eventual supply gap will grow. Then, when a price shock does happen, it just might surprise many to the upside.

Recommended Reading

Kissler: Are We Set Up for a Summer Natural Gas Rally?

2024-07-02 - A warmer-than-normal season could jolt prices.

Glenfarne: HOAs Commit More than Half of Texas LNG Plant Capacity

2024-07-02 - Glenfarne Energy Transition said a new, nonbinding agreement has committed half of the Texas LNG Brownsville plant's 4 million tons/year capacity.

IGU: Global Liquefaction Capacity Expected to Grow by 75% by 2030

2024-07-02 - The International Gas Union (IGU) expects global liquefaction capacity to reach 700 mtpa by 2030, up 75% from 2023, driven by new FIDs and the start-up of other projects under construction.

New Fortress Energy Sells Small-scale Florida LNG Unit

2024-07-02 - New Fortress Energy is selling a small-scale liquefaction and storage facility in Miami, Florida, to an unnamed buyer.

US NatGas Prices Fall 3% to One-month Low on Output Rise, Lower Demand Forecast

2024-07-01 - Analysts say there is about 19% more gas in storage than usual for this time of year.