Although U.S. crude production fell from its record high of 13.436 MMbbl/d in October to 13.314 MMbbl/d in November, that latest figure is still high. At the same time, President Donald Trump is calling on OPEC to increase production, which could easily push crude prices lower into the second quarter, as supply would likely then outpace demand.

Just how low could prices go—or will they fall at all? The answer depends on a confluence of factors, as supply is just one part of the equation.

Economic slowdown still a risk

For instance, another fear haunting crude is the stubborn 10-year Treasury yield currently hovering just over 4.5%. If 10-year yields drift north of 5%, it would very likely create the economic slowdown that most economists once predicted but have now reneged on.

Although the U.S. stock market highs that investors have enjoyed make it easy to ignore this possibility, keep in mind that the last two years of the S&P 500 posting returns north of 23% each year are not sustainable. That’s especially true given that a handful of stocks known as the “Magnificent 7” anchored these gains, rather than performance being spread out within the index.

And then there’s China to consider. The Chinese economy struggled throughout 2024 despite government stimulus to try to jumpstart growth.

As China is still the “manufacturer of the world”—and thus the second-largest oil consumer—continued economic slowdown in China would negatively impact global oil demand. Along these lines, if we add declining demand from China to the other factors, it’s easy to justify the view that crude prices may decline.

At the same time, the prospect of more Chinese economic stimulus, combined with potential sanctions on Iranian and Russian oil, have been encouraging hedge fund investors to increase their bullish positioning on U.S. crude.

Although these bets may at first seem to support the view that higher U.S. crude prices are to come, it’s also important to keep in mind that they place the market in a vulnerable position. In other words, there could be a significant price drop in the market if traders who previously bet on the price going up are now forced to sell due to a sudden downturn, causing further selling pressure and accelerating the price decline.

Effects of Trump policies remain to be seen

Many speculated that Trump taking office would impact the energy industry. In just the first few weeks of his term, he announced policies and plans that could indeed impact crude prices. Most directly, he said he plans to refill the U.S. Strategic Petroleum Reserve (SPR) “right to the top and export American energy all over the world.”

This plan to refill the SPR—and do it quickly—could create a buying floor for crude, and purchases could step up very quickly if the price of WTI falls significantly.

Furthermore, the Trump administration’s policies on tariffs could be both a positive for crude prices and a negative, depending on who bears the brunt. Tariffs on imports from oil-producing countries would likely restrict supply, driving prices higher. Meanwhile, tariffs on imports from countries with heavy demand for crude, such as the tariff on Chinese goods, could easily slow those countries’ economies, creating less demand.

Initially, U.S. gas prices rose on the news that the U.S. was imposing tariffs on Canada, Mexico and China, but then fell again on Feb. 3 after the tariffs on Mexican and Canadian goods were paused. Around 25% of the crude that comes into the U.S. is from Canada and Mexico.

How other countries respond to these tariffs is also a question mark. Immediately after Trump made the announcement, Canada responded by putting 25% tariffs on some American goods, such as alcohol and perfume, but Trump pivoted and delayed the tariffs for 30 days so Canada paused theirs as well.

RELATED

Impacts of Trump’s Tariffs on North American Energy Markets

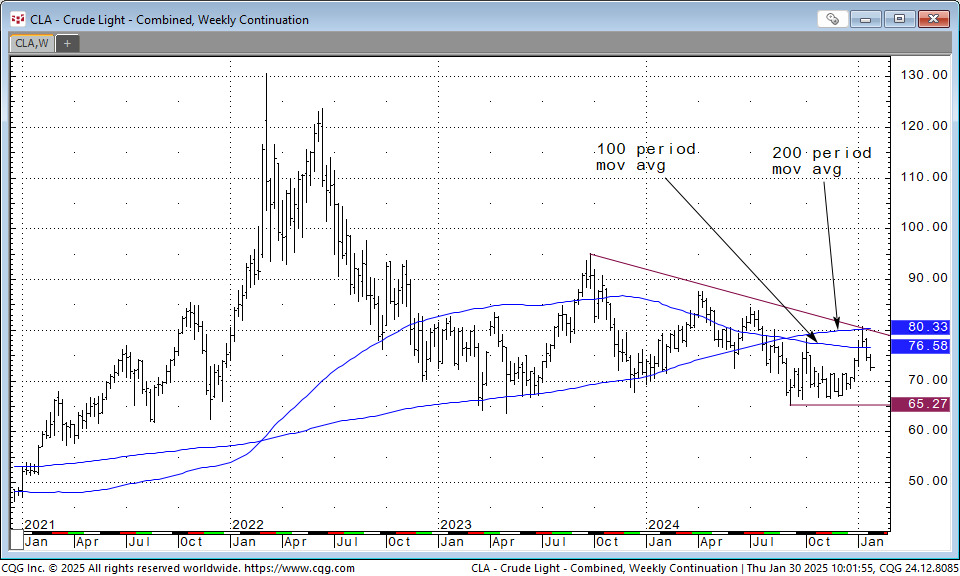

And so, what’s ahead? Well, looking from a longer-term technical outlook, the trends have been retracing lower for WTI crude futures. The longer-term weekly chart, which sets moving averages below both the 100 and the 200 period, is possibly trending back toward the $65/bbl area.

While the trend is lower, keep in mind that the fundamentals of supply and demand draw the charts, and the fundamental outlook is definitely a moving target in each coming week as the Trump administration settles in further.

Recommended Reading

Queen’s Chess: Changing the Rules

2025-02-28 - There’s a popular response to the inexplicable: “I don’t know. I don’t make the rules.” But what is known with certainty, as shown throughout history, is that we can change them.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.